Conservation Programs

USDA's conservation programs help agricultural producers improve their environmental performance with respect to soil health, water quality, air quality, wildlife habitat, and greenhouse gas emissions. These programs include "working land programs" that provide financial and/or technical assistance to farmers who adopt, install, or maintain conservation practices on land in production, as well as programs that provide easements or contracts to remove land from agricultural production.

A Portfolio of Incentive Programs

- The Conservation Reserve Program (CRP) generally provides 10-15 year contracts to remove land from agricultural production. Most of the land enrolled in the CRP was in crop production prior to CRP enrollment and is now planted to an approve conservation cover such a mixture of grasses or trees. Many regionally-targeted initiatives within CRP fund high-priority, partial-field practices such as filter strips and grass waterways. At least 2 million total acres of grassland must be enrolled in CRP by 2023 in contracts under which landowners agree to keep the land in grazing use rather than tilling it for crop production or converting it to any other use. The Clean Lakes Estuaries and Rivers 30-year program (CLEAR-30) offers 30-year contracts for reenrollment in specific practices targeting erosion, water quality, and wildlife habitat.

- The Agricultural Conservation Easement Program (ACEP) provides long term or permanent easements for preservation of wetlands and the protection of agricultural land (cropland, grazing land, etc.) from commercial or residential development. ACEP works through partnerships with American Indian tribes, state and local governments, and non-governmental organizations.

- The Environmental Quality Incentives Program (EQIP) provides financial assistance to farmers who adopt or install conservation practices on land in agricultural production. Common practices include nutrient management, conservation tillage, cover crops, field-edge filter strips, irrigation water management, livestock watering facilities, and fences to exclude livestock from streams.

- The Conservation Stewardship Program (CSP) supports ongoing and new conservation efforts for producers addressing natural resource concerns on working agricultural and forest lands. CSP contracts are for five years, and payments go toward maintaining the existing level of conservation and toward implementing additional conservation activities. The 2018 Farm Act also established the CSP Grassland Conservation Initiative, a program that allows eligible producers to receive $18/acre/year over a five-year contract for base acres that have been in grass or grasslands over the previous nine-year period, rather than planted with commodity crops.

- The Regional Conservation Partnership Program (RCPP) provides assistance to partners to solve problems on a regional or watershed scale. RCPP can fund a wide range of activities (similar to those funded by other USDA programs) including land retirement, easements, partial-field practices (e.g., filter strips and grass waterways), and conservation practices on working land (e.g., cover crops and nutrient management).

- Through Conservation Technical Assistance (CTA), USDA provides ongoing technical assistance to agricultural producers who seek to improve the environmental performance of their farms.

For more information about how USDA conservation programs can support adoption of conservation practices, see

- Cover Crop Trends, Programs, and Practices in the United States (EIB-222, February 2021), and

- Cover Practice Definitions and Incentives in the Conservation Reserve Program (EIB-233, February 2022).

For more information about what happens to land in the Conservation Reserve Program when CRP contracts expire, consider

- The Fate of Land in Expiring Conservation Reserve Program Contracts, 2013-16 (EIB- 215, January 2020).

For more information about how farmers use technical assistance to address resource concerns, see

- USDA Conservation Technical Assistance and Within-Field Resource Concerns (EIB-234, May 2022).

