2014 Farm Act Shifts Crop Commodity Programs Away From Fixed Payments and Expands Program Choices

Highlights:

-

Title I of the new Farm Act repeals fixed annual Direct Payments and replaces them with new programs tied to current prices and/or revenues, increasing potential annual variability in farm program payments.

-

Insurance programs introduced in the Farm Act offer new options for covering small revenue or yield losses, both as stand-alone policies and in combination with traditional insurance.

-

Choices among new commodity and insurance programs involve complex trade-offs requiring producers to consider both the type and level of coverage that will best protect their operations.

Introduction

The 2014 Farm Act introduces a marked change in U.S. commodity policy, ending nearly 20 years of fixed annual payments to producers based on historical production. New programs offer a variety of payment structures, commodity coverage, and level of yield and/or revenue risk, but all are tied in some way to annual or multi-year fluctuations in prices, yields, or revenues. The new Farm Act continues a movement toward closer links between commodity programs and Federal crop insurance that began with the 2008 Farm Act, but producers also face increased choices that add complexity to the program enrollment decision.

Farmers have a variety of approaches to managing risk, including savings, off-farm employment, forward contracting, and portfolio diversification. While most producers use one or more of these private tools for risk management, many also combine these with participation in Government commodity and insurance programs. Producers of eligible commodities who choose to enroll in commodity programs or purchase new insurance products have a range of new options under the Agricultural Act of 2014.

Fixed Direct Payments Are Replaced With New Programs Tying Payments to Annual Prices and/or Yields

The repeal of the Direct Payments (DP) program ends nearly 20 years of fixed annual payments based on historical production that were paid to producers, regardless of whether farms faced losses. These fixed payments were introduced with the 1996 Federal Agriculture Improvement and Reform Act as Production Flexibility Contract (PFC) payments and were renamed Direct Payments beginning with the 2002 Farm Security and Rural Investment Act. Payments were calculated based on historical production (base) acres and yields.

Congress repealed two other programs linked to DPs in the 2014 Farm Act: Countercyclical Payments (CCP), which provided payments to producers on historical base acres and yields but were triggered by movements in current prices, and the Average Crop Revenue Election (ACRE) program, which provided payments to producers when their revenues fell below benchmark levels. The marketing assistance loan program, which offers short-term credit to producers based on legislated national average loan rates and provides benefits to producers if prices fall below loan rates, continues under the new Farm Act. Two new commodity programs were introduced by the 2014 Farm Act—Price Loss Coverage (PLC) and Agriculture Risk Coverage (ARC), which share some design elements with the repealed CCP and ACRE programs. Payments under these programs are also tied to historical base acres of covered commodities (wheat, feed grains, rice, oilseeds, peanuts, and pulses). Producers with historical base acres of upland cotton, no longer a covered commodity under these new programs, retain those base acres, termed “generic base acres,” but they are treated differently in the calculation of payments under the programs.

PLC provides payments to producers on a commodity-by-commodity basis when market prices fall below reference prices set in the 2014 Farm Act. Per-acre payments are calculated by multiplying the payment rate for the commodity (the difference between the national average market price—or the marketing assistance loan rate, if it is higher—and the reference price) by the producer’s payment yield for that commodity. PLC payments are made on 85 percent of the producer’s base acres of the commodity. ARC payments are based on the difference between moving average benchmark revenue and actual revenue under two different program designs—county-based coverage and individual producer-based coverage. The legislation defines “moving average benchmark revenue” as the product of the 5-year Olympic (dropping the high and low year) average county yield and the 5-year Olympic average national market price (substituting the reference price for the national market price in the calculation in any year that it is higher). County ARC offers producers commodity-by-commodity coverage based on the difference between a moving-average county revenue benchmark and actual county revenue.

Individual ARC offers producers the option of moving-average benchmark coverage based on individual farm revenue, rather than average county revenue. For individual ARC purposes, a “farm” is defined as the sum of a producer’s interest in all individual ARC-enrolled farms in a State. The program provides an individual farm guarantee of 86 percent of the farm’s benchmark revenue. Payments are issued when the actual individual crop revenues, summed across all covered commodities on the farm, weighted by plantings, are less than the individual farm guarantee.

