ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Monday, April 15, 2024

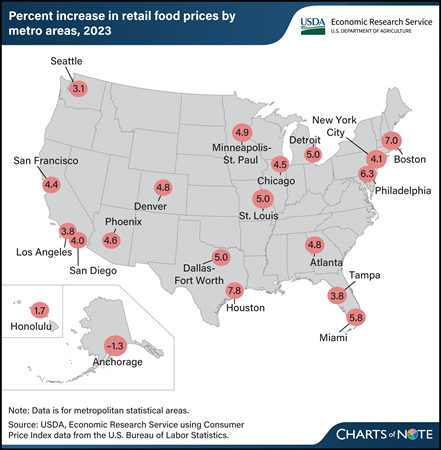

Retail food price inflation varies by locality. In 2023, food-at-home (grocery) prices rose the fastest in Houston, TX, by 7.8 percent, followed by Boston, MA, at 7.0 percent. In contrast, food-at-home prices declined by 1.3 percent in 2023 in Anchorage, AK, and rose by the lowest amount (1.7 percent) in Honolulu, HI. Across the United States, food-at-home prices increased by 5.0 percent on average in 2023. Differences in retail overhead expenses, such as labor and rent, can explain some of the variation among cities, because retailers often pass local cost increases to consumers in the form of higher prices. Furthermore, differences in consumer purchasing patterns for specific foods may help explain variation in inflation rates among cities. Products that consumers purchase vary regionally, and each metro area’s inflation rate is calculated based on a representative set of foods unique to the area. For example, an area whose residents purchase more foods with slower price inflation (such as fresh fruits and vegetables at 0.7 and 0.9 percent average growth in 2023, respectively) might experience lower food-at-home price inflation than an area whose residents buy more cereals and bakery products or nonalcoholic beverages, which increased by 8.4 percent and 7.0 percent, respectively, in 2023. This chart is drawn from the USDA, Economic Research Service Food Price Environment: Interactive Visualization, last updated in February 2024, which presents the 10-year average change in prices by metro area and provides context for the Food Price Outlook data product.

Wednesday, February 14, 2024

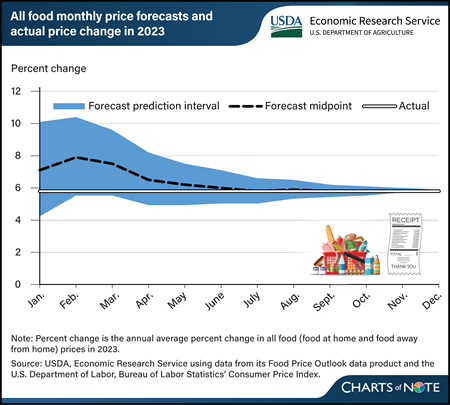

In 2023, all food prices (representing both food at home and food away from home) increased by 5.8 percent on average compared with 2022. The USDA, Economic Research Service (ERS) publishes food price forecasts in the Food Price Outlook (FPO) data product. Each month, the FPO forecasts the annual average change in prices for the current year, and the forecasts are presented as a midpoint and a prediction interval. The prediction interval, which represents uncertainty of the forecast, starts out wider at the beginning of the year and narrows as forecasts incorporate more months of observed data and the forecast period shortens. In January of each year, final data are available to assess the performance of the forecasts from the previous year. During the first few months of 2023, the all-food forecast midpoints were higher than the actual annual average change in all food prices, but the prediction interval from each forecast developed in 2023 contained the actual annual average change in prices. By July, the forecast midpoint converged on the actual average change in prices and remained within 0.1 percent through the remainder of the year. ERS researchers project all food prices to increase 1.3 percent in 2024, with a prediction interval of -1.4 to 4.2 percent. This chart is based on data from the ERS Food Price Outlook, updated January 25, 2024.

