Sub-Saharan Africa’s Reliance on Oil Exports Leads to Decline in Agricultural Imports During Pandemic

- by Adam Gerval and James Hansen

- 9/26/2022

Highlights

- Many Sub-Saharan African economies are reliant on exports of a single, high-value commodity as the primary source of export revenue.

- Single-commodity exporters, particularly of oil, are especially vulnerable to downturns in commodity prices as occurred with the oil price collapse during the COVID-19 pandemic’s onset.

- Without the foreign exchange credits to import foods that the United States exports, such as wheat, rice, and poultry, Sub-Saharan Africa’s food imports fell during the COVID-19 pandemic. Imports of these commodities through 2031 are expected to continue below pre-COVID era projections.

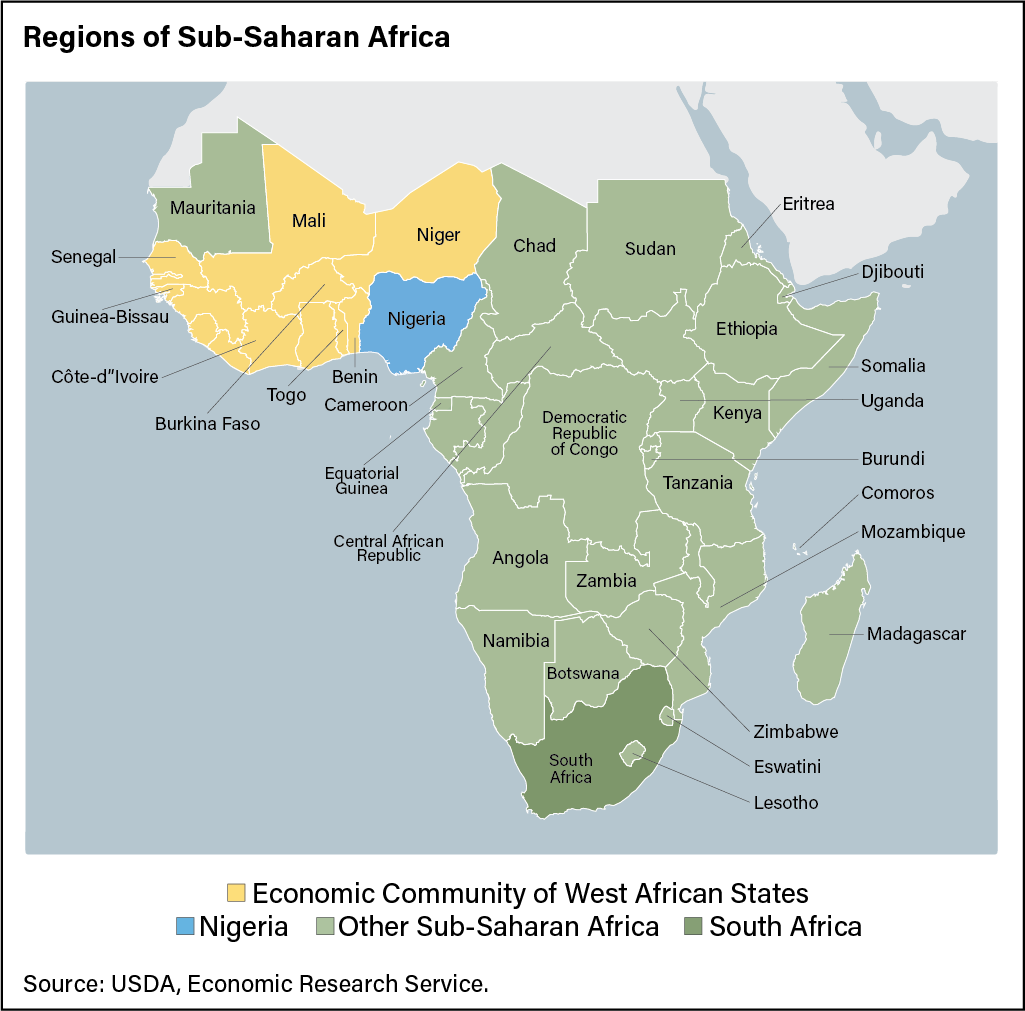

Sub-Saharan Africa is a region characterized by economies with growing populations, rising per capita incomes, and increasing urbanization. Despite being markers for significant market growth, these traits also can be symptomatic of economic development struggles that jeopardize stability in trade relationships. For example, most Sub-Saharan African countries depend almost exclusively on revenues and foreign exchange from the export of a high-value commodity such as oil.

