Major Changes in Export Flows Over the Last Decade Show the U.S. Is Losing Market Share in Global Grain Trade

- by Olga Liefert and David Nulph

- 10/1/2018

The U.S. maintained its status as the world’s grain superpower for most of the post-WW II period by being the leading corn and wheat producer and exporter. Before the beginning of this century, the United States annually exported about a third of globally traded wheat and around 70 percent of corn.

The emergence of new low-cost producers and exporters in the global wheat and corn markets reduced the U.S. share of grain exports and transformed global grain trade. Competition from Russia, Ukraine, and Argentina has weighed down on U.S wheat exports, while Brazil, Argentina, and Ukraine are driving down the U.S. corn export share. Higher surplus-generating grain production in these countries has reduced the U.S. share in global output for both grains. However, a contributing factor for wheat is that U.S. producers have been shifting area from that crop to the more profitable commodities of corn and soybeans. The decline in U.S. wheat output and exports has been not only relative to growing global trade but also absolute, and the changes involving wheat trade have been particularly pronounced as other exporters have capitalized on the opportunity.

World demand for wheat has been growing at a steady pace. This has been driven mainly by population growth in low-income countries and a switch from rice to wheat consumption in countries that are traditionally heavy rice consumers. Several regions have been leading the growth in global wheat consumption and imports, with the fastest being South and Southeast Asia (Indonesia—one of the world’s largest wheat importers, Thailand, Vietnam, and Bangladesh); Sub-Saharan Africa (Nigeria, Kenya, and Tanzania); and North Africa (Egypt and Algeria).