Thursday, January 25, 2024

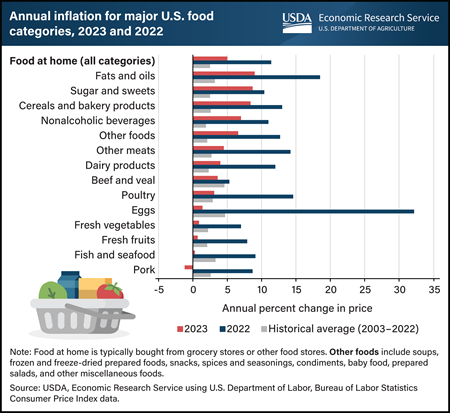

Food-at-home prices increased by 5.0 percent in 2023, much lower than the growth rate in 2022 (11.4 percent) but still double the historical annual average growth from 2003 to 2022 (2.5 percent). All product categories shown grew more slowly in 2023 compared with 2022. Food price growth slowed in 2023 as economy-wide inflationary pressures, supply chain issues, and wholesale food prices eased from 2022. In 2023, prices for fats and oils grew the fastest (9.0 percent), followed by sugar and sweets (8.7 percent), and cereals and bakery products (8.4 percent). Pork prices declined 1.2 percent in 2023, and prices for several categories grew more slowly than their historical averages, including beef and veal (3.6 percent), eggs (1.4 percent), fresh vegetables (0.9 percent), fresh fruits (0.7 percent), and fish and seafood (0.3 percent). Egg price growth receded in 2023 after a highly pathogenic avian influenza (HPAI) outbreak affected the industry in 2022. USDA, Economic Research Service (ERS) researchers project overall food-at-home prices will decrease 0.4 percent in 2024, with a prediction interval of -4.5 to 4.0 percent. ERS tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, updated January 25, 2024.

Monday, November 20, 2023

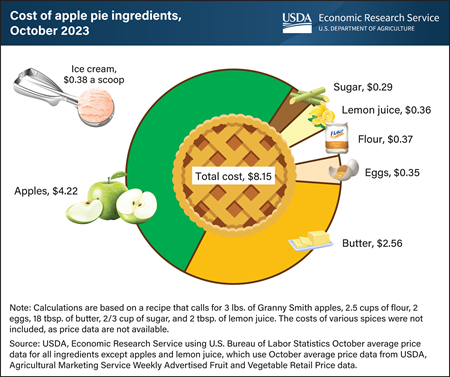

U.S. consumers baking a homemade apple pie for Thanksgiving this year can expect to pay about $8.15 for the ingredients, a decrease of 7.0 percent from last year. Price increases for flour, sugar, and lemon juice were offset by lower prices for apples, butter, and eggs, leading to a $0.61 decrease in the cost of a pie between 2022 and 2023. The price of the main ingredient, Granny Smith apples, fell 7.5 percent from $1.52 per pound in October 2022 to $1.41 per pound in October 2023. Prices decreased the most for eggs (38.6 percent), followed by butter (6.2 percent), between October 2022 and October 2023. Prices increased the most for lemons (20.0 percent) and sugar (16.0 percent), though those ingredients contribute only a small share to the total cost of a pie. If serving the apple pie à la mode, ice cream adds an additional $0.38 per scoop, an increase of $0.02 from last year. The most recent average price data are from October, meaning prices for Thanksgiving week may vary. For example, savings may occur if grocers offer holiday discounts. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, which will next be updated on November 22, 2023.

