ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Thursday, March 21, 2024

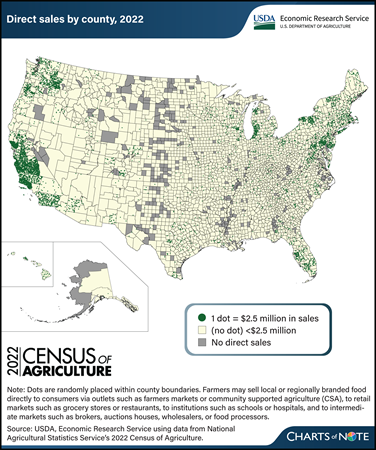

Errata: On March 25, 2024, the map legend was revised to show that areas in yellow without dots represent direct sales of less than $2.5 million.

The Census of Agriculture reports data on local or regionally branded food sold directly to retail outlets, institutions (like schools), intermediate markets (like food hubs), and consumers (via outlets such as farmers markets). These local-food sales channels provide opportunities for farmers to explore revenue streams beyond traditional wholesale markets. Data from the 2022 Census of Agriculture, released in February 2024, show producers sold $17.5 billion in food, including both unprocessed and processed (value-added) food, through direct marketing channels. That was a 25-percent increase (after adjusting for inflation) since the 2017 Census of Agriculture and an annual real growth rate of 4.6 percent. The increase from 2017 was driven by a surge in food sold directly to retail outlets, institutions, and intermediate markets. From 2017 to 2022, sales through these three direct-sales channels increased 33.2 percent (adjusted for inflation) to $14.2 billion, and the number of operations selling through them more than doubled to 60,332. Direct-to-consumer sales through farmers markets, on-farm stores or stands, u-pick operations, community supported agriculture (CSA), and online marketplaces remained consistent with those in 2017 after adjusting for inflation. However, the number of farm operations (116,617) selling directly to consumers in 2022 was 10.3 percent less than in 2017. As was the case in 2017, direct food sales continue to be concentrated along the West Coast, particularly in California (37.7 percent of direct sales), and in the Northeast. Most counties with high volumes of direct sales are in or around metropolitan areas, whose populations provide a large customer base for producers. This chart is based on data obtained from USDA, National Agricultural Statistics Service’s 2022 Census of Agriculture. For more on direct food sales, see the USDA, Economic Research Service report Marketing Practices and Financial Performance of Local Food Producers: A Comparison of Beginning and Experienced Farmers, published in 2021.

Wednesday, February 7, 2024

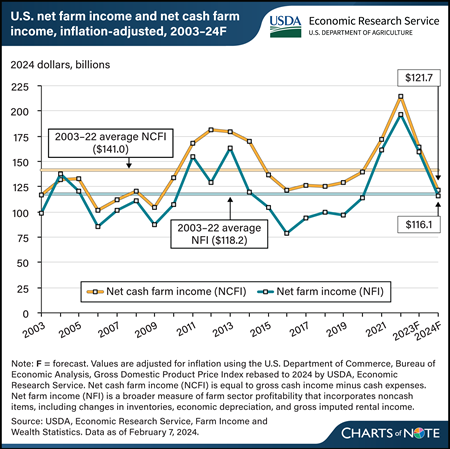

USDA’s Economic Research Service (ERS) forecasts that U.S. net cash farm income (NCFI), defined as gross cash income minus cash expenses, will decrease by $42.2 billion (25.8 percent) to $121.7 billion in 2024 in inflation-adjusted dollars. This is after NCFI decreased in 2023 by a forecast $50.2 billion to $163.9 billion. Net farm income (NFI) is forecast to decrease by $43.1 billion (27.1 percent) to $116.1 billion from 2023 to 2024. NFI is a broader measure of farm sector profitability that incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income. The forecasted 2024 NFI decrease follows a decrease of $37.2 billion from 2022 to $159.2 billion in 2023. These decreases are from record levels in 2022, and if forecasts are realized, NCFI and NFI would fall below their respective 2003–22 averages in 2024. Underlying these forecasts, cash receipts for farm commodities are projected to fall by $32.2 billion (6.2 percent) to $485.5 billion in 2024. During the same period, production expenses are expected to increase by $7.2 billion (1.6 percent) to $455.1 billion in 2024. Also, total commodity insurance indemnity payments are forecast to fall by $1.5 billion (6.6 percent) in 2024, and direct Government payments to farmers are projected to fall by $2.2 billion (17.7 percent) from 2023 levels to $10.2 billion in 2024. Find additional information and analysis on the USDA, ERS topic page for Farm Sector Income and Finances, reflecting data released on February 7, 2024.

