Pandemic-Related Increase in Consumer Restaurant Spending Using Mobile Apps Continued Through 2022

The Coronavirus (COVID-19) pandemic led to large shifts in how consumers spent money on and acquired food. USDA, Economic Research Service (ERS) researchers examined the changes in how individuals in the United States acquired food away from home by analyzing spending trends on carryout and delivery. They examined these trends among full- and quick-service restaurants by mobile application types (including mobile use of restaurant websites) using 3-month rolling spending averages from December 2019 through December 2022.

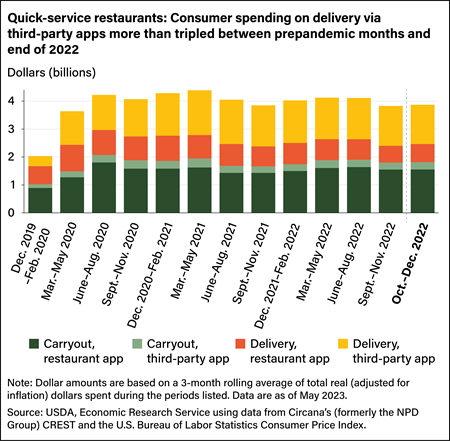

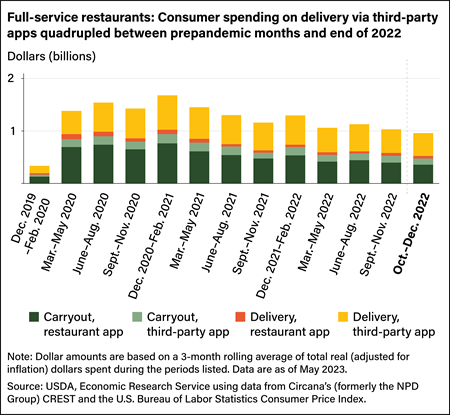

When pandemic-related restrictions limited access to onsite dining options, consumers shifted to alternatives such as carryout and delivery. How consumers accessed these options also shifted, particularly how they used cell phone-based apps or mobile webpages. To order food for carryout or delivery, customers typically use a restaurant-specific app associated with a single establishment or firm or a third-party app, which connects customers to a variety of restaurants. Before the pandemic (December 2019–February 2020), customers at quick-service, or fast food, restaurants, mainly used the restaurant-specific apps over the third-party apps for carryout and delivery services. However, at full-service restaurants, which typically offer table service to customers who sit down and order food before paying, spending varied little between restaurant-specific and third-party apps.

Starting from March—May 2020, in the early months of the pandemic, spending on delivery through third-party apps started to become more popular for both full- and quick-service restaurants. At quick-service restaurants, third-party delivery spending in the United States tripled from about $0.4 billion in the December 2019–February 2020 period to about $1.4 billion 3 years later (October–December 2022). Third-party delivery spending nearly quadrupled at full-service restaurants over that period from about $0.1 billion to about $0.4 billion. Carryout spending using restaurant-specific apps over the period increased from $0.9 billion to $1.6 billion at quick-service restaurants and from $0.1 billion to about $0.4 billion at full-service restaurants. Although total spending through apps has declined since peaking in early 2021, it remained higher through the end of 2022 than before the pandemic, with the increase more pronounced for quick-service restaurants than for those offering full service.

COVID-19 Working Paper: Food-Away-From-Home Acquisition Trends Throughout the COVID-19 Pandemic, by Keenan Marchesi and Patrick W. McLaughlin, ERS, May 2023

Food Expenditure Series, by Eliana Zeballos and Wilson Sinclair, USDA, Economic Research Service, February 2024