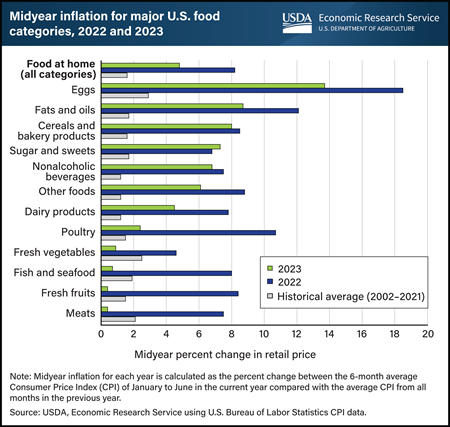

Wednesday, July 26, 2023

Retail food prices increased 4.8 percent in the first 6 months of 2023, lower than the rate of midyear inflation in 2022 (8.2 percent). The 20-year average for midyear inflation from 2002 to 2021 was 1.6 percent. All food categories except for sugar and sweets experienced smaller price increases through the first half of 2023 compared with the same period in 2022. Prices for eggs increased the most (13.7 percent) so far in 2023, followed by fats and oils (8.7 percent), and cereals and bakery products (8.0 percent). All food categories increased in price in the first 6 months of 2023 compared with 2022, but the increases for meats (0.4 percent), fresh fruits (0.4 percent), fish and seafood (0.7 percent), and fresh vegetables (0.9 percent) were below their historical average price increases. Inflationary pressures and trends differ by food category. For example, egg prices reached historically high levels early in 2023 because of an outbreak of highly pathogenic avian influenza (HPAI), though prices have since fallen from their peak. Prices will continue to change during the remainder of 2023 and may affect the annual inflation rate. The USDA, Economic Research Service (ERS) Food Price Outlook projects food-at-home prices will increase 4.9 percent in 2023, with a prediction interval of 3.7 to 6.1 percent, and was last updated July 25, 2023.

_450px.png?v=8651.8)

Tuesday, June 27, 2023

For Fourth of July cookouts this year, cheeseburgers could cost more than they did in 2022. In May 2023, the ingredients for a home-prepared ¼-pound cheeseburger totaled $2.17 per burger, an increase of 10 cents (4.9 percent) from 2022. Prices for cheeseburger ingredients grew more slowly over the year than prices for all groceries (food at home), which rose 5.8 percent from May 2022 to May 2023. Ground beef made up the largest cost of the burger at $1.24, and Cheddar cheese accounted for $0.37. Both these items increased in price by 3.5 percent between 2022 and 2023 and together accounted for half the increase in costs. Bread prices rose the fastest, by 21.5 percent, and added 4 cents to the cost of a burger between 2022 and 2023. Tomato prices fell slightly over the year, but an increase in lettuce prices added 1 cent to total costs. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the Food Price Outlook data product, updated June 23, 2023.

-FPO-Forecasts-2-23_450px.png?v=8651.8)

Thursday, February 23, 2023

USDA, Economic Research Service (ERS) publishes price forecasts in the monthly Food Price Outlook (FPO) data product. The FPO forecasts food-at-home (FAH) prices will increase 8.6 percent in 2023, with a prediction interval of 5.6 to 11.8 percent. ERS updated the FPO forecasting methods in January 2023, and forecasts now include a midpoint and a prediction interval to represent the expected price change and range of likely price changes, respectively. The prediction interval conveys uncertainty about the forecast, starting out wider at the beginning of the year and narrowing as forecasts incorporate more months of observed data and the forecast period shortens. The prediction intervals vary in size across food categories based on price volatility and available information. In 2023, egg prices are forecast to grow the fastest (37.8 percent, with a prediction interval of 18.3 to 62.3 percent) while fresh fruit prices are predicted to experience little change (0.1 percent) and have a prediction interval of -5.6 to 6.4 percent. In general, food prices are expected to grow more slowly in 2023 than in 2022 but remain above historical average rates. FAH prices grew 11.4 percent in 2022, the largest annual increase since 1974, compared with a historical annual average of 2.5 percent from 2003–22. This chart is updated from the Amber Waves article, ERS Refines Forecasting Methods in Food Price Outlook, published February 2023.