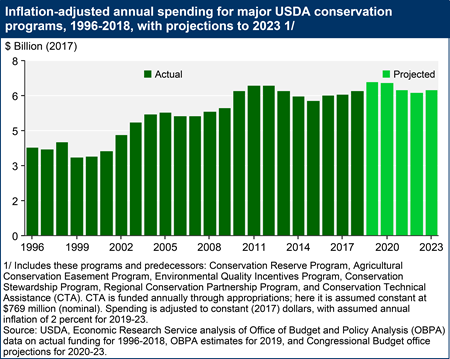

Conservation Spending is Level in the 2018 Farm Act

ERS studies conservation program spending levels and analyzes trends in support for the different types of conservation assistance programs. The 2002 Farm Act and 2008 Farm Act each increase conservation program spending. By 2011, real (inflation-adjusted) conservation spending increased by more than 70 percent over 1996 levels. The 2012 Farm Act and 2018 Farm Act held total spending largely level at between $6.0 and $6.5 billion per year (except in 2014 and 2015) while also changing several aspects of program rules. Conservation spending is projected to continue within that range through 2023. Under the Agriculture Improvement Act of 2018 (2018 Farm Act), the Congressional Budget office (CBO) estimates mandatory conservation spending of $29.5 billion over 5 years, about $560 million more than CBO’s projection of 2019-23 spending if the programs and provisions of the 2014 Farm Act had been extended. Although most conservation programs receive "mandatory" funding, the funding levels are not guaranteed and could be revised in future years.

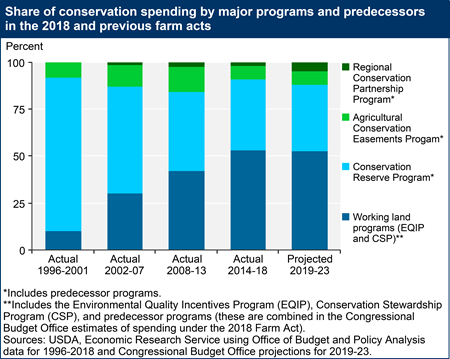

Beginning with the 2002 Farm Act, the share of conservation program funding devoted to working land programs (EQIP and CSP) increased to 53 percent of the total funding for the five largest conservation programs under the 2014 Farm Act. Funding for working lands programs remained relatively stable as a share of total conservation spending under the 2018 Farm Act, but the allocation of funding between programs shifted.

While overall conservation funding is roughly equal to baseline levels for fiscal 2019 through fiscal 2023, the 2018 Act shifted funding among programs:

- Conservation Stewardship Program: The CSP acreage enrollment cap was replaced with a funding cap that sets spending limits of $700 million for fiscal 2019, increasing to $1 billion by fiscal 2023.

- Environmental Quality Incentives Program: EQIP funding was increased from $1.75 billion in fiscal 2019 to $2.025 billion in FY2023.

- Conservation Reserve Program: CRP funding was projected to decline slightly (a total of -$189 million) over fiscal 2019 through fiscal 2023.

- Agricultural Conservation Easements Program: Funding was increased from $250 million to $450 million annually.

- Regional Conservation Partnership Program: The 2018 Farm Act made the RCPP a standalone program, and increased funding from $100 million to $300 million annually.

For more information about how the 2018 Farm Act impacts allocations between different conservation programs: 2018 Farm Act Retains Conservation Programs But Could Reduce Payments for Land Retirement (Amber Waves, December 2019).

Compliance Links Conservation to Eligibility for Farm Support

Conservation Compliance makes soil and wetland conservation conditions of eligibility for most USDA farm program benefits. Compliance, which explicitly links environmental and farm income objectives, can leverage farm program payments for environmental gain, but may not reach every producer (not all farmers receive income support or other payments).

Under highly erodible land conservation provisions (often referred to as "sodbuster"), farmers who crop highly erodible land must apply an approved soil conservation system or risk becoming ineligible for nearly all agriculture-related farm program benefits, including farm commodity programs, crop insurance premium subsidies, conservation programs, disaster assistance, farm loan programs, and other benefits. Under wetland conservation provisions (often referred to as "Swampbuster"), producers must refrain from draining wetlands or face the loss of farm program benefits.

For producers who choose to till native sod that has not been previously tilled (whether or not it is highly erodible land), the "sodsaver" provision reduces crop insurance premium subsidies and limits the yield or revenue guarantee available during the first 4 years of crop production. These sodsaver provision apply only to native sod in Minnesota, Iowa, North Dakota, South Dakota, Montana, and Nebraska. There are also imitations that apply to noninsured crop disaster assistance. Unlike sodbuster or sodsaver, these limitations apply only on the land that has been converted from native sod to crop production

As farm programs evolve over time, the nature and size of the compliance incentive may also change, possibly affecting compliance incentives. See, for example, Conservation Compliance: How Farmer Incentives Are Changing in the Crop Insurance Era (ERR-234, July 2017).

