Data Feature

- by Sophia Huang and Fred Gale

- 4/1/2006

China’s Rising Profile in the Global Market for Fruits and Vegetables

China’s emergence as a fruit and vegetable exporter presents a new source of competition for U.S. producers. China’s fruit and vegetable exports have increased most rapidly in three categories: apples, apple juice, and fresh vegetables. Since 2003, China’s apple exports have surpassed those of the United States and have made inroads into major U.S. export markets in Asia. China is now the world’s leading exporter of apple juice, and U.S. apple juice producers face both import competition and loss of export markets. China’s exports of processed fruits and vegetables do not yet pose a serious challenge to the United States, because the two countries do not export the same types of products. However, China’s rising exports of fresh vegetables have begun to compete with U.S. exports to Asian markets, and in some cases U.S. market shares have slipped.

However, such rapid export growth on the part of China may not be a long-term phenomenon. Growing domestic demand for fruits and vegetables is likely to reduce the supply available for export. As Chinese household incomes rise, fruit and vegetable consumption will rise, as will the variety demanded. Several important U.S. horticultural products are already popular among high-income Chinese households. Moreover, as the growth in the Chinese economy deepens, income gains will be spread more widely over the Chinese population. In the coming years more households will likely emulate the consumption patterns of the top-earning households, and Chinese consumption of fruits and vegetables could rise sharply.

Chinese apples and apple juice erode U.S. market share

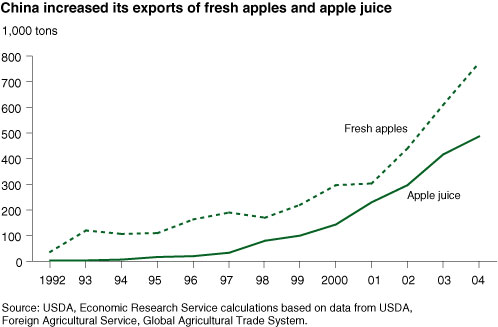

China, the world’s largest apple producer, has boosted its exports of apples and apple juice. In 1992, apple juice exports were negligible, and apple exports were less than 50,000 tons. Exports of both products began growing rapidly during the late 1990s. By 2004, fresh apple exports reached more than 750,000 tons and apple juice exports reached nearly 500,000 tons. China is now the world’s leading exporter of apple juice and, in 2004, had a 56-percent share of the U.S. import market.

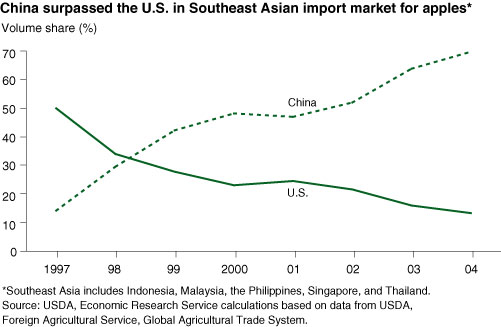

While Chinese fresh apples are not allowed into the United States because of phytosanitary issues, China’s apple exports are eroding U.S. market share in Southeast Asian markets, which purchase nearly 60 percent of China’s apple exports. In 1999, China surpassed the United States as the leading supplier of apples to Southeast Asia, and its share in volume grew to nearly 70 percent in 2004. The U.S. share of the Southeast Asian apple market fell from 50 percent in 1997 to 13 percent in 2004.

And China’s fresh vegetable exports take over Asian markets

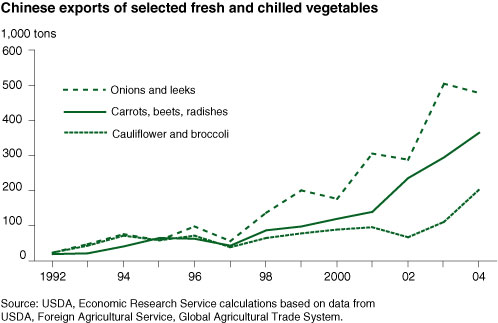

China’s fresh vegetable exports include a wide variety of products grown in coastal regions, often under contract for Japanese or other Asian companies. Many vegetable products exported by China are different from those exported by the United States. But as China’s fresh vegetable exports have diversified, they present more competition to U.S. exporters. Exports of onions, carrots, cauliflower, and broccoli grew from just a few thousand tons in 1992 to a combined total of over 1 million tons in 2004, making China the largest supplier in some Asian markets. Other prominent vegetable exports include garlic and mushrooms.

