Developing Countries Specialize in Agricultural Commodities After Free Trade Agreements With the United States

- by Adam Gerval

- 3/28/2023

Highlights

- Free trade agreements (FTA) often lead to increased trade volume and economic diversification by fueling the rise of other sectors. In the agricultural sector, growth in trade is often achieved by the consolidation of resources in the production of high-demand commodities.

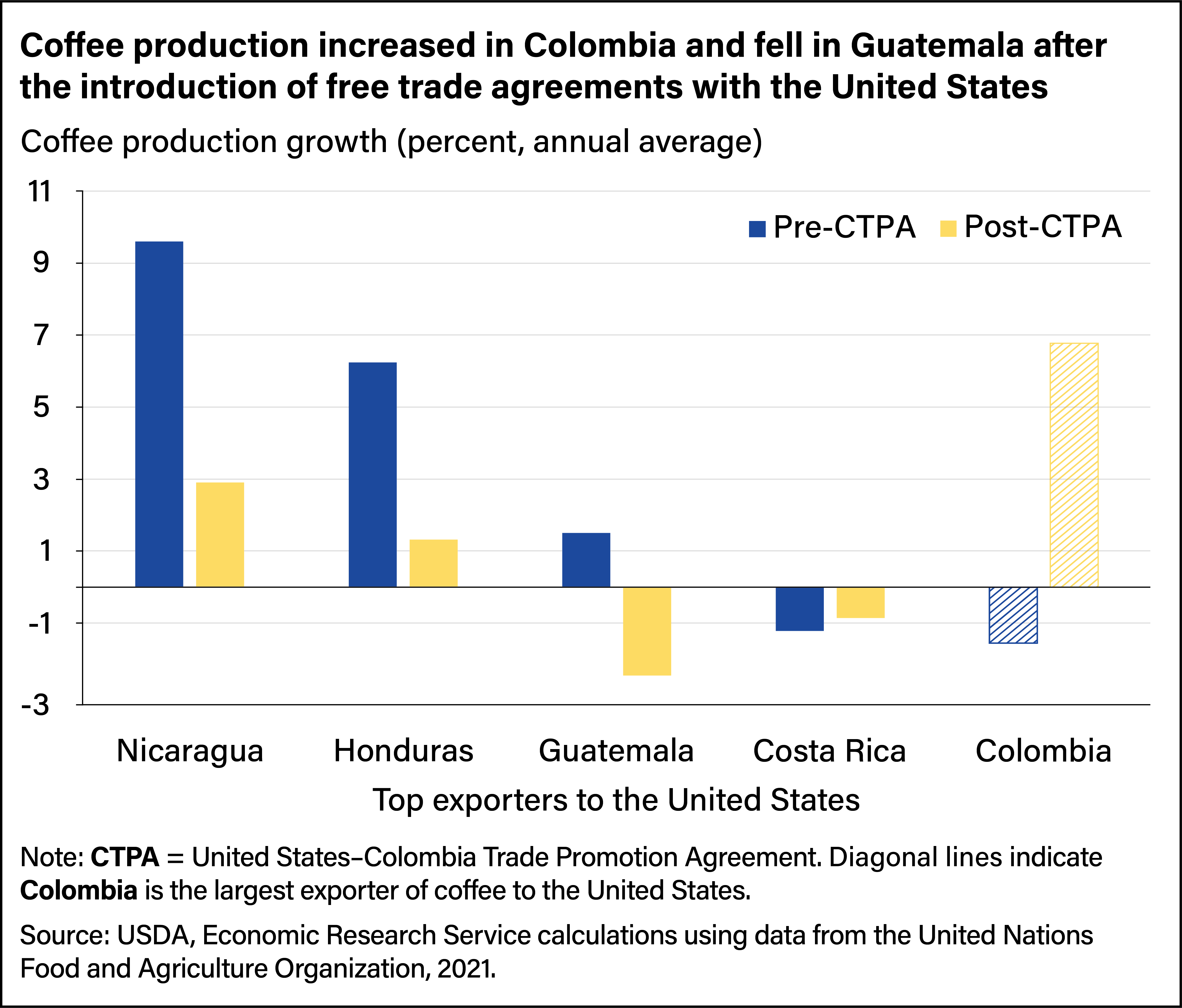

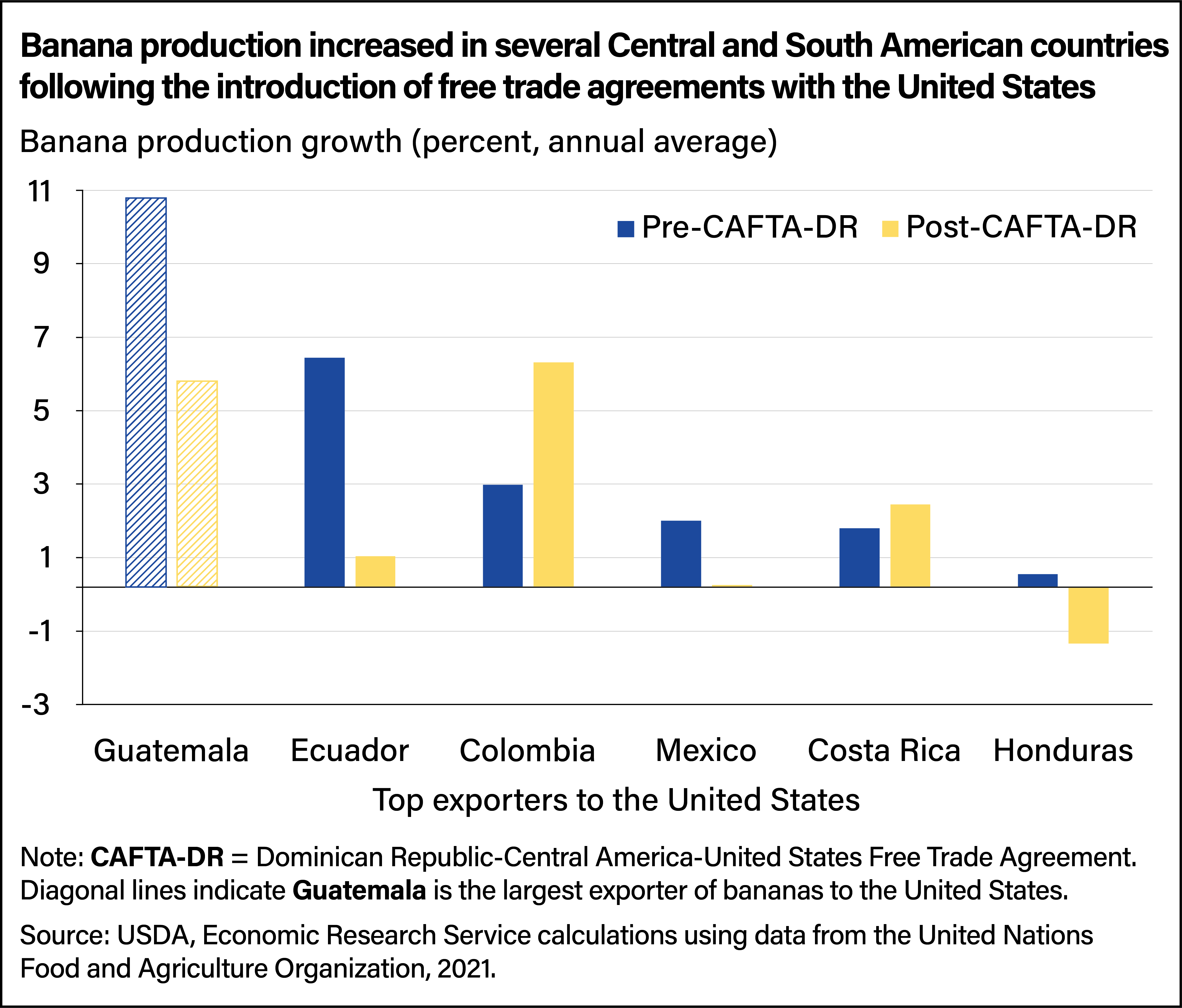

- After an FTA with the United States, the most efficient producers of popular import commodities in the U.S. consumer market see growth in their share of the U.S. market for such commodities, as was the case with Guatemala and Colombia’s growth in market share for bananas and coffee, respectively.

- Developing countries often specialize in the production of certain products after an FTA with the United States. The number of exporting countries for coffee and bananas to the United States, for example, dropped as large suppliers consolidated resources to increase production.

Free trade agreements (FTA) historically have boosted agricultural trade and production, particularly in developing countries where farming is often a vital pillar of the economy. Once an agreement is in place and trade flows begin to rise, a developing country’s agricultural sector can undergo significant transformations. When developing countries gain access to large consumer markets, like that of the United States, they often shift to specialization, producing commodities in high demand in those markets. The countries consolidate resources to increase production of commodities in which they have a competitive advantage relative to other countries. In the short term, this preference can shift resources and production away from other commodities, including staple crops. In the longer term, such changes could affect food security, economic development, and regional ecosystems.