When countries rely on the exports of a single commodity, significant fluctuations in international prices for that commodity can leave them vulnerable to economic shocks. If global prices drop, income and foreign exchange earned through exports fall. Gross Domestic Product (GDP) declines, as does consumer income. This reduces demand for agricultural goods and diminishes a commodity-dependent country’s ability to trade effectively. Researchers at USDA’s Economic Research Service sought to identify the conditions that might indicate whether a market is insulated from this type of economic volatility, focusing on prominent U.S. export markets in Sub-Saharan Africa. Through the lens of the Coronavirus (COVID-19) pandemic, the research illuminated the economic development challenges related to a lack of economic diversification in Sub-Saharan African countries.

When the price of a country’s primary export commodity is at a peak, incoming revenue provides resources to finance increases in public consumption, as well as urban development projects vital to keeping pace with the region’s rising urbanization rates. But when global economic shocks such as the COVID-19 pandemic cause that commodity’s price to drop, the volatility has consequences for development. In the context of agricultural trade, these shocks disrupt the country’s ability to import primary commodities such as poultry, wheat, or rice. These commodities are consumed increasingly by a growing number of middle-income households throughout the Sub-Saharan African region.

Markets Dependent on Trade of a Single Commodity Are Volatile and Vulnerable

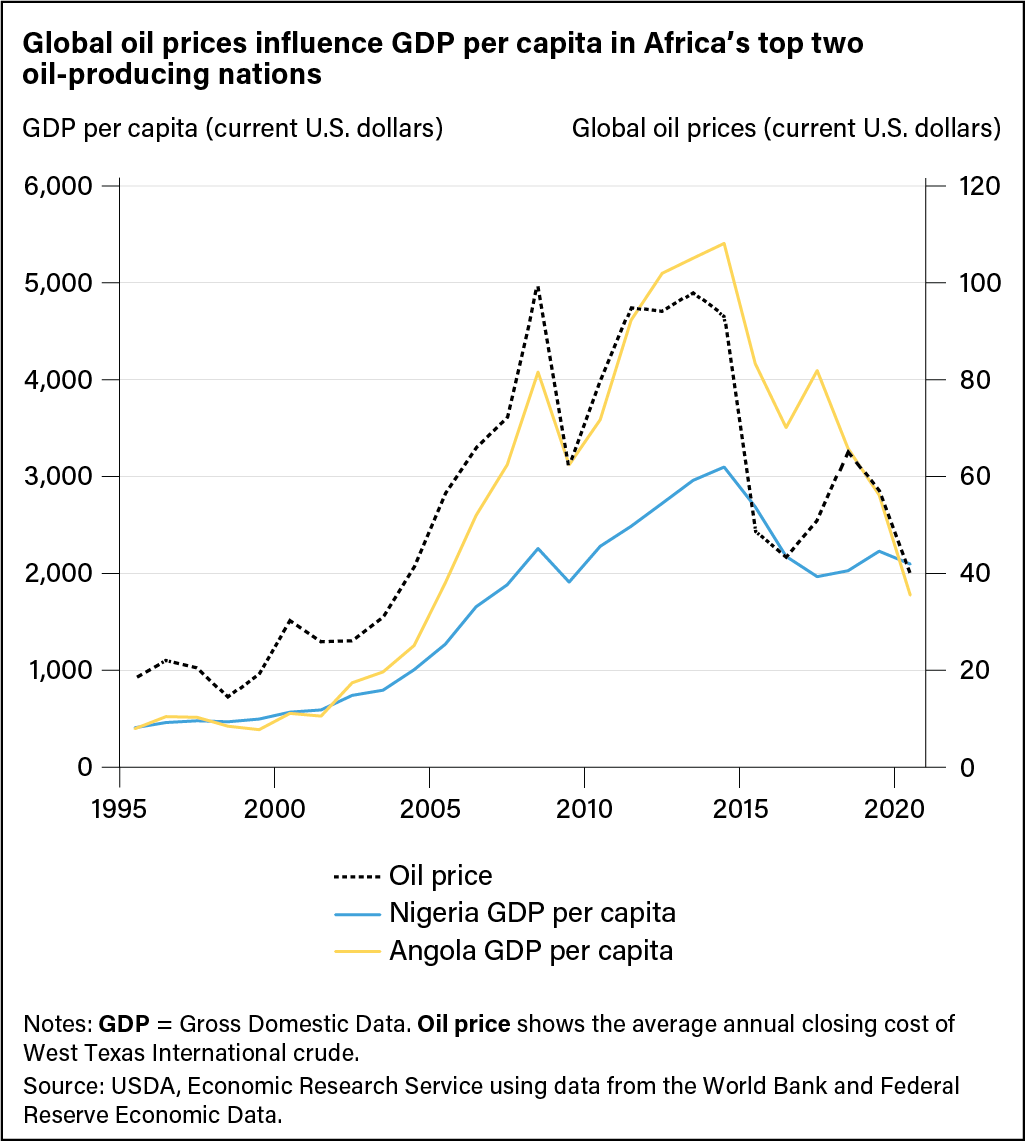

Large U.S. export destinations in Sub-Saharan Africa, such as Nigeria and Angola, have some of the highest per capita incomes in the region. While this is potentially positive for U.S. export growth, it also reflects economic volatility in Sub-Saharan Africa, where 41 of 46 countries rely almost entirely on commodity exports. For example, Nigeria and Angola, Africa’s two largest oil-producing countries, earn 70 to 75 percent of export revenue from oil. Frequent changes in global oil prices expose these two countries to broad economic instability. Between January 2014 and June 2021, there were 37 periods of oil-price declines, averaging about 10 percent. During the Great Recession of 2007 to 2009, the price of crude oil fell more than 25 percent in October 2008. More recently, oil prices fell more than 42 percent in March and April 2020 during the onset of the COVID-19 pandemic. That was the second largest drop since World War II.

When export revenue streams slow, currency exchange rates depreciate and foreign exchange decreases. That creates disruptions in trade. For example, the Nigerian currency, the naira, depreciated 140 percent between 2010 and 2020 as the average annual closing price for West Texas International crude oil fell from $79.48 to $39.68 per barrel. Prices had not recovered to their pre-2014 level when the pandemic began to affect the global oil market in January 2020, and the naira has depreciated more than 7 percent further since February 2020. Angola’s kwanza has depreciated more than 400 percent since 2010, falling an additional 22.5 percent since the beginning of 2020.

