Developing Alternatives to Antibiotics Used in Food Animal Production

- by Stacy Sneeringer

- 5/30/2019

Highlights

- Development of alternative pharmaceutical products can help limit the spread of antibiotic resistance by reducing the use in food-animal production of antibiotics important for human disease treatment; however, such alternative products must compete with other priorities for research and development dollars.

- Although the animal pharmaceutical industry (animal pharma) continues to develop new drugs, a growing share are generic versions of existing animal drugs or are designed for companion animals (instead of food animals).

- Historically, many animal drugs have been originally approved for the human pharma market, but in recent years, fewer of those drugs are migrating to animal markets—lowering the potential of human pharma as source of innovations for alternatives.

Antibiotics are a lifesaving technology widely used in human and veterinary medicine. However, the use of antibiotic drugs, by humans or animals, can also create selective evolutionary pressures that can spawn microbes and genes resistant to the drugs. Antimicrobial resistance has become a global human health concern, with widespread public and private initiatives aimed at managing resistance. Livestock agriculture is a major consumer of antibiotics and, thus, a contributor to antibiotic resistance.

As the agricultural use of antibiotics becomes a greater focus of policymakers and consumers, animal pharma—the industry that develops and markets antibiotics for food animal use—is altering its outlook on developing as well as investing in new antibiotic products. Rising awareness of antibiotic resistance has generated a number of effects, including regulations on the use of antibiotics in food-animal production, increasing demand for food products raised without antibiotics, and wider adoption of disease-reduction methods. These developments, in turn, may lead to further effects, including decreasing sales of antibiotic products, decreasing incentives to invest in new livestock antibiotics, and increasing incentives to invest in non-antibiotic products. On the other hand, the growing export demand for U.S. meat, intensifying animal disease pressures brought about by globalization, and further antibiotic resistance in animals may spur demand for antibiotics as well as the development of new antibiotics.

In deciding what new products to develop, animal pharma must weigh these opposing pressures surrounding antibiotic use in food-animal production with other factors as follows: Human drug innovations have historically been a source of new products in animal pharma, but this role may change as the focus of human versus animal medicine changes (e.g., toward a focus on palliative-care drugs for humans with no analogous purpose in the food animal market). Furthermore, pharma companies may divert R&D spending to products specific to the companion-animal market, which has grown with the rise in pet ownership in the last decade. Lastly, some companies may choose to market generic animal drugs instead of innovating new products.

How Are Animal Drugs Approved?

Product development is a long, complicated, and costly process. Development of a new animal drug may take 7 to 10 years and cost over $50 million per new drug. A new product passes through multiple phases (discovery, development, and registration) before it comes to market, with many potential product candidates never coming to market. A company must, therefore, make decisions about where best to spend its research dollars.

Regulatory approval for animal drugs and dietary supplements in the United States is overseen by the Center for Veterinary Medicine at the U.S. Food and Drug Administration (FDA). FDA considers a drug to be any product intended for use in diagnosing, curing, mitigating, treating or preventing disease. In general, to receive drug approval, the product’s sponsor must file information on the drug’s chemistry and composition, the proposed labeling, and evidence demonstrating three things. First, the drug must be effective in doing what it proposes to do on its label. Second, the sponsor must be able to consistently manufacture the product with good practices. Finally, the drug must be safe for the animal, the environment, and people, when used as directed on the label. Further testing is required for the approval of new antibiotics.

Firms may seek to protect their product with a patent. Patents typically grant market exclusivity for a period of 20 years. Once a product loses patent protection, rivals are free to develop generic alternative versions. Generic approval requires showing a drug is “bioequivalent” to the originally approved drug, but does not require re-establishing the safety and efficacy of the drug in new clinical trials. In the United States, the ability to market generic animal drugs began in 1988, with the first generic drugs making it to market in 1992.

After many years of incurring costs, a successful product may be marketed and begin to make an economic return. However, for the initial time period after a product is released, sales are merely recouping R&D costs. It may take over a decade after approval before the product fully recovers R&D costs.

Human and animal pharma are closely linked, with similar research processes. Although animal pharma is a large global presence as evident in sales ($23.9 billion in 2014), human pharma tallies 42 times that amount (nearly $1 trillion in sales in 2014). Many drugs are originally aimed at the more lucrative human pharma market. Some drugs developed for use in animal production are “cast-offs” from products originally intended to be marketed to humans.