Increased Trade, Specialization Among Free Trade Agreement Partners

The United States is party to 14 free trade agreements, many with developing or emerging economies. Among those agreements, the Dominican Republic-Central American Free Trade Agreement (CAFTA-DR), implemented in 2006, represents the largest bloc of developing countries. The United States also has agreements with South American partners Chile, Colombia, and Peru—three countries representing a collection of emerging markets that are key suppliers of agricultural commodities, especially specialty crops. From 2012 to the end of 2021, CAFTA-DR countries increased their agricultural exports to the United States by an average of 58 percent and export volume from the three South American FTA partners rose by an average of 63 percent.

As their agricultural exports grew, many partner countries also increasingly moved toward specialized production after the enactment of their free trade agreements. Central and South American FTA partner countries produce similar primary commodities, mainly fruits and vegetables, sugar, and coffee. As export opportunities increased, these countries consolidated resources and increased the production of fresh produce, sugar, and—in some cases—coffee, all commodities in high demand from trade partners.

The increase in competition from a growing number of U.S. FTA suppliers has encouraged greater efficiency among these producers, leading to increased specialization across countries. During the time between the accession of the CAFTA-DR in 2006 and the United States–Colombia Trade Promotion Agreement (CTPA) in 2012, Central American coffee production decreased. In addition to changes brought about by the FTA, Central American coffee markets faced depressed international prices, increased global competition, a severe coffee rust epidemic and variable rainfall levels. Combined, those factors made regional coffee production less profitable and encouraged expanded production into other commodities such as palm oil. Conversely, Colombian producers began consolidating resources and gravitating toward coffee production. Since the CTPA’s implementation, U.S. imports of coffee products from other Central and South American countries generally declined, mirroring the drop in production across these countries. An exception is Colombia. Unlike most Central American countries and other South American FTA partners, Colombian coffee production has increased along with U.S. imports of Colombian-grown coffee.

Following the implementation of FTAs, regional banana production experienced shifts similar to those in coffee production. Specifically, a surge in Guatemalan banana exports to the United States came at the expense of other banana exporters such as Ecuador and Honduras. Guatemala’s share of the U.S. banana export market increased from its pre-CAFTA-DR average share (1990–2005) of 16.5 percent to 35.9 percent in the years that followed (2006–20) the agreement’s implementation. In 1990, Guatemala was the fifth largest supplier of bananas to the United States behind much larger suppliers such as Ecuador, Costa Rica, and Honduras. As of 2021, Guatemala supplied 40.5 percent of bananas to the U.S. market, while the United States remains the largest importer of Guatemalan bananas. Like coffee production, the cultivation of bananas in these countries faces threats, including a variety of yield-sapping diseases, especially the fungal disease Tropical Race 4.

