U.S. Agricultural R&D in an Era of Falling Public Funding

Highlights:

-

U.S. private sector funding in food and agricultural R&D has risen rapidly over the last decade, surpassing public sector funding.

-

Falling public sector funding for agricultural R&D in the U.S. and greater spending by some other nations have reduced the U.S. share in public agricultural R&D worldwide.

-

While these trends may have negative implications for agricultural productivity growth, at present, the U.S. remains the top producer of agricultural R&D output, as measured by agricultural patents and academic journal articles.

Unlike in many other parts of the U.S. economy, the public sector rather than the private sector has historically been the dominant player in the conduct of research and development (R&D) directly used by agriculture. The U.S. public sector has also been the largest performer of agricultural R&D worldwide.

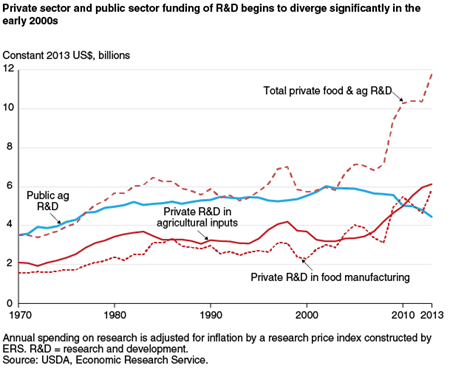

In recent years, however, this status quo changed substantially. Between 1970 and 2008, the share of total food and agricultural R&D conducted in the United States by the public sector was relatively stable at around 50 percent. But, by 2013, that share had fallen to under 30 percent. This dropoff was due to a decline in Government spending on public agricultural R&D as well as a surge in R&D spending by the private sector. Between 2008 and 2013, for example, real (inflation-adjusted) public food and agricultural R&D fell by about 20 percent while real private R&D increased by 64 percent.

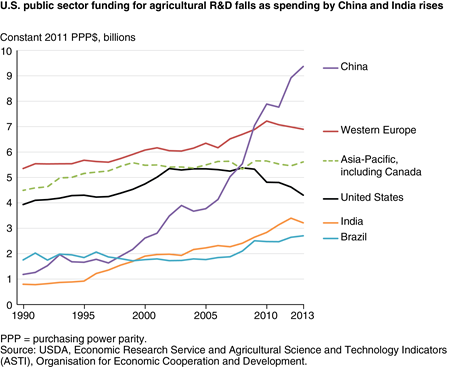

The United States also lost its position as top global performer of public agricultural R&D, falling behind China in 2009 through at least 2013. Among countries with substantial investments in public sector R&D for agriculture, the U.S. led with 20-23 percent of the global total between 1990 and 2006. By 2013, this share had fallen to 13 percent. Nonetheless, the U.S. remains the top producer of R&D outputs by several measures, at least as of 2013. Based on the latest available data, the U.S. produces more journal articles and patents related to agricultural R&D than any other country, though by a smaller margin than in the past.

The longer term impact of these funding shifts, however, may have negative implications for future agricultural growth. Total agricultural output in the United States grew by 169 percent between 1948 and 2013. This rise was not due to increases in agricultural land or labor—in fact, both inputs declined over the period. Rather, it stemmed from the adoption of a whole suite of innovations in crop and livestock breeding, nutrient use, pest management, farm practices, and farm equipment and structures. These innovations are the fruits of agricultural R&D.

The Role of the Public Sector

Historically, the U.S. Government took a prominent role in producing new innovations and technologies for agriculture because farmers themselves did not have the means to conduct formal R&D. Over time, specialized firms in the farm machinery, agricultural chemical, crop seed, and other agricultural input industries grew large enough to make considerable investments in R&D.

This private R&D, however, has tended to focus on commercially useful applications, so the public sector is still responsible for much of the fundamental research that creates the building blocks for major agricultural innovations. Private R&D also has tended to gravitate toward technologies that are easy to patent or otherwise protect with intellectual property rights. Many important new farming technologies—such as agronomic and animal husbandry practices, farming methods that conserve environmental resources, and technologies requiring collective action like pest eradication—are not likely to be profitable for private R&D. These technologies may embody knowledge difficult to incorporate into a patentable product or service, or they may require additional incentives for farmers to adopt them.

Economists have noted several reasons why the production and sale of knowledge differs from that of other goods and services:

- • Knowledge may have social benefits that are difficult to capture in a market.

- • Knowledge builds on itself so that the pace of discovery is faster when knowledge is freely available.

- • Knowledge may have applications outside the domain of the discoverer’s expertise.

Perhaps most important in agriculture, though, is that technological innovations are often difficult and expensive to acquire at first but are then comparatively cheap to distribute and copy. Consider, for example, improved crop varieties. While these are developed at great cost, if they are nonhybrids, they are essentially self-replicating. Once a new variety is sold, a customer has the means to produce and sell it cheaply without incurring the cost of research.