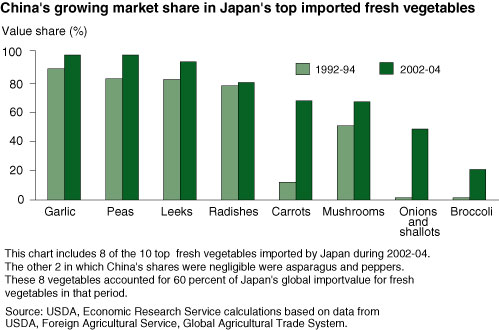

China’s vegetable exports compete with U.S. products primarily in Japan and, to a much lesser degree, South Korea. China surpassed the United States as the leading fresh vegetable exporter to Japan in 1996. It is the dominant supplier to Japan of imported garlic, peas, leeks, radishes, and mushrooms. China’s share of Japan’s imports of carrots, onions, and broccoli also grew rapidly over the past decade, and these are displacing U.S. products.

China emerges as a market for U.S. exports of fruits and vegetables

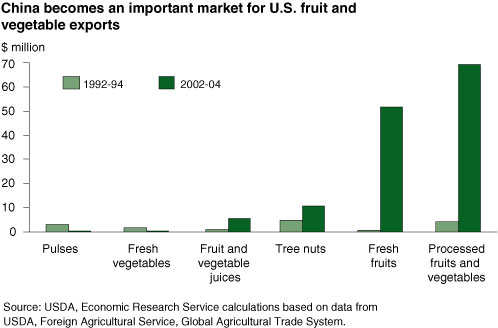

Driven by demand from the growing population of upper income consumers in urban centers, China expanded its global import value of fruits and vegetables (including fresh fruit, fresh vegetables, processed fruits and vegetables, fruit and vegetable juices, pulses, and tree nuts) more than ninefold since the early 1990s to reach $910.2 million in 2002-04. China’s imports of U.S. fruits and vegetables increased almost without interruption from $15.7 million in 1992-94 to $137.7 million in 2002-04, despite existing trade barriers. While China’s fruit and vegetable imports still remain small, China now ranks among the top 15 largest importers of U.S. fruits and vegetables.

Among all categories of these imports, fresh fruits and processed fruits and vegetables grew the fastest—to the benefit of U.S. exporters. The U.S. share of China’s fresh fruit import market grew from less than 4 percent to nearly 15 percent, in part because of China’s growing upper income class and relaxation of trade barriers. Grapes, oranges, and apples accounted for the bulk of shipments. China’s imports of U.S. processed fruits and vegetables also increased substantially, reflecting rapid Westernization in the Chinese diet. Processed potatoes (mainly french fries) and sweet corn accounted for 83 percent of China’s imports of U.S. processed fruits and vegetables in 2002-04.

This article is drawn from:

- Huang, S. & Gale, F. (2006). China's Rising Fruit and Vegetable Exports Challenge U.S. Industries. U.S. Department of Agriculture, Economic Research Service. FTS-32001.

- Huang, S., Calvin, L., Coyle, W.T., Dyck, J., Ito, K., Kelch, D., Lucier, G., Perez, A., Pollack, S., Pryor, S., Regmi, A., Shane, M., Shields, D., Stout, J. & Worth , T. (2004). Global Trade Patterns in Fruits and Vegetables. U.S. Department of Agriculture, Economic Research Service. WRS-0406.