Farm Households Face Larger Tax Liabilities When Provisions of the Tax Cuts and Jobs Act of 2017 Expire

Highlights:

-

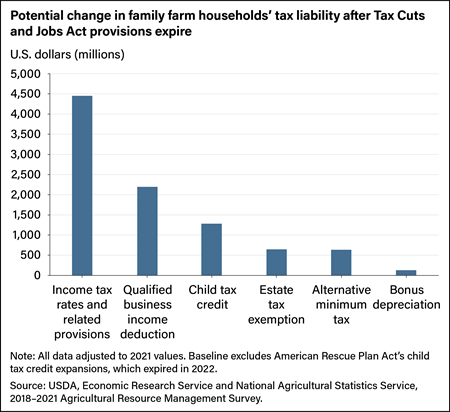

The sunsetting of Federal individual income tax provisions from the Tax Cuts and Jobs Act that will have the biggest effect on total tax liabilities of farm households are the reduced marginal tax rates and related changes, the qualified business income deduction, and the expanded Child Tax Credit.

-

Moderate-sales farm households would experience the largest percentage increase in tax liability as a result of the expiration of reduced marginal tax rates and related changes and the qualified business income deduction.

-

Expiration of the increased estate tax exemption (which will decrease the amount exempted from $13.95 million to $6.98 million) is estimated to increase the percent of farm operator estates taxed from 0.3 to 1.0.

The 2017 Tax Cuts and Jobs Act (TCJA) made significant changes to Federal individual income and estate tax policies. Federal income and estate tax policy modifications can affect not only the financial well-being of farm households but also the number and size of farms, so these changes are of considerable importance to family farms. Several of the TCJA changes to Federal individual income and estate tax policies were temporary and are scheduled to expire by the end of 2025.

The expiration of the TCJA provisions would result in:

- Higher marginal income tax rates. The TCJA reduced the top income tax rate to 37 percent from 39.6 percent and changed the income tax brackets to make more income subject to lower rates. It also increased the standard deduction for married joint and single filers and eliminated the personal exemption.

- A decrease in the Child Tax Credit amount and eligibility. The TCJA expanded the per-child tax credit to $2,000 from $1,000 and increased the income threshold for eligibility for the tax credit.

- An increase in the scope of the alternative minimum tax (AMT). For higher income earners, the TCJA significantly reduced the impact of the AMT by increasing its exemption amount and increasing the threshold where the exemption begins to phase out.

- The elimination of the qualified business income deduction (QBID), created through TCJA for farms and other businesses that are not organized as C-corporations, which are taxed separately from their owners. The QBID provision was intended to provide parity with C-corporations, which received tax rate cuts through the TCJA.

- The elimination of bonus depreciation, which allows businesses to deduct a percentage of their capital expenses in the first year. TCJA increased that deductible amount to 100 percent from 50 percent. The bonus depreciation allowance is set to be fully phased out by 2026.

- A decrease in the estate tax exemption. TCJA increased the estate tax exemption to $11.18 million in 2018. At the end of 2025, the exemption amount will revert to the pre-TCJA level (adjusted for inflation) of $6.98 million.

In a recently released report, researchers with the USDA, Economic Research Service (ERS) estimated the impact these expiring tax provisions would have on farms by using two economic models coupled with demographic and financial data for farms and farm households collected as part of USDA’s Agricultural Resource Management Survey (ARMS). As shown in the chart below, the expiration in income tax rates and related provisions would increase total tax liabilities the most. Changes after the provisions expire include tax bracket revisions resulting in more income being taxed at higher rates, reductions in the standard deduction, reinstatement of the personal exemption, and removal of a limit on the deduction for State and local taxes. The expiring provision with the second biggest total impact would be the elimination of the QBID. This deduction allows sole proprietorships and other noncorporate business owners to deduct 20 percent of their business income from their taxable income. Eliminating this deduction has the potential to increase tax liabilities for famers who typically earn positive farm income. Expiring expansions to the Child Tax Credit would increase total tax liabilities by more than $1 billion the year following expiration. The expiring provisions related to the AMT, bonus depreciation, and the estate tax exemption generally affect higher income and wealthier households and are more limited in their total impact.