Wednesday, January 17, 2024

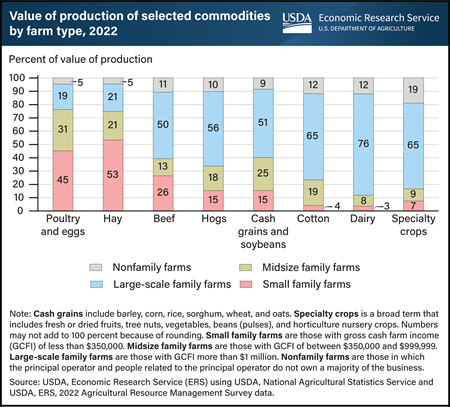

Large-scale family farms accounted for a majority of the value of commodity production in 2022, including cash grains and soybeans (51 percent), hogs (56 percent), cotton (65 percent), specialty crops (65 percent), and dairy (76 percent). On the other hand, small family farms accounted for 3 percent of the value of production for dairy, 4 percent for cotton, 7 percent for specialty crops, and 26 percent for beef, but they produced the majority of hay (53 percent) and 45 percent of poultry and eggs. The value of production by nonfamily farms ranged from 5 percent for both hay production and poultry and eggs production to 19 percent for specialty crop production. This chart uses data appearing in America’s Farms and Ranches at a Glance, published December 2023.

Thursday, November 30, 2023

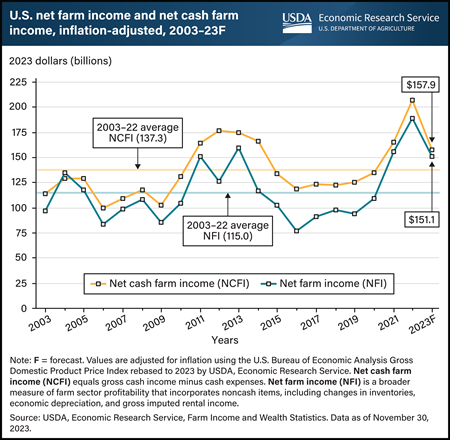

The USDA, Economic Research Service (ERS) forecasts inflation-adjusted U.S. net cash farm income (NCFI) to decrease by $49.2 billion (23.8 percent) from 2022 to $157.9 billion in 2023. Similarly, U.S. net farm income (NFI) is forecast to fall by $37.9 billion (20.0 percent) from 2022 to $151.1 billion in 2023. NCFI is calculated as gross cash income minus cash expenses. NFI is a broader measure of farm sector profitability that incorporates noncash items including changes in inventories, economic depreciation, and gross imputed rental income. The projected decreases in 2023 come after both NCFI and NFI reached all-time highs in 2022 of $207.1 billion and $188.9 billion, respectively. For 2023, cash receipts for farm commodities are projected to fall by $43.0 billion (7.8 percent) from 2022 to $509.6 billion in 2023. This includes forecasted declines in milk, corn, and broiler receipts. Total production expenses are expected to remain relatively stable in 2022, increasing by $0.6 billion (0.1 percent) to $443.4 billion in 2023. However, individual expense items are expected to vary, with interest expenses forecast to increase in 2023, while spending on fertilizer/lime/soil conditioner and feed is expected to decrease. Finally, direct Government payments to farmers are forecast to fall $4.0 billion (24.8 percent) lower in 2023 to $12.1 billion because of lower supplemental and ad hoc disaster assistance. Find additional information and analysis on the ERS topic page Highlights from the Farm Income Forecast, reflecting data released on November 30, 2023.