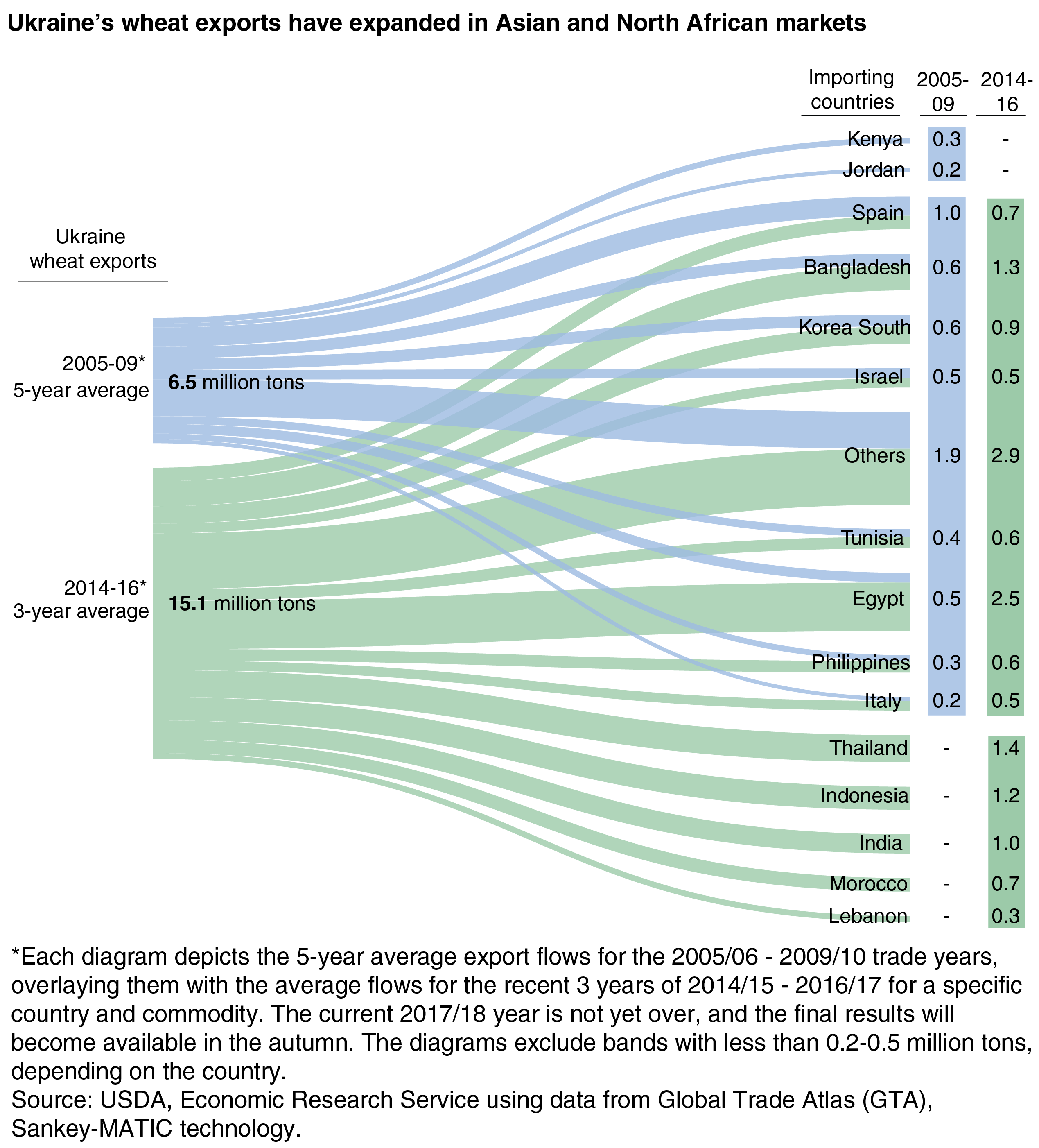

However, the growth in global wheat trade is increasingly being captured by the Black Sea region countries of Russia and Ukraine in addition to the European Union (EU). A comparison of U.S. wheat export totals and destinations in 2005-09 with the same data for 2014-16 reveals the markets lost, retained, and gained over the two periods.

Between the two periods, U.S. wheat exports have decreased as Russia, Ukraine, and the EU have gained market share in several key U.S. markets. Although the U.S. retained and even increased its wheat exports to some of its markets, such as Mexico and the Philippines, it did not raise its import share with those countries. Much of the growth in U.S-displacing wheat exports by Russia and Ukraine is low-quality milling wheat (for food consumption) and feed grain.

A striking example of changing markets for U.S. wheat exports is Egypt, one of the world’s top wheat importers. Egypt used to purchase the bulk of its wheat from the United States but now receives most of its imports from Russia, Ukraine, and the EU, while mostly terminating purchases of wheat from the United States. A similar shift is happening now with Nigeria and Yemen.

The average volume of wheat exports by Russia and the EU nearly doubled between the two periods, while those of Ukraine rose by more than 150 percent. There was also the emergence of new and major shifts in these countries’ export destinations. Iran, Nigeria, and Sudan are among the new market destinations for Russian wheat, as is the more distant market of Mexico, which was previously out of reach for Eastern Hemisphere countries. Although Egypt, Turkey, and Bangladesh are not new importers of Russian wheat, Russian exports to these countries have increased substantially. India and Pakistan are among the few countries to which Russia has nearly stopped exporting wheat. India has switched to Ukraine as a supplier, while Pakistan has largely terminated its wheat imports. Ukraine has become the major wheat supplier to the dynamic markets of Thailand, Indonesia, and Bangladesh and has boosted its position in Egypt and South Korea.

As with wheat, corn trade volume and flows have also undergone significant changes. The shifts in corn trade are similar to those for wheat, such that the expansion in global corn trade is being captured by countries other than the United States – Brazil, Argentina, and Ukraine – while the U.S. share is falling.

This article is drawn from:

- Bond, J.K. & Liefert, O. (2018). Wheat Outlook: May 2018. U.S. Department of Agriculture, Economic Research Service. WHS-18E.

- Capehart, T., Liefert, O. & Olson, D.W. (2018). Feed Outlook: May 2018. U.S. Department of Agriculture, Economic Research Service. FDS-18E.

You may also like:

- Wheat Data. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Foreign Agricultural Trade of the United States (FATUS). (n.d.). U.S. Department of Agriculture, Economic Research Service.