Changing Farmland Values Affect Renters and Landowners Differently

- by Nigel Key and Christopher Burns

- 2/21/2018

Highlights

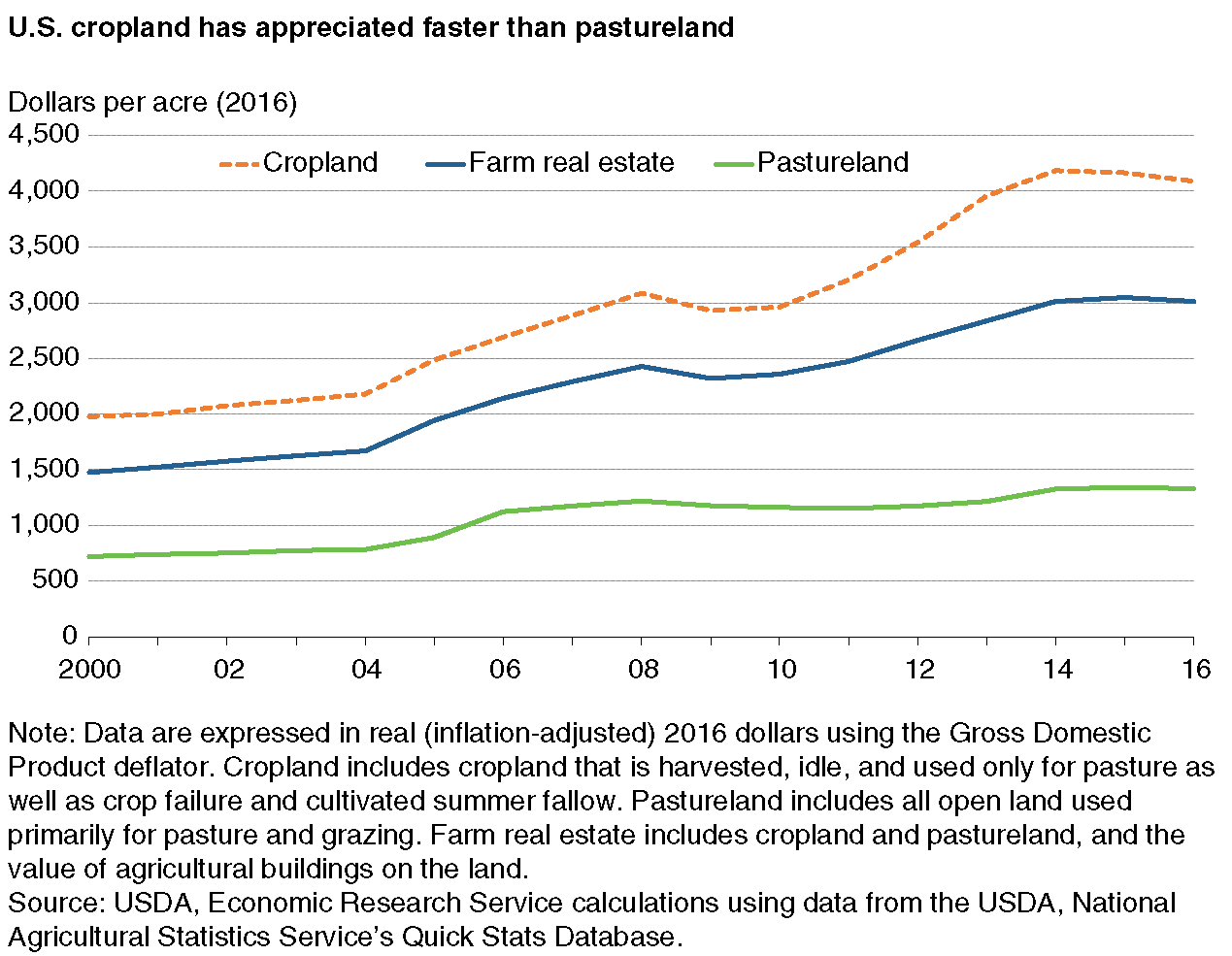

- Farmland values have appreciated substantially since 2000, more than doubling from $1,483 per acre in 2000 to $3,060 per acre in 2015.