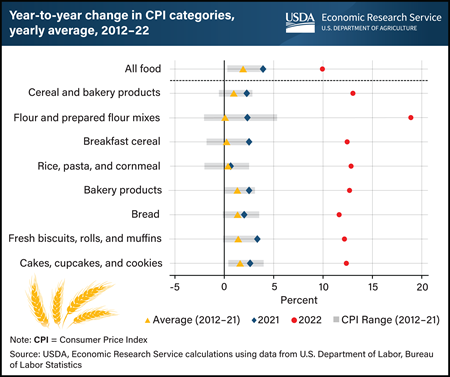

Wednesday, February 15, 2023

Consumer prices for wheat-based products were up substantially in 2022 compared to 2021, as indicated by the Consumer Price Index (CPI) data published by the U.S. Department of Labor, Bureau of Labor Statistics. Price levels of a variety of wheat products were up more than 10 percent from 2021, outpacing the rate of inflation in the broader “all food” category, which was up 9.9 percent, more than double the average increase of the previous decade. The average price level across the cereals and bakery products category was up 13 percent in 2022, well above the previous year’s increase (2.3 percent) and more than three times as large as any year in the past decade. Prices for flour and prepared flour mixes were nearly 19 percent higher in 2022, far exceeding the average from the previous decade (0.2 percent). Commodity prices for wheat were elevated in 2021 and 2022, but the increase in prices for wheat-based consumer products did not fully appear until 2022. Consumer price changes tend to lag price changes at the commodity level, partly based on the tendency of processors to purchase inputs well in advance. Rising input prices for non-wheat ingredients—such as eggs and butter, which tend to feature prominently in wheat food products—in addition to elevated labor and fuel expenses have all contributed to wheat food price inflation in 2022. This chart is drawn from the USDA, Economic Research Service Wheat Outlook, February 2023.

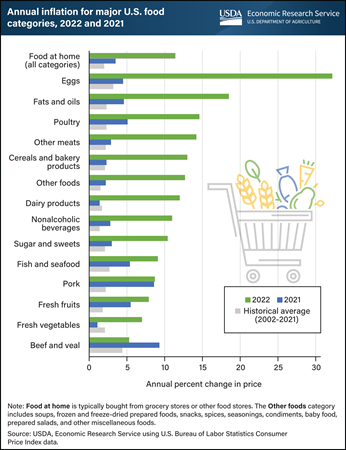

Thursday, January 26, 2023

Food-at-home prices increased by 11.4 percent in 2022, more than three times the rate in 2021 (3.5 percent) and much faster than the 2.0-percent historical annual average from 2002 to 2021. Of the food categories depicted in the chart, all except beef and veal grew faster in 2022 than in 2021. In 2022, price increases surpassed 10 percent for food at home and for nine food categories. Egg prices grew at the fastest rate (32.2 percent) after an outbreak of highly pathogenic avian influenza (HPAI) throughout 2022. Prices for fats and oils increased by 18.5 percent, largely because of higher dairy and oilseed prices. Prices also rose for poultry (14.6 percent) and other meats (14.2 percent). Elevated prices for wholesale flour—attributed to the conflict in Ukraine and rising fertilizer prices—and eggs contributed to a 13.0-percent price increase for cereals and bakery products. Prices for beef and veal (5.3 percent), fresh vegetables (7.0 percent), and fresh fruits (7.9 percent) rose more slowly, but all categories exceeded their historical averages. Food prices grew more quickly than the overall rate of inflation (8.0 percent), as the HPAI outbreak, the Ukraine conflict, and economy-wide inflationary pressures contributed specifically to rising food prices. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase 8.0 percent in 2023, with a prediction interval of 4.5 to 11.7 percent. ERS tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, updated January 25, 2023.

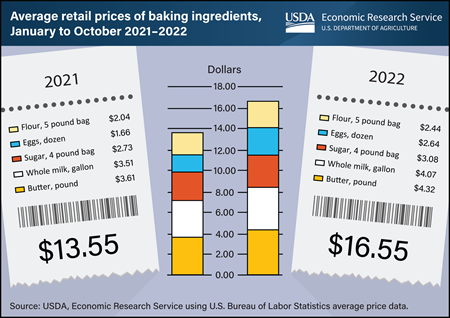

Tuesday, December 13, 2022

As people sift through holiday baking recipes and head to the store, they will find key ingredients cost more this year. The total cost for five baking staples – flour, sugar, milk, butter, and eggs – was about 22 percent higher through the first 10 months of 2022 compared with the same period in 2021. A 5-pound bag of flour, 4-pound bag of sugar, gallon of whole milk, pound of butter, and a dozen eggs cost a total $16.55 in 2022, compared with $13.55 in 2021, an increase of $3.00. Egg prices increased the fastest (60 percent) and cost about $0.98 more per dozen compared with 2021, as the egg industry was affected by the highly pathogenic avian influenza outbreak. Prices for flour and butter each rose by about 20 percent, adding about $0.40 to the price of a bag of flour and $0.71 to a pound of butter. Prices increased more slowly for milk (16 percent) and sugar (13 percent) in 2022, although price increases for all products were above historical averages. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, which predicts food-at-home prices will increase between 11 and 12 percent in 2022.