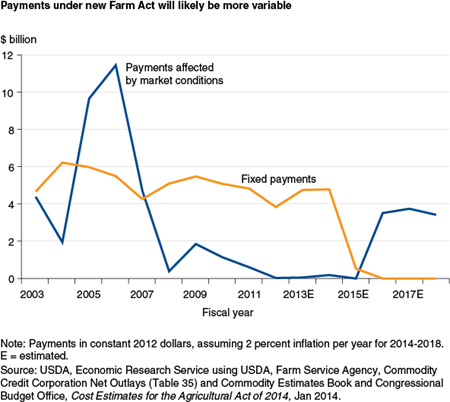

Total commodity program payments over the 5 crop years of the 2014 Farm Act will depend entirely on variable market and weather events, in contrast to the previous 5 years, during which fixed DPs made up the bulk of commodity program payments. Based on January 2014 projections by the Congressional Budget Office, annual payments under these programs may be just below $4 billion beginning in 2015. However, increasing the share of commodity payments linked to prices by eliminating fixed payments will likely increase the variability of payments.

New Crop Insurance Programs Offer Producers an Option for Covering Small Losses

Under the 2014 Farm Act, Congress established several new programs aimed at providing support for revenue or yield losses smaller than those covered by traditional crop insurance programs unless the highest coverage levels are selected. In addition to the ARC program, administered by USDA's Farm Service Agency (FSA) as a Title I commodity program, these programs include the Supplemental Coverage Option (SCO) and Stacked Income Protection Plan (STAX), administered by the USDA Risk Management Agency (RMA) as Title XI crop insurance programs. ARC and SCO are alternative options—producers who elect to enroll in ARC in a given crop/county cannot also purchase SCO in the same crop/county. STAX is available only to upland cotton producers who are not eligible for ARC. (Upland cotton growers may purchase SCO policies, but not for the same acres they have covered with STAX.)

SCO will be made available with the 2015 crop and will offer producers the opportunity to purchase area-based insurance coverage in combination with traditional crop insurance policies. The program will allow producers to cover up to 86 percent of their individual revenue or yield losses. While traditional insurance policies can cover up to 85 percent of farm level revenue or yield losses, producers typically insure for around 70 – 75 percent of losses. SCO policies provide an option for additional loss coverage at a fixed premium subsidy rate of 65 percent, a higher rate than many traditional insurance policies for the same coverage level. In addition, SCO, like traditional crop insurance, is not subject to payment limitations or adjusted gross income (AGI) eligibility limits, making it available to producers who might be ineligible for benefits under ARC or other commodity programs.

STAX will provide area-based revenue insurance policies to producers of upland cotton, also beginning with the 2015 crop. The STAX program was developed to address U.S. obligations under the World Trade Organization (WTO) ruling that U.S. upland cotton subsidies affected world prices and thus distorted trade. Similar to SCO, STAX policies will be area policies, basing the loss calculation on the difference between expected and actual county average revenues, rather than individual farm losses. The more closely an individual producer’s yields vary with the area average, the better the program will cover individual farm losses. Unlike SCO, which must be purchased in conjunction with a traditional crop insurance policy, cotton producers will be able to purchase STAX either in conjunction with their insurance policies or as stand-alone policies to cover up to 20 percent of revenue losses, in 5-percent increments. Federal subsidies will cover 80 percent of producers’ premiums. STAX, like SCO, is not subject to payment limitations or adjusted gross income (AGI) eligibility limits.

Participation in the STAX program is expected to be strong, given the 80-percent premium subsidy rate offered by the program and the ineligibility of upland cotton producers for most other programs. Despite these expectations, Government outlays for upland cotton support were estimated by the Congressional Budget Office in January 2014 to be lower than levels would have been had the Direct and Countercyclical Payments (DCP) programs been continued.