When firms cannot recoup their R&D investments by charging a higher price for the innovation, there is little or no incentive to conduct R&D. Assigning intellectual property rights, such as patents, can help address this problem by preventing rival firms from copying and selling the innovation (for a period), but these rights did not apply to biological innovations for much of U.S. history. Moreover, fundamental research as well as a whole host of important agricultural innovations mentioned earlier are not well protected by patents. Because the private sector may not perform some beneficial research, the public sector has traditionally acted as a major supplier of food and agricultural R&D.

There is a large body of economic research that attempts to measure the return on public investments in agricultural R&D, which may shed light on whether public R&D is worth the cost. Estimating the return on public R&D generally includes measuring not only the economic benefits to farmers, but also the gains to consumers (who may benefit from more abundant food at lower prices) and to society at large (if the technologies produce nonmarket benefits like improved environmental or human health). Comparing these benefits to public costs gives an estimate of the “social” return to R&D. A high rate of return relative to other public or private investment opportunities would justify the continued financing of agricultural R&D by the public sector. And, indeed, this body of literature has tended to find that agricultural R&D has a very large rate of return—on the order of 20 to 60 percent with a median rate of return of 40 percent. Such large rates of return support the case for robust public sector agricultural R&D.

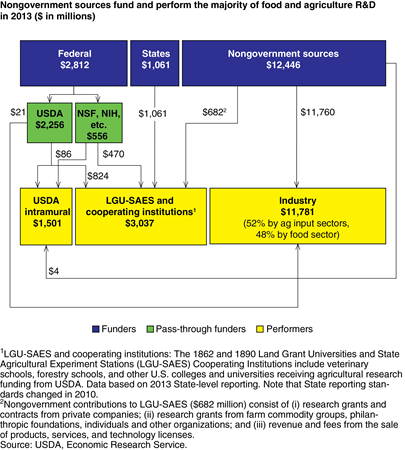

Out of a total of $16.3 billion spent on food and agricultural R&D in 2013, funding from the Federal Government accounted for $2.8 billion (17.2 percent), and the States accounted for an additional $1.0 billion (6.1 percent). By comparison, nongovernment sources—mostly the private business sector but also including foundations and farmer organizations—contributed $12.4 billion (76.3 percent).

The Federal Government has a highly decentralized process for allocating money to research. For agriculture, most Federal dollars are allocated through USDA ($2.3 billion in 2013), with the remainder flowing through a host of other agencies such as the National Science Foundation and the National Institutes of Health. Within USDA, research funding flows through multiple channels, including the Agricultural Research Service, ERS, and the Forest Service (which conduct in-house research) and the National Institute for Food and Agriculture (which funds research primarily in universities). Additionally, a large share of public funding comes from the States to support research at State universities and experiment stations, often due to requirements that States match Federal funding.

As mentioned earlier, the public sector is not the dominant player in funding or performing U.S. food and agricultural research. In 2013, public research institutions—namely USDA intramural research and land grant universities, State agricultural experiment stations, and cooperating institutions (LGU/SAES/CI)—performed under 30 percent of total agricultural R&D.

Moreover, the majority of public and private money stays in its respective sector. All but $21 million of public funding in 2013 went to public institutions. Similarly, out of $12.4 billion spent by private firms and other nongovernment bodies during the same period, all but $686 million financed industry research, with most of the rest funding research at LGU/SAES/CI. Within the public sphere, LGU/SAES/CI conducted $3.0 billion in research, twice the level of USDA’s intramural labs. Within the private sector, nearly half of the research is in the food sector, and the remainder is in agricultural input sectors like the seed, agricultural chemical, animal health and farm machinery industries.

Declining Real Investment in Public Sector Research

The dominance of the private sector in agricultural R&D is a comparatively new phenomenon. From 1971 to the early 2000s, public R&D and total private R&D followed each other quite closely. At the same time, the public sector had much larger investments in agricultural input R&D than the private sector (while the private sector funds both agricultural input and food R&D nearly equally, the public sector allocates little funding to food R&D). In 2003, however, the two series began to diverge. Private R&D—in both the food and agricultural input sectors—began to rise steadily from $6.0 billion in 2003 to $11.8 billion in 2013. At the same time, public agricultural R&D fell from $6.0 billion to around $4.5 billion. By 2010, private agricultural input R&D alone had surpassed total public R&D.