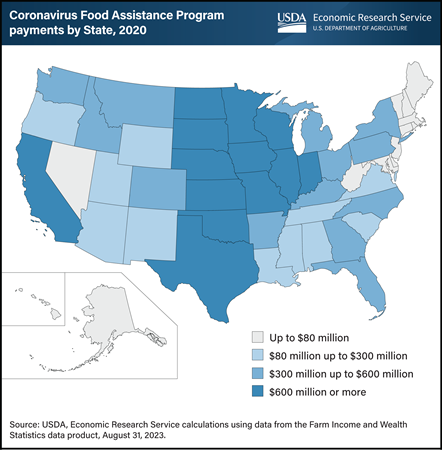

Thursday, October 19, 2023

In 2020, two rounds of Coronavirus Food Assistance Program (CFAP) payments provided $23.5 billion to U.S. farmers and ranchers who faced sales losses, lower prices, or increased production and marketing costs associated with the Coronavirus (COVID-19) pandemic. The CFAP was USDA’s primary pandemic assistance program. According to the USDA, Economic Research Service data product Farm Income and Wealth Statistics, producers in nine States received more than a billion dollars each in estimated CFAP payments in 2020. Those States were: Iowa ($2.1 billion), California ($1.8 billion), Nebraska ($1.6 billion), Minnesota ($1.4 billion), Texas ($1.3 billion), Illinois ($1.3 billion), Kansas ($1.1 billion), Wisconsin ($1.0 billion), and South Dakota ($1.0 billion). In calendar year 2020, direct Federal payments to U.S. farmers and ranchers totaled $45.6 billion. Therefore, the payments made from CFAP were more than half of all direct government payments made that year. CFAP continued to make payments to U.S. producers and ranchers in 2021. This chart updates information that appeared in the USDA, Economic Research Service report COVID-19 Working Paper: Distribution and Examination of Coronavirus Food Assistance Program Payments and Forgivable Paycheck Protection Program Loans at the State Level in 2020, published August 2023.

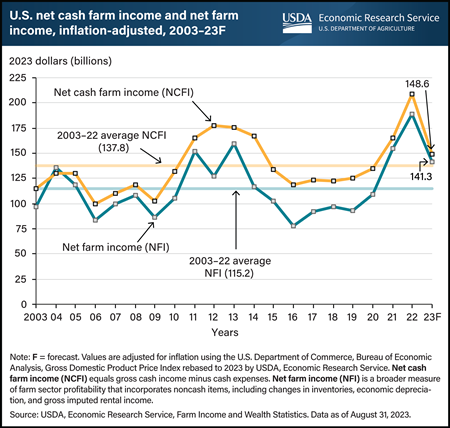

Thursday, August 31, 2023

The USDA, Economic Research Service (ERS) forecasts inflation-adjusted U.S. net cash farm income (NCFI) to decrease by $60.5 billion (28.9 percent) from 2022 to $148.6 billion in 2023. Similarly, U.S. net farm income (NFI) is forecast to fall by $48.0 billion (25.4 percent) from 2022 to $141.3 billion in 2023. NCFI is calculated as gross cash income minus cash expenses. NFI is a broader measure of farm sector profitability that incorporates noncash items including changes in inventories, economic depreciation, and gross imputed rental income. The projected decreases in 2023 come after both NCFI and NFI reached all-time highs in 2022. NCFI reached $209.1 billion in 2022, and NFI reached $189.3 billion. Underlying these forecasts, cash receipts for farm commodities are projected to fall by $41.4 billion (7.5 percent) from 2022 to $513.6 billion in 2023. This includes forecasted declines of $13.9 billion (23.6 percent) in milk receipts and $11.6 billion (12.6 percent) in corn receipts. In addition, production expenses are expected to increase by $14.8 billion (3.3 percent) to $458.0 billion in 2023. Finally, direct Government payments to farmers are projected to fall by $3.5 billion (21.6 percent) from 2022 to $12.6 billion in 2023, because of lower supplemental and ad hoc disaster assistance. Find additional information and analysis on the USDA, ERS’ topic page Highlights from the Farm Income Forecast, reflecting data released on August 31, 2023.

