Market Outlook

See the latest Fruit and Tree Nuts Outlook report.

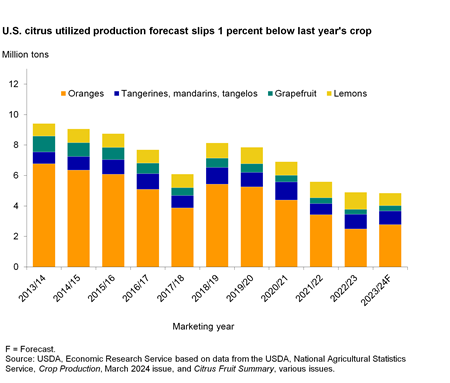

U.S. Citrus Crop Down Slightly

The most recent U.S. citrus crop forecast (March 2024) for 2023/24 is 4.85 million tons, down 1 percent from the 2022/23 final utilized total of 4.9 million tons. The March 2024 USDA, National Agricultural Statistics Service (NASS) Crop Production report forecasts that domestic producers will grow 2.77 million tons of oranges, an 11 percent increase from final production in the 2022/23 season. Grapefruit production is expected to reach 340,000 tons, up 4 percent from 2022/23. Lemon production, 95 percent of which is supplied by farms in California, is expected to decrease by 25 percent, from 1,116,000 tons in 2022/23 to 836,000 tons in 2023/24. Tangerine production is expected to decrease by 7 percent, from 971,000 tons in 2022/23 to 904,000 tons in 2023/24.