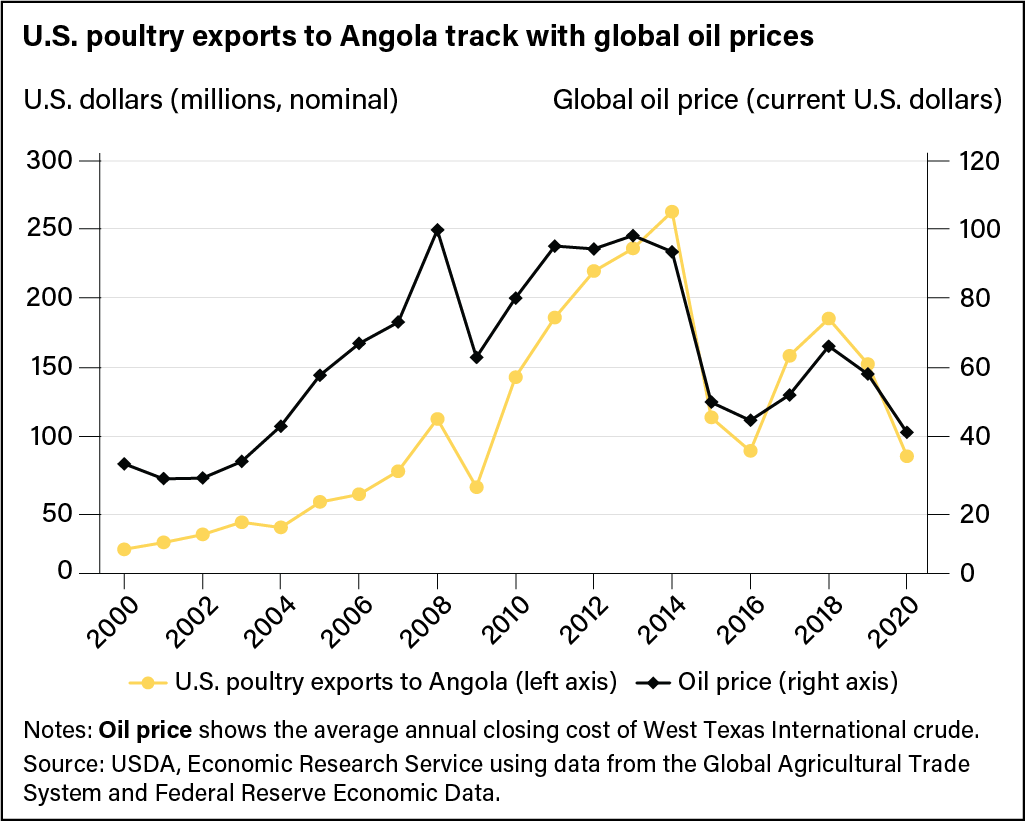

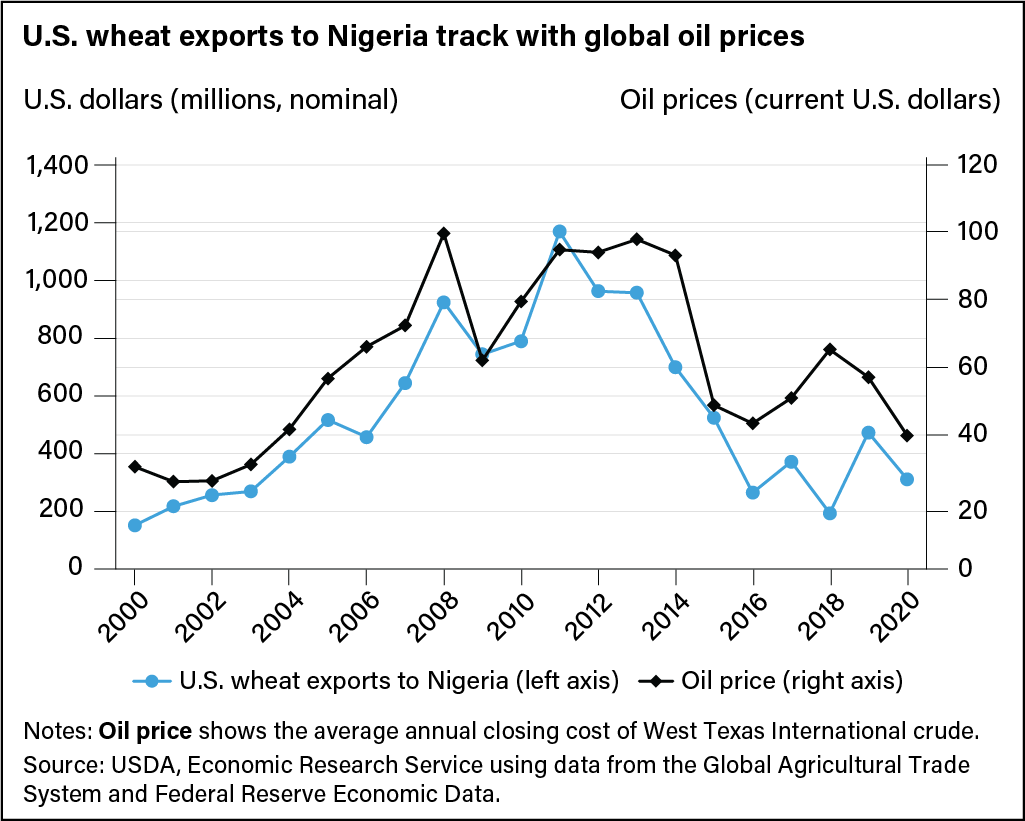

In Nigeria and Angola, where oil exports generate 90 percent of foreign exchange earnings, dollar shortages have delivered a competitive advantage to U.S. competitors. Historically, a depletion of U.S. dollar reserves has led to a decrease in U.S. exports to those two countries, mirroring declines in global oil prices. The fluctuation in oil prices parallels the trends in exports (see chart below). As a result, Nigeria and Angola have turned to non-U.S. exporters for agricultural imports. For example, the largest importer of Nigerian oil—the European Union—expanded its share of the Nigerian wheat market by nearly fivefold in 2020, compared with 2019, after the 2020 oil price plunge. Similarly, Russia and Ukraine garnered greater shares of the Nigerian wheat market in recent years because of its relatively cheaper wheat crop, although this dynamic may change as the conflict in Eastern Europe continues.