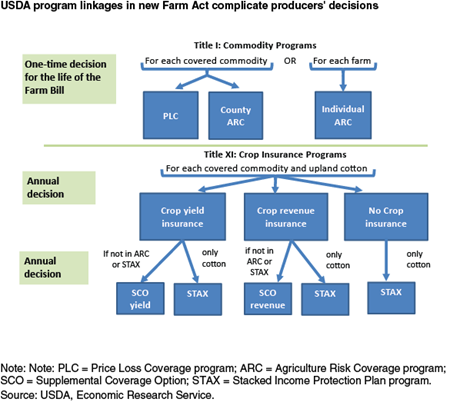

Producer Choices Among the New Commodity and Crop Insurance Programs Involve Complex Decisions

Producers are faced with a number of choices among commodity and crop insurance programs under the new Farm Act, many of which are interconnected, making decisions more complex. For farms holding base acres of covered commodities, the decision process may begin with the one-time enrollment choice between PLC and ARC.

Actively engaged producers (a category to be defined by the Secretary of Agriculture as part of the Farm Act’s implementation) with interests in a farm together may make a one-time choice between enrolling in PLC or county-based ARC for each of the covered commodities for which the farm holds base acres. Alternatively, these producers may choose to enroll the farm in individual ARC, which automatically applies to all covered commodities on the farm.

| Insurance program | Price/yield trigger | Payment basis | Range of loss coverage | Premium subsidy | Payment or eligibility limits | Links to other programs |

|---|---|---|---|---|---|---|

| PLC | Fixed reference prices for individual covered commodities | 85 percent of base acres for the covered commodity X program payment yield for that commodity X loss coverage | Difference between the reference price and the national price (higher of market year average price or loan rate) | No premium | Yes | Cannot be used with ARC-county for same commodity, cannot be used with ARC-individual, can be combined with SCO and crop insurance for same commodity |

| ARC-county | Moving 5-year county Olympic average of annual benchmark price X 5-year Olympic average county yield X 86 percent for individual covered commodities | 85 percent of a farm’s base acres for the covered commodity X loss coverage. Payments may not exceed 10 percent of each commodity’s benchmark revenue | 76-86 percent of the difference between the county guarantee and the county average revenue for the commodity in that year | No premium | Yes | Cannot be used with PLC for same commodity, cannot be used with ARC-individual, cannot be combined with SCO for same commodity, can be combined with crop insurance |

| ARC-individual | Moving 5-year Olympic average farm revenue benchmark X 86 percent for all covered commodities on the farm | 65 percent of the base acres for all covered commodities on the farm X loss coverage. Payments may not exceed 10 percent of the individual benchmark revenue | 76-86 percent of the difference between the individual guarantee revenue and the actual individual crop revenue across all covered commodities planted on the farm | No premium | Yes | Cannot be used with PLC or ARC-county, cannot be combined with SCO, can be combined with crop insurance |

| SCO | Futures prices (or equivalent) and/or area average yield | 100 percent of insured planted acres, except what is covered by STAX | 50-86 percent of yield or revenue | 65 percent | None | Cannot be combined with ARC-county or individual, must be combined with crop insurance |

| STAX | Futures prices and area average yield | 100 percent of insured planted acres, except what is covered by SCO | 5-20 percent of revenue | 80 percent | No payment or adjusted gross income eligibility limits, but only upland cotton producers eligible | Cannot be combined with SCO for same acres, can be combined with crop insurance but not required |

| Crop insurance | Futures prices (or equivalent) and/or farm average yield | 100 percent of insured planted acres | 50-85 percent of yield or revenue | 38-80 percent | None | Can be combined with PLC, ARC, SCO, and STAX |

