Recession Had Greater Impact on Visits to Sit-Down Restaurants Than Fast Food Places

- by Karen Hamrick

- 3/2/2015

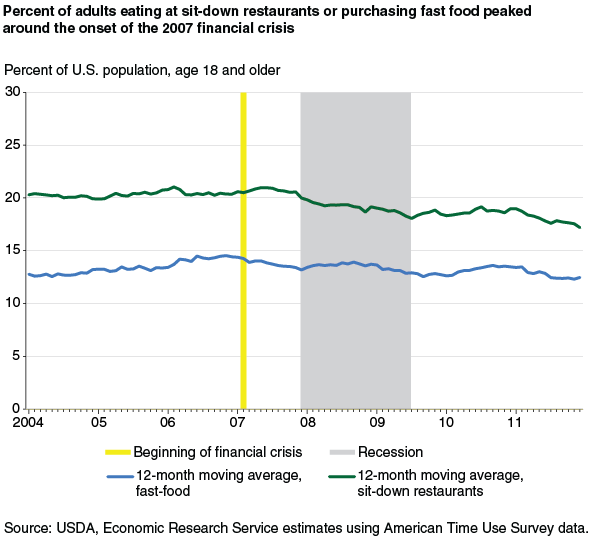

Economic recovery since the Great Recession—which officially ran from December 2007 to June 2009—has been slow, particularly for the labor market. The 8.7 million jobs lost during the recession were not recovered until May 2014. Tough economic times cause consumers to adjust their spending on discretionary items, including their eating-out habits. Time use data show that visits to sit-down restaurants declined during and after the 2007-09 recession, while fast food visits were little changed.

Using American Time Use Survey (ATUS) diaries from 2003-11, ERS researchers calculated the amount of time that American adults spent eating out. When averaged across all individuals whether or not they ate out and across 7 days a week, time spent eating out declined from 15 minutes on a typical day before the recession to 13 minutes during and after the recession, while the total time spent eating and drinking stayed around 67 minutes. The decline in time spent eating out resulted from fewer visits to sit-down restaurants, not from less time spent eating out by those who patronized a fast food or sit-down restaurant.

The share of the adult population purchasing fast food at a counter-service restaurant on a given day stayed fairly constant over 2007-11 at around 13 percent. In contrast, the share of adults visiting a sit-down restaurant once or more on an average day showed a clear decline beginning in early 2007, perhaps precipitated by the financial crisis and resulting consumer uncertainty. In 2006, 20 percent of adults patronized a sit-down restaurant on an average day; in 2011, just 17 percent did.

ERS researchers also examined the fast food purchasing habits of different demographic groups before, during, and after the recession. Those who were employed were 1.5 percent more likely to purchase fast food on an average day than those not employed before the recession, and 3.4 percent more likely after the onset of the recession. Employed single parents were 3.9 percent more likely than other households to purchase fast food on an average day before the recession and 5.2 percent more likely after the recession’s onset. Single parents also became more sensitive to prices for fast food. A $1 increase in the price of a fast food meal was associated with a 5-percent reduction in the probability of purchasing the meal. Before the recession, such a price change was not associated with a change in single-parents’ fast food purchasing behavior.

This article is drawn from:

- Hamrick, K. & Okrent, A. (2014). The Role of Time in Fast-Food Purchasing Behavior in the United States. U.S. Department of Agriculture, Economic Research Service. ERR-178.