Mexico: Policy

SADER and the Special Concurrent Program for Sustainable Rural Development

Agricultural Finance

OECD Support Estimates

Mexico’s agricultural programs reflect the heterogeneity of the country’s agricultural sector. Producers range from large commercial operations to small, subsistence-oriented farms. Accordingly, some Mexican farm programs are designed for advanced commercial operations, others for less developed operations, and still others for virtually all producers. Mexico’s current presidential administration (2018–24) has emphasized policy initiatives focused on small- and medium-scale farmers. This reorientation of the Mexican Government’s activities concerning agriculture is accompanied by a reallocation of resources toward activities dedicated to small- and medium-scale producers.

SADER and the Special Concurrent Program

The Special Concurrent Program for Sustainable Rural Development (PEC—Programa Especial Concurrente para el Desarrollo Rural Sustentable) is a budgetary instrument the Mexican Government uses to plan and implement its activities in the areas of agriculture and rural development. PEC covers activities implemented by several cabinet ministries, including the Secretariat of Agriculture and Rural Development (SADER—Secretaría de Agricultura y Desarrollo Rural), Mexico’s counterpart to USDA.

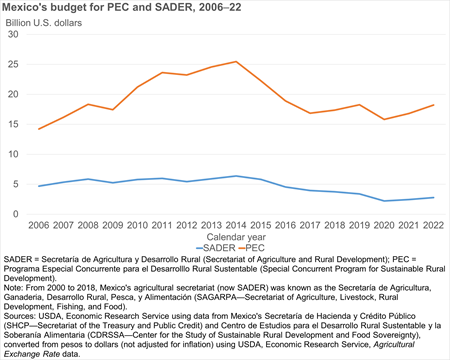

When measured in nominal U.S. dollars—i.e., not adjusted for inflation—PEC’s overall budget since 2017 has held fairly steady, roughly totaling 17 billion to 18 billion U.S. dollars. The one exception to this pattern was in 2020, when the budget dropped to 15.8 billion U.S. dollars. In contrast, SADER’s budget was reduced from 3.9 billion U.S. dollars in 2017 to 2.2 billion U.S. dollars in 2020. SADER’s budget then rebounded in 2021 and 2022. For 2022, a budget of 18.2 billion U.S. dollars for PEC and 2.8 billion U.S. dollars for SADER has been approved.

Download chart data in Excel format

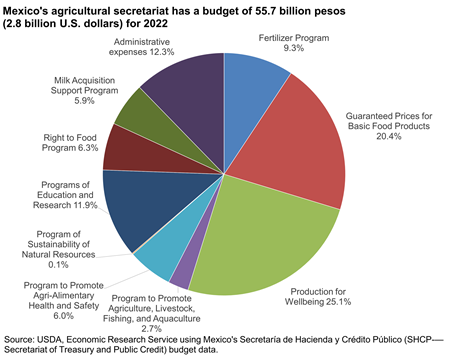

For 2022, SADER was allocated a budget of about 55.8 billion pesos (2.8 billion U.S. dollars). A little more than half (54.8 percent) of this budget was dedicated to three programs:

- The Production for Wellbeing Program (Producción para el Bienestar) accounted for 25.1 percent of the budget. This program channels direct payments to producers of corn, dry beans, wheat for bread, rice, and other grains. For 2021, the payment rates were either 1,200 or 2,000 pesos per hectare (about 59 or 99 U.S. dollars per hectare, using the nominal exchange rate for that year) depending on farm size and access to irrigation. Payments are generally limited to 20 hectares. The program also provided direct payments in 2021 to producers of chia, amaranth, coffee, cocoa, honey, and sugarcane.

- Guaranteed Prices for Basic Food Products accounted for 20.4 percent of the budget. Under this program, the Mexican Government reestablished guaranteed prices for white corn, dry beans, rice, wheat for bread, and milk but limited their availability to small- and medium-scale producers or—in the case of rice and wheat—to specified quantities of production.

- The Fertilizer Program accounted for 9.3 percent of the budget. This program seeks to promote national food security by providing up to 600 kilograms of fertilizer per producer to qualifying small-scale growers (up to 5 hectares) of corn, dry beans, rice, and other crops of high economic or social impact in the States of Chiapas, Guerrero, Morelos, Puebla, and Tlaxcala.

Download chart data in Excel format

Agricultural Finance

In agricultural finance, Mexico has traditionally relied on several Government financial institutions to augment the activities of the commercial banking sector:

- Funds Instituted in Relation with Agriculture (FIRA—Fideicomisos Instituidos en Relación con la Agricultura);

- National Financier of Agricultural, Rural, Forestry, and Fishing Development (FND—Financiera Nacional de Desarrollo Agropecuario, Rural, Forestal, y Pesquero); and

- Capitalization and Investment Fund of the Rural Sector (FOCIR—Fondo de Capitalización e Inversión del Sector Rural).

FIRA was created in 1954 by the Mexican Government to offer credits, guarantees, training, technical assistance, and support of technology transfer to Mexico’s agricultural, forestry, fishery, and rural sectors. This second-tier, Government-owned fund is managed by Banco de México, Mexico’s central bank.

Since 1999, FIRA has pursued a new business model considering the financial needs of the entire food system, including some non-agricultural activities in rural areas. To accomplish this task, FIRA has developed new products, such as structured financial instruments and inventory financing. It has also fostered a wider distribution network for its funds including various non-bank lending institutions, including Limited-Purpose Financial Societies (SOFOLES—Sociedades Financieras de Objeto Limitado), Multi-Purpose Financial Societies (SOFOMES—Sociedades Financieras de Objeto Múltiple), financial leasing companies, warehouse companies, and credit unions. Additionally, FIRA offers agribusiness consulting and sector-specialized information and analysis to its clients.