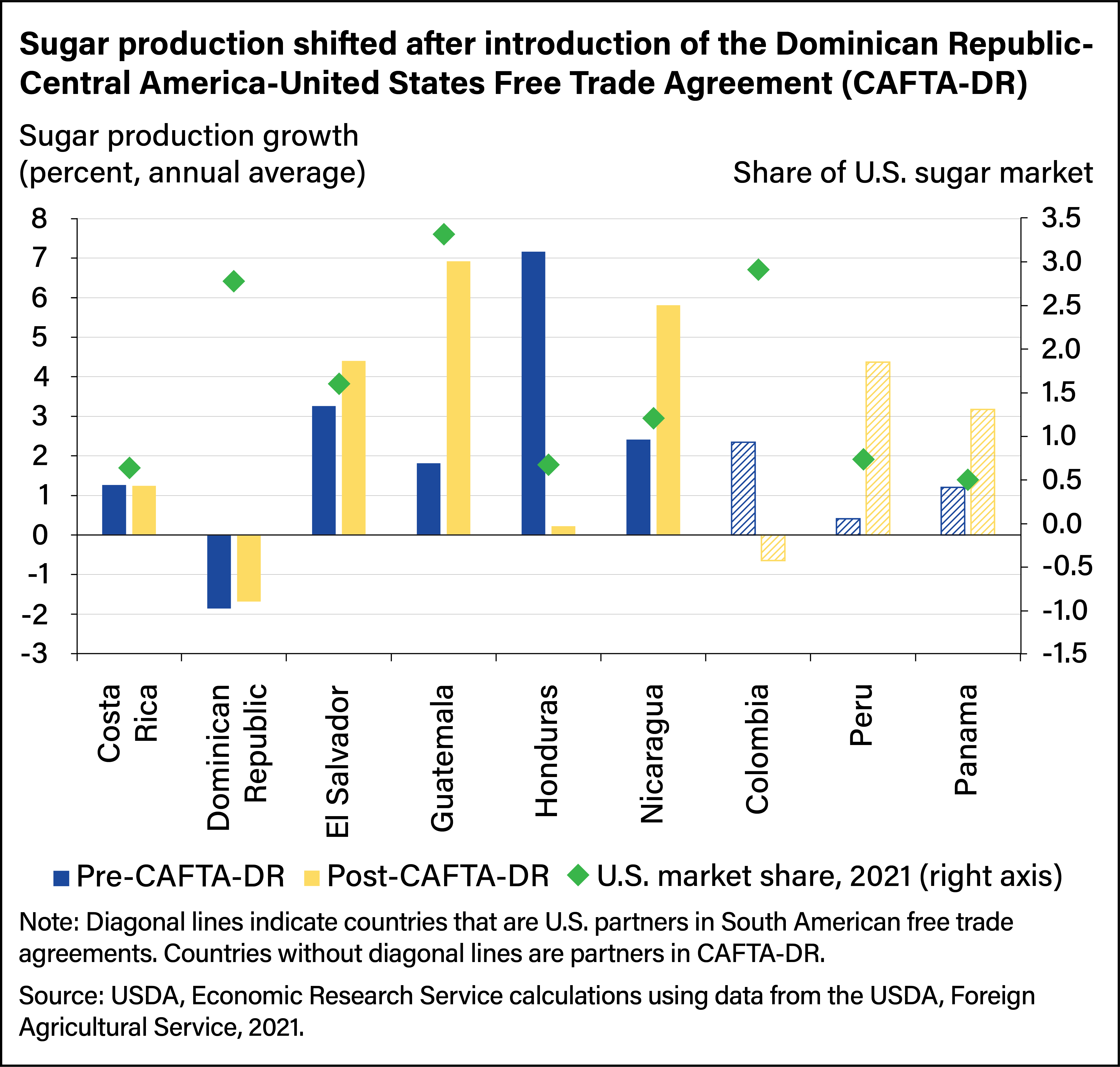

By volume, sugar is the largest commodity produced in 9 out of 10 of United States’ Central and South American FTA partners. Collectively, CAFTA-DR and South American FTA trading partners accounted for 21 percent of all U.S. sugar imports in 2021, with Guatemala and Colombia representing the 2 largest producers of this group. However, since the implementation of CAFTA-DR, production by those two countries moved in different directions. Since CAFTA-DR was implemented in 2006, Colombia’s sugar production fell by 0.7 percent, while Guatemalan sugar production rose an average of 7 percent annually. For Chile, the outlying country for which sugar is not the largest commodity, sugar production decreased partly because sugarcane is increasingly used for producing ethanol instead. In Guatemala, the land area dedicated to sugarcane cultivation steadily increased since CAFTA-DR was introduced.

FTAs offer a means for developing countries to expand and diversify their economies, as well as increase trade. Shifts in producer preferences to accommodate the demand of U.S. consumers have resulted in market share gains. Subsequent growth in gross domestic product, as well as trade volume, typically seen from FTAs often leads to the emergence of other economic sectors such as manufacturing, industrial, or services. This is necessary to accommodate workers leaving the agricultural sectors.

This article is drawn from:

- Ajewole, K., Beckman, J., Gerval, A., Johnson, W., Morgan, S. & Sabala, E. (2022). Do Free Trade Agreements Benefit Developing Countries? An Examination of U.S. Agreements. U.S. Department of Agriculture, Economic Research Service. EIB-240.

You may also like:

- Beckman, J. (2021). Reforming Market Access in Agricultural Trade: Tariff Removal and the Trade Facilitation Agreement. U.S. Department of Agriculture, Economic Research Service. ERR-280.

- Beckman, J., Gale, F. & Lee, T. (2021). Agricultural Market Access Under Tariff-Rate Quotas. U.S. Department of Agriculture, Economic Research Service. ERR-279.

- Gomez, M.I., Puerto, S., Zahniser, S. & Li, J. (2021). U.S. Agricultural Exports to Colombia: Rising Sales in Response to Trade Liberalization and Changing Consumer Trends. U.S. Department of Agriculture, Economic Research Service. AES-118-01.