To estimate the effect of each expiring income tax provision, researchers put family farm household adjusted gross income and tax liability data into ERS’s Federal Income Tax model. For the Federal estate tax estimations, researchers used ERS’s Estate Tax model, an actuarial model using farm financial information from ARMS (2018-21). The estate tax model also uses mortality data from the Social Security Administration (2019), publicly available estate tax data from the Internal Revenue Service (2020), and interest rate data from Farm Credit System lenders (2021). With this model, researchers can compare Federal estate tax liabilities for farm households in 2026 for the exemption levels increased through TCJA with the exemption level that would apply if the law’s provisions were to expire.

Researchers used ERS’s farm typology—categorizing family farms by size and primary occupation of the principal operator—to explore additional insights into the effects of those expiring tax provisions. Retirement farms have gross cash farm income (GCFI) of less than $350,000, and the principal operators report they are retired from farming. Off-farm occupation farms have GCFI of less than $350,000, and the principal operators’ primary occupation is not farming. For all other farm types, the primary occupation of the principal operator is farming. The GCFI thresholds for low-sales, moderate-sales, midsize, and large farms are $150,000, $350,000, $1 million, and $5 million, respectively. Very large farms are those with more than $5 million GCFI.

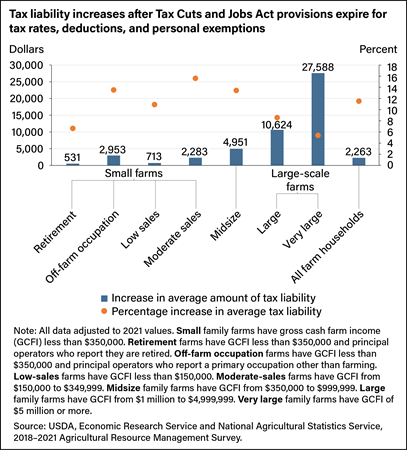

The Impact of Expiring Income Tax Provisions Would Vary by Farm Typology

The combined effect of expiring marginal income tax rates and other income tax changes would increase average tax liabilities for a farm household by $2,263, or 11.5 percent, compared with current law. Retirement farm households would experience the lowest increase in both dollar amounts and percentage terms. Moderate-sales farm households would experience the highest percentage increase in tax liabilities of 15.6 percent. Very large farms would experience the largest dollar increase in tax liabilities of $27,588, a 5.4-percent increase.

The TCJA temporarily increased the Child Tax Credit from $1,000 per child to $2,000 per child. It also increased the income phaseout threshold for married filers from $110,000 to $400,000 and for single filers from $75,000 to $200,000. Reinstating the more restrictive income thresholds would decrease the share of farm households that receive the Child Tax Credit from 36 to 27 percent. These lower income thresholds would have the largest effect on midsize and large farm households and would approximately halve the share of these households that receive the Child Tax Credit. For households that would continue to receive the Child Tax Credit, the expiring TCJA provision would reduce the amount they receive. Across farm households affected by the expiration, the average Child Tax Credit received would decrease from $3,770 to $1,331, with each farm type and size showing a similar outcome.