COVID-19’s Dampening Effect on Sub-Saharan Africa’s Consumption Patterns and Trade

Beginning in the late 1990s, consumption of wheat and rice among Sub-Saharan African households began rising and is projected to continue to grow over the next decade. Sub-Saharan Africa is the fastest growing region in the world for rice imports and is projected to account for about 36 percent of the world’s rice imports by 2030. Animal protein consumption also has increased, beginning in the late 1990s, primarily among the lower priced proteins such as eggs and poultry.

A significant portion of household income in Sub-Saharan Africa goes toward the purchase of food. The region has high food-income elasticities, which means that when consumers earn less, they also consume less. Macroeconomic shocks such as the COVID-19 pandemic reduce food demand. Non-staples—such as wheat, poultry, and rice—are among the first foods for which consumption decreases as GDP growth slows.

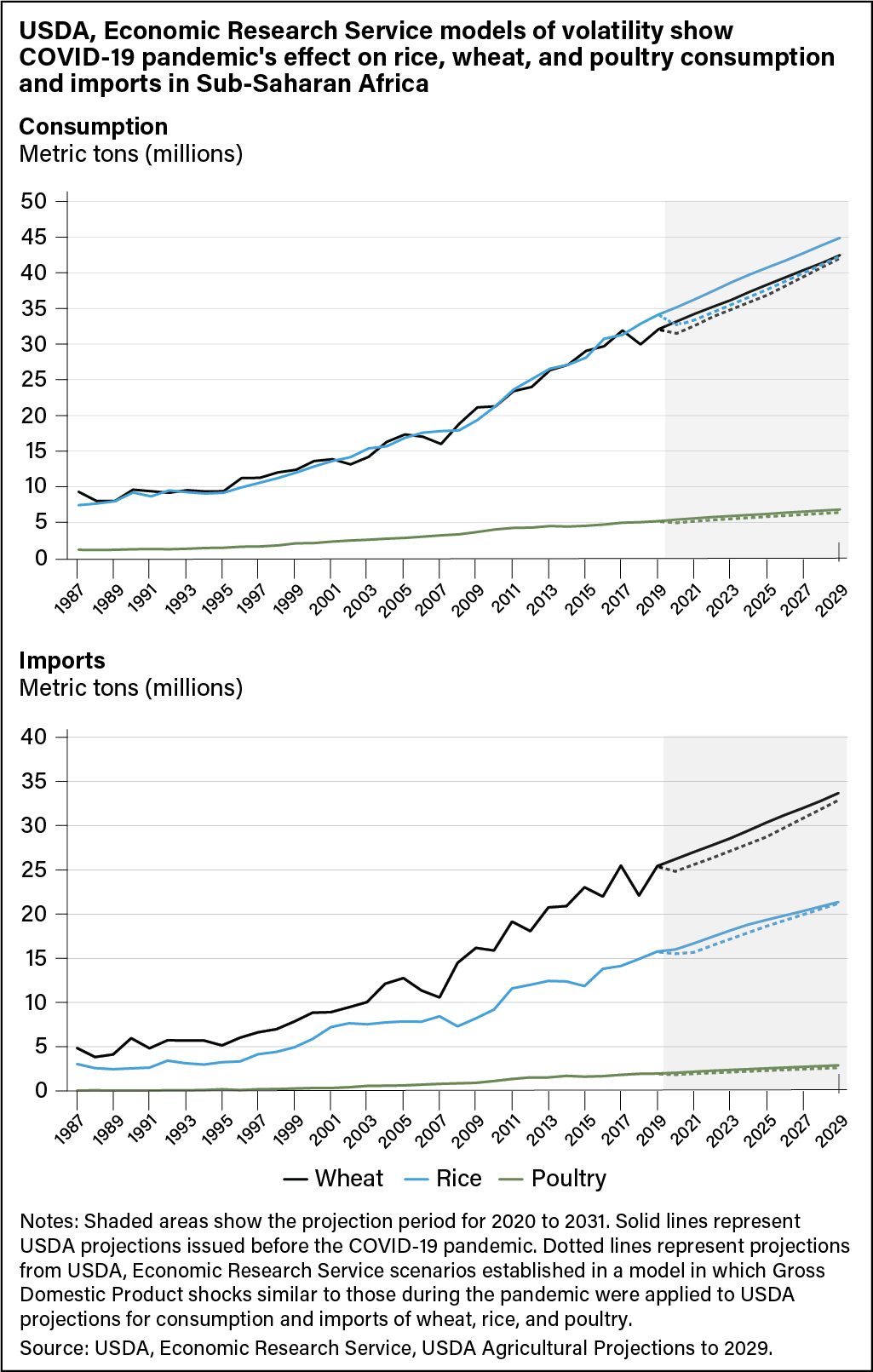

ERS researchers examined the impact of the pandemic on consumption, production, and trade of wheat, poultry, and rice—three commodities that have exhibited the strongest growth in consumption and imports over the past 10 to 15 years. COVID-era data for Sub-Saharan Africa had not yet become available so the researchers modeled scenarios to mimic what the income shock of the COVID-19 pandemic would look like using a GDP shock similar to the one experienced during the pandemic. They applied these scenarios against USDA’s projections for trade and consumption of the three commodities for 2021 through 2031. In the model, the shocks to GDP growth decreased overall trade and consumption but varied across all commodities. These results were consistent with the expectations that lower GDP growth would reduce consumption and imports of rice, wheat, and poultry.

According to the model, rice consumption would decrease the most across Sub-Saharan Africa, falling by 4.3 percent in volume in 2020 from the pre-pandemic projection. That decline was expected to continue through 2031. The decline was largely led by a drop in rice imports. Researchers found this to be significant because West Africa has become the world’s leading importer of rice. Lower consumption from this region is expected to affect global rice markets.

Wheat consumption in Sub-Saharan Africa would decrease 0.8 percent to 1.7 percent throughout the projection period, according to the model, leading to a decrease in imports of 2.1 percent to 2.2 percent. Sub-Saharan Africa relies mostly on imported wheat, producing only about 25 percent of its consumption. Nigeria accounted for 27 percent of the decline in wheat imports across the region.

