Long-Term Prospects for Agriculture Reflect Growing Demand for Food, Fiber, and Fuel

- by Paul Westcott and Ronald Trostle

- 9/20/2012

Highlights

- Economic growth and population gains in developing countries underpin increases in global demand for food and fiber over the next decade; production of biofuels also will continue to be an important source of demand in the agricultural sector.

- Growth in global aggregate yields for grains and oilseeds is likely to continue to slow, putting increased pressure on use of land for agriculture.

- Nominal prices for major crops, after falling from current highs, are projected to rise over the next decade and remain at historically high levels; real prices are likely to return to a downward movement, although at a higher level than the 1980-2000 path.

A number of developments in the agricultural sector have put upward pressure on farm-commodity prices over the past decade. These include growing food demand in developing countries, rising biofuel demand, and slowing yield growth for grains and oilseeds. According to USDA's annual baseline projections, these and other factors will continue to influence prospects for U.S. and world agriculture over the next decade (see box, 'What Is the USDA Baseline?').

Economic and Population Growth in Developing Countries Key for Agricultural Demand

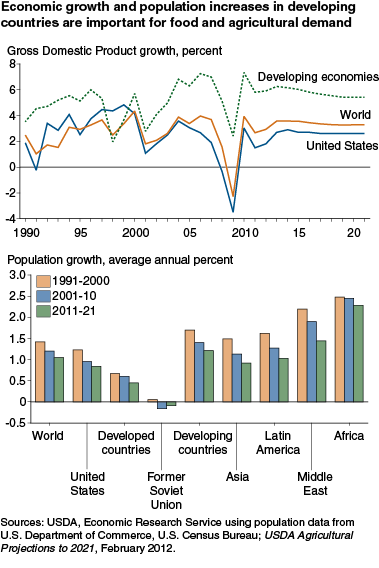

Economic growth provides the foundation for demand for food and agricultural products. Following the world financial crisis and economic recession that began in 2008, prospects for the coming decade are for a return to longrun, steady, global economic gains. High growth rates in China, India, and other emerging markets underpin these world macroeconomic gains.

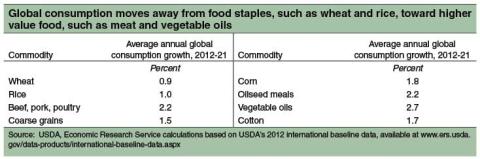

Developing countries will have a growing role in the world economy and global food demand over the next 10 years. And they will continue to be the source for most of the growth in U.S. agricultural exports. Economic growth in developing countries is especially important for agriculture because food consumption and feed use are particularly responsive to income growth in those countries. As incomes rise in developing countries, consumers tend to diversify their diets, moving away from traditional staple foods, such as wheat and rice, and increasing their consumption of such foods as meat, dairy products, and vegetable oils. With these changes, agricultural demand shifts toward high-value food products and feedstuffs. As a result, global consumption gains over the next decade are projected to be higher for meats (2.2 percent) and coarse grains (1.5 percent) than for wheat (0.9 percent) and rice (1.0 percent). Similarly, global cotton consumption, also responsive to income growth, is expected to increase more than staple food consumption over the next 10 years, averaging 1.7 percent annually.

Population growth also underlies agricultural demand. Growth in global population has slowed over the past 50 years. Annual population growth peaked at a rate exceeding 2 percent in the mid-1960s but has averaged about 1.2 percent annually over the past decade. Nonetheless, according to U.S. Census Bureau estimates, the world's population surpassed 7 billion in March 2012. Although global population gains are likely to continue to slow over the next decade as birth rates decline, population growth rates in most developing countries will remain above those in the rest of the world. As a consequence, the developing-country share of the world's population is expected to increase to 82 percent by 2021, up from 79 percent in 2000.

Population gains in developing countries, along with increased urbanization and expansion of the middle class, are particularly important for growth in global food and fiber demand. Populations in developing countries, in contrast to those in more-developed countries, tend to be younger and consume growing quantities of food of increasingly diverse types.