| Percent of farm households receiving Child Tax Credits |

Average Child Tax Credit for eligible farm households (dollars) |

|||

| Farm type | Baseline, TCJA active |

Expired TCJA CTC expansion |

Baseline, TCJA active |

Expired TCJA CTC expansion |

| Small | ||||

| Retirement | 14.6 | 12.5 | 3,341 | 1,422 |

| Off-farm occupation | 42.4 | 29.5 | 4,107 | 1,342 |

| Low sales | 34.4 | 30.2 | 3,099 | 1,331 |

| Moderate sales | 43.3 | 30.4 | 4,325 | 1,588 |

| Midsize | 39.5 | 19.6 | 4,249 | 1,029 |

| Large scale | ||||

| Large | 27.3 | 12.9 | 4,348 | 981 |

| Very large | 17.7 | 10.2 | 4,017 | 1,159 |

| All farm households | 35.9 | 26.8 | 3,770 | 1,331 |

| Note: TCJA = Tax Cuts and Jobs Act. CTC = child tax credit. All data adjusted to 2021 values. Baseline excludes American Rescue Plan Act’s child tax credit expansions, which expired in 2022. Small family farms have gross cash farm income (GCFI) less than $350,000. Retirement farms have GCFI less than $350,000 and principal operators who report they are retired. Off-farm occupation farms have GCFI less than $350,000 and principal operators who report a primary occupation other than farming. Low-sales farms have GCFI less than $150,000. Moderate-sales farms have GCFI from $150,000 to $349,999. Midsize family farms have GCFI from $350,000 to $999,999. Large family farms have GCFI from $1 million to $4,999,999. Very large family farms have GCFI of $5 million or more. Source: USDA, Economic Research Service and National Agricultural Statistics Service, 2018–2021 Agricultural Resource Management Survey. |

||||

Elimination of the qualified business income deduction will affect business owners who typically earn positive net income from their business. Estimates suggest that 45.3 percent of all farm households earned positive farm income and received an average decrease in their tax liability of $2,464 because of the deduction. The total increase in tax liability resulting from the expiration of QBID increases with farm size. Without the QBID, tax liabilities would increase for low-sales farm households by an average of $711 and would increase for very large farm households by an average of $87,219. The percentage increase in tax liability ranges from a 4 percent increase in tax liability for off-farm occupation farm households to a 20 percent increase in tax liability for moderate-sales farm households.

| Percent of farm households that received qualified business income deduction |

For farm households affected by expiration of qualified business income deduction |

||

| Farm type | Change in average tax liability (dollars) |

Change in tax liability (percent) |

|

| Small | |||

| Retirement | 43.4 | 851 | 8.4 |

| Off-farm occupation | 40.6 | 1,010 | 4.0 |

| Low sales | 39.1 | 711 | 9.0 |

| Moderate sales | 73.3 | 3,068 | 20.0 |

| Midsize | 76.0 | 5,678 | 14.0 |

| Large scale | |||

| Large | 77.8 | 11,868 | 8.5 |

| Very large | 79.7 | 87,219 | 14.1 |

| All farm households | 45.3 | 2,464 | 9.0 |

| Note: TCJA = Tax Cuts and Jobs Act. CTC = child tax credit. All data adjusted to 2021 values. Baseline excludes American Rescue Plan Act’s child tax credit expansions, which expired in 2022. Small family farms have gross cash farm income (GCFI) less than $350,000. Retirement farms have GCFI less than $350,000 and principal operators who report they are retired. Off-farm occupation farms have GCFI less than $350,000 and principal operators who report a primary occupation other than farming. Low-sales farms have GCFI less than $150,000. Moderate-sales farms have GCFI from $150,000 to $349,999. Midsize family farms have GCFI from $350,000 to $999,999. Large family farms have GCFI from $1 million to $4,999,999. Very large family farms have GCFI of $5 million or more. Source: USDA, Economic Research Service and National Agricultural Statistics Service, 2018–2021 Agricultural Resource Management Survey. |

|||

Expiring Estate Tax Provisions Will Increase Percentage of Farm Operator Estates That Owe Tax

The Federal estate tax has applied to the transfer of property at death since 1916, but it has never directly affected a large percentage of farmers or other taxpayers. Since the TCJA, the percent that owe Federal estate tax has dropped to about 0.1 percent of all estates.

One of the primary determinants of the scope of the estate tax is the exemption amount. Only those estates with assets exceeding the estate tax exemption amount must file a Federal estate tax return, and only those returns that have a taxable estate above the exemption amount after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax.

In 2018, the TCJA increased the estate tax exemption amount to $11.18 million. Adjusting for inflation, that amount is expected to grow to $13.95 million by the time it expires at the end of 2025. When that happens, the exclusion amount will revert to the pre-TCJA level adjusted for inflation of $6.98 million. Since 2011, married couples have been able to take advantage of their combined exemption amounts more fully by electing to allow any unused portion of the deceased spouse’s exemption amount to be transferred to the estate of the surviving spouse. This portability provision will be of increased importance if the exemption amount reverts to the pre-TCJA level. A spouse who has died or dies between 2018 and 2025, when exemptions are higher, potentially will have more unused exemption to pass to their surviving spouse. That could be beneficial to the estates that result from the death of the surviving spouse, if that occurs after 2025, when exemptions are lower.