What Are the Trends in the Number of New Animal Drug Approvals?

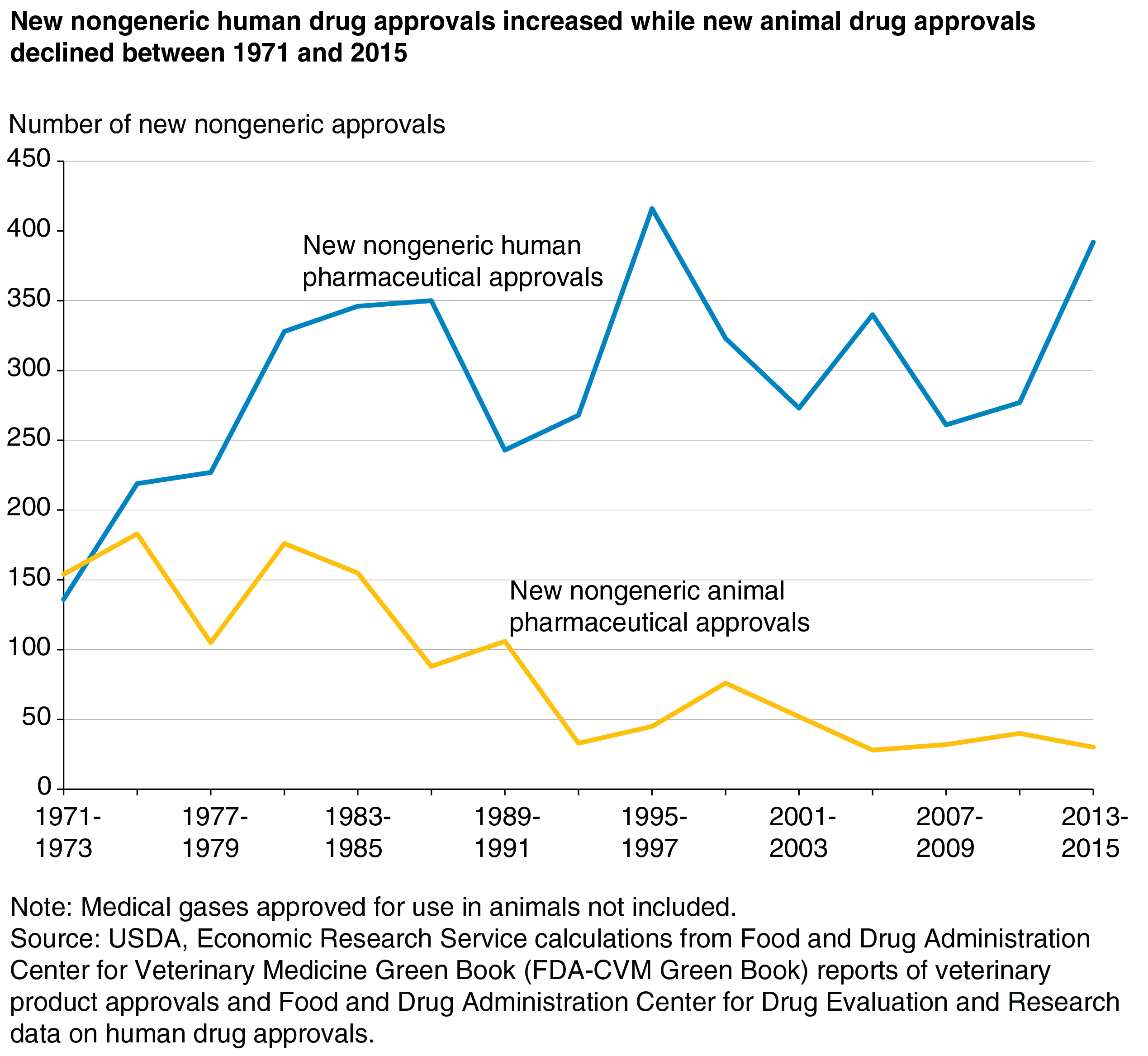

We might expect the number of new animal drug approvals to follow the number of human drug approvals, given these industries’ close ties. A new nongeneric drug approval represents some form of innovation, and as such, we might expect approvals for nongeneric animal and human drugs to trend together—or with a lag reflecting the time during which research might be transferred from humans to animals.