Multiple factors have contributed to the changing share of food and agricultural R&D conducted by the public and private sectors. First, between the 1970s and 1980s, intellectual property rights were extended to biological innovations, initially via special tools such as plant breeders’ rights and eventually through patents. Prior to the availability of intellectual property rights for biological innovations, most private seed research focused on crops grown from hybrid seed, like corn. Hybrid seed gives exceptional yield but only for the first generation, so farmers need to obtain fresh seed each year. The extension of intellectual property rights to crop varieties gave seed companies the incentive to breed improved nonhybrid crops as well. As the number of private nonhybrid varieties grew, public breeding programs in these crops were closed or curtailed.

Second, new scientific opportunities, particularly under the umbrella of what is sometimes referred to as “the New Biology,” have increased the potential value of agricultural R&D. The New Biology has advanced the life sciences by blending in elements from other disciplines—such as physics, engineering, and mathematics—and plays a crucial enabling role in a host of agricultural innovations, ranging from genetically modified (GM) crops to new techniques for conventionally breeding plants and animals. The private sector has capitalized on these opportunities.

Third, population and incomes are growing rapidly in developing countries, and trade barriers are falling. These changes have substantially opened potential markets for agricultural exports, including inputs like crop seeds and chemicals. Because research entails large upfront fixed costs and then relatively small costs associated with producing and selling the innovations, large markets enable firms to recoup large R&D costs and help promote further R&D. For example, large corn and soybean markets helped these crops become some of the first to benefit from genetic modification.

Finally, the decline in public funding for agricultural R&D has of course contributed to the decline in the public’s share of total R&D. State-level public research expenditures began to fall in 1991, although this was partially offset by a rise in funding from non-USDA Federal agencies until 2002. USDA research expenditures also began to drift downward after 2001. The fall in combined public spending for agricultural R&D began to accelerate in 2009, mirroring a decline in total Federal real R&D spending (across all Federal agencies) over the same period.

U.S. public R&D is also falling as a share of public R&D among major countries. Between 1990 and 2013, the U.S. share of spending among nations with major public agricultural R&D investments fell from 22.5 percent to 13.4 percent. This decline was driven by a combination of falling U.S. spending and rapidly rising spending in developing countries such as India and, especially, China. Indeed, Chinese government spending on agricultural R&D rose nearly eightfold in real (inflation-adjusted) terms between 1990 and 2013, surpassing U.S. spending in 2008.

U.S. Remains First in Key Innovation Output Indicators

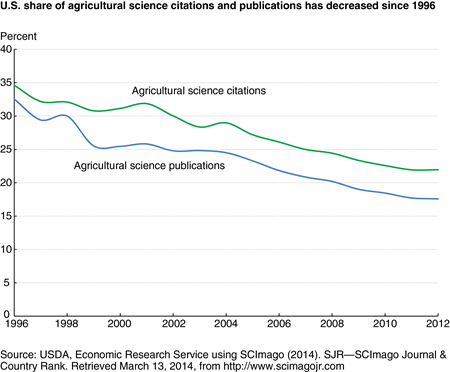

While the U.S. public sector share of agricultural R&D has slipped relative to the private sector share and to global public R&D, the U.S. agricultural research system as whole remains one of the most productive in the world. In fact, the U.S. is still a leader in agricultural science publications and citations, as well as agricultural patents. Scientific publications often reflect research aimed at making more fundamental discoveries about how the world works, while patents may indicate the transformation of R&D knowledge into agricultural products.

In 2012, the U.S. had the highest share (18 percent) of global agricultural science publications, more than twice the share of the second highest nation, China. Still, the U.S. share has dropped sharply from nearly a third of the global total in 1996, driven by a rise in publications from other countries rather than a decline in total U.S. publications. The U.S. share of citations to its published research output is higher than its publication share, indicating higher-than-average quality. The U.S. share (over a fifth of citations worldwide) is the highest among all nations, but it, too, has decreased since 1996.

The United States also remains the world’s largest agricultural inventor. Between 2006 and 2011, U.S. inventors had 4,500 patents in agricultural science and 18,000 patents in agriculture—about three times as many as the next highest country, Japan. U.S. patents for new plant technologies and crop cultivars have also increased rapidly since utility patent protection was extended to biological innovations in the 1980s. The number of patents granted annually for plant modifications topped 1,500 in 2014, while the number of patents for crop cultivars exceeded 1,000 in the same year.

Both the public and private sector produce scientific publications and patents. However, as the private sector increases its own investments in agricultural R&D and moves into new areas previously under the purview of public research, there is a risk that public sector R&D may compete directly with private sector R&D for customers and scientific talent. Competition from the public sector, which does not have to recoup R&D costs, may discourage private R&D from these areas—an effect called “crowding out.” But if the public sector focuses on areas where the private sector continues to undersupply research (for example, because the social benefits exceed potential profits), crowding out may be minimal. Then, the new technological opportunities opened up by public research could stimulate more private R&D. In such cases, public sector R&D is “complementary” to private sector R&D.

