Participation, Payouts in Two USDA Risk Management Programs Vary Widely Based on Market Outcomes

- by Dylan Turner

- 4/3/2024

The 2014 Farm Bill introduced several commodity support programs, including the Agriculture Risk Coverage (ARC) and Price Loss Coverage (PLC) programs. PLC compensates farmers when prices fall below established levels, and ARC provides income support to mitigate revenue risk. Payment calculations for ARC and PLC are based on commodity specific price thresholds, various measures of yields, and national average prices. The 2018 Farm Bill enabled farmers to choose one program or the other on a more frequent basis, causing the balance of participation between ARC and PLC programs to shift widely from year to year. As with program participation, payouts to farmers—which are tied to market outcomes—vary widely in any year.

Under the 2014 Farm Bill, producers who participated in ARC or PLC were required to choose a one-time election into either program, and that choice would remain in effect for the entirety of that Farm Bill. After the 2018 Farm Bill, farmers had an option to change their elections. Their program selection would be fixed for 2019 and 2020, and then would become an annual decision.

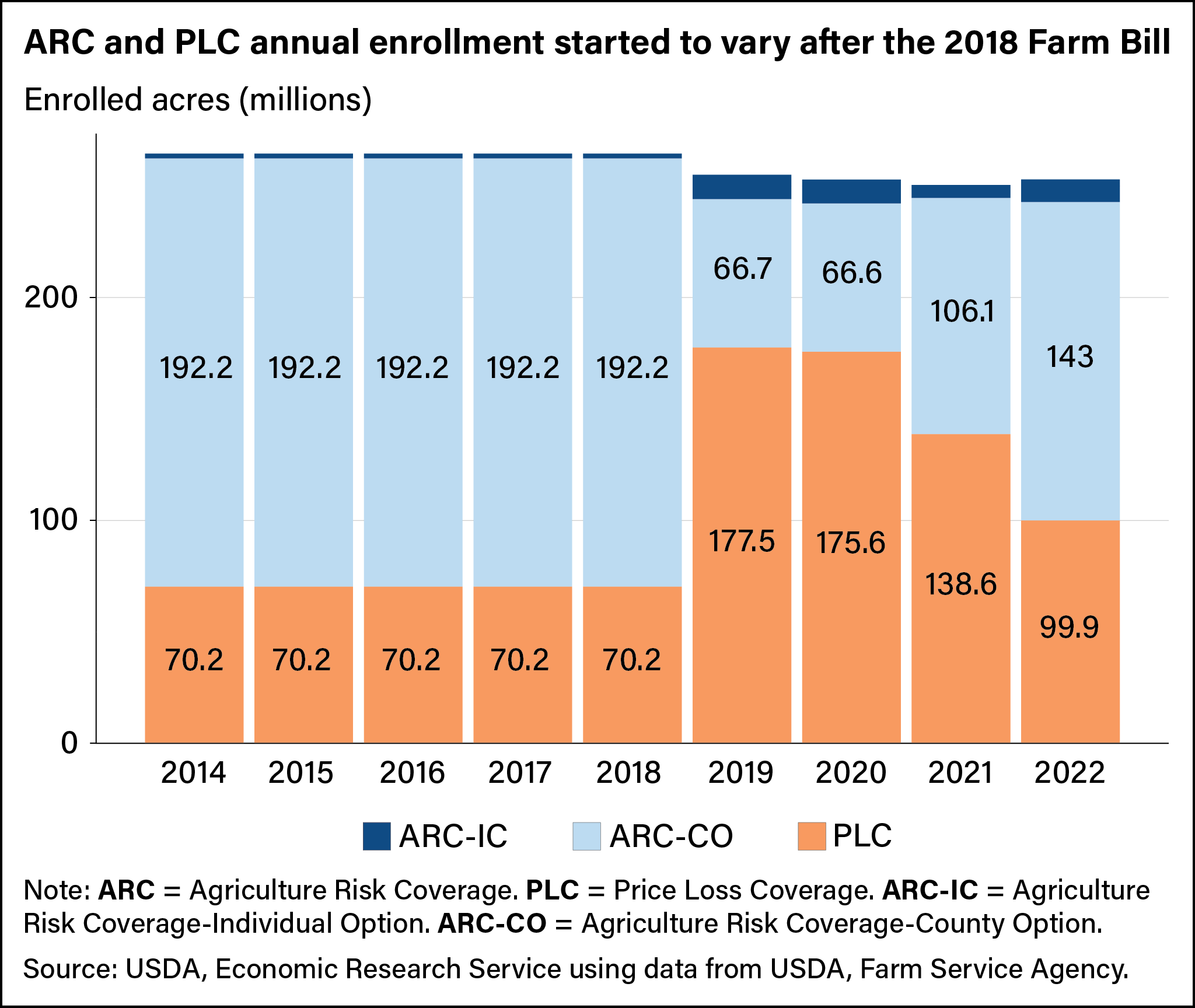

After initial enrollment following the 2014 Farm Bill, most acres were enrolled in a variation of the ARC program called Agriculture Risk Coverage–County (ARC-CO). About 73 percent of enrolled acres were in ARC-CO. The remaining acres—about 27 percent—were under PLC. A minority of producers selected another variation of ARC called Agriculture Risk Coverage–Individual (ARC-IC). However, ARC-IC enrollment accounted for less than 1 percent of enrolled acreage.

After the 2018 Farm Bill, the distribution of acres enrolled between ARC and PLC shifted. Instead of keeping acreage enrolled under ARC-CO, most producers elected to enroll in PLC. About 70 percent of all enrolled acres in 2019 were under PLC. Subsequently, the distribution of enrollment has started to revert to that observed before passage of the 2018 Farm Bill. For 2022, the majority of acres again were enrolled in ARC-CO (about 57 percent), followed by PLC (about 40 percent), with ARC-IC representing about 4 percent of enrolled acres.

