Mexico: Trade & FDI

Mexico: Trade

Mexico is a major participant in international agricultural trade. In 2022, Mexico’s agricultural exports (to all countries) totaled about $46.6 billion (applying the World Trade Organization’s definition of agricultural trade to the Mexican Government’s trade statistics). Mexico’s agricultural imports (from all countries) in 2022 totaled about $41.4 billion. The United States is Mexico’s largest agricultural trading partner, buying approximately 80 percent of Mexican exports and supplying roughly 70 percent of the country’s imports in this category.

A turning point in U.S.-Mexico agricultural trade came in the late 1980s, when Mexico emerged from a period of economic difficulties and adopted a series of trade reforms. In 1986, Mexico signed the General Agreement on Tariffs and Trade (GATT), the predecessor to the World Trade Organization (WTO). In the early 1990s, Mexico lowered a number of agricultural trade barriers, and in 1994, it joined Canada and the United States in implementing the North American Free Trade Agreement (NAFTA). Mexico also has free-trade agreements with about 40 other countries. In November 2018, Canada, Mexico, and the United States signed the United States-Mexico-Canada Agreement (USMCA)—a newer trade accord that replaced NAFTA. The entry-into-force date for USMCA was July 1, 2020.

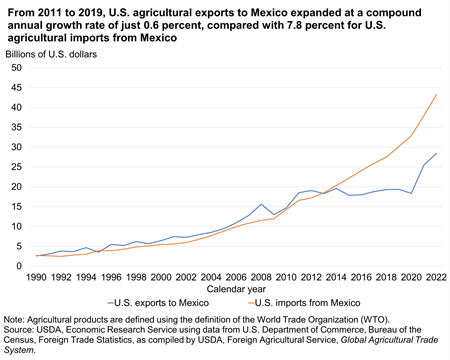

With a growing population and a market-oriented agricultural and food sector that is open to international trade, Mexico is the United States’ largest agricultural trading partner in terms of combined exports and imports, with Canada being a close second. In 2022, Mexico accounted for 14.5 percent of U.S. agricultural exports and 22.8 percent of U.S. agricultural imports (as defined and categorized by the World Trade Organization (WTO)). Between 1993 (the year before NAFTA’s implementation) and 2022, U.S. agricultural exports to Mexico expanded at a compound annual growth rate (CAGR) of 7.3 percent, while agricultural imports from Mexico grew at a rate of 9.9 percent. Lower prices for many bulk agricultural commodities, slow economic growth in Mexico (compounded by the global recession caused by the COVID-19 pandemic), and depreciation of the Mexican peso caused the total value of U.S. agricultural exports to Mexico to experience little to no growth during the period 2012-20. From 2011 to 2019 (the last year before the pandemic’s onset in the United States and Mexico), U.S. agricultural exports to Mexico grew at a CAGR of 0.6 percent, compared with 7.8 percent for corresponding imports from Mexico, In 2021, U.S. agricultural exports to Mexico saw a year-to-year rebound of 38.7 percent, due to the recovery of Mexican consumer demand and higher prices for many agricultural products following the first year of the pandemic. In 2022, these exports saw a year-to-year increase of 11.8 percent.

Download chart data in Excel format

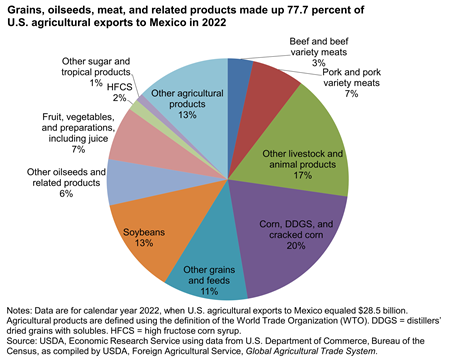

U.S.-Mexico agricultural trade is largely complementary, meaning that the United States tends to export different commodities to Mexico than Mexico exports to the United States. More than three-fourths (77.7 percent) of U.S. agricultural exports to Mexico are grains, oilseeds, meat, or related products. Mexico does not produce enough grains and oilseeds to meet internal demand, so the country’s food and livestock producers import sizable volumes of these commodities to make value-added products such as meat, vegetable oil, and wheat products (primarily for the domestic market).

Download chart data in Excel format

Detailed table on selected U.S. agricultural exports to Mexico

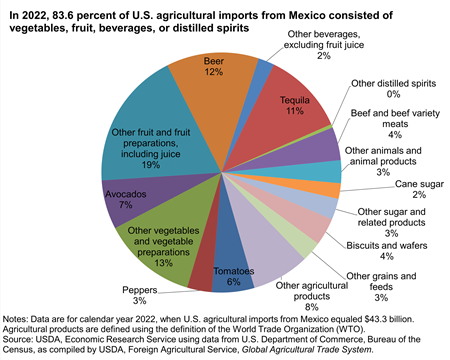

More than four-fifths (83.6 percent) of U.S. agricultural imports from Mexico consist of vegetables, fruit, beverages, and distilled spirits. These imports are closely tied to Mexico’s historical expertise in producing alcoholic beverages (such as beer, tequila, and mezcal) and a wide range of fruit and vegetables—and to Mexico’s growing seasons, which largely complement those of the United States. For example, many types of produce that the United States does not grow in winter are grown during that time in Mexico.