China is expected to have an increasingly strong effect on world agricultural markets. Over the next decade, China's growing income and population are expected to bring large increases in consumption of many agricultural commodities. Rising consumer demand for livestock products, for example, will lead to expanding meat production and larger demand for feed grains and protein meals. China's imports of corn are projected to grow sharply and account for almost half the overall growth in world corn trade over the next 10 years. China has an even larger presence in world soybean trade, accounting for over 80 percent of global import growth. China has a large oilseed crush capacity, and its government's policies encourage imports of oilseeds rather than oilseed products.

China's textile and apparel industries benefited from the country's 2001 accession to the World Trade Organization and the 2005 elimination of textile and apparel import quotas that had been in place under the Multi-Fiber Arrangement. China has since become the world's largest importer of cotton. Its cotton imports are expected to grow during the next decade and account for more than one-third of the global increase in cotton imports. In contrast, as incomes rise in China, consumption of some agricultural products, such as rice, will continue to decline.

The combined regions of Africa and the Middle East are projected to see some of the strongest growth in food demand and agricultural trade over the coming decade. Not only is import growth for staple food commodities, such as wheat and rice, expected to continue to be strong, but the region's rising demand for meat is projected to lead to increasing imports of both poultry and beef as well as imports of feed grains and protein meals for a growing domestic meat production sector.

Mexico is another large agricultural growth market, not only for meat imports but also for grains and oilseeds. Projected increases in Mexican meat demand over the next decade will bring greater meat imports as well as expansion of domestic livestock production and increased imports of feedstuffs. Mexico is second only to China in projected growth for corn imports over the next 10 years. And Mexico is expected to account for over 90 percent of the growth in world sorghum imports, mostly from the United States.

Changing destinations for U.S. agricultural exports illustrate the growing importance of developing countries in global food demand. Twenty years ago, the two leading U.S. agricultural export destinations were Japan and the European Union (EU); in recent years, however, two of the top three destinations have been China and Mexico.

A generally weakening dollar since 2002 has made U.S. agricultural exports more competitive in international markets. This trend should continue as the dollar is expected to decline further over the next decade. The continuing depreciation is part of a global rebalancing of trade and financial markets in the aftermath of the global financial crisis and recession.

The United States Faces Competition From Some Emerging Markets

Over the next decade, competition from South America, particularly Brazil, is expected to limit gains in U.S. soybean exports, leading to a reduction in the U.S. share of global soybean trade. U.S. exports of soybean meal and soybean oil will also face strong competition from South America. Argentina, in particular, benefits from a large crushing capacity and differential export taxes that favor exports of soybean products over soybeans.

U.S. wheat exports are expected to decline over the next 10 years, while exports from the Black Sea region will increase. The United States is projected to remain the world's largest corn exporter, but the U.S. share of global corn trade will be lower than was typical in the late 1990s, averaging less than 50 percent per year over the coming decade. This decline is partly due to use of corn for ethanol production in the United States. The U.S. is expected to remain the world's largest cotton exporter. Cotton exports from South America are projected to increase and gain market share during the period, but they will remain less than 40 percent of U.S. exports.

Global Biofuel Expansion Increases Agricultural Feedstock Demand

Growing biofuel demand also will affect world trade and commodity prices over the next decade, spurred by continued high oil prices and policies in many countries to support the production and consumption of biofuels. Since the late 1990s, crude oil prices rose from under $20 per barrel to over $100 per barrel in 2011, as strong world economic growth brought an increase in global oil demand. In particular, economic growth in 2001-10 averaged nearly 10 percent in China and about 7.5 percent in India. The economies of these countries are much more energy intensive than that of the United States. According to data from the U.S. Department of Energy's Energy Information Administration, in 2008, China used 3.5 times the amount of energy per U.S. dollar of output than did the United States and India used 2.5 times the U.S. per unit amount.

Higher oil prices in recent years helped spur a growing interest in renewable energy sources in many countries looking to lessen their dependence on foreign oil and diversify energy sources. The United States established a biofuels use mandate in 2005 and expanded the Renewable Fuel Standard in the Energy Independence and Security Act of 2007. As a result, U.S. ethanol production expanded as did demand for corn, the primary ethanol feedstock in the United States. U.S. biodiesel production also rose, along with use of soybean oil as a feedstock, although gains were less pronounced than those for ethanol.

