Japan, Vietnam, and the Asian Model of Agricultural Development and Trade

- by Shawn Arita, John Dyck and David Marquardt

- 2/2/2015

Highlights

- Fast-developing Vietnam is following in the footsteps of Japan and its model of export-oriented industrialization.

- Trade policy in Japan and Vietnam has protected agricultural imports, selectively favoring imported inputs relative to consumer-ready products.

- Vietnam’s agricultural imports are rising fast and appear to be following the historical growth pattern of Japan’s imports.

Japan and Vietnam represent two stages of agricultural development in Asia. Japan is relatively wealthy and agriculture has become a protected and subsidized niche in its economy. Vietnam is relatively poor, and agriculture remains a significant source of exports and a large part of Vietnam’s economy.

Both societies were long centered on rice agriculture, with its characteristic small farms. Both nations have non-agricultural sectors growing faster than agriculture. Since agriculture dominates land use and employs millions of people—even in today’s Japan—both countries intervene to support farm household incomes.

Asian economic development has followed a process of dynamic comparative advantage whereby countries sequentially climb up the industrialization ladder (from unskilled labor-intensive sectors to more skill-based capital sectors). Japan, which industrialized earliest, is commonly viewed as a regional economic leader. Once a principal source of textile products that relied on imported cotton, Japan’s industries have evolved to include steel, machinery, and electronics. Unskilled sectors transferred to the newly industrialized South Korea, Taiwan, Hong Kong, and Singapore. As labor costs increased in these countries, they in turn passed down the unskilled sectors to China and Southeast Asian countries, including Vietnam.

| Indicator | Japan | Vietnam |

|---|---|---|

| Macroeconomic1 | ||

| Population (millions, 2013) | 127 | 90 |

| Annual population growth rate (%, 2011-2013 avg.) | -0.09% | 1.07% |

| GDP (billion USD, 2013) | 4,902 | 171 |

| GDP per capita (USD, 2013) | 38,504 | 1,911 |

| Projected Real GDP Growth Rate (avg. annual, 2014-2025) | 0.87% | 6.58% |

| Agriculture value added (% of GDP, 2012) | 1.20% | 19.60% |

| Agricultural land (% of total land area, 2011) | 13% | 35% |

| Trade2 | ||

| Agriculture exports to United States (million USD, 2011-2013 avg.) | 521 | 1,170 |

| Agriculture imports from United States (million USD, 2011-2013 avg.) | 16,513 | 1,519 |

| Percent changes in per capita consumption , 2014-20253 | ||

| Cereals | -0.3% | -0.9% |

| Fruits/vegetables | 4.4% | 5.3% |

| Oils and fats | 0.4% | 22.6% |

| Meat | 1.6% | 20.8% |

| Dairy | 0.4% | 19.6% |

| Other foods | 0.2% | 37.6% |

| GDP = gross domestic product. Sources: 1World Bank, USDA, Economic Research Service (ERS) International Macroeconomic Data Set; 2United Nations Comtrade database; and 3ERS Trans-Pacific Partnership mode. |

||

Industrialization in agriculture is difficult if farms are small, as in Asia. Workers leave agriculture for industrial or service-sector jobs, often migrating to cities. Farms throughout East Asia have tended to accommodate the reduced work force by simplifying and reducing farm activities, often concentrating on one crop (usually rice), livestock, or horticulture specialization. However, household incomes in small farms, especially rice farms, trail those of non-agricultural households. Governments then intervene to shore up agricultural household income. In countries where large farms have evolved, such as the United States, farm household incomes often approach or surpass nonfarm incomes. In trade liberalization talks, reconciling the protective policies in East and Southeast Asia with the export-oriented policies of countries with commercial farms can be hard.

Japan, the first Asian country to industrialize, has about 6 million people living on 1.6 million commercial farms. About 1.8 million of the farm residents spend over 50 percent of their time on farming. Although commercial farms average less than 5 acres, the households on these small farms still manage to have incomes close to that of nonfarm households. Some of that income comes from nonfarming pursuits; however, Japanese farms also benefit from output prices that are very high by global standards. These high prices are maintained by barriers to imports for key commodities produced in modern Japan: rice, beef, dairy products, and sweetener feedstocks such as beets and cane. Government subsidies also bolster farm income. Over half of Japanese farm income stems from government interventions. Some sectors, such as vegetables and fruits, require less government assistance because local production is fresher and closely attuned to the tastes of Japanese consumers—and therefore difficult for imports to replace.