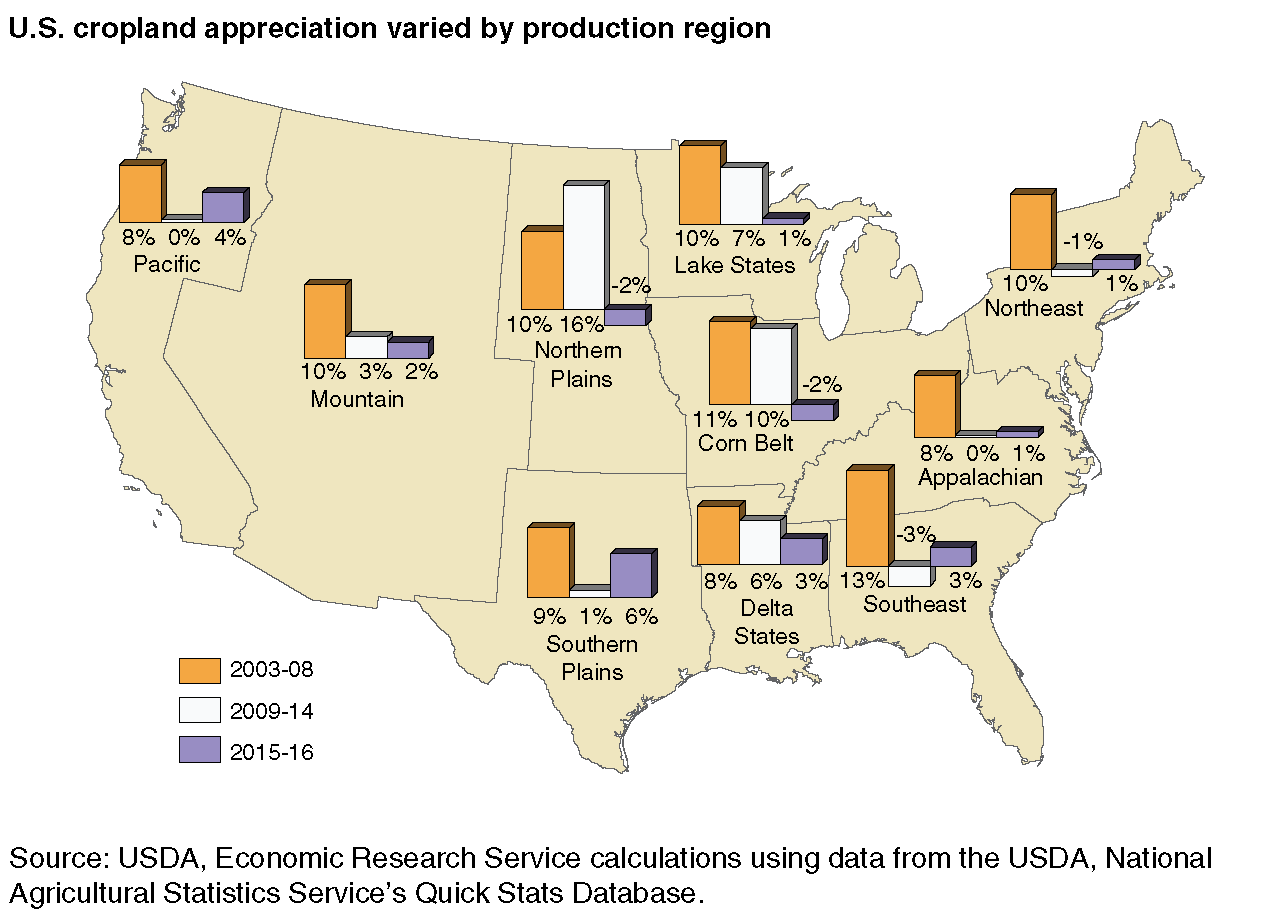

- Cropland appreciated faster than pastureland, while farmland in the Midwest appreciated faster than other areas of the country.

- When land was appreciating rapidly, crop farmers in the Heartland region who owned more of their land had greater growth in real estate secured debt and land purchases.

Farm real estate (including land and the structures on the land) accounts for over 80 percent of farm sector assets. Land ownership patterns vary widely, however, from retired farmers who own all of their land to large-scale grain farmers who rent substantial amounts of land. As a result, changes in the value of farmland can affect farmers differently, depending on the amount of land that they own or rent.