The EU adopted policies to expand biofuels, including targets and mandates for biofuels inclusion in transportation fuel use. Biodiesel accounts for much of the increase in the EU's biofuel use, raising global demand for vegetable oils. The EU has increased its use of EU-produced rapeseed, and it also imports rapeseed and rapeseed oil from Russia and Ukraine and soybean oil-based biodiesel from Argentina. Increases in ethanol use in the EU draw from domestically produced ethanol using wheat and corn as feedstocks, as well as from imported sugar-based ethanol from Brazil.

Other countries that have expanded biofuels production include China, Brazil, Argentina, and Canada. Along with the United States and the EU, these six countries accounted for more than 96 percent of global biofuels production in 2010.

Looking forward, ethanol expansion in the United States is likely to slow from the rapid gains of the past decade. This reflects declining overall U.S. gasoline consumption, limited potential for further market penetration of ethanol into the E10 (10-percent ethanol blend) market, constraints in the E15 (15-percent ethanol blend) market, and the small size of the E85 (85-percent ethanol blend) market. Despite the resulting 'blend wall' for further U.S. ethanol expansion, corn-based ethanol production in the United States is expected to remain an important source of agricultural demand over the next decade, accounting for more than a third of total U.S. corn use. Soybean oil, as well as other first-use vegetable oils, animal fats, and recycled vegetable oil, will continue to be used as feedstocks to produce U.S. biodiesel, with about a fifth of total U.S. soybean oil use going to biodiesel production.

Although slowing somewhat from the strong pace of the past decade, expansion of biofuel production in the rest of the world is projected to be more rapid than in the United States. Thus, global demand for agricultural products used as biofuel feedstocks will continue to rise.

Production Growth for Cereals and Oilseeds Continues To Slow

On the supply side, growth in overall global production of grains and oilseeds has been slowing. Between 1970 and 1990, world production of these crops rose an average of 2.4 percent per year. From 1990 to 2010, annual growth averaged 1.6 percent. According to the USDA baseline, this rate will fall to 1.5 percent per year between 2010 and 2021.

Growth in world production of grains and oilseeds has been mostly attributed to gains in yields per harvested area, rather than expansion in land planted to these crops. Nonetheless, growth in global aggregate yields for grains and oilseeds declined over the last several decades, from 1.9 percent per year between 1970 and 1990 to 1.2 percent between 1990 and 2010. Yield growth per harvested area for these crops is projected to continue to slow over the next 10 years, averaging less than 1.0 percent per year.

Declining expenditures on agricultural research and development by governmental and international institutions may have affected the pace of growth in crop yields. These reductions may be due in part to generally stable food commodity prices during much of the 1980s and 1990s.

The increased difficulty in obtaining more water for agricultural uses is also contributing to slower yield growth. Gravity-flow irrigation systems have become more expensive to develop, and in some areas, irrigation wells have to be dug deeper as water tables decline.

In light of slowing yield growth, the agricultural sector will likely look more to land-use expansion to meet increasing demand in the coming decade. Annual growth for global area harvested for grains and oilseeds averaged about 0.5 percent in 1970-90 and 0.4 percent in 1990-2010. Land use for these crops is projected to rise an average of 0.6 percent annually during 2010-21. Much of this expansion is likely to occur in South America, the former Soviet Union, and Sub-Saharan Africa. Some of the expanded area will come from land converted from non-cropland uses, such as pasture and forest. Area harvested will also increase as a result of more intensive use of existing cropland, generally from double cropping and reduced fallow area.