Download chart data in Excel format

Detailed table on selected U.S. agricultural imports from Mexico

To view more U.S.-Mexico agricultural trade statistics, go to USDA Foreign Agricultural Service's Global Agricultural Trade System.

Mexico: Foreign Direct Investment

Mexico is the fifth-largest destination for U.S. direct investment in the food industry (after the United Kingdom, European Union, Australia, and Canada) and has also attracted U.S. direct investment in its beverage industry. Many of these investments were initiated following implementation of the North American Free Trade Agreement (NAFTA) in 1994. That agreement contained provisions designed to facilitate foreign direct investment (FDI). These provisions include equal treatment of both foreign and domestic investors, and the prohibition of certain performance standards (such as a minimum amount of domestic content in production) for foreign investments. The United States-Mexico-Canada Agreement (USMCA), the trade accord that replaced NAFTA in July 2020, contains similar investment provisions. However, Mexico really began to open up to foreign investment in the 1980s, when the country first relaxed (and then eliminated) rules for most sectors of its economy that limited foreign ownership of Mexican businesses.

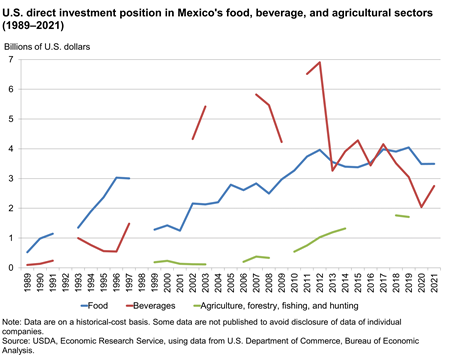

In 2021, U.S. direct investment in Mexico—on a historical-cost basis—was about $3.5 billion in the food industry and $2.7 billion in the beverage industry (nominal figures—not adjusted for inflation—information from the U.S. Department of Commerce, Bureau of Economic Analysis [BEA]). The 2021 data for agriculture, fishing, forestry, and hunting are not published in order to avoid disclosing data for individual companies. However, according to the most recently published data for those sectors, U.S. direct investment equaled about $1.7 billion in Mexican agriculture, fishing, forestry, and hunting combined in 2019.

Mexico also has substantial direct investment in the U.S. food industry—about $5.0 billion in 2021. According to BEA, “direct investment position at historical cost” is defined as a “measure of the value of direct investors’ equity in, and net outstanding loans to, their affiliates in which the direct investors’ investment is valued at book value. It largely reflects prices at the time of the investment rather than prices of the current period and is not ordinarily adjusted to reflect the changes in the current costs or the replacement costs of tangible assets or in stock market valuations of firms.”

U.S. direct investment in Mexico’s food and beverage industries expanded greatly during the first decade of NAFTA, growing from a total of about $2.3 billion in 1993 to about $10.9 billion in 2012. The total declined to about $6.8 billion in 2013. Since then, the total has been in the neighborhood of $7-8 billion (see line graph below). Mergers and acquisitions in the beverage industry largely explain the decline that occurred in 2013. Between 2012 and 2013, U.S. direct investment in Mexico’s beverage industry dropped from about $6.9 billion to $3.3 billion. Since then, it has fluctuated, equaling $2.0 billion in 2020.

Download chart data in Excel format

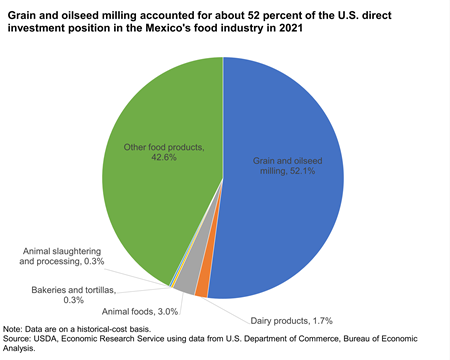

The composition of U.S. direct investment in the Mexican food industry parallels the composition of U.S. agricultural exports to Mexico, in which grains and oilseeds are among the most prominent commodities. Grain and oilseed milling accounted for about 52 percent of U.S. direct investment in Mexico’s food industry in 2021. Much of the growth in U.S. FDI in the Mexican food industry took place in grain and oilseed milling, where U.S. direct investment expanded from $378 million in 1999 to about $2.5 billion in 2019—an increase of 551 percent—before declining to $1.8 billion by 2021.

Download chart data in Excel format

Detailed table on U.S. direct investment position in Mexico