Chinese Banks Carry Out Rural Policy

- by Fred Gale

- 4/1/2006

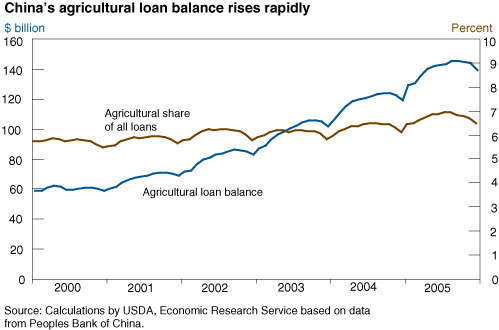

Since 2001, China has been pushing vast amounts of cash into its countryside through rural financial institutions. The value of outstanding agricultural loans more than doubled in 4 years, from $60 billion in 2001 to $145 billion in late 2005. Surprisingly, agriculture’s share of loans rose as well, even with lending to industrial and real estate sectors growing at a rate of 20-30 percent per year.

The boost in agricultural lending is part of a policy campaign to bolster the rural economy, where growth is lagging far behind that of China’s booming cities. The agricultural loan campaign reflects the strong policy role of financial institutions, one of the last segments of China’s economy to be reformed. Banks and rural credit cooperatives increasingly resemble commercial banks, but they must still set aside loans to support government initiatives. But for all the rhetoric, the surge in agricultural lending has had little impact on China’s agricultural sector.

Some of the loans finance agribusiness firms, rural roads, water projects, and other infrastructure. Most of the loans, however, are small short-term loans of less than $1,000 made to agricultural households by rural credit cooperatives, the primary financial institutions serving rural communities. While the loans are labeled “agricultural,” their value far exceeds the combined value of agricultural fixed asset investments and farm input expenses, so it is not clear how the borrowers are spending the money.

Such a large boost in agricultural lending should improve the competitiveness of China’s agricultural sector. However, statistics show little discernible increase in agricultural investment or input expenditures coinciding with the increase in agricultural lending. Farms remain small—on average, less than 2 acres—and labor-intensive, with minimal capital investment.

China’s financial institutions, flush with cash from China’s high saving rate, foreign investment, and government injections of cash to clean up nonperforming loans, continue to lend at a furious pace. China’s financial liquidity has allowed its financial system to simultaneously boost lending to rural areas and other lagging regions, recapitalize its shaky banks, and fund one of the largest infrastructure construction efforts in history. China’s ability to continue its financial juggling act depends on continued growth in domestic savings and inflows of foreign capital.

This article is drawn from:

- New Directions in China’s Agricultural Lending. (2006). USDA, Economic Research Service. WRS-06-01..

- China: A Study of Dynamic Growth. (2005). USDA, Economic Research Service. WRS-04-08..