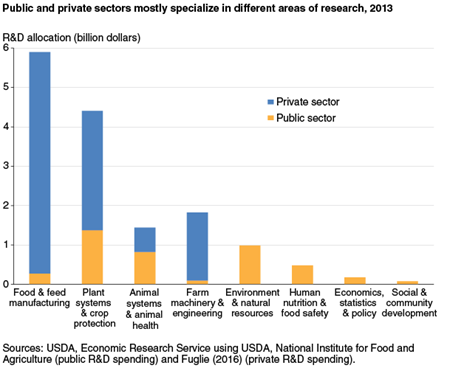

As it happens, public and private R&D expenditures do tend to fall in different research areas. The private sector performs almost all research in “food and feed manufacturing” and “farm machinery and engineering,” areas that may result in improved production processes or products that provide profits for investors. In contrast, the public sector performs nearly all R&D associated with “environment and natural resources,” “human nutrition and food safety,” “economics, statistics, and policy,” and “social and community development.” Successful research in these areas may generate widespread social benefits, even if private R&D investors are unable to capture enough of the benefits to justify their own expenditures.

The public and private sector each conduct significant research in “plant systems and crop protection” and “animal systems and animal health.” However, public and private research appear to focus on different areas within these sectors. Much of the private R&D on plant and animal systems aims at new commercial products like new GM crop traits, agricultural pesticides, and veterinary pharmaceuticals. In contrast, public R&D focuses on topics like improving field practices; studying pest populations, animal pathogens, and soil attributes; and developing improved diagnostic tools for use in public and private research.

A more formal way to check for crowding out or complementary R&D is to see what happens to private R&D spending when public R&D spending changes. If the public sector crowds out the private sector, each increase in public R&D spending ought to decrease private R&D spending, as the public sector siphons off customers and scientists in the affected research area. The opposite will be true if the sectors are complementary. Economic studies have generally found that public R&D stimulates private R&D: an additional dollar spent on agricultural research by the public sector appears to stimulate $0.70 in additional private R&D spending.

The Future of R&D

The decline in U.S. public spending on agricultural R&D may have negative implications for agricultural productivity. The recent emergence of new pests, diseases, and climate stresses on agriculture—such as citrus greening, California’s drought, and new strains of viruses affecting pigs and poultry—are imposing new demands on the Nation’s basic agricultural science capacities. Over the coming decades, rising world population and changing diets afforded by higher per capita incomes are projected to greatly increase the global demand for food. Significant improvements in agricultural productivity around the world will be necessary to meet this rising demand. Finally, in the longer run, climate change may have yet more serious effects on yields, pests, and disease, which may further reduce agricultural productivity.

In simple dollar terms, the decline in public sector funding has been more than offset by a rise in private research spending, and stronger intellectual property rights and access to new markets are likely to continue bolstering private sector R&D. Yet, public research and private research are not substitutes. Rather, they are complementary ingredients to the Nation’s agricultural innovation system. The effects of a decline in public agricultural R&D are likely to become more pronounced over time if the pace of fundamental advances in agricultural sciences slows. Meanwhile, studies continue to find high rates of return to public spending on agricultural research, which suggests that research is a good investment even in the absence of the new threats to agriculture.

Slippage of U.S. funding in agricultural R&D also carries implications for U.S. engagement with the global research community. Many of the scientific and technical constraints facing agriculture are shared among countries and regions, and the U.S. has long played an important role in pushing out the scientific frontier needed to address these global challenges. To benefit from the rising research capacity of the global community and the private sector, collaborative research arrangements with other countries and the private sector will become increasingly important. These arrangements may help adapt and transfer scientific advances from U.S. institutions into useable technologies for farmers around the world, as well as bring scientific advances from elsewhere to the United States.

Finally, in addition to promoting R&D collaboration between the public and private sectors, agriculture can benefit from collaborating with disciplines outside agricultural science. New scientific discoveries and technological advances from other disciplines—genomics and information sciences, in particular—may also be applicable to the challenges facing agriculture.

Innovation, Agricultural Productivity and Sustainability in the United States. TAD/CA/APM/WP(2016)15/REV1, Organisation for Economic Cooperation and Development (OECD), Paris, France, November 2016

“The Evolving Institutional Structure of Public and Private Agricultural Research.” Keith Fuglie and Andrew Toole, American Journal of Agricultural Economics 96(3): 862-883, October 2014

“The Growing Role of the Private Sector in Agricultural Research and Development World-wide.” Keith Fuglie, Global Food Security 10: 29-38, November 2016

“Long-Run and Global R&D Funding Trajectories: The U.S. Farm Bill in a Changing Context.” Phillip G. Pardey, Connie Chan-Kang, Jason M. Beddow, and Steven P. Dehmer., American Journal of Agricultural Economics 97(5): 1312-1323, October 2015