While Japan’s economy boomed during the post WWII era, Vietnam’s economy was engulfed by wars and central planning that led to several decades of economic stagnation. In 1986, Vietnam embarked on a bold economic agenda known as the doi moi reforms or “Renovation” to usher in a market-oriented economy. The strategy was gradual in nature, with the state-owned enterprises and political structure left largely intact. Farm households were allowed to produce and market goods individually, rather than collectively. Farmers were granted long-term leases, which allowed for the exchange, transfer, further leasing, inheritance, and mortgaging of land-use rights. In conjunction with the doi moi reforms, Vietnam applied a growth strategy that promoted industrialized exports.

By the 21st century, Vietnam evolved along the industrialization ladder and developed its finished textile goods and footwear sectors. For both sectors, foreign investment helped embed Vietnam in the global production chain and become a major exporter, with other manufacturing industries following behind. The export-led growth strategy spurred economic growth. In 1986, Vietnam’s gross domestic product (GDP) per capita was $269 (2005 U.S. dollars); by 2013, it had grown almost fourfold. Economic development is transforming Vietnam’s agricultural sector and workforce. Since 1990, when the urban population was 20 percent of the total, many rural people have left farm villages for urban areas.

Agricultural Trade Policies Favor Imported Inputs While Protecting Consumer-Ready Products

Agricultural development and support are prime issues when trade policies are negotiated, as in the Doha Round of the World Trade Organization (WTO) or proposed preferential trade agreements (PTAs) such as the Trans-Pacific Partnership (TPP) and the Regional Comprehensive Economic Partnership (RCEP), in which both countries are engaged. Japan and Vietnam impose a variety of border measures, including tariffs, tariff-rate quotas (TRQs)—especially in Japan—and state trading of certain imports. Other measures include the use of reference prices to determine tariffs for imports of some commodities (Vietnam) and variable duties (Japan, pork). Food safety, sanitary, and phytosanitary controls have legitimate roles, but can also be used to protect domestic producers. Japan and Vietnam have been embroiled in disputes over the alleged misuse of such controls. Japan maintains strict sanitary and phytosanitary (SPS) measures for horticultural products. For Vietnam, the regulatory and food safety regime is still in its infancy, and the capacity of its testing agencies is limited, leading to inconsistent enforcement. For example, in 2010, Vietnam banned meat offal imports without explanation. The ban was partially lifted in 2011 and was scheduled to end in 2014.

Trade policies in Japan, Vietnam, and other Asian countries have tended to favor inputs to production. As part of Vietnam’s export-led growth strategy, tariff liberalization was selective. Tariffs on imported inputs needed for production of export commodities, such as cotton and hides used for textiles and footwear, were lowered. Both Japan and Vietnam depend on imported feed to support their livestock sectors, so feed imports are not subject to significant tariffs in either country. In contrast, protection is high for domestically produced products such as wheat and rice in Japan and many consumer-ready foods in both countries.

With industrialization, rice farmers have replaced draft animals (cattle and water buffaloes) with mechanized tillers and tractors. The livestock are sometimes then raised for beef. Japan still has thousands of small farms specializing in cattle, although the number of farms has fallen sharply. In contrast, swine and poultry farms have become large operations, as in western countries. Dairy farms, while large and capital-intensive by Japanese standards, are not as large as North American farms. But few feed sources are available in Japan. Pasture is quite limited, and cattle—like swine and poultry—are fed a corn- and soy-based ration. As a result, Japan has been the largest single-country importer of corn for many years and is also a major importer of soymeal and other feedstuffs.

Vietnam’s feed situation may soon mirror Japan’s. Vietnam’s hog industry is the world’s 10th largest, and production is growing to satisfy rising pork demand. Hog farming is changing from small backyard operations using locally procured feeds to full-time farms that raise hogs bred for more efficient meat production and that use formula feeds. Vietnamese demand for chicken meat is also rising, with feedstuff production—corn and cassava—also growing, but not as fast as feed demand. However, Vietnam needs more feed inputs than it produces (for broilers as well as hogs), and increasingly, feed mills rely on imported ingredients to mix feed. Vietnam has some native cattle and water buffalo, but few cattle from modern meat breeds that efficiently convert grain to meat.

Wheat consumption in noodles and bread rises as Asian economies urbanize and industrialize. Wheat products are convenient, appealing, and affordable. Japan’s Government controls wheat in order to support what domestic production there is. In Vietnam, wheat is not grown, and wheat imports are not taxed.

Agricultural imports directly for human food consumption—including meat, vegetables, fruit, and processed foods—have faced higher barriers. Trade creates more dining variety, though Asian governments have been cautious about allowing free trade of consumer-ready products. Nevertheless, consumer-ready imports have become very large in Japan—$25 billion in 2012—and represent 40 percent of agricultural imports. In Vietnam, imports of consumer-ready foods remain relatively small: $2 billion or 18 percent of agricultural imports.