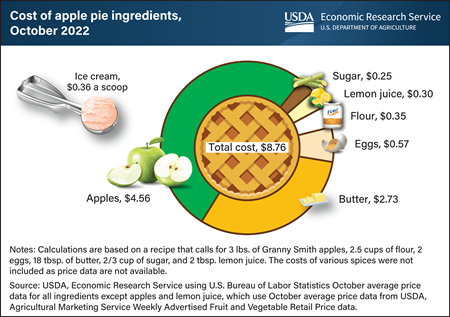

Tuesday, November 22, 2022

Pie is a time-honored staple of Thanksgiving around the country. U.S. consumers baking a homemade apple pie this year can expect to pay about $8.76 for the ingredients, an increase of about 19.5 percent from 2021. Prices increased for all ingredients. Apples comprised about half the cost of a pie ($4.56), and prices for Granny Smith apples increased from an average $1.41 per pound in October 2021 to $1.52 per pound in October 2022. Prices increased the most for eggs (90.0 percent) and flour (34.6 percent), but rising butter costs had the largest impact on the total, adding an additional $0.68 to the cost of a pie between 2021 and 2022. If serving the apple pie a la mode, ice cream adds $0.36 per scoop. The most recent average price data are from October; prices for Thanksgiving week may vary. For example, savings may occur if grocers offer holiday discounts. USDA, Economic Research Service (ERS) used average price data from the U.S. Bureau of Labor Statistics and USDA, Agricultural Marketing Service Weekly Advertised Fruit and Vegetable Retail Price data to derive the cost for the ingredients of an apple pie. Forecasts for aggregate food category prices can be found in ERS’s Food Price Outlook data product, updated November 22.

_450px.png?v=8651.8)

Thursday, September 29, 2022

National Coffee Day is today, September 29, and according to a National Coffee Association survey, 66 percent of U.S. adults are coffee drinkers. Consumers who get through the daily grind with a 12-ounce cup of black coffee they brewed at home paid, on average, 23.6 cents in the first 8 months of 2022, compared to 19.3 cents in 2021. For those who prefer their daily joe with milk or sugar, adding an ounce of whole milk costs 3.2 cents in 2022, up from 2.7 cents in 2021. Each teaspoon of sugar added 0.7 cents to the cost of a cup of coffee in 2022, compared to 0.6 cents in 2021. Average ground coffee prices through the first 8 months of 2022 were 21.9 percent higher compared to the same period in 2021. Prices rose more slowly for milk (15.9 percent) and sugar (11.0 percent) compared to coffee during those same months. More information on USDA, Economic Research Service’s food price data can be found in the Food Price Outlook data product, updated September 23, 2022.

_450px.png?v=8651.8)

Thursday, August 25, 2022

Retail food prices increased 8.9 percent in the first seven months of 2022, higher than the rate over the same period in 2021 (1.9 percent) and 2020 (3.1 percent). The 20-year historical average for the same months from 2001 to 2020 was 1.7 percent. All 13 food categories depicted in the chart experienced faster price increases so far in 2022 compared with both the same period in 2021 and historical average price increases through July. All food categories saw price increases of at least 4 percent in the first seven months of 2022. Prices for three food categories increased by more than 10 percent: eggs (20.9 percent), fats and oils (13.4 percent), and poultry (11.8 percent). Inflationary pressures differ by food category. For example, eggs and poultry prices are currently much higher than their historical average in part because of an outbreak of highly pathogenic avian influenza (HPAI). Fresh vegetables historically experienced higher midyear average price increases compared to most categories, but prices for fresh vegetables increased the least of all categories over the first seven months of both 2022 (4.9 percent) and 2021 (0.4 percent). Prices will continue to change during the remainder of 2022 and may significantly affect the annual inflation rate. For example, prices increased for all food categories in the second half of 2021, and some increased more rapidly than the first half of 2021. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase between 10 and 11 percent in 2022. Forecasts for all food categories, including for 2023, are available in ERS’s monthly Food Price Outlook data product, updated August 25, 2022.