However, as the chart shows, the number of new nongeneric drug approvals for animal use has trended downward since 1971, while those for human use crept upward. This contrast may be due to differences in the size of the respective industries and the basic science of products being pursued in human versus animal health. The human pharma market is much larger, so the number of drugs approved is much higher.

Competition From Generic Drugs and Drugs for Companion Animals May Affect the Development of New Livestock Drugs

The ability to market generics represents another shift in animal drug development, with uncertain effects. Because firms are allowed to market generic products, the increased competition for specific drug types may yield greater innovation so that firms maintain a competitive advantage. Conversely, more generic competition may lead to less innovation, because generic competition may hurt firms’ ability to recapture their large initial investments. The first generic animal drug was marketed in 1992, and 52 percent of all animal product approvals were generics by 2015.

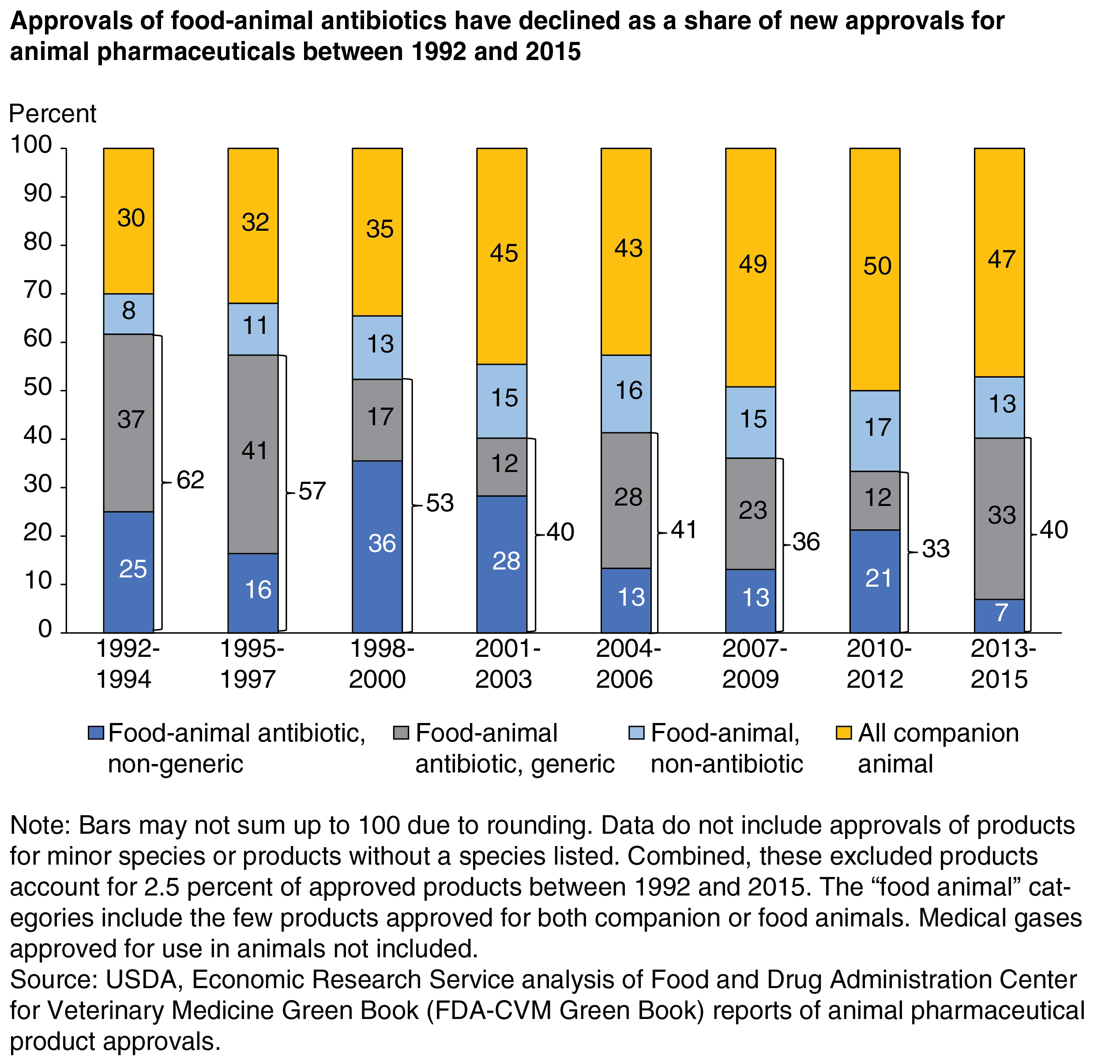

Another factor putting pressure on the R&D dollars for new food animal drugs is the rise of companion-animal ownership and spending. As the chart below shows, the share of new animal drugs approved for companion animals grew between 1992 and 2015. This trend suggests that the overall decline in the number of new animal drugs approved largely reflects a reduction in the number of new food-animal drugs approved. Beginning in the 2000s, the number of companion-animal drug approvals was very similar to that of food-animal drug approvals. Between 1992 and 2015, only 20 drugs (2.8 percent of all products) were approved for both companion and food animals.