Rice has special status in much of Asia. Vietnam is usually among the top three rice exporters. Japan maintains high internal rice prices through strong border barriers. Following the Uruguay Round (UR) of the WTO, Japan was obliged to establish a large TRQ that makes it one of the larger rice-importing nations. However, a high over-quota tariff has prevented trade outside the TRQ, and the Government carefully manages trade within the TRQ. As a result, imported rice usually does not reach consumers’ tables but is exported as food aid, fed to animals, or used for processing. Vietnam tries to control rice exports to maintain stable prices. Despite this intervention, Vietnam’s rice prices are much lower than Japan’s and close to world price levels. While both countries have surplus rice production, Vietnam earns money from large exports, while Japan pays farmers to plant less rice. However, Like Japan, Vietnam faces the challenge of reconciling small rice farms with a modern economy.

The Role of Preferential Trade Agreements

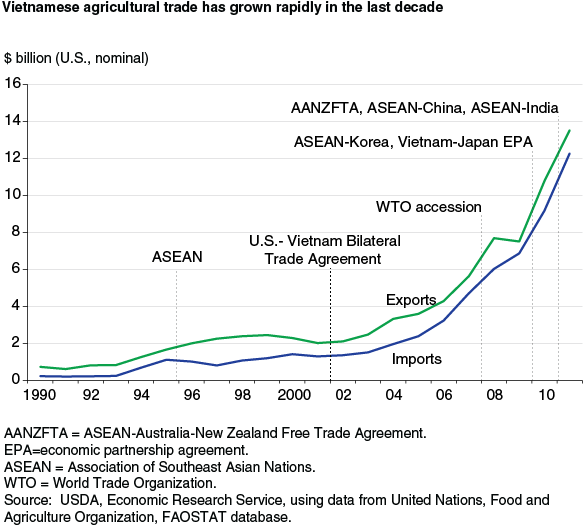

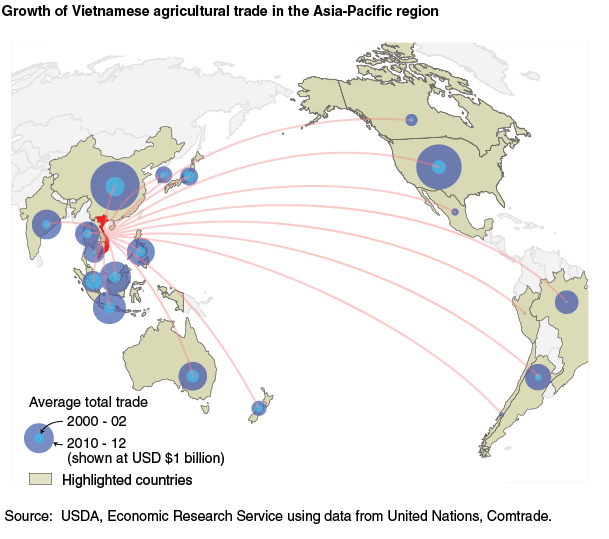

While Japan’s imports have been largely stagnant, overall trade growth for Vietnam has been explosive. In 1995, Vietnam joined the Association of Southeast Asian Nations (ASEAN), and its agricultural trade within the 10-member regional trade bloc significantly expanded. Vietnamese agricultural trade also benefited from the renormalization of trade with the United States in 2001. WTO accession in 2007 provided a major catalyst for growth and integration. Subsequent PTAs have led to tariff reductions that have only recently begun to take effect. Japan has also embarked on PTAs, but its agreements left in place the web of constraints on trade in certain commodities, including food grains (rice, wheat, and barley), meats (beef and pork), sweeteners (sugar and corn syrup), and dairy products. Today, Vietnam’s agricultural trade is still led by trade with its ASEAN partners. However, China has become a major export market and is Vietnam’s largest trade partner. The United States is a close second and the largest source of imports. Trade growth with both partners has been dramatic, growing 7- and 10-fold, respectively. Imports from South America have grown in both Japan and Vietnam. The proposed TPP agreement, now under negotiation, is viewed as important to the long-term economic strategy for both Japan and Vietnam. Vietnam hopes that the TPP will help secure markets abroad and facilitate the flow of foreign investment. In particular, Vietnam seeks open access for its textile and footwear industry. In turn, exporting countries see Vietnam as a market with growth potential. However, Vietnam’s current PTAs overlap with many of the negotiating TPP countries. As part of its membership in ASEAN, Vietnam already enjoys low tariffs with Brunei, Malaysia, and Singapore. Under Vietnam’s PTAs with Australia, New Zealand, and Chile, most Vietnamese tariffs are set to phase out.

Japan could also benefit from a comprehensive agreement involving agricultural trade. Liberalizing trade in protected commodities would bring consumers lower prices and greater variety and introduce competition on the supply side that would restructure parts of Japan’s agriculture. For exporting countries, Japan’s large market offers a chance for significant trade growth.