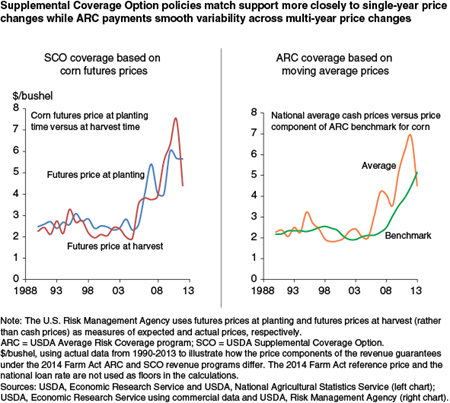

Enrollment choices made in 2014 will reflect producers’ risk preferences and their expectations of prices and yields for 2014 to 2018. Price expectations will be a key determinant in the choice of PLC versus ARC. If market prices are expected to fall and remain below reference prices fixed in the 2014 Farm Act, producers who enroll base acres in PLC could expect to receive regular annual payments. For base acres enrolled in ARC, however, payments are based on moving average revenues. If market prices are on a multi-year downward trend, then the expected prices used annually to calculate ARC benchmark revenue will fall as well. If the downward price trend for a commodity remains above the reference price, then ARC may provide payments while PLC will not.

For those producers choosing ARC, the choice between the county and individual options will involve considering several potential trade-offs. Individual ARC will offer more tailored benefits, since payments are based on the individual farm’s yields rather than county yields. For producers whose farm yields often differ from county average yields, payments more directly linked to the individual farm’s performance could be beneficial, although if individual yields generally out-perform county averages, payments under county ARC might be higher. However, ARC payments are made on 85 percent of base acres, while individual ARC payments are made on only 65 percent. For producers whose farm yields generally follow county average yields, the difference in payment rate may outweigh the value of individually tailored coverage. Individual ARC payments are also based on average revenues across all covered commodities on the broadly defined individual ARC farm. Higher revenue losses for one commodity may be offset by lower revenue losses or even revenue increases for others, resulting in lower payments than if losses were calculated separately for each commodity.

Producers will also face choices about coverage options under the Federal crop insurance program. Producers of upland cotton, no longer a covered commodity under Title I commodity programs, face the choice of whether or not to purchase policies under either the STAX program or SCO and whether or not to supplement that area-based revenue or yield coverage with individual yield or revenue coverage.

Producers of Title I-covered commodities who are interested in shallow loss coverage, however, must choose between enrolling in ARC or purchasing SCO, since producers are not eligible to purchase SCO policies for commodities/counties enrolled in county or individual ARC. Among key considerations in that choice will be the different methods used to calculate revenue and the revenue guarantee. Because the ARC revenue benchmark is a moving average of national average market prices, payments under ARC will be affected by multi-year price trends. On the other hand, SCO bases payments on the difference between futures prices at planting and harvest within the same year, not taking into account price trends across years. As a result, SCO coverage may be better tailored to single-year losses, but will not provide protection against multi-year price declines.

Producers will also likely consider the trade-offs between traditional crop insurance and SCO, since the costs and benefits of SCO coverage are linked to the level of coverage chosen under traditional crop insurance. While producers’ price expectations will be critical in the annual decisions they make regarding the purchase of crop insurance coverage, premium subsidy rates may also help guide producers’ choices.

The subsidy for SCO premiums is fixed at 65 percent. For traditional crop insurance policies, however, subsidy rates vary depending on the level and type of coverage purchased. Producers can choose coverage rates from 50 to 85 percent of expected yield or revenue. The subsidy on premiums decreases from 80 to 38 percent depending on the coverage level and type of insured unit (i.e. basic, optional, enterprise, or whole farm) chosen by the producer. The units chosen define the way coverage on the farm can be divided, allowing producers to customize insurance coverage for the various parts of their operation. The more aggregated the unit, the higher the subsidy rate—the goal is to encourage combined coverage across a more diverse operation, which can be expected to reduce insurance risks.

SCO covers the difference between the producer’s traditional insurance revenue or yield loss coverage and 86 percent of the producer’s expected revenue or yields. For producers who choose traditional crop insurance using basic and optional units, the SCO subsidy rate of 65 percent is higher than that for any traditional insurance coverage level above 50 percent. Based simply on this subsidy difference, these producers may choose to reduce their coverage level under traditional crop insurance and purchase an SCO policy to cover the remaining range of losses up to 86 percent.