An actuarial estate tax model and ARMS data were used to estimate the number of farm estates that would be created in 2026 as well as the share of those estates that would be required to file a return and would owe Federal estate tax. Under the increased exemption amount, about 0.3 percent of all farm estates are estimated to owe tax, with the share increasing with farm size, ranging from 0.1 for low-sales farms to 6.9 percent for very large farms. Total Federal estate taxes for all taxable farm estates are estimated at $572 million in 2026.

Upon expiration of the higher exemption amount provided in the TCJA, the share of farm estates that would owe tax would increase to 1.0 percent. While the share of retirement, off-farm occupation, low-sales, and moderate-sales farms expected to owe tax would remain under 2 percent, the share of the large and very large farms subject to tax would increase to 7.3 and 8.5 percent respectively. Total Federal estate taxes for all taxable farm estates are expected to more than double to $1.2 billion after the exemption amounts revert to pre-TCJA levels.

| Exemption = $13.95 million | Exemption = $6.98 million | |||||

| Farm type | Percent of estates paying estate tax | Average net worth of estates taxed (dollars) | Average tax rate (percent) | Percent of estates paying estate tax | Average net worth of estates taxed (dollars) | Average tax rate (percent) |

| Small | ||||||

| Retirement | 0.1 | 35,800,000 | 11.3 | 0.5 | 20,900,000 | 10.7 |

| Off-farm occupation | 0.3 | 23,800,000 | 9.7 | 1.4 | 15,600,000 | 11.4 |

| Low sales | 0.1 | 42,500,000 | 11.2 | 0.5 | 19,500,000 | 13.5 |

| Moderate sales | 0.6 | 36,000,000 | 20.6 | 1.5 | 24,800,000 | 18.5 |

| Midsize | 1.4 | 29,600,000 | 14.6 | 3.3 | 22,900,000 | 15.8 |

| Large scale | ||||||

| Large | 2.8 | 34,500,000 | 17.8 | 7.3 | 21,200,000 | 19.8 |

| Very large | 6.9 | 53,000,000 | 28.1 | 8.5 | 45,900,000 | 31.7 |

| All farm households | 0.3 | 32,500,000 | 14.6 | 1.0 | 19,600,000 | 14.7 |

| Note: TCJA = Tax Cuts and Jobs Act. Results are forecasted values based on real annual growth in asset value of 2.5 percent. Small family farms have gross cash farm income (GCFI) less than $350,000. Retirement farms have GCFI less than $350,000 and principal operators who report they are retired. Off-farm occupation farms have GCFI less than $350,000 and principal operators who report a primary occupation other than farming. Low-sales farms have GCFI less than $150,000. Moderate-sales farms have GCFI from $150,000 to $349,999. Midsize family farms have GCFI from $350,000 to $999,999. Large family farms have GCFI from $1 million to $4,999,999. Very large family farms have GCFI of $5 million or more. Source: USDA, Economic Research Service using data from Agricultural Resource Management Survey 2018–21; USDA’s 2021 June Area Survey; Social Security Administration’s 2019 Actuarial Life table; Internal Revenue Service’s 2021 Farm Credit System Bank Loan Interest Rates chart; and Number, Timing, and Duration of Marriages and Divorces: 2016, U.S. Department of Commerce, Bureau of the Census (2021). |

||||||

An Analysis of the Effect of Sunsetting Tax Provisions for Family Farm Households, by Tia M. McDonald and Ron Durst, ERS, February 2024

Farm Bill, USDA, Economic Research Service, March 2024

Federal Tax Issues, by Tia M. McDonald, USDA, Economic Research Service, April 2024

Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in 2020, by Tia M. McDonald and Ron Durst, USDA, Economic Research Service, April 2021

Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households, by James Williamson and Siraj G. Bawa, ERS, June 2018