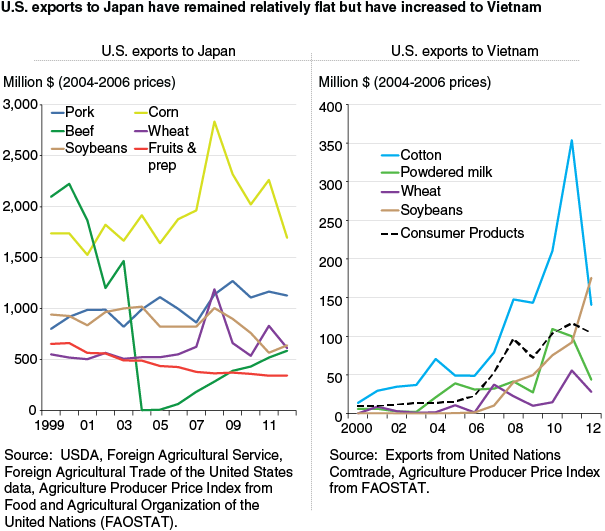

Asian Markets Provide Challenges and Opportunities for U.S. Agricultural Exports

The United States has comparative advantages that complement the agri-food sectors of both Japan and Vietnam, and it has long been the largest supplier of agricultural products to Japan. However, the value of U.S. agricultural exports to Japan has stagnated (in real terms) in recent years. Some of the leading U.S. exports to Japan—including soybeans and fruits/preparations—have diminished since 2000. Other exports, such as wheat and corn, have been stagnant. U.S. pork exports are an exception, with strong growth over the last 15 years.

The U.S. share of Japan’s total agricultural imports has also declined in most years. Imports from South America (soybeans, soy meal, poultry meat, and grains); Southeast Asia (palm oil, rubber, and poultry meat); South Asia (soy meal); and South Korea (alcoholic beverages and processed foods) have gained share.

In contrast, U.S. agricultural exports to Vietnam have experienced strong growth, largely due to that country’s fledgling economic development. Japan’s economy is mature, and its population is declining. Vietnam’s economy is growing, and its population is younger and slowly growing. For example, feed imports have expanded as Vietnam’s meat consumption has grown.

Japan’s protection for agricultural products has been in place for many years. Trade agreements like the Beef-Citrus Agreement with the United States in 1989 and the UR in 1995 brought some liberalization, but there has been little change in the 15 years since the UR implementation period ended. Japan has been unable to negotiate sweeping trade agreements because of its unwillingness to liberalize agricultural protection. Vietnam does not have a fixed set of strong protection measures in place, and it has been negotiating relatively far-reaching agreements with trade partners—notably its accession to ASEAN and the WTO—that explicitly limit its ability to impose new protection.

The challenge facing U.S. agricultural exports is that Japan may not further liberalize its trade barriers—leading to further stagnation in agricultural imports—and that Vietnam may seek to slow down imports that compete with domestic production. In Vietnam’s case, while imports of inputs like cotton continue to grow, imports of a broader suite of products may be hindered, even as economic growth stimulates potential demand. Vietnam could choose to retain its current high tariffs and sanitary barriers to meat imports. It could find ways to reduce potential imports of consumer-ready foods and beverages, hoping to encourage domestic production instead.

The opportunity for U.S. agricultural exports is that both countries may further open their markets to agricultural trade, especially in the context of the WTO or regional negotiations such as TPP or RCEP. In doing this, Vietnam and Japan would likely expose their agricultural producers to more competition. Some producers would expand and compete well against imports, while others might leave farming or switch to a different agricultural activity. For protected commodities, lower prices from greater import competition would benefit consumers. For some commodities, lower-prices on imports might lead to greater total consumption.

If Vietnam follows Japan’s model, it could turn to greater protection of agriculture in one form or another as its economy grows. Alternatively, if Japan decides to liberalize agriculture as it has done other industries, it would influence other countries, including Vietnam. The Asian model of development has had many effects on U.S. agriculture. Changes could open new opportunities.

This article is drawn from:

- Dyck, J. & Arita, S. (2014). Japan's Agri-Food Sector and the Trans-Pacific Partnership. U.S. Department of Agriculture, Economic Research Service. EIB-129.

- Arita, S. & Dyck, J. (2014). Vietnam's Agri-Food Sector and the Trans-Pacific Partnership. U.S. Department of Agriculture, Economic Research Service. EIB-130.

You may also like:

- Burfisher, M.E., Dyck, J., Meade, B., Mitchell, L., Wainio, J., Zahniser, S., Arita, S. & Beckman, J. (2014). Agriculture in the Trans-Pacific Partnership. U.S. Department of Agriculture, Economic Research Service. ERR-176.