Are Fewer Medically Important Antibiotics Being Approved for Food Animal Use?

The number of new human antibiotics being developed has been declining over the past three decades. If current antibiotics lose efficacy and new ones are not developed, then the ability to treat human infections may be hindered. Not surprisingly, given this decline and the links between human and animal pharma, the number of animal drug approvals also declined. Food-animal antibiotics as a share of all veterinary drug approvals between 1992 and 2015 likewise fell (aside from an uptick in 2013-15). This drop in animal drugs’ share of new veterinary drug approvals coupled with the overall decline in the number of new animal drug approvals means that approvals for new antibiotics for food-animal production are declining in number, as is true in human medicine. The number of new nongeneric food-animal antibiotics is also decreasing, with generics making up an increasing share of new antibiotic approvals.

U.S. regulations on antibiotic use in food-animal production have focused on antibiotics important for human disease treatment, which FDA terms “medically important." FDA policies instituted in 2017 ended the use of medically important antibiotics for purposes of growth promotion in food animals. Antibiotics classes, most notably ionophores, deemed “currently not medically important” are not used to treat human illnesses and can still be used for animal growth promotion. Other uses of medically important antibiotics in food animal production require veterinarian oversight. These policies follow earlier actions in the European Union (EU) banning medically important antibiotics for growth promotion.

