More Microloans Issued in Regions With Higher Concentrations of Small Farms and Beginning Farmers, Women, and Minorities

- by Sarah Tulman

- 4/2/2018

USDA’s Farm Service Agency (FSA) provides loans to farmers through a number of programs. Direct Operating Microloans are designed to be more convenient and accessible than FSA’s traditional Direct Operating Loans (DOLs) for groups such as beginning farmers, veterans, women, and minorities. Microloans are much smaller than traditional DOLs, with a maximum loan limit of $50,000 compared to $300,000.

Many farmers who would otherwise be interested in a traditional DOL might forego applying because of the lengthy application process or requirements that can be more difficult for some farmers to meet. The Microloan program is designed to lower these barriers. Microloans, for example, have relaxed requirements for farm management experience, production history, and collateral.

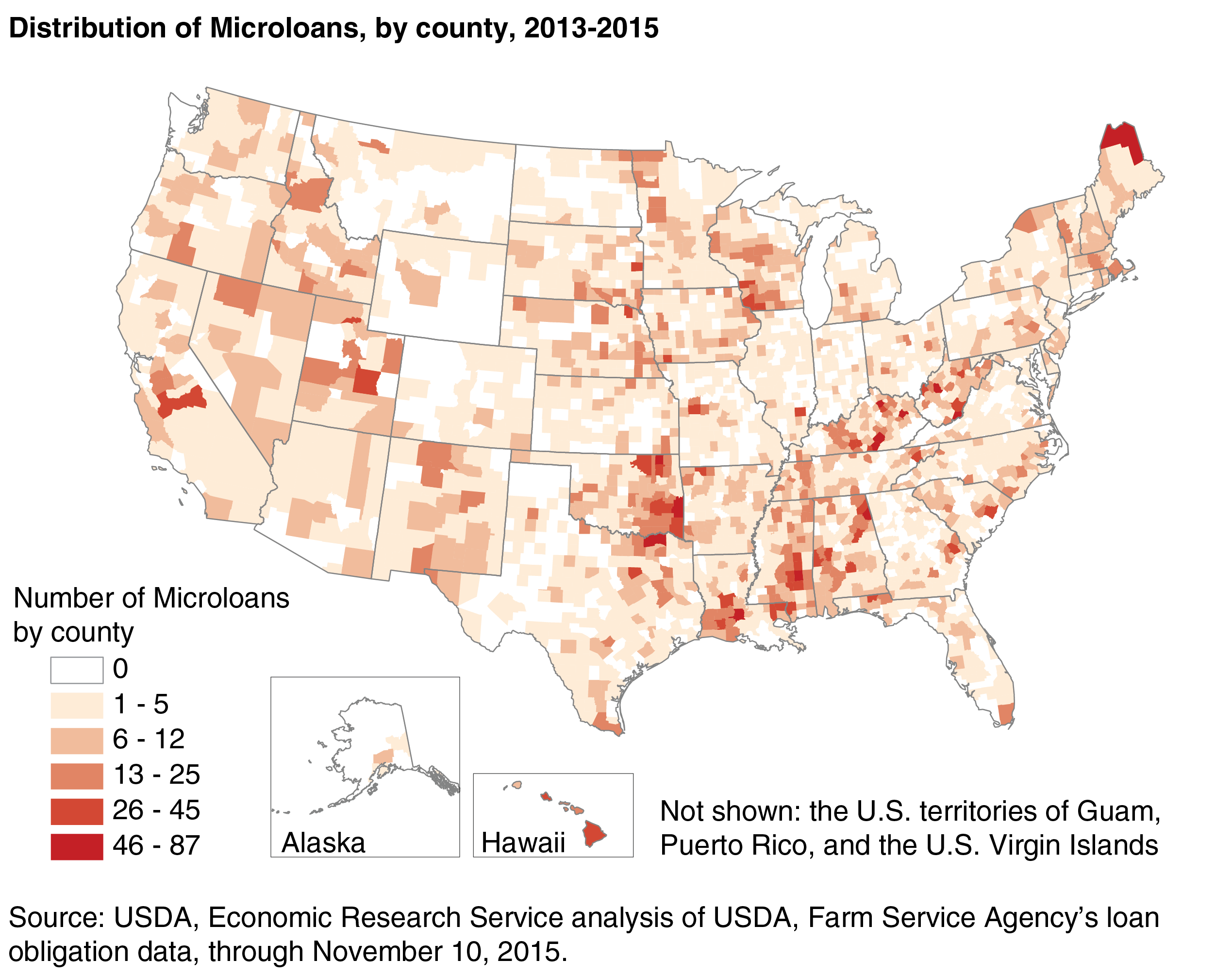

USDA researchers examined lending patterns in the Microloan program since its inception. FSA issued over 13,800 Microloans as of mid-November 2015. Although any farmer can apply for a Microloan, FSA reserves 70 percent of its funds for beginning farmers, veterans, women, and minorities. Correspondingly, FSA distributed more Microloans in regions with larger shares of farmers belonging to these groups, and in regions with smaller average farm size. Appalachia received the largest share of all Microloans (19 percent)—followed by the Southern Plains, Delta, and Southeast regions (about 12 percent each).

In addition, the share of all Microloans received by borrowers in the Appalachia, Delta, and Southeast regions exceeded the share of U.S. farms located within these regions. The demographic composition of farmers in these regions might have contributed to this outcome. In the Southern Plains, for example, 63 percent of all farms had at least one operator who belonged to at least one of the groups the Microloan program targets, according to the 2012 Census of Agriculture. In the Southeast, that share was 61 percent of all farms. Both of these shares were higher than the 58 percent of farms nationally.

The relatively higher number of loans also may have reflected the financial well-being of farms in those regions. In 2014, Appalachia and Southern Plains had the lowest and second-lowest average gross cash farm income (GCFI) before expenses: $70,616 and $95,565, respectively. The national average GCFI, by comparison, was $184,214 in 2014.

This article is drawn from:

- Tulman, S., Higgins, N., Williams, R., Gerling, M., Dodson, C. & McWilliams, B. (2016). USDA Microloans for Farmers: Participation Patterns and Effects of Outreach. U.S. Department of Agriculture, Economic Research Service. ERR-222.