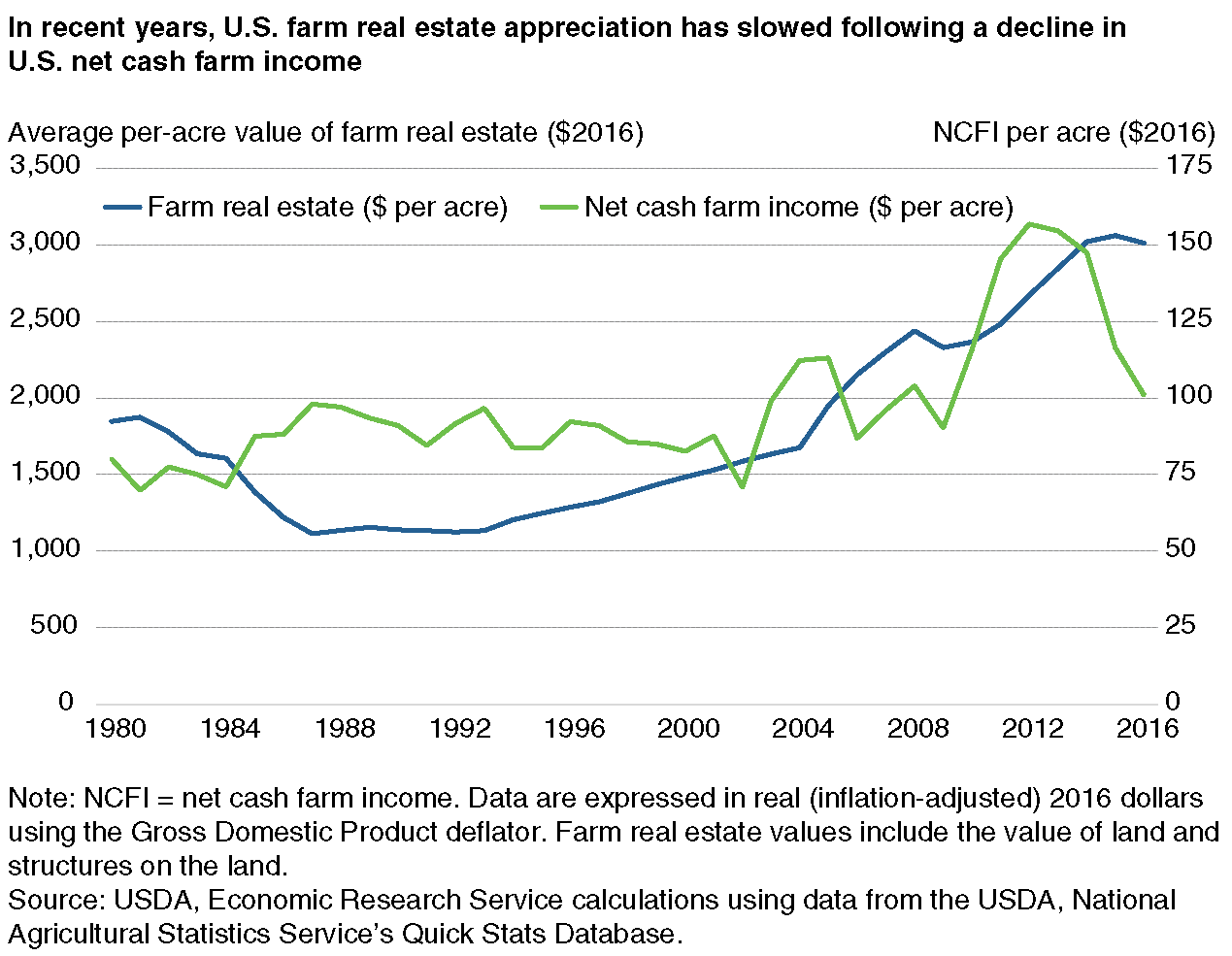

U.S. farm real estate values have been rising following the 1980s farm crisis. Beginning in the mid-2000s, higher farm incomes and lower interest rates contributed to rapid appreciation—reaching record high values in 2015. Nationally, average per-acre farm real estate values more than doubled in real terms (adjusted for inflation), from $1,483 in 2000 to $3,060 in 2015. However, farmland appreciation slowed considerably from 2015 to 2016, with some regions experiencing small declines caused by falling commodity prices and net cash farm income.

Over the last two decades, farm real estate values appreciated differently by land use and region. Both cropping and pasture—two major uses for farmland—increased substantially in value over the 2004-14 period, with cropland doubling in real terms. Cropland appreciated faster than pastureland, reflecting the relatively steep rise in grain and oilseed commodity prices. Regionally, this led to greater appreciation where these crops are grown (including the Northern Plains, Lake States, and Corn Belt). However, between 2015 and 2016, these same regions had low to negative farmland appreciation, reflecting falling farm income and commodity prices. Regional differences in land values may also be due to varying demands for farmland for nonagricultural purposes, such as demand for oil and gas development in shale areas.

