EU and U.S. Organic Markets Face Strong Demand Under Different Policies

- by Carolyn Dimitri and Lydia Oberholtzer

- 2/1/2006

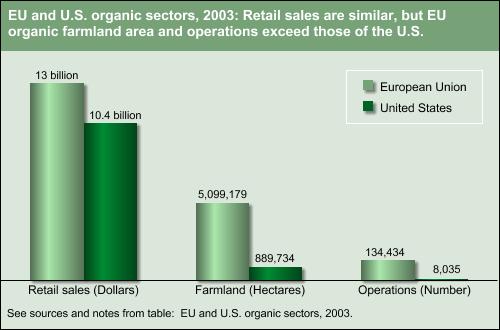

Organic markets in the European Union member states and the U.S. are nearly the same size in terms of retail sales. At the same time, their farm sectors differ significantly, with the EU-15 member states having more organic farmland and more organic operations than the U.S. (see “EU and U.S. Organic Sectors”). The U.S. and EU Governments have also adopted markedly different policy approaches to the organic sector. The EU actively promotes the growth of the organic sector with a wide variety of policies designed to increase the amount of land farmed organically, including government standards and certification, conversion and support payments for organic farmers, targets for land under organic management, and policies supporting research, education, and marketing. The U.S. largely takes a free-market approach: its policies aim to facilitate market development through national standards and certification and federally funded grants that support research, education, and marketing for organic agriculture.

The policy approaches adopted by the two regions are the result of the inherently dissimilar perspectives and histories that the EU and U.S. governments have concerning agriculture, the environment, and by extension, organic agriculture. From the perspective of many EU countries, organic agriculture delivers environmental and social benefits to society, and is regarded as an infant industry requiring support until it is able to compete in established markets. This view of organic farming as a provider of public goods affords an economic rationale for government intervention in the market.

The U.S. Government’s approach, while acknowledging organic agriculture’s positive impact on environmental quality, treats the organic sector primarily as an expanding market opportunity for producers and regards organic food as a differentiated product available to consumers. In such cases, government-devised standards and labels facilitate market transactions and allay consumer concerns about product identity.

EU and U.S. Adopt Organic Agriculture Standards and Certification

Both the EU and U.S. have established organic food standards, as well as systems that certify operations as organic. Such standards reduce transaction costs by ensuring that attributes of organic food do not have to be specified for each transaction. They also resolve an information problem since a product’s “organic” status is unobservable to buyers, whereas the producer has knowledge of the production and handling methods.

Certification is a process providing third-party assurance that a product was raised, processed, and distributed appropriately, and meets the official organic standards. Thus, standards and certification work in tandem. Certification also reduces opportunistic behavior (such as falsely claiming a product is organic) by creating a specific enforcement system. In the U.S., penalties are clearly outlined for firms that use the organic label inappropriately, while the EU leaves enforcement up to individual member states.

In the EU, labeling of organic plant products is governed by EU Regulation 2092/91 (enacted in 1993); organically managed livestock is governed by EU Regulation 1804/99 (enacted in 2000). The regulations set minimum rules for production, labeling, and marketing for the whole of Europe, but each member state is responsible for interpreting and implementing the rules, as well as enforcement, monitoring, and inspection. EU labeling of organic products is complex because some member states have public labels, while private certifiers in other member states have their own labels, some well known to the public (e.g., KRAV in Sweden, Skal in the Netherlands, or the Soil Association in the UK). In addition, the EU introduced a voluntary logo in 2000 for organic products that could be used throughout the EU by those meeting the regulation. So far, few companies are using the logo. Most recently, in December 2005, the European Commission made compulsory the use of either the EU logo or the words “EU-organic” on products with at least 95 percent organic ingredients.

In the U.S., the 1990 Organic Foods Production Act (OFPA) required that USDA establish national standards for U.S. organic products. The three goals of OFPA were to (1) establish standards for marketing organically produced products, (2) assure consumers that organic products meet a consistent standard, and (3) facilitate interstate commerce. The legislation targeted environmental quality by requiring that an organic production plan pay attention to soil fertility and regulate manure application to prevent water contamination. It also included environmental and human health criteria to evaluate materials used in organic production. Along with the USDA organic logo, the USDA National Organic Standards (NOS) were implemented on October 21, 2002, replacing the prior patchwork system of State organic standards.