_450px.png?v=8651.8)

Wednesday, June 29, 2022

For Fourth of July cookouts this year, cheeseburgers could cost more than they did in 2021. In May 2022, the ingredients for a home-prepared 1/4-pound cheeseburger totaled $2.07 per burger, with ground beef making up the largest cost at $1.20 and cheddar cheese accounting for $0.35. This represents an increase of 11.3 percent compared to the $1.86 it cost to produce the same cheeseburger in May 2021. Retail prices for one-pound quantities of all ingredients were higher in May 2022 compared with May 2021. Ground beef prices increased 16.9 percent and accounted for 17 cents of the increase between 2021 and 2022. Cheddar cheese and bread costs each rose about 1 cent per burger from 2021 to 2022. Iceberg lettuce prices rose the most, by 23.3 percent, but the relatively small proportion it contributes to the total cost of a burger means it added just 2 cents to the total. This chart uses data from the ERS Food Price Outlook data product, which was updated on June 24, 2022, U.S. Bureau of Labor Statistics Average Price data, and USDA Agricultural Marketing Service Weekly Advertised Fruit and Vegetables Retail Prices.

Monday, May 23, 2022

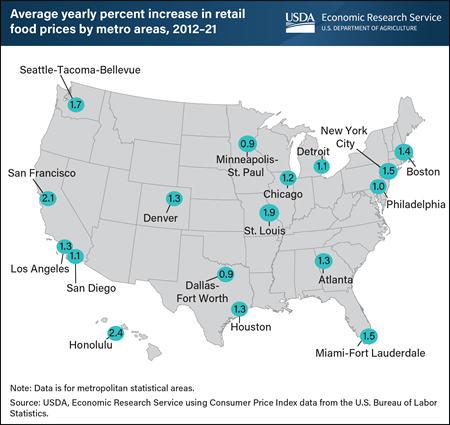

Retail food price inflation varies by locality. In the 10 years from 2012 to 2021, increases in retail food prices ranged from an average of 2.4 percent a year in Honolulu, HI, to 0.9 percent in the Dallas-Fort Worth, TX, area. Retail food at home includes food bought in grocery stores as opposed to restaurants. Differences in transportation costs and retail overhead expenses, such as labor and rent, can explain some of the variation among cities because retailers often pass local cost increases on to consumers in the form of higher prices. Furthermore, differences in consumer preferences among cities for specific foods may help explain variation in inflation rates. For example, a city whose residents strongly prefer foods with less price inflation (such as fresh fruits and vegetables, at 1.3 and 0.8 percent average yearly growth for 2012-21) might experience lower food-at-home price inflation than a city whose residents buy more beef and veal, which increased by an average of 4.2 percent a year in the 10-year period. Across the United States, food-at-home prices increased by an average of 1.4 percent a year over the 10-year period. This chart appears in an Economic Research Service data visualization, Food Price Environment: Interactive Visualization, released May 12, 2022.