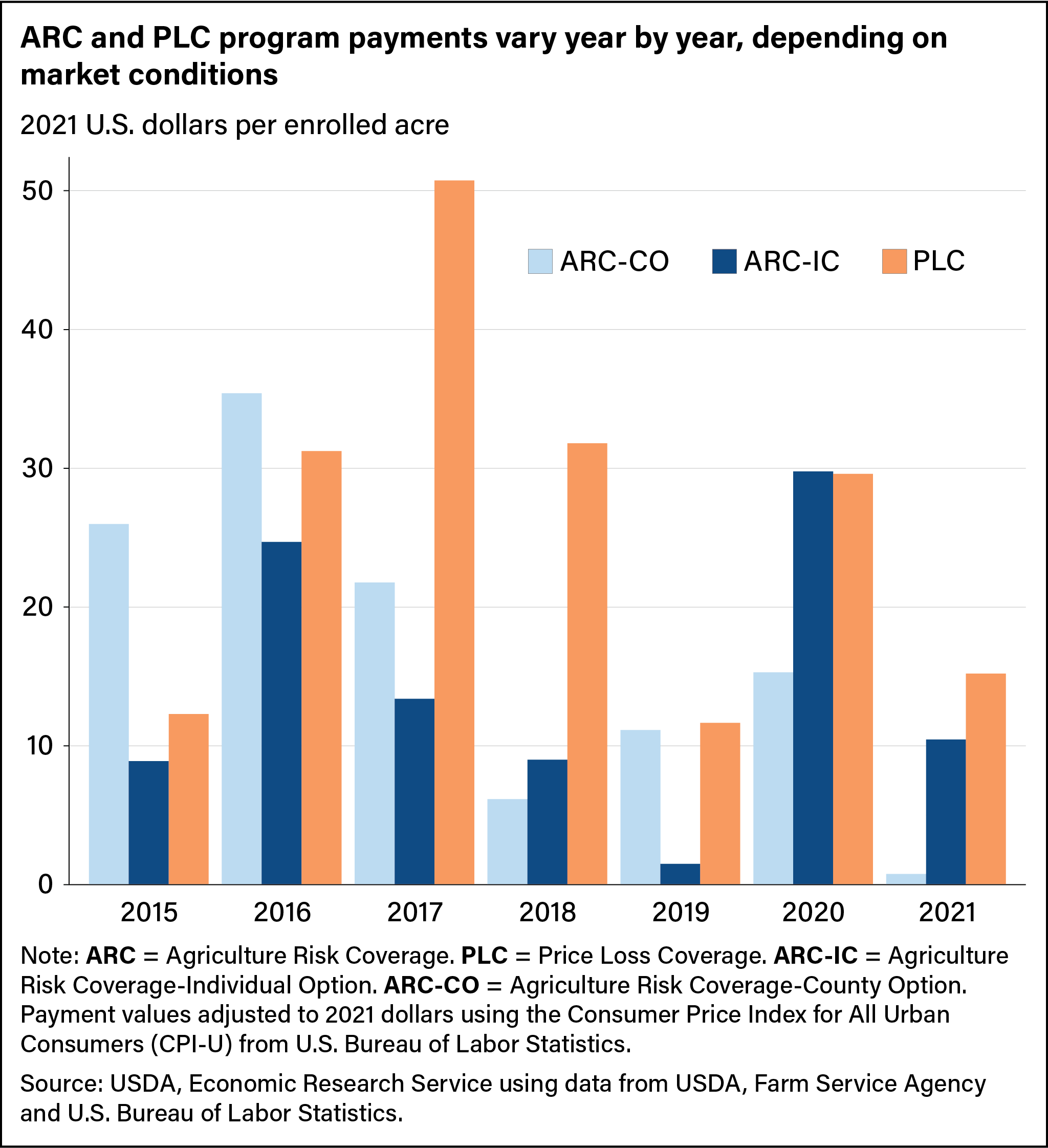

A combination of recent experiences and expectations of future market conditions—which influence prospective payments by program—are likely to inform a farmer’s decision over whether to participate in ARC or PLC. ARC payments are calculated based on variation in revenue. Payments typically are less sensitive to price declines because higher yields can offset lower prices, helping to maintain farm revenues. In contrast, payments under PLC start when the commodity price drops below an established price, regardless of realized yields. For example, corn prices were below the benchmark for triggering a PLC payment from program years 2015–18. An expectation that these market conditions would continue spurred enrollment of corn base acres into PLC for program years 2019 and 2020. Farmers in areas with strong and stable yields were likely to see little benefit for the yield protection inherent in the ARC program design and had greater incentive to participate in the PLC program. ARC payments per enrolled acre were generally declining leading into the 2018 Farm Bill (see chart below). For 2018, PLC payments averaged just under $32 per enrolled acre, while ARC-CO and ARC-IC averaged $9 and $6.16 per enrolled acre respectively (all 2021 U.S. dollars).