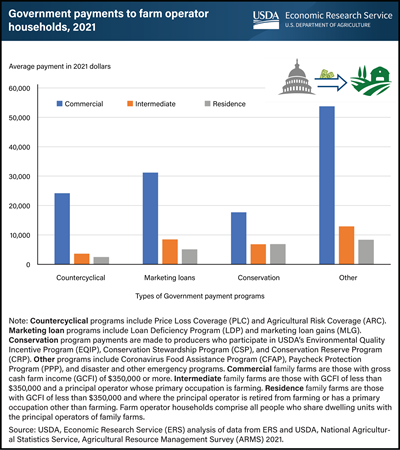

Monday, June 26, 2023

In 2021, more than 34 percent of the 1.96 million U.S. family farms received Government payments through four types of programs: countercyclical, marketing loan, conservation, and other programs. These Government payments totaled $14.3 billion based on data from USDA’s Agricultural Resource Management Survey (ARMS). Economists with USDA’s Economic Research Service examined three groupings (commercial, intermediate, residence) of family farms to find that about 75 percent of commercial family farms—those with $350,000 or more in gross cash farm income (GCFI)—received Government payments. For intermediate family farms—those with less than $350,000 in GCFI and a principal operator whose primary occupation is farming—31 percent received Government payments. Finally, Government payments went to 29 percent of residence family farms, defined as those with less than $350,000 in GCFI and where the principal operator is retired from farming or has a primary occupation other than farming. Overall, on average, commercial farms received $66,314, intermediate farms received $12,794, and residence farms received $8,354 in Government payments in 2021. This chart is drawn from data in the USDA, Economic Research Service’s ARMS Farm Financial and Crop Production Practices data product and in the May 2023 Amber Waves article Commercial Farms Led in Government Payments in 2021. For more information on Federal programs, visit the Farm & Commodity Policy topic page.

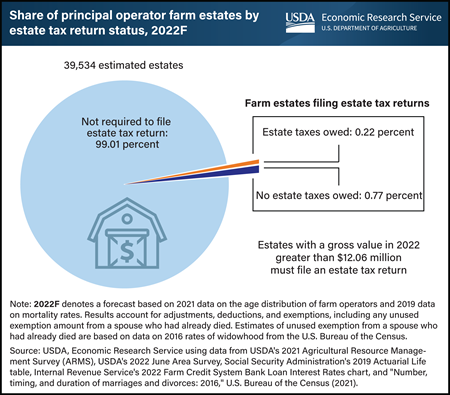

Monday, May 22, 2023

Created in 1916, the Federal estate tax is a tax on the transfer of property to a person’s heirs upon death. In 2022, the Federal estate tax exemption amount was $12.06 million per person and the federal estate tax rate was 40 percent. Under the present law, the estate of a person who owns assets above the exemption amount at death must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests will pay Federal estate tax. Researchers from USDA, Economic Research Service (ERS) estimate that in 2022, 39,534 estates were created from principal operator deaths. Of those estates, ERS forecasts that 305 (0.77 percent) will be required to file an estate tax return, and a further 87 (0.22 percent) will likely owe Federal estate tax. Total Federal estate tax liabilities from the 87 farm estates owing taxes are forecast to be $566 million in 2022. The exemption amount was increased to $12.92 million per person in 2023. This chart appears in the ERS Topic Page, Federal Estate Taxes, published in April 2023.

