Federal Estate Taxes

The Federal estate tax has applied to the transfer of property at death since 1916, as part of a unified system of transfer taxes. Although amended many times, the estate tax, the gift tax (imposed upon transfers before a person's death), and generation-skipping transfer tax have never directly affected a large percentage of taxpayers, as many fall below the exemption amount. Under the current Federal estate tax system, individuals can transfer up to a specified amount in money and other property without incurring Federal estate tax liability. When property is transferred at death, it is generally the responsibility of the estate to pay any taxes due as a result of the transfer unless other arrangements for payment are made. Under present law, the estate of a decedent who, at death, owns assets in excess of the estate tax exemption amount—or $12.92 million in 2023—must file a Federal estate tax return. However, only those returns that have a taxable estate above the exempt amount after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at the highest maximum tax rate of 40 percent (see the table below on exemption amounts and tax rates).

Over the years, some targeted provisions have been enacted to reduce the estate tax owed by farms and small business owners. These include a special provision allowing farm real estate to be valued at farm-use value rather than at fair-market value and an installment payment provision. A provision aimed at encouraging farmers and other landowners to donate an easement or other restriction on development has also provided additional estate tax savings. Together, these provisions have reduced the potential impact of estate taxes on the transfer of a farm or other small business to the next generation.

Legislative History Since 2001

Economic Growth and Taxpayer Relief Reconciliation Act of 2001

The Economic Growth and Taxpayer Relief Reconciliation Act of 2001 ("the 2001 Act") provided estate tax relief to farmers and other small business owners. The 2001 Act reduced Federal estate and gift tax rates and substantially increased the amount of property that can be transferred to the next generation without incurring Federal estate tax, culminating in the tax's complete repeal in 2010—so persons dying in 2010 owed no estate tax under the 2001 Act.

In addition to repealing the estate tax, the 2001 Act changed the treatment of unrealized gains at death, effective with estate tax repeal in 2010. Prior to 2010, the basis—which is the value used to determine gain/loss of assets acquired from a decedent—was stepped up to the estate's fair market value at the date of death. This "step-up in basis" rule essentially eliminated the recognition of income on the appreciation of the property that occurred before the property owner's death. Upon repeal of the estate tax in 2010, however, the step-up in basis rule was replaced with a modified carryover of the decedent's basis, with an adjustment amount of up to $1.3 million—plus an additional $3 million for transfers to a surviving spouse. This change added to the compliance burden since it was necessary to determine the basis of inherited assets. In farming, these assets may have been held for several decades with limited documentation on their original cost or the method in which they were acquired.

Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010

The Tax Relief, Unemployment Insurance Reauthorization, and Job Creation Act of 2010 ("the 2010 Act"), extended and augmented the expiring provisions of the 2001 Act. Instead of allowing for the full repeal as planned in 2010, the law retroactively set a new tax exemption amount at $5 million for an individual, and a maximum estate and gift tax rate of 35 percent, effective for 2010. The 2010 Act also reinstated the step-up in basis rule. Although most estates will owe fewer taxes under the $5 million and stepped-up basis provisions, some very large estates would owe less tax under the repeal and carryover basis provisions that applied under the original 2001 legislation. For deaths occurring in 2010, the law provided an election allowing the estate to be treated under the 2001 law in which the estate tax was eliminated and the modified carryover basis rules applied. Also, the 2010 Act provides a decedent of an estate who is survived by a spouse the ability to make a "portability election." A "portability election" allows the surviving spouse to apply the decedent's unused tax exemption amount to the surviving spouse’s own estate transfers during life and at the surviving spouse’s own death.

American Taxpayer Relief Act of 2012

The American Taxpayer Relief Act of 2012 ("ATRA 2012") made permanent the estate tax provisions in the 2001 Act and subsequently modified by the aforementioned 2010 Tax Relief Act. The ATRA 2012 permanent provisions also included a unified exemption for estate and gift tax purposes of $5 million, indexed for inflation after 2011 ($5.45 million for 2016), a statutory maximum estate and gift tax rate of 40 percent, and the portability election of the exemption between spouses, allowing a decedent's estate to elect to permit the surviving spouse to claim any unused exemption amount.

Tax Cuts and Jobs Act (December 2017)

The Tax Cuts and Jobs Act (TCJA), passed in December 2017, approximately doubles the previous estate tax exemption amount to $11.18 million per individual and keeps the 40 percent maximum marginal rate for 2018. The new exemption amount is temporary and applies to decedents dying or gifts made after December 31, 2017, and before January 1, 2026. After December 31, 2025, the exemption amount returns to $5 million but will be adjusted for inflation. The TCJA maintains previous law by allowing the basis in the property acquired from a decedent to be stepped-up to the value of the asset at the date of death, just as it was under previous estate tax law. This "step-up in basis" rule essentially eliminates any capital gains tax liability for the appreciation of the property that occurred prior to the property owner’s death. The maintenance of the rule is significant for at least two reasons. First, the step-up in basis rule can reduce the amount of capital gains tax an heir will owe. The amount of tax owed by heirs if and when they sell the asset would be calculated based on when they inherited it rather than when it was originally acquired. Second, research suggests much of the appreciation in the value of assets in the estate has never been taxed—either as income or capital gains—and thus will escape taxation completely.

