Market Outlook

See the latest Corn and Other Feedgrains Outlook report.

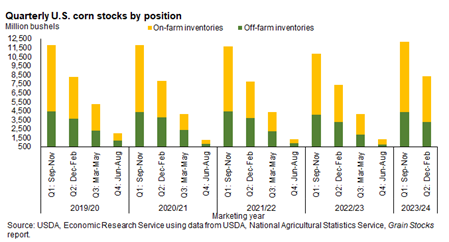

2023/24 U.S. Corn Ending Stocks Are Reduced on Higher Domestic Use

U.S. corn ending stocks are lower this month after upward adjustments for corn ethanol and feed and residual use. Based on second quarter indicated disappearance in 2023/24, feed and residual corn use is raised by 25 million bushels to 5.7 billion. Corn used for ethanol production is raised by the same volume and is expected to reach 5.4 billion bushels. The 2023/24 season-average farm corn price is lowered by $0.05 per bushel to $4.70 per bushel. Looking ahead, USDA, NASS’s Prospective Plantings report indicates total feed grain acres are expected to fall in tandem with principal crop acres for 2024/25.

Corn production is reduced in South Africa, Argentina, and Mexico. Mexico’s corn imports are raised, with the country being forecast to become the second-largest global corn importer, following China. Projections for barley imports by China continue to increase, sourced mainly from Australia, but also from Russia and Kazakhstan. Saudi Arabia’s lower demand for composite feed is expected to limit feed use and its imports of corn and barley.