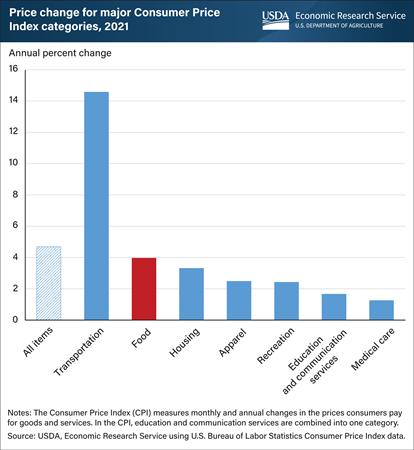

Wednesday, February 23, 2022

Food prices overall increased by an average of 3.9 percent in 2021 compared to 2020, the highest annual increase since 2008. Food prices grew more slowly than the “all items” and transportation CPIs, but more quickly than all other of the “major groups” tracked by the U.S. Bureau of Labor Statistics (BLS). The CPI for all items rose 4.7 percent in 2021. Among the food categories that comprise the food CPI, the food-away-from-home (restaurant purchases) CPI increased 4.5 percent, compared with an increase of 3.5 percent for food-at-home (grocery stores or other purchases from food retailers). The highest price increases in food-at-home categories in 2021 were for beef and veal (9.3 percent), pork (8.6 percent), and fresh fruit (5.5 percent). Using the CPI data, USDA, Economic Research Service (ERS) researchers project overall food prices will increase between 2 and 3 percent in 2022. A five-year comparison of changes in major CPI categories is available in the Food Prices and Spending section of ERS’s Ag and Food Statistics: Charting the Essentials data product, and a time-series visualization of the data appears in the Food Price Environment data tool. More information on ERS’s monthly food price forecasts can be found in ERS’s Food Price Outlook (FPO) data product. The next FPO release is February 25, 2022.

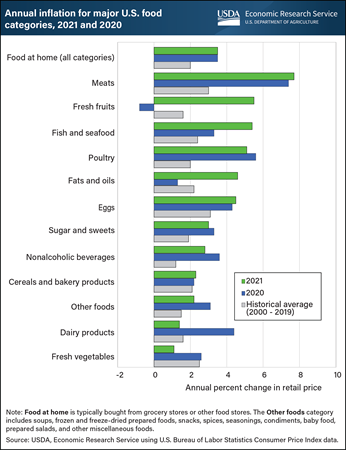

Friday, January 28, 2022

Retail food prices increased by 3.5 percent in 2021, equal to the rate in 2020 and greater than the historical annual average of 2.0 percent from 2000 to 2019. Of the 12 food categories depicted in the chart, six showed slower price increases in 2021 compared with 2020. Dairy products and fresh vegetables, in particular, had significantly slower price increases in 2021 than 2020 and their historical averages. Dairy product prices increased at 1.4 percent in 2021 versus 4.4 percent in 2020 and fresh vegetable prices increased by 1.1 percent compared to 2.6 percent is 2020. Conversely, prices in six food categories increased in 2021 at a faster rate than in 2020 as well as in years prior. Prices for fresh fruits, for instance, increased 5.5 percent in 2021 compared to a 0.8-percent decrease in 2020 and a 1.6-percent average increase over the prior 20 years. Inflationary pressures differ by food category. For example, meat prices, which rose the most of any included product groups, have been driven up by strong domestic and international demand, high feed costs, and supply chain disruptions. Winter storms and drought impacted meat prices in the spring, and processing facility closures due to cybersecurity attacks affected beef and other meat production in May. USDA, Economic Research Service (ERS) researchers project that prices for food-at-home, or food purchased typically from grocery stores or other food stores, will increase between 1.5 and 2.5 percent in 2022, lower than the 3.5-percent increase that occurred in both 2020 and 2021. Forecasts for all food categories for 2022 are available in ERS’s monthly Food Price Outlook data product, updated January 25, 2022.