As shown in the table, the exemption amount has grown over time due to legation that increased the exemption amount and inflation adjustment which began in 2012. While the exemption has grown considerably, the maximum tax rate has fallen. For example, since 2000, the exemption amount for each decedent has grown, from $675,000 to $12.92 million in 2023, leading to a reduction in the estimated number of farm estates required to file a return. Because the exemptions are for each individual, the estate of a married couple would have an estate tax exemption of $25.84 million in 2023.

Farm Household Estate Tax Forecast

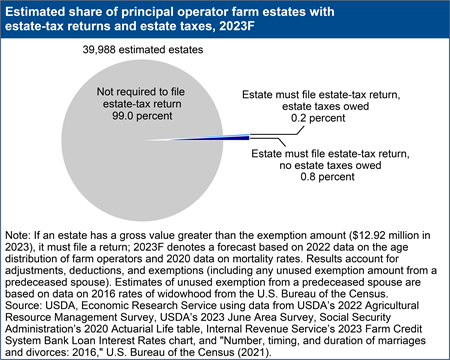

For 2023, USDA, Economic Research Service (ERS) estimated 39,988 estates would result from principal operator deaths, and out of those, approximately 0.8 percent—or 330 estates—would be required to file an estate tax return but would not owe estate tax. About another 0.2 percent—or 89 estates—would be required to file an estate tax return and would owe estate tax. The estate tax forecasts are based on simulations using the latest available farm-level survey data (USDA's 2022 Agricultural Resource Management Survey), assets and debt forecasts from the USDA-ERS Farm Sector Income and Finances forecast, mortality rates from the Social Security Administration actuarial life tables, interest rate data from the Farm Credit System, and cash rental rates for farmland from the 2023 USDA National Agricultural Statistics Service (NASS) June Area Survey. The farm estate forecast based on 2022 ARMS data alone may be an undercount of total farm estates created because ARMS does not collect wealth information on non-spousal farm operators. According to ARMS, about 14 percent of farm operations contain additional non-spousal farm operators.

Total aggregate Federal estate tax liabilities from principal operator farm estates in 2023 are forecast to be $473 million. The tax liability forecast accounts for adjustments, deductions, and exemptions, including the special-use valuation provision that is available to farm estates and the portability provision available to surviving spouses. The special-use valuation provision reduction in value for 2023 was capped at $1.31 million.

The special-use valuation provision allows farm real estate to be valued at farm-use value rather than at its fair-market value, and there is also an installment payment provision. We forecast the special-use valuation provision provided $43.8 million in estate tax savings in 2023. A separate provision aimed at encouraging farmers and other landowners to donate an easement or other restriction on development has also provided additional estate tax savings. However, we do not have enough information from the data to include these donation/restriction provisions in our estimates.

Documentation for the Estate Tax Model

The following documentation defines the Federal estate tax model for farm households. Estate tax is a tax on the transfer of property at death. Model documentation includes a description of data sources, assumptions, and estimation methods.

Data

The estate tax model was first developed in 2009 (see Federal Tax Policies and Farm Households, May 2009) and uses data from multiple Government agencies, including U.S. Department of Agriculture (USDA), Social Security Administration (SSA), and Internal Revenue Service (IRS). The data include:

- Agricultural Resource Management Survey (ARMS) provides the financial and demographic information for farm households.

- Mortality Tables from the Social Security Administration Actuary Life Tables, show the probability of a person's death before their next birthday, given their age.

- USDA, National Agricultural Statistics Service (NASS) June Area Survey provides cash rental rate information for cropland by State. The data are used to compute tax relief provided by valuing farmland for its agricultural use, as allowed by law.

- Farm Credit System Bank Loan Interest Rates include IRS-published interest rates that are used for computing the special-use valuation provisions.

- "Number, Timing, and Duration of Marriages and Divorces: 2016" by Yerís Mayol-García, Benjamin Gurrentz, and Rose M. Kreider provides a summary of data from U.S. Census Bureau's American Community Survey on the share of population that is single and widowed used in the estimation of portability (from report number P70-167 published April 2021).

Model

This section broadly explains the estimation of estate tax components for farm households. The exemptions, limits, tax rates, special deductions, and other elements of the model are based on the Federal estate tax code (Chapter 11 of the Internal Revenue Code) for the relevant year.

- For more technical details of the model, see Appendix C of Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households (June 2018) as well as Appendix B of An Analysis of the Effect of Sunsetting Tax Provisions for Family Farm Households (February 2024).