Among the commodities analyzed in this study, poultry patterns changed the most. The model showed that lower GDP in 2020, 2021, and 2022 would have the greatest reduction on poultry imports, but GDP had been projected to be lower. Even when GDP rebounded, poultry consumption and imports were still lower for all years. The decline in poultry imports was most prominent in the “Other Sub-Saharan Africa” region, which includes large poultry importers such as Angola. In that “Other” category, poultry imports fell 546,000 metric tons through the projection period.

When actual data for 2020 and 2021 were released, they showed the pandemic led to even greater declines than those modeled in the ERS analysis. ERS had projected that rice consumption and imports in the Economic Community of West African States (not including Nigeria), Nigeria, and South Africa would fall less than what actual data later showed for 2020 and 2021. Rice is a more common commodity in urban areas, where incomes tend to be higher and access to imported foods is more prevalent. For wheat, the model projections indicated a stronger effect on consumption and imports than what actual data later showed. Compared with the other two commodities, poultry results were more mixed. For most of the Sub-Saharan African region, modeling results mostly overestimated the decline for consumption, imports, and production of poultry compared with what actual data showed. For South Africa, the model results underestimated the effect of the pandemic on imports and consumption of poultry products.

Modeling results described in this analysis indicate the shock of the COVID-19 pandemic will have varied effects on Sub-Saharan Africa’s future import demand for non-staple commodities such as rice, wheat, and poultry, with implications for U.S. exports to the region through 2031.

The shock of the COVID-19 pandemic will compound many of the developmental challenges that were already prevalent throughout Sub-Saharan Africa, further entrenching the macroeconomic volatility inherent in countries dependent on a single commodity. The subsequent turmoil of such shocks means nations must reallocate their economic resources at the cost of other sectors of the economy, as well as socioeconomic structures such as health, education, and urban development that enable greater economic stability.

This article is drawn from:

- Gerval, A. & Hansen, J. (2022). COVID-19 Working Paper: Single Commodity Export Dependence and the Impacts of COVID-19 in Sub-Saharan Africa. U.S. Department of Agriculture, Economic Research Service. AP-101.

You may also like:

- Liefert, W.M., Mitchell, L. & Seeley, R. (2021, April 29). Economic Crises in Foreign Markets Reduce U.S. Agricultural Exports. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Muhammad, A., D'Souza, A., Meade, B., Micha, R. & Mozaffarian, D. (2017). The Influence of Income and Prices on Global Dietary Patterns by Country, Age, and Gender. U.S. Department of Agriculture, Economic Research Service. ERR-225.