U.S. farm sector liquidity forecast to decline in 2021

- by Carrie Litkowski

- 5/21/2021

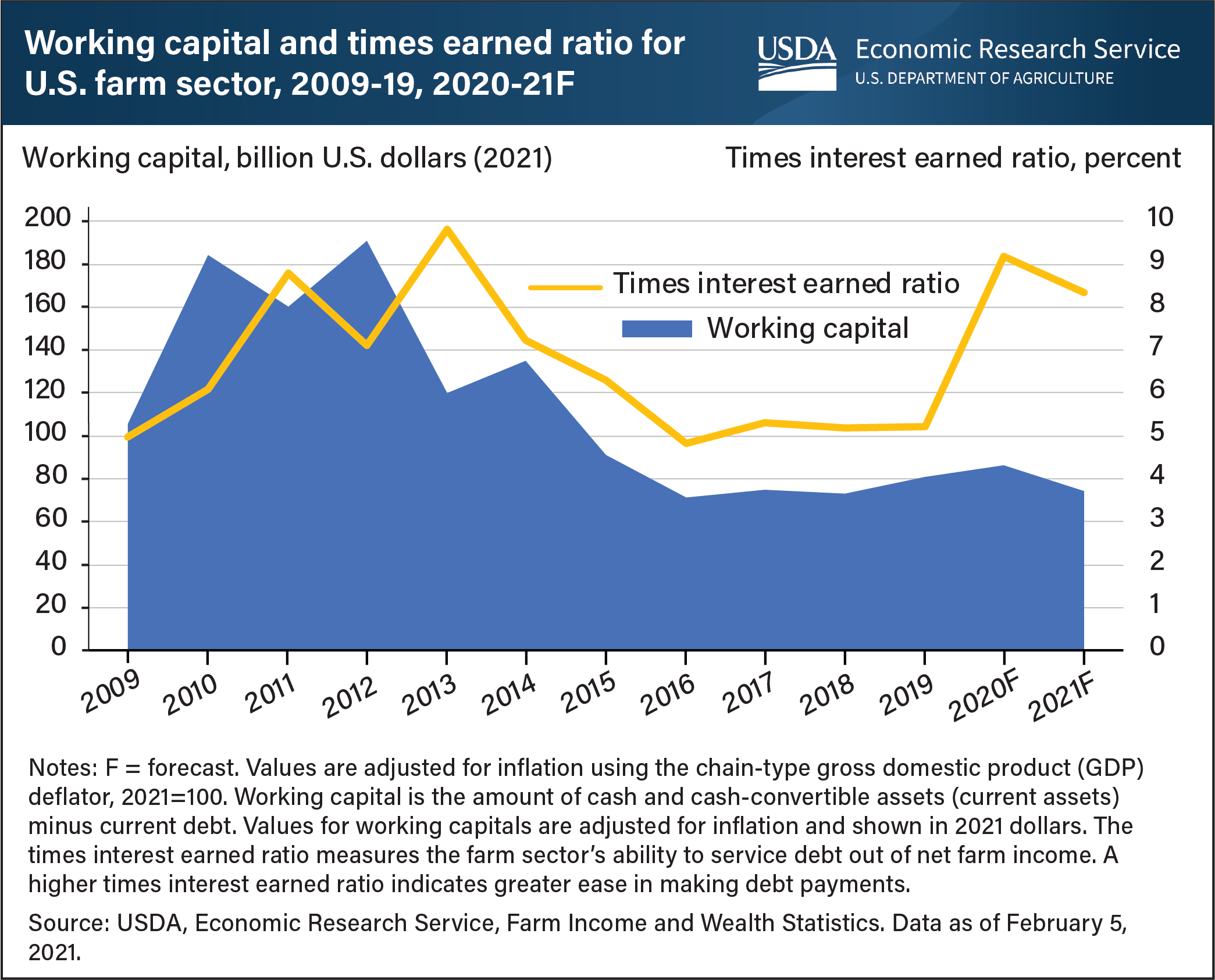

Liquidity is the ability to convert assets to cash quickly to satisfy short-term obligations without the assets losing material value. Researchers at the USDA, Economic Research Service (ERS) examined two measures of the U.S. farm sector’s liquidity: working capital and the times interest earned ratio. Working capital measures the amount of cash available to fund operating expenses after paying off debt to creditors due within 12 months (current debt). ERS forecasts U.S. farm sector working capital in 2021 at $74.3 billion, a 13.6-percent decrease from 2020 after adjusting for inflation. If realized, this would be the largest decline since 2016. By comparison, the times interest earned ratio measures the farm sector’s ability to service debt out of net farm income, so a higher times interest earned ratio indicates greater ease in making debt payments. ERS forecasts the times interest earned ratio will decrease from 9.2 in 2020 to 8.4 in 2021, after a forecasted increase in 2020. The weakening of this ratio in 2021 reflects the forecast decline in net farm income as well as the expected increase in interest expenses. Still, the times interest earned ratio is forecast to remain above 2014-19 levels. This chart appears in the ERS Amber Waves finding, Farm Sector Liquidity Forecast to Decline in 2021, released March 2021.

We’d welcome your feedback!

Would you be willing to answer a few quick questions about your experience?