A further consideration for producers, however, will be that SCO payments are based on county average yield or revenue, while most traditional crop insurance coverage is based on farm level yield or revenue. Shifting insurance coverage to SCO thus may come at the cost of less efficient risk protection if the farm’s yields differ markedly from county averages.

| Type of coverage | Coverage level: 50 | Coverage level: 55 | Coverage level: 60 | Coverage level: 65 | Coverage level: 70 | Coverage level: 75 | Coverage level: 80 | Coverage level: 85 |

|---|---|---|---|---|---|---|---|---|

| Traditional insurance (by type of unit insured) | ||||||||

| Basic or optional unit | 67 | 64 | 64 | 59 | 59 | 55 | 48 | 38 |

| Enterprise unit | 80 | 80 | 80 | 80 | 80 | 77 | 68 | 53 |

| Whole farm unit | 80 | 80 | 80 | 80 | 80 | 80 | 71 | 56 |

| Supplemental Coverage Option (SCO) | ||||||||

| All units | 65 | 65 | 65 | 65 | 65 | 65 | 65 | 65 |

| *Percentage of premium paid by Federal Government. Insured units are based on the location of the land, the crops grown, the production practices used, and the rental arrangements in place to help determine policy eligibility. A basic unit may include all land planted to a single crop within a county that (a) a producer owns and/or cash rents or (b) that is share-rented with a single landlord (share-rentals with separate landlords require separate basic units). Basic units can be divided into optional units based on location (if the basic unit covers more than one township) or production practices (if the basic unit incorporates, e.g., irrigated and non-irrigated land). Basic units can be combined into enterprise units which include all of an operator’s acres of a single crop within a county regardless of ownership, rental arrangement, or production practice. Whole farm units combine all of an operator’s eligible crops and farm units within a county regardless of ownership, rental arrangement, or production practice. Whole farm insurable units are generally only available for crops insured under revenue protection plans. Source: USDA, Risk Management Agency. |

||||||||

The 2014 Farm Act ends fixed annual payments and offers producers new options for incorporating Government commodity and insurance programs into their risk management strategies. Two new commodity programs, PLC and county ARC, are tied to historical base acres rather than planted acres. Similar to the repealed DP and CCP programs, they may reduce farm risk by increasing savings to help buffer periods of low farm income. The choices between fixed reference prices and moving-average revenue benchmark guarantees at county or individual whole-farm levels, as well as new insurance options, offer producers real alternatives for balancing costs and benefits of addressing price and yield risk on their operations. How much the new commodity programs and insurance options will help to reduce income variability for eligible producers remains to be seen. However, unless prices and yields remain fairly steady over the life of the 2014 Farm Act, the new suite of programs seems likely to increase the year-to-year volatility of budgetary outlays compared to the period covered by the 2008 Farm Act.

Identifying Overlap in the Farm Safety Net, by Erik O'Donoghue, Anne Effland, Joseph Cooper, and Chengxia You, USDA, Economic Research Service, November 2011

Potential Farm-Level Effects of Eliminating Direct Payments, by Jennifer Ifft, Cynthia Nickerson, and Chengxia You, USDA, Economic Research Service, November 2012

Alternatives to a State-Based ACRE Program: Expected Payments Under a National, Crop District, or County Base, by Christine Arriola, Keith H. Coble, David Ubilava, and Joseph Cooper, USDA, Economic Research Service, September 2011

Economic Aspects of Revenue-Based Commodity Support, by Joseph Cooper, USDA, Economic Research Service, April 2009

Farm Practices & Management, USDA, Economic Research Service, October 2023

“Deductibles versus Coinsurance in Shallow-Loss Crop Insurance”, Choices, 3rd Quarter, June 2013

“Distributional and Risk Reduction Effects of Commodity Revenue Program Design”, Applied Economic Perspectives and Policy, Vol. 30, Issue 3, pp. 543-553, June 2008