According to FIRA’s 2020 annual report, FIRA’s Institutional Plan for 2020–24 outlines three priority objectives: (1) financial inclusion; (2) productivity and efficiency; and (3) sustainability. Within the financial inclusion objective in 2020, about 2.2 million of FIRA’s 2.4 million borrowers were “microempresas”—small-scale firms with less than 10 employees and income not more than 4 million pesos—about 186,000 U.S. dollars, using the nominal exchange rate for 2020. To foster productivity and efficiency within Mexico’s agricultural, forestry, fishing, and rural sectors, FIRA lent a total of 416.3 billion pesos (19.4 billion U.S. dollars) for agricultural and rural financing, a real increase of 26.8 percent from 2019. FIRA designated 9.4 billion pesos to projects for managing environmental risks, promoting sustainable investments, efficiently using natural resources, and circulating best practices, and to other activities related to environmental sustainability. In response to the Coronavirus (COVID-19) pandemic, FIRA also pursued a fourth priority objective: maintaining financial sustainability and institutional capacity. In pursuit of this objective, FIRA discounted some of its new loans and restructured some of its existing loans.

FND (formerly named Financiera Rural) was created as a replacement for Banco Nacional de Crédito Rural (BANRURAL), which had been dissolved in 2003. FND’s mission is “to promote rural development and the activities of the primary sector through credit and financial services accessible to producers, rural financial intermediaries, and other economic agents, in order to raise productivity and contribute to improving the population’s standard of living.”

FOCIR’s mission is “to support and complement the economic capacity of rural producers and their economic organizations, to promote the development and consolidation of rural and agro-industrial companies, through investments, long-term investment, in a temporary and minority form, that trigger projects of high potential and social benefit.” FOCIR’s 2020 annual report indicated FOCIR contributes to a set of six agribusiness investment funds, used “to trigger sustainable productive projects, the development of technical, productive, and commercial capacity, and the integration of local circuits of production, marketing, investment, and financing.” The total amount of investment planned is about 2.9 billion pesos (135 million U.S. dollars), where about one-third comes from FOCIR. FOCIR is part of Mexico’s Secretariat of Treasury and Public Credit (Secretaría de Hacienda y Crédito Público).

OECD Support Estimates

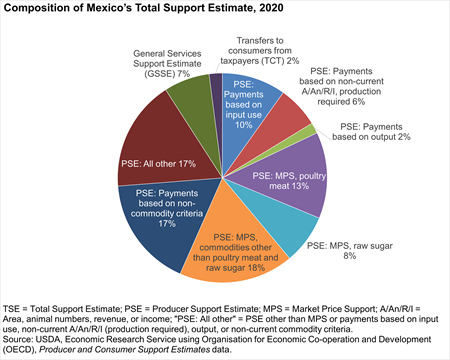

Agricultural support estimates calculated by the Organization of Economic Cooperation and Development (OECD) provide a common framework for evaluating the size of government support to agriculture. The Total Support Estimate (TSE) measures “the annual monetary value of all gross transfers from taxpayers and consumers arising from policy measures that support agriculture, net of the associated budgetary receipts, regardless of their objectives and impacts on farm production and income, or consumption of farm products.” In 2020, Mexico’s TSE totaled about 137.8 billion pesos (6.4 billion U.S. dollars). This estimate includes some agriculture-related activities that took place outside of SADER, and the estimate does not cover some activities of SADER that OECD does not count as government support to agriculture.

The TSE has three components:

- The Producer Support Estimate (PSE), “the annual monetary value of gross transfers from consumers and taxpayers to support agricultural producers, measured at farm gate level”;

- The General Services Support Estimate (GSSE), “the annual monetary value of gross transfers to general services provided to agricultural producers collectively (such as research, development, training, inspection, marketing, and promotion)”; and

- Transfers to Consumers from Taxpayers (TCT), the “annual monetary value of gross transfers to consumers of agricultural commodities, measured at the farm gate level, arising from policy measures that support agriculture, regardless of their nature, objectives, or impacts on consumption of farm products.”

Of Mexico’s 2020 Total Support Estimate, PSE accounted for 89.0 percent, GSSE accounted for 8.5 percent, and TCT accounted for 2.5 percent.

Download chart data in Excel format

The leading forms of agricultural support in Mexico are: (1) support based on commodity outputs (48.7 percent of 2020 TSE); and (2) payments based on non-commodity criteria (20.7 percent of 2020 TSE). Market Price Support (MPS) accounted for about 46.7 percent of TSE and 95.9 percent of support based on commodity outputs in 2020. MPS is calculated “by adding together the price transfers to producers from consumers and taxpayers, minus the contribution that producers make to these transfers.” For an individual commodity, these price transfers are estimated by multiplying the Market Price Differential (MPD) by the quantity of domestic supply, where the MPD is the difference between the domestic market price and the border price of the commodity, measured at the farm gate level. In 2020, poultry meat accounted for 33.0 percent of Mexico’s MPS, and raw sugar accounted for 19.0 percent. Tariffs on agricultural imports from non-USMCA countries are the main policy corresponding to Mexico’s MPS.

Another way to consider the level of Mexico’s agricultural support is to compare Mexico’s support with the value of the country’s agricultural production using a measure called the Percentage Producer Support Estimate (PSE), which equals the amount of producer support divided by the sum of transfers from taxpayers to producers plus the value of agricultural production. During calendar years 2018–20, Mexico’s PSE ranged from 9 to 11 percent—roughly the same level as the United States’ PSE and about 10 percentage points less than the OECD country average.

Click here for data on Mexico's Total Agricultural Support Estimate, 2014-2020