Rapid Land Appreciation Allows Landowners To Borrow More and Purchase More Land

Land value appreciation and depreciation affect farmers differently, depending on the amount of land they own versus rent. For many farmers, particularly larger scale crop farmers, farm real estate represents a substantial share of total household wealth and is the most important source of equity used to secure loans. Because land is an important source of collateral, land value appreciation or depreciation can influence access to credit. When land prices rise, landowners gain additional collateral, which may allow them to increase borrowing. When land prices fall, farmers lose equity and their access to credit may shrink or even disappear. Hence, changing land values could affect how much landowners can borrow to purchase land, expand production, or make on-farm (and off-farm) investments.

Unlike landowners, renters do not enjoy wealth gains from land price appreciation. Instead, rents usually rise along with land values, raising operating costs. Hence, higher land prices can make it more difficult for renters to expand production or purchase more land.

To better understand the effect of changing land values on farm business decisions, ERS researchers recently used Census of Agriculture data to compare the same farms over two 5-year periods with different land appreciation rates. From 1997 to 2002, the average farm real estate value increased by 20 percent in real terms—while from 2002 to 2007 it appreciated by 44 percent. As prices increased, farmers who owned a greater share of their farmland gained more wealth than similar farmers who rented more of their land.

The research tested whether farmers who owned a greater share of their land borrowed more, bought more land, or expanded their operations faster from 2002 to 2007 compared to 1997-2002. Researchers focused on crop farmers who remained in business from 1997 to 2007 and who harvested at least 25 acres in the Heartland region (which includes all of Iowa, Illinois, and Indiana, as well as parts of neighboring States). In 1997, the average farm in this sample owned 35 percent of the total land that it operated, producing roughly $470,000 in output on 1,360 acres of farmland. The average farmer paid almost $30,000 in interest expenses, implying about $340,000 in debt (at an 8.8 percent interest rate). Because land appreciation was greater in the second period (2002-07), owning an additional 1 percent of the farm’s land would have increased the average farmer’s wealth by $7,637 more in the second period than in the first (1997-2002).