Prices Projected To Retreat From Current Spike But Remain Historically High

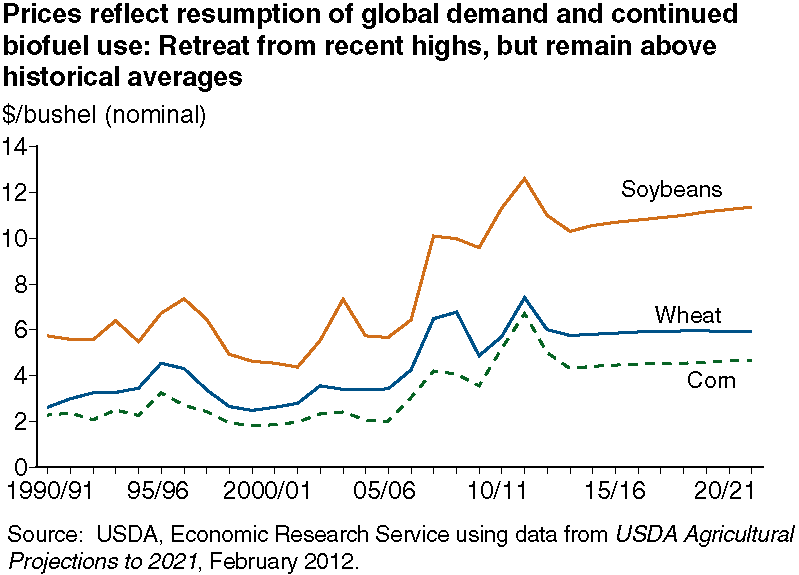

Over the past decade, the combined effect of supply and demand factors has been a gradual increase in food commodity prices. This trend has been exacerbated by shorter term price spikes in 2007-08 and 2010-11, brought about by weather-related production shocks and changes in trade policies and practices in some countries, as well as by the current price runup largely due to the 2012 U.S. drought.

In response to the 2010-11 price spike, a large increase in global agricultural production for grains and oilseeds had been expected in 2012, with prices for major crops projected to decline in the near term. With lowered 2012 U.S. production prospects for corn and soybeans due to the drought, large global production increases and companion declines in food commodity prices may now be delayed until 2013. Nonetheless, even after those expected declines in prices, in the longer term, nominal prices of corn, wheat, oilseeds, and many other crops are projected to stay at historically high levels due to long-term growth in global demand for agricultural products, continued demand for corn by the U.S. ethanol industry and vegetable oils for EU biodiesel use, and slowing yield gains.

For many years, real (inflation-adjusted) prices have generally declined. For example, from 1979 to 2001, real prices for corn, wheat, and soybeans fell by an average of 4.4 to 5.0 percent per year. Growth in yields and other productivity factors accounted for these price declines. Starting in 2002, however, real prices for corn, wheat, and soybeans began to rise; in 2009, prices of these crops were 45, 49, and 81 percent higher than in 2001. Prices subsequently increased in 2010-11 and have risen further due to the 2012 U.S. drought. Once global supplies are able to respond to these price signals, USDA's projections suggest that real prices are likely to return to a downward movement over the next decade, although on a higher path than before 2002.

Future Challenges

The primary factors driving agricultural demand over the next decade, including population and income growth and a global interest in biofuels, will have important effects in the years beyond, as well. As a result, the world will continue to be challenged to meet future agricultural demands for food, fiber, and fuel.

If yield growth continues to slow, expansion of land used for agriculture will be necessary to meet these rising global demands. Increased investments in research and development may lessen the need to expand land use. However, constraints on other resources, such as water, may become increasingly important. Further, any changes in agricultural output patterns resulting from climate change would add to the challenges of assuring that agricultural production and distribution are able to meet global demand.

Agricultural commodity prices play a critical role as indicators of market conditions and in facilitating adjustments in the marketplace. When there are shocks to agricultural markets, prices will reflect changes in supply and demand and provide economic incentives to assure appropriate short-term responses, such as seen during the 2007-08 and 2010-11 price spikes. Prices are also indicators of slowly evolving trends in agricultural markets, facilitating longer run and more long-lasting supply-and-demand adjustments in the marketplace, such as seen in response to the gradual tightening of global balances of grains and oilseeds over the past decade.

This article is drawn from:

- Westcott, P. (2012). USDA Agricultural Projections to 2021. U.S. Department of Agriculture, Economic Research Service. OCE-121.

You may also like:

- Westcott, P. (2009, September 1). Full Throttle U.S. Ethanol Expansion Faces Challenges Down the Road. Amber Waves, U.S. Department of Agriculture, Economic Research Service.

- Trostle, R. (2008). Global Agricultural Supply and Demand: Factors Contributing to the Recent Increase in Food Commodity Prices. U.S. Department of Agriculture, Economic Research Service. WRS-0801.