Assumptions

We make two important assumptions when estimating the estate tax liabilities that rely on estate heirs’ motivation to maximize consumption over their lifetime. There may be exceptions to these assumptions for heirs who have alternative motivations. The assumptions include:

- Married households: Since 1982, the estate tax code allows for tax-exempt transfer of estates from the deceased spouse to the surviving spouse. As a result, we assume the surviving spouse chooses to defer any estate tax payments until his/her death. Additionally, we assume each partner in a married household holds equal shares of property, assets, and debt.

- Special Use Valuation (SUV): The Federal estate tax code allows qualifying farm estates to value their land at its actual use, rather than its potential use, under the condition that such land will remain farmland for ten years. We assume that all farm estates that qualify will accept this deduction.

For some cases we forecast estate taxes using ARMS data from the previous year—for example, estimating 2023 estates taxes using 2022 data. For these cases, we inflated the assets and net-worth values simultaneously to avoid capturing the inflation value twice in net worth. These inflated forecasts have been consistent with predicted changes in the most recent USDA-ERS Farm Sector Income and Finances forecast. The implicit assumption is that assets and net worth for all individuals in our sample will change by the same percentage.

Estimating Net Taxable Estate Values

Because we cannot access administrative data on estate tax filings, we use ARMS data and an actuarial table showing the probability of death to estimate the number of farm estates created in a given year. The total expected number of farm estates is estimated as the weighted sum of the probability of death across all farm households.

The net worth of the estate is then calculated for each farm household. Net worth is defined as the sum of farm and nonfarm assets minus farm and nonfarm debts. The value of the estate is equal to farmer's net worth minus an "administrative" cost. These administrative costs are estimated to be 4 percent of the farmer's gross worth, based on IRS tabulations.

According to the provisions of the tax code, estates are required to file a tax return only in cases where the gross estate value exceeds the estate tax exemption for that year (e.g., $12.92 million for an individual in 2023, an amount indexed for inflation). When forecasting estate taxes using ARMS data from a previous year, since we don't know which farmers died during the year, we use the expected value of the estate created—i.e., the probability that an estate is created times its estate value. If the expected gross value of an estate is above the exemption limit, then the model assumes a return is required for the estate. Summing the probabilities across all estates with an expected value above the exemption provides the estimated number of estate tax returns by farmers.

Not all estates filing an estate tax return have a tax liability. For example, surviving spouses will defer the payment of estate taxes until their own death, resulting in no estate tax liability for that year. Since 1982, surviving spouses could transfer the estate of their deceased spouse in a tax-free manner. However, it was not until 2010 that the surviving spouse was allowed to transfer the unused estate tax exemption from their deceased spouse and add it to their own estate tax exemption. Since there is no penalty for deferring taxes until death—in the sense of losing exemptions—most surviving spouses will defer any tax payment till death.

Qualifying farm estates can reduce the value of their estate using the SUV provision. To qualify for SUV, the farm estate must pass two tests:

- Test 1: the adjusted farm real property (i.e., farm property minus farm debt) must be at least 25 percent of the adjusted gross estate.

- Test 2: farm net worth must be at least 50 percent of the adjusted gross estate.

A farm estate that passes both tests can substitute the value of the property dedicated to its actual use, rather than its fair market value based on potential use, up to the stipulated maximum amount. The SUV is computed using cash rents, farm bank loan interest rates, and farm property taxes under the formula found in Section 2032A of the IRS Tax Code.

Estate taxes are assessed on the difference between the taxable estate value—inclusive of applicable SUV deductions—and the estate tax exemption amount for the year. We compute the expected tax liability using the Federal estate tax brackets and rates specified in the tax code. Total estimated tax liability is the weighted sum of the tax liabilities times the probability of the creation of an estate. The effective estate tax rate is the total estimated tax liabilities as a share of the total adjusted estate values for estates with a tax liability.

Updates and Revisions to the Model

The current version of the estate tax model for farm households contains changes that are likely to result in differences among the estimated variables relative to estimates published before 2016 that were obtained using the original model. The most notable changes to the original model are:

- Special use valuation: The current version of the estate tax model incorporates this provision using data for cash rents, farm bank system loan rates, and property taxes.

- Mortality rates: The current version of the model uses the most recent data from the SSA’s actuarial life table on mortality rates for 2020.

- The current model also includes the "portability" provision. After 2010, married couples may transfer not only their estate to a surviving spouse in a tax-free manner, but also their unused estate tax exemption. Beginning in 2021, portability is calculated using the probability that an unmarried person is currently widowed. The transfer credit from a predeceased spouse is an average of exemptions transferred in each year (reported by the IRS) weighted by the probability of death in a single year. These estimates are further adjusted to match the share of IRS reported returns that elect portability to account for surviving spouses who do not utilize the provision. For more details on the portability calculation used in this forecast see appendix B of the ERS report, An Analysis of the Effect of Sunsetting Tax Provisions for Family Farm Households (February 2024). For more information on the election of portability, see the IRS website.

- The analysis was updated in September 2021 to include farms organized as estates, trusts, cooperatives, and grazing associations in cases where majority ownership is held within a single family, thereby meeting the definition of a family farm.