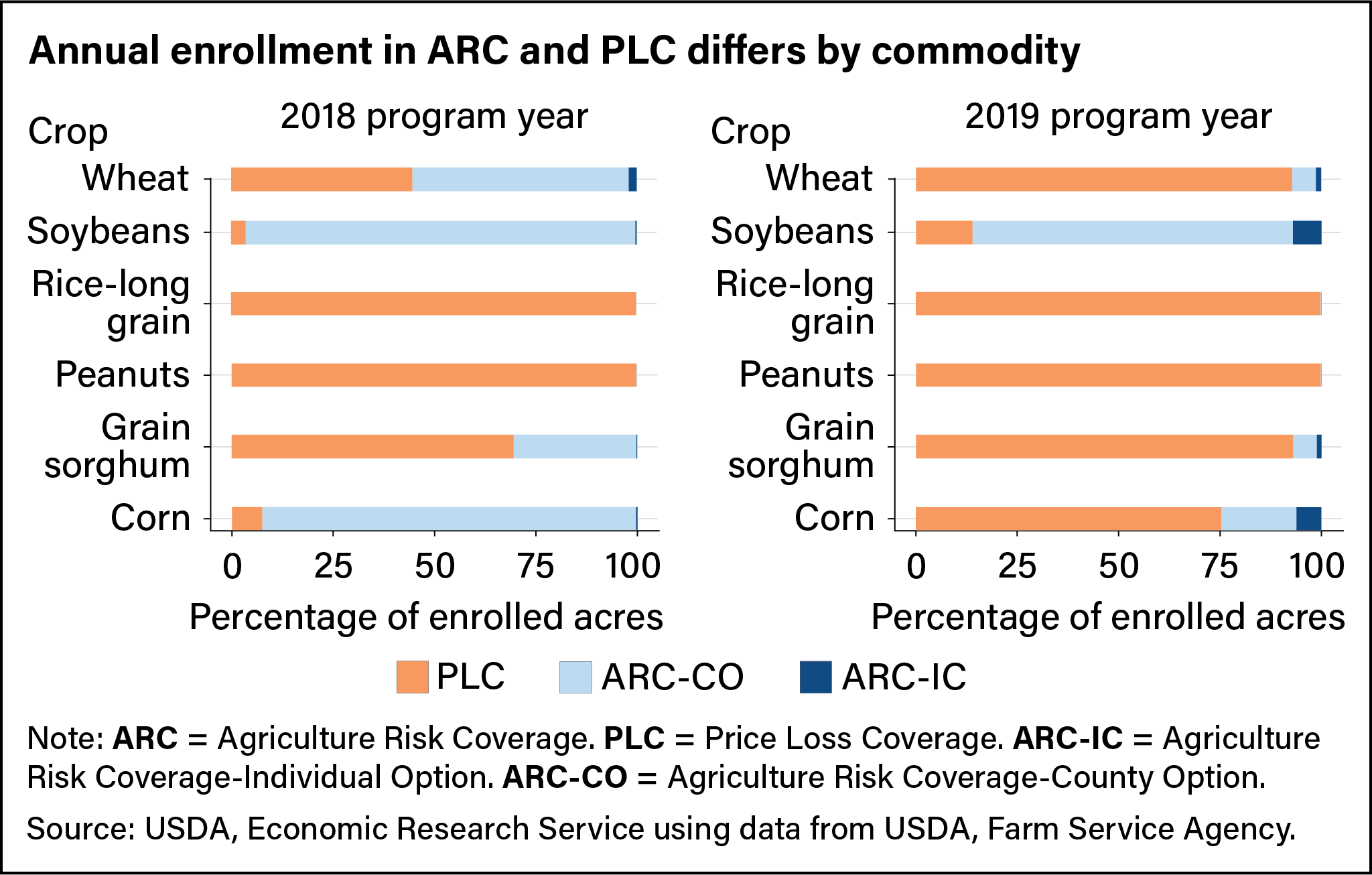

In 2019, when producers weighed the benefits of participation in ARC or PLC, they considered the recent substantial payouts from the PLC program and relatively lower support payments from ARC. This in turn encouraged expanded participation in the PLC program. However, adoption rates varied by commodity. Producers of long-grain rice, peanuts, and canola, for example, consistently have opted for PLC since the program’s inception as market prices for these crops routinely have fallen below the trigger prices. Alternatively, soybean producers have not received PLC payments since the inception of the ARC and PLC programs because market prices have not been low enough to trigger a PLC payment. Soybeans are the only commodity that maintained a majority of enrolled acres in ARC-CO when the option to alter elections for the 2019 program year became available.

This article is drawn from:

- Turner, D., Tsiboe, F., Baldwin, K.L., Williams, B., Dohlman, E., Astill, G., Raszap Skorbiansky, S., Abadam, V., Yeh, D.A. & Knight, R. (2023). Federal Programs for Agricultural Risk Management. U.S. Department of Agriculture, Economic Research Service. EIB-259.

You may also like:

- Boussios, D. & O'Donoghue, E. (2019). Potential Variability in Commodity Support: Agriculture Risk Coverage and Price Loss Coverage Programs. U.S. Department of Agriculture, Economic Research Service. ERR-267.