Both the EU and U.S. rely on accredited agents to certify organic farmers and handlers. The EU system is more complicated, largely because member states have some latitude as to how they approve and supervise certifying entities, resulting in a great deal of diversity among the states. A national authority from each member state certifies that organic products comply with EU law. These bodies, in turn, approve other entities that are allowed to certify organic production and handling processes. Most member states have government-approved private certification bodies, but some have public member state certification. In addition, some member states and certifiers have additional public or private standards, as well as standards for products not covered under the EU Regulation, such as fish and nonfood agricultural products. Some certifiers require stricter standards than those of the EU legislation. As a result, not all EU certificates are acceptable to each certification body. In contrast, in the U.S., agents are accredited by USDA to carry out organic certification, and the certification process is well defined so that all farmers and handlers are certified according to the same standard.

| Country | Retail sales | Organic operations | Organic land | Farmland under organic production |

|---|---|---|---|---|

| Million euros | Number | Hectares | Percent | |

| Austria | 400 | 19,056 | 328,803 | 9.7 |

| Belgium | 300 | 688 | 24,000 | 1.7 |

| Denmark | 339 | 3,510 | 165,146 | 6.1 |

| Finland | 212 | 5,074 | 159,987 | 7.2 |

| France | 1,578 | 11,377 | 550,000 | 1.9 |

| Germany | 3,100 | 16,476 | 734,027 | 4.3 |

| Greece | 21 | 6,028 | 244,455 | 6.2 |

| Ireland | 40-50 | 889 | 28,514 | 0.7 |

| Italy | 1,400 | 44,039 | 1,052,002 | 6.9 |

| Luxembourg | NA | 59 | 3,002 | 2.4 |

| Netherlands | 395 | 1,522 | 41,865 | 2.2 |

| Portugal | NA | 1,507 | 120,729 | 3.2 |

| Spain | 144 | 17,028 | 725,254 | 2.8 |

| Sweden | 420 | 3,562 | 225,776 | 7.4 |

| United Kingdom | 1,607 | 4,017 | 695,619 | 4.4 |

| European Union1 | 9,966 | 134,434 | 5,099,179 | 3.9 |

| U.S.2 | 8,047 | 8,035 | 889,734 | 0.2 |

| NA = Not available. Note: U.S. retail sales dollars were converted to euros using an exchange rate of $1.29 = €1.00, May 2005. 1Some EU land numbers are provisional. All EU hectares and farms are for certified organic and in-conversion land. Numbers for Sweden do not reflect the substantial hectares that are managed organically but not certified. In Sweden, these lands are given governmental support payments as recognition by Sweden and increasingly other Scandinavian countries that financially supporting organic land management for environmental gain does not necessarily need to be linked to the marketing of organic food, for which certification is a legal requirement. In Sweden, these lands accounted for another 180,000 hectares and an estimated 12,500 farms in 2003. 2The U.S. reports certified organic acreage, which has been converted to hectares (1 acre = 0.405 hectares). The U.S. does not report farms or acreage in transition to organic production, as does the EU, and does not report subcontracted organic growers. Sources: Various sources, cited in Market-Led Versus Government-Facilitated Growth: Development of the U.S. and EU Organic Agricultural Sectors, by Carolyn Dimitri and Lydia Oberholtzer,WRS-05-05,USDA, Economic Research Service, August 2005, available at: http://www.ers.usda.gov/publications/wrs-international-agriculture-and-trade-outlook/wrs0505.aspx. U.S. operation and land numbers for 2003 are available at: http://www.ers.usda.gov/data-products/organic-production.aspx |

||||

The EU, Unlike the U.S., Subsidizes Organic Production

European governments (including countries not in the EU, such as Switzerland) support organic agriculture through green payments (payments to farmers for providing environmental services) for converting to and continuing organic farming. The economic rationale for these subsidies is that organic production provides benefits that accrue to society and that farmers lack incentives to consider social benefits when making production decisions. In such cases, payments can more closely align each farmer’s private costs and benefits with societal costs and benefits. EU green payments partly compensate new or transitioning organic farmers for any increase in costs or decline in yields in moving from conventional to organic production, which takes 3 years to complete.