Monday, May 8, 2023

After reaching recent highs in 2021 and 2022, the average net cash income (gross cash income minus cash expenses) of U.S. farm businesses is expected to decline by 18 percent in 2023 compared with 2022. Farm businesses across the country are forecast to see higher production expenses, lower cash receipts, and lower Government payments in 2023, resulting in lower expected average net cash farm income. However, this overall decline will vary considerably across the country, driven primarily by the commodities produced in each resource region. The USDA, Economic Research Service (ERS) uses resource regions to depict the geographic specialization in production of U.S. commodities. ERS defines farm businesses as the operations with gross cash farm income of at least $350,000 or smaller operations in which farming is reported as the operator’s primary occupation, which includes just over half of all U.S. farms. Farm businesses in the Northern Crescent region, which leads the Nation in dairy production, are forecast to see the largest average percentage decrease (30 percent), while those in the Mississippi Portal, which leads the Nation in rice production, are forecast to see the smallest percent decrease (9 percent). Find additional information and analysis on the ERS topic page Farm Business Income, reflecting data released on February 7, 2023. For more details on the ERS Farm Resource Regions, see Agricultural Income and Finance Situation and Outlook: 2021 Edition.

Wednesday, May 3, 2023

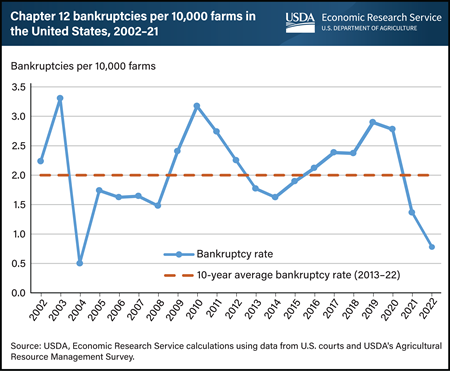

In 2022, the Chapter 12 bankruptcy rate reached the lowest level in nearly two decades, 0.78 bankruptcies per 10,000 farms. Under Chapter 12 bankruptcy, a financially distressed family farmer can propose and carry out a plan to repay their debts fully or partially, and the total number of these bankruptcies is an indicator of financial stress in the farm sector. In 2003, the annual bankruptcy rate reached a high of 3.3 per 10,000 farms and then declined to a low of 0.5 per 10,000 farms in 2004. After 2010, the bankruptcy rate declined until 2014 but started to increase again in 2015 with another peak in 2019 (2.9 bankruptcies per 10,000 farms). Since then, bankruptcies have declined to the lowest level in two decades after 2004. In 2022, 0.78 farms per 10,000 filed for Chapter 12 bankruptcy, almost two-thirds lower (61.0 percent) than the 10-year annual average of 2.00 bankruptcies per 10,000 farms. Based on the data from U.S. courts, the number of bankruptcies not only declined nationally, but also in the major agricultural States. When examining the 10-year average bankruptcy rate (2013–22) for major agricultural States, Wisconsin had the highest rate at 5.66 per 10,000 farms, followed by Nebraska and Kansas. Texas had the lowest average bankruptcy rate among the top 10 agricultural States at 0.77 per 10,000 farms. This chart uses data from U.S. courts and the USDA’s Agricultural Resource Management Survey (ARMS) to update information in Agricultural Income and Finance Situation and Outlook: 2021 Edition and the Amber Waves article, Chapter 12 Bankruptcy Rates Have Increased in Most Agricultural States, published in November 2021.