Conservation Policy and Program Design

ERS research examines the cost-effectiveness of conservation policies and programs, with an emphasis on identifying conservation program design features that increase environmental gain per program dollar. ERS also investigates the environmental impact of broader agricultural policies and programs on land use, input use, and conservation practice adoption. Research findings address many issues in program design:

- Incentives: Paying farmers to adopt specific conservation practices and paying for the level of environmental performance are two different approaches with distinct benefits. Paying for performance is more cost effective than paying for practices because program incentives are directly linked to environmental outcomes. See, for example, Rewarding Farm Practices versus Environmental Performance (EB-5, March 2006). These outcomes, however, are not easy to observe, making performance-based payments difficult and costly to implement. Benefit-cost targeting, where cost-based payments are directed to farms, fields, and practices with high expected benefits may be a practical compromise.

- Targeting: In voluntary conservation programs, eligibility requirements, participation incentives, and ranking of program applications can be used to direct payments to fields, practices, or specific resource concerns that are likely to generate large environmental gains relative to cost (see Better Targeting, Better Outcomes (EB-3, March 2006)). ERS research has explored the design of ranking mechanisms for multiple objectives (e.g., Balancing the Multiple Objectives of Conservation Programs (ERR-19, May 2006)), targeting wetland restoration efforts ( Targeting Investments To Cost Effectively Restore and Protect Wetland Ecosystems: Some Economic Insights (ERR-183, February 2015)), and cost reductions that could be achieved through spatial targeting in addressing specific environmental problems like water quality in the Chesapeake Bay ( An Economic Assessment of Policy Options To Reduce Agricultural Pollutants in the Chesapeake Bay ERR-166, June 2014)) and the Gulf of Mexico ( Reducing Nutrient Losses From Cropland in the Mississippi/Atchafalaya River Basin: Cost Efficiency and Regional Distribution (ERR-258, September 2018)). Also see Economic Experiments for Policy Analysis and Program Design: A Guide for Agricultural Decisionmakers (ERR-236, August 2017).

- Auctions: Bidding—a process in which farmers compete in an auction for conservation payment contracts—integrates market-like features into conservation programs. Under some conditions bidding can encourage farmers to accept lower payments or install practices that have greater environmental benefits but are also more expensive or more difficult to use. For more detail on auction design and the conditions that make auctions an effective approach to implementing conservation programs, see Options for Improving Conservation Programs: Insights from Auction Theory and Economic Experiments (ERR-181, January 2015). Also see Economic Experiments for Policy Analysis and Program Design: A Guide for Agricultural Decisionmakers (ERR-236, August 2017).

- Additionality: A conservation practice that is adopted by a farmer who receives financial assistance is "additional" only if the practice would not have been adopted without the payment. That is, to satisfy the requirements of "additionality," the payment must be critical to securing adoption—and any associated environmental gain. Payments for practices that would have been adopted even without financial assistance are not additional. While these payments help defray farmer adoption costs, they do not yield any additional environmental gain. ERS research shows that USDA conservation programs are effective in encouraging conservation practice adoption, although additionality varies across conservation practices, see Additionality in U.S. Agricultural Conservation and Regulatory Offset Programs (ERR-170, July 2014).

- Contract design: All USDA conservation programs contract with farmers to specify the application of conservation practices and related payments. Most contracted practices are completed as scheduled. Sometimes, though, contracts are modified or entirely terminated, and agreed-on practices are either replaced with other practices or dropped entirely. For more information on what practices are most often dropped and some possible reasons for dropped practices, see Working Lands Conservation Contract Modifications: Patterns in Dropped Practices (ERR-262, March 2019). Also see Economic Experiments for Policy Analysis and Program Design: A Guide for Agricultural Decisionmakers (ERR-236, August 2017).