EU support for organic agriculture falls under the EU’s general agri-environment program that is part of the Common Agricultural Policy (CAP). The EU commission establishes the general framework and co-financing, and each member state chooses a set of policies from this menu of measures. The 1992 CAP reform (EC Regulation 2078/92) provided the policy framework for EU member states to support organic farming, and many of the payments currently granted were implemented under this reform, dating back to 1994. More recently, under Agenda 2000, these measures were included in the rural development program (Rural Development Regulation No. 1257-99), a CAP reform carried out from 1999 to 2001. In 2001, the EU-15 spent almost €500 million ($559 million; the average annual exchange rate for 2001 was $1 = €0.895) on organic lands under the two measures, with organic farms receiving average payments of €183-€186 ($204-$208) per hectare, compared with €89 ($99) per hectare paid to conventional farms.

| Organic land supported under agri-environmental programs1 | Average support premium for organic land | |||||

|---|---|---|---|---|---|---|

| Country | 1992 CAP reform | Agenda 2000 | Share of organic land in policy support programs | Public support of organic land under 1992 CAP reform | 1992 CAP reform | Agenda 2000 |

| Hectares | Percent | Thousand euros | Euros/hectare | |||

| Austria | 36,193 | 210,833 | 89 | 67,905 | 211 | 286 |

| Belgium | 13,032 | 3,616 | 74 | 3,416 | 187 | 269 |

| Denmark | 79,731 | 78,347 | 94 | 16,377 | 137 | 199 |

| Finland | 23,948 | 113,631 | 93 | 3,402 | 141 | 117 |

| France | 54,727 | 82,508 | 33 | 23,951 | 196 | 188 |

| Germany | 278,884 | 254,715 | 84 | 84,477 | 154 | 163 |

| Greece | 4,928 | 10,614 | 50 | 17,505 | 401 | 445 |

| Ireland | 13,691 | NA | 46 | 1,848 | 135 | NA |

| Italy | 351,113 | 101,134 | 37 | 158,898 | 361 | 318 |

| Luxembourg | 736 | 1,224 | 98 | 328 | 158 | 173 |

| Netherlands | 8,140 | 14,593 | 63 | 4,446 | 266 | 156 |

| Portugal | 26,970 | 90 | 38 | 3,779 | 137 | 111 |

| Spain | 142,591 | 112,554 | 53 | 14,544 | 69 | 195 |

| Sweden2 | 81,067 | 349,562 | 113 | 69,018 | 153 | 162 |

| UK | 285,633 | 122,330 | 60 | 27,591 | 42 | 45 |

| European Union | 1,401,384 | 1,455,751 | 62 | 497,485 | 186 | 183 |

| NA = Not available. 1Organic support falls under EC Regulation 2078/92, the agri-environmental program of the 1992 Common Agricultural Policy reform. After 1999, organic farming support was part of Rural Development Regulation 1257/97, under Agenda 2000. 2Sweden’s 113 percent signifies that there is more policy-supported organic land than certified area, reflecting the country’s policy of supporting uncertified organically managed lands (see note to table: EU and U.S. organic sectors, 2003, on page 15). Sources: Various sources, cited in Market-Led Versus Government-Facilitated Growth: Development of the U.S. and EU Organic Agricultural Sectors, by Carolyn Dimitri and Lydia Oberholtzer, WRS-05-05, USDA, Economic Research Service, August 2005 |

||||||

Many EU Member States Set Targets for Organic Land . . .

Many EU member states have established targets for the share of farmland under organic production in their organic farming action plans. The EU governments use targets to convey their level of commitment to growth in the organic sector. Some countries have selected relatively attainable targets, while others have chosen more ambitious ones. For example, in 1995, Denmark announced a target of 7 percent of farmland certified as organic by 2000 and nearly reached this goal with 6 percent. Denmark’s goal of having 12 percent of farmland certified as organic by 2003, however, fell short. In response to the 2000 Bovine Spongiform Encephalopathy (BSE) crisis, Germany set a target of certifying 20 percent of farmland as organic by 2010, a number that may be hard to reach since only 4 percent of land was in organic production in 2003.

