Editors' Pick: Charts of Note 2019

This chart gallery is a collection of some of the best Charts of Note from 2019. These charts were selected by ERS editors as those worthy of a second read because they provide context for the year’s headlines or share key insights from ERS research.

Monday, September 23, 2019

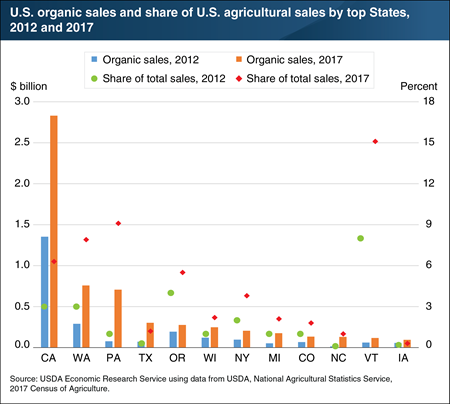

Although the total value of U.S. agricultural sales remained relatively flat between 2012 and 2017, U.S. organic sales more than doubled to $7.3 billion. Growth in the U.S. organic sector has accelerated since the early 2010s as retailers, food manufacturers, and livestock producers have increased demand for organic food and inputs. Agricultural sales averaged $400,603 for organic operations in 2017, more than double the average agricultural sales for all farms ($190,245). The organic share of U.S. agricultural sales doubled to 2 percent between 2012 and 2017, and was over 6 percent in some States. California was the top State in both organic and overall agricultural sales. Most other top organic States were in the Pacific Northwest (a major grower of organic produce), Upper Midwest (a major producer of organic milk), and Northeast (which has many small-scale organic farms). Pennsylvania and North Carolina were among the States with the fastest growth between 2012 and 2017, with organic sales up ten- and eight-fold, respectively. In contrast, Iowa ranked second in overall agricultural sales and twelfth in organic sales, reflecting the low adoption of organic systems for U.S. grain production. This chart updates data found in the Amber Waves feature, “Growing Organic Demand Provides High-Value Opportunities for Many Types of Producers,” originally published in February 2017.