Monday, January 3, 2022

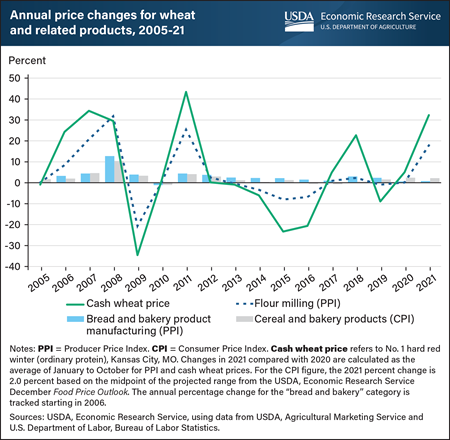

Wheat prices at the farm level rose substantially in 2021, but these changes did not result in correspondingly higher prices for consumer products made from wheat. This disparity reflects the historical pattern most observable from 2005–12, wherein the degree of movement in prices of wheat products was markedly less than the more dramatic changes in wheat prices. Cash wheat prices in Kansas City, MO—the market price that most closely reflects the prices mills pay for wheat—were up by more than 30 percent in 2021 from the same time in 2020. Similarly, the Producer Price Index (PPI) for flour milling—a measure of how wholesale flour prices change over time—also rose, registering an 18-percent year-on-year increase in 2021. In contrast, prices U.S. consumers paid for wheat-containing products, as measured by the Consumer Price Index (CPI), for cereal and bakery products, is projected up 2 percent. This year-to-year increase is below the overall inflation rate for 2021 and similar to the previous year’s gains. The muted and lagged impact of the wheat grain price surge on consumer product prices is in line with historical precedent in which commodity prices usually represent a small share of the consumer food dollar that is spent on processed foods such as bread and pasta. This chart was drawn from “The Effect of Rising Wheat Prices on U.S. Retail Food Prices,” which appeared in the USDA, Economic Research Service’s November 2021 Wheat Outlook.

Monday, November 22, 2021

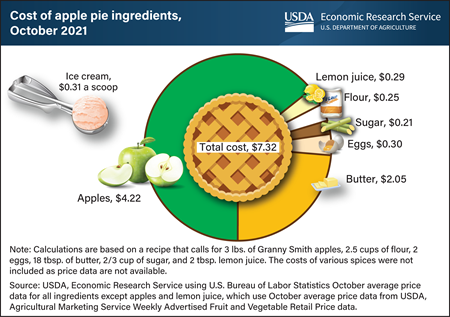

As U.S. consumers finalize their Thanksgiving menus, they might be curious to know how much ingredients will likely cost. If a homemade apple pie is on the menu, consumers can expect to pay about $7.32 for the ingredients, more than half of which ($4.22) is for apples. The same pie ingredients cost about $6.75 last year, meaning the total cost is 8.4 percent higher this year. The cost increase is driven by the price of Granny Smith apples, which increased from an average $1.26 per pound in October 2020 to $1.41 per pound in October 2021. Sugar, eggs, butter, and lemons also increased in price over the same period, while flour prices decreased. If the apple pie is served a la mode, plan to factor in an additional $0.31 per scoop, the same price as in 2020. USDA, Economic Research Service used average price data from the U.S. Bureau of Labor Statistics and USDA, Agricultural Marketing Service Weekly Advertised Fruit and Vegetable Retail Price data to derive the cost for the ingredients of an apple pie. The most recent data points are from October, meaning prices for Thanksgiving week may vary; savings may occur if grocers offer holiday discounts. Forecasts for aggregate food category prices can be found in the Food Price Outlook data product, which will next be updated on November 23.

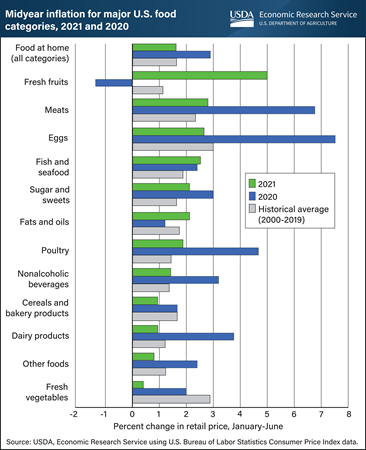

Wednesday, July 28, 2021

Retail food prices have increased 1.6 percent in the first six months of 2021, less than the rate over the same period last year (2.9 percent) and equal to the historical average over the same six months from 2000 to 2019. Of the 13 food categories depicted in the chart, 10 have experienced slower price increases so far in 2021 compared with halfway through 2020, while 5 categories trailed their historical midyear average price increases. In the first six months of 2021, prices for five food categories increased at a rate slower than in 2020 and years prior: eggs, dairy, fresh vegetables, cereals and bakery products, and “other foods.” Conversely, prices for three food categories increased in the first six months of 2021 at a rate faster than in 2020 and in years prior: fresh fruits (4.8 percent), fish and seafood (2.5 percent), and fats and oils (1.9 percent). Inflationary pressures differ by food category. For example, fresh fruit prices currently are increasing more than four times faster than their historical average rate because of low citrus supplies and increased exports. Prices may change during the remainder of 2021; in the second half of 2020, prices increased for all food categories except eggs and the category of beef and veal. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase between 2 and 3 percent in 2021. Forecasts for all food categories, including for 2022, are available in ERS’s monthly Food Price Outlook data product, updated July 23, 2021.