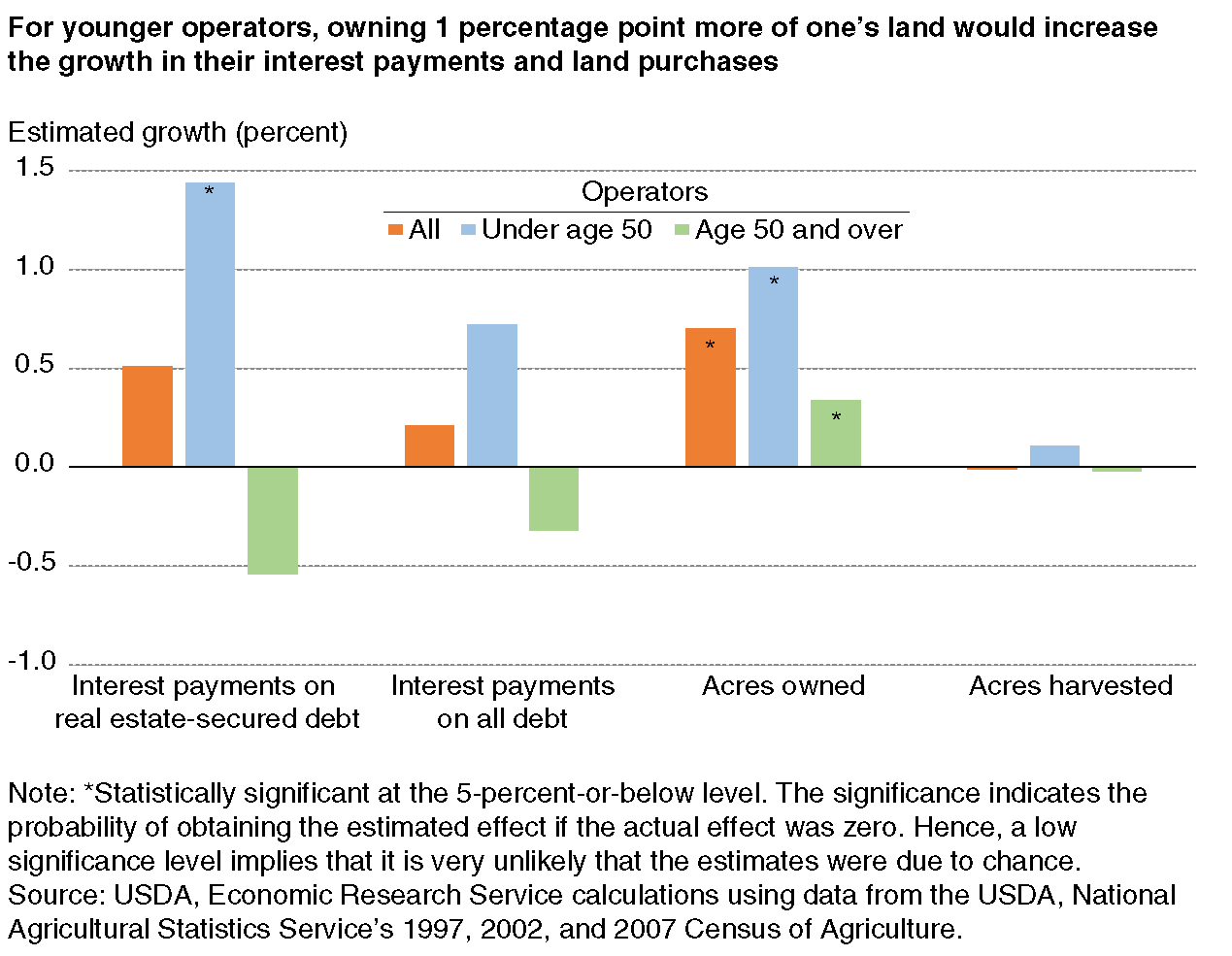

Researchers estimated the effects for the entire sample and separately for farmers who, in 1997, were younger than 50 and those who were 50 or older. Splitting the sample by age can reveal different effects for younger farmers who are more likely to have a demand for credit (because they are in a growth phase of the business) and more likely to be constrained by their wealth (because they have had less time to accumulate it).

The results indicate that, for younger farmers, owning 1 percentage point more of one’s land increased the growth rate in interest expenses by 1.44 percentage points, holding everything else the same, including interest rates, operator age, and farm size. Hence, during the period of rapid land appreciation (2002-07), young farmers who owned more of their land increased borrowing more than young farmers who owned less of their land. For an average farm, this implies that owning 1 percentage point more of one’s land would increase interest expenses by $281 and debt by $3,465. There was no significant effect for older farmers.

In addition to increasing their borrowing expenses during the period of rapid land appreciation (2002-07), younger farmers with larger land wealth gains also bought more land. For them, owning 1 percentage point more of one’s land increased the growth rate in land owned by 1.01 percentage points. For the average farmer in the sample, this corresponded to a purchase of about 4.9 acres, which would have cost about $12,250. The results also indicate that land-induced increases in wealth had little effect on acres harvested. With no change in harvested crop acreage, the estimates imply that farmers who gained more from land appreciation replaced the cropland they rented from others with cropland they purchased. The lack of a land wealth effect on acres harvested also implies that decisions to expand the farm are not constrained by access to capital. In general, larger farms are more profitable and own a smaller share of their land than smaller farms, so greater land ownership is not a requirement for higher profits. Changes in farm size may be driven more by differences in farm profits than by access to capital: farmers earning higher profits per acre are better able to expand because they can afford to pay higher rents or purchase prices for land.

Changing Land Values Could Affect Who Owns the Land

The findings suggest that those who own relatively more land will respond to land price appreciation by increasing borrowing and the share of cropland they own. The data also show that there is a strong inverse relationship between the share of land that is owned and farm size (as measured by value of production). Farmers who own less than 25 percent of their land produce, on average, more than twice the output of farmers who own more than 75 percent of their land. Hence, the results suggest that rapid land value appreciation could increase the rate of land purchases more for smaller (lower value of production) farms, since smaller farms generally own a larger share of their land. Conversely, a period of declining land prices could be accompanied by greater consolidation of ownership among larger (higher value of production) farms.

Farmers who own most of their land also tend to be older and have more farming experience than those who rent most of their land. For example, only 5 percent of those owning at least 75 percent of their land were young beginning farmers (those under 50 years old with 10 or fewer years of farming experience). By comparison, nearly 22 percent of those owning less than 25 percent of their land were young beginning farmers. Over time, farmland is gradually passed from older to younger farmers through land sales and inheritances. The finding that wealth gains from land appreciation permit farmers to purchase additional land, combined with the fact that older experienced operators generally own more of their land, suggests that a rapid increase in land values could slow the transfer of land from older to younger farmers. On the other hand, young beginning farmers may be better able to purchase land when land prices level out or decline.

This article is drawn from:

- Land Use, Land Value & Tenure. (n.d.). U.S. Department of Agriculture, Economic Research Service.

- Burns, C., Key, N., Tulman, S., Borchers, A. & Weber, J.G. (2018). Farmland Values, Land Ownership, and Returns to Farmland, 2000-2016. U.S. Department of Agriculture, Economic Research Service. ERR-245.