. . . and Higher Funding for Research

Public funding of organic-related research and programs is increasing in both the EU and U.S., although European governments are financing more programs with a broader range. European funding supports innovation in production techniques, food processing, food marketing, and food retailing, and is estimated at €70-€80 million annually from 2003 to 2005. Germany, the Netherlands, Switzerland, and Denmark accounted for 60 percent of this. In fiscal year 2005, the U.S. Government made approximately $7 million available exclusively for organic programs, including a certification cost-share program and $4.7 million for a research grant program. This amount is supplemented by other programs that benefit organic producers, including funding for organic research and technical assistance by Federal, State, and local agencies that focus on organic agriculture.

Consumers in Both Regions Drive Market Growth

In many ways, development of the EU and U.S. organic markets has followed a similar path. In the early days, the organic sectors were supply driven and organic products were introduced by farmers. More recently, consumers have been the driving market force in both regions. Studies indicate that most European consumers have shifted from buying organic food for altruistic reasons to more self-interested reasons, such as food safety and health. Ranking behind these are taste, nature conservation, and animal welfare. Similarly, U.S. consumers 20 or more years ago bought organic food because of their concern for the environment. In 2002, according to national surveys, two-thirds of U.S. consumers cited health and nutrition as a reason for buying organic, followed by taste, food safety, and the environment.

Consumers in both regions offer similar reasons for why they do not purchase organic food. In Europe, the main factors include high prices, poor product distribution, little obvious difference in quality, lack of information on the nature of organic products, and doubts about the organic integrity of the items. In the U.S., according to consumer surveys, price leads the list of barriers to purchasing organic products, followed by availability of organic products. Despite these factors, retail sales are growing rapidly in both regions.

In 2003, U.S. organic food sales were distributed almost evenly between natural product/health food stores (47 percent) and conventional retail stores (44 percent), with direct sales and exports accounting for 9 percent. This is a significant shift from 1998, when corresponding sales were 63 percent, 31 percent, and 6 percent. As in the U.S., mainstream European supermarkets in some countries stock a wide range of organic products. However, the main type of retail channel for organic food varies across countries. Over 85 percent of organic products are sold through general food shops in Denmark; in Luxembourg and Greece, organic foods are primarily sold through other stores (e.g., organic/health food stores, bakers, and butchers). In a number of countries, including Ireland, Italy, France, Belgium, the Netherlands, and Germany, sales are more evenly divided between supermarkets and other stores.

Although the organic market is growing in both the EU and the U.S., there are some problems with the flow of products to market. In Europe, the organic dairy and livestock industries, in particular, have grown rapidly over the last decade, and in some cases have outpaced the capacity of the market and distribution channels. Organic milk supplies in some regions were large enough to reduce organic prices, causing some producers to exit the sector because they were unable to turn a profit. The milk glut, however, appeared to be giving way to shortages in the UK, as demand continues to grow and supply has declined. The U.S. organic food market was formerly supply constrained, but now seems better able to meet consumer demand, especially for fresh produce. In the dairy market, however, with demand increasing rapidly, suppliers are struggling to provide enough organic milk to satisfy demand at current prices.

EU CAP Reform Renews Support for Organic Farming

In June 2004, the European Commission adopted an Action Plan for Organic Food and Farming, with 21 policy actions aimed at facilitating ongoing developments in the organic sector. The actions are focused on three main areas: information development e.g., increasing consumer awareness, improving statistics on organic production and demand); encouraging member states to apply a more coherent approach and to make better use of the different rural development measures; and improving/reinforcing the EU’s organic farming standards and import/inspection requirements.

The 2003-04 CAP reforms partially shift agricultural policy toward a market-driven policy and convert the current system of direct payments to a single-farm payment independent of the volume of production. The single-farm payments began in 2005, with member states having discretion in implementing them. The farm payment will require cross-compliance with a wide range of standards, including environmental, food safety, animal welfare, and occupational health/safety. While the impact on organic agriculture is still unknown, the overall changes are expected to favor an expansion of organic farming.

This article is drawn from:

- Organic Agriculture. (n.d.). U.S. Department of Agriculture, Economic Research Service.