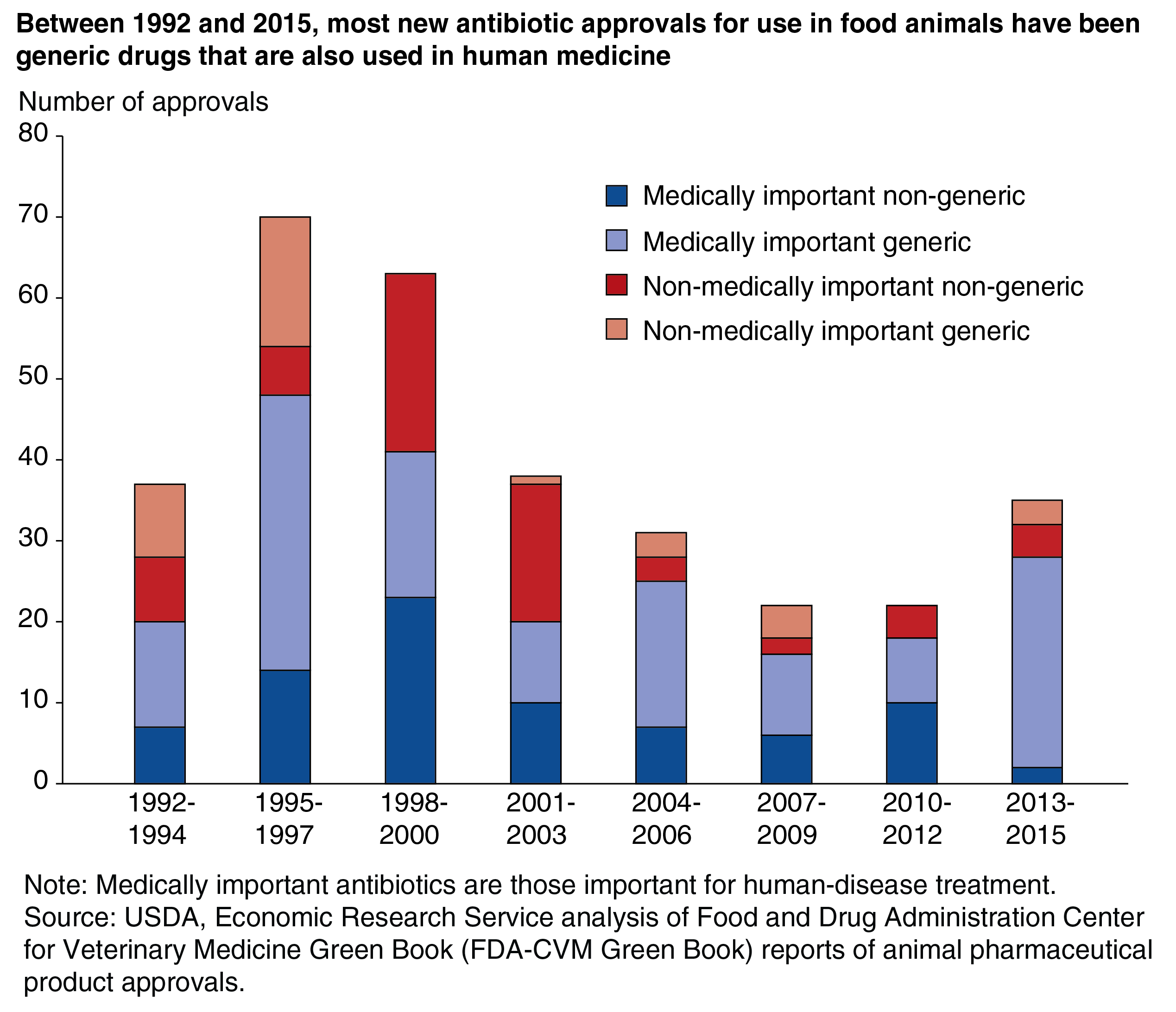

Because these legal changes have been discussed for many years, we might expect fewer medically important antibiotics to be developed for animal use. As the chart below shows, most antibiotics were considered medically important (70 percent between 1992 and 2015). This finding supports the previous finding that animal pharmaceutical companies are increasingly developing generic food-animal antibiotics, not new antibiotics. However, some innovation in new antibiotics for animal use still is occurring. Although new approvals for nonmedically important nongeneric antibiotics for food animals have declined, they still average about 1.3 per year.

The FDA policies banning use of medically important antibiotics for growth promotion in food animals were originally announced in 2013, so any potential effects on drug development may not be identifiable yet. For example, products that were already in the R&D pipeline may have been carried to market regardless of the regulation’s effects on eventual sales. Thus, we still might see changes in product development due to the FDA regulations.

Conclusions

Animal pharma is a growing industry whose role in antibiotic resistance is a key focus of policy discussions. The development of new drugs may help reduce the use of current antibiotics in food-animal production, and reduce resistance. However, shifting priorities in human pharma and lack of development of new human antibiotics likely slowed the development of new products in animal pharma, specifically new antibiotics for food animals.

In addition, competition with generic drugs might mean that fewer dollars are spent innovating new products. Demand for drugs designed for companion animals may encourage the development of new products for that market, instead of food animals. Lastly, FDA regulations limit the use of medically important antibiotics on animals, making development of new products in those categories less desirable.

This article is drawn from:

- Sneeringer, S., Bowman, M. & Clancy, M. (2019). The U.S. and EU Animal Pharmaceutical Industries in the Age of Antibiotic Resistance. U.S. Department of Agriculture, Economic Research Service. ERR-264.

You may also like:

- Bowman, M. & Marshall, K.K. (2016, September 6). Voluntary Labeling of Chicken “Raised Without Antibiotics” Has Posed Challenges for Firms and Consumers. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Sneeringer, S., MacDonald, J.M., Key, N., McBride, W.D. & Mathews, K. (2015). Economics of Antibiotic Use in U.S. Livestock Production. U.S. Department of Agriculture, Economic Research Service. ERR-200.

- Fuglie, K., Heisey, P., King, J., Pray, C.E., Day Rubenstein, K., Schimmelpfennig, D., Wang, S.L. & Karmarkar-Deshmukh, R. (2011). Research Investments and Market Structure in the Food Processing, Agricultural Input, and Biofuel Industries Worldwide. U.S. Department of Agriculture, Economic Research Service. ERR-130.