Monday, May 1, 2023

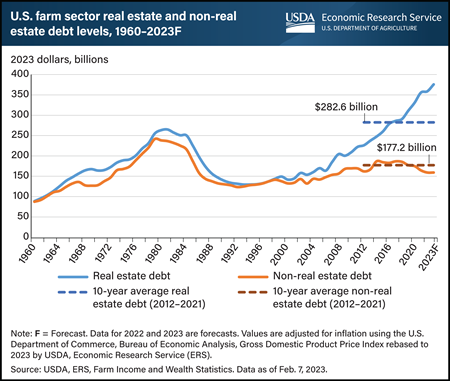

Farm sector debt tied to real estate is expected to be at a record high of $375.9 billion in 2023, according to data from the USDA, Economic Research Service (ERS). Farm sector real estate debt has been increasing continuously since 2009 and is expected to reach an amount that is 87.5 percent higher in 2023 compared with 2009 in inflation-adjusted dollars. Real estate debt now far outpaces debt that is not secured by a mortgage (non-real estate debt). Historically, real estate debt and non-real estate debt have trended similarly, but they have diverged in recent years. Non-real estate debt showed an 11.9-percent year-to-year increase in 2014 in inflation-adjusted dollars but has shown decline after 2017. Meanwhile, there has been a continuous increase in real estate debt since 2009. Growth in farm real estate asset values and relatively low interest rates contributed to the increase in farm real estate debt. In 2023, real estate debt is expected to be 33.0 percent higher than the 10-year average (2012–2021), while non-real estate debt is expected to be 10.2 percent lower than the 10-year average. According to the USDA, National Agricultural Statistics Service’s Land Value 2022 Summary, the average value of farm real estate reached a record $3,800 per acre in 2022, a 12.4-percent increase from 2021. Find information and analysis on ERS’s Farm Sector Income & Finances topic page, which is updated four times a year.

Thursday, April 27, 2023

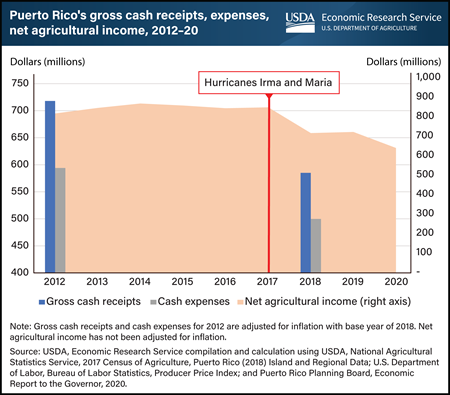

In September 2017, Hurricanes Irma and Maria caused major destruction across Puerto Rico’s agricultural sector. The destruction of infrastructure, operations, and crops led to an exodus of farmworkers, which further hampered the farm sector’s ability to recover. Data from the USDA, National Agricultural Statistics Service (NASS), Census of Agriculture, conducted every 5 years, show how the hurricanes impacted Puerto Rico’s farm income and expenses. Between 2012 and 2018, the number of farms declined by nearly 38 percent. Gross cash receipts—the sum of the sale of agricultural commodities, cash from farm-related income, and participation in Government farm programs—fell 19 percent in inflation-adjusted dollars from $718 million to $585 million. Cash expenses for Puerto Rican farms also decreased, falling 16 percent from $594 million to $500 million. Puerto Rico Planning Board’s data for net agricultural farm income, which includes non-cash income and expenses such as inventory changes, show a similar decline over the span of time that includes years not captured by NASS census data. From 2012 to 2020, net agricultural farm income (not adjusted for inflation) fell by $101 million. This chart first appeared in the USDA, Economic Research Service report, Puerto Rico’s Agricultural Economy in the Aftermath of Hurricanes Irma and Maria: A Brief Overview, April 2023.

Tuesday, February 7, 2023

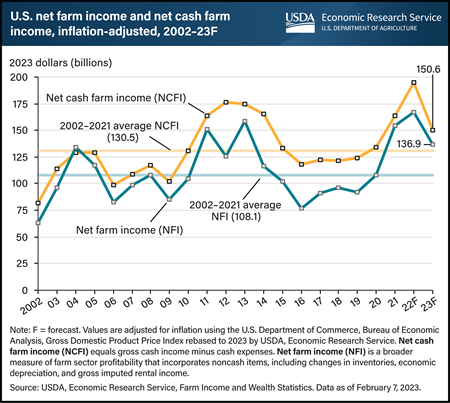

The USDA, Economic Research Service forecasts inflation-adjusted U.S. net cash farm income (NCFI)—gross cash income minus cash expenses—to decrease by $44.7 billion to $150.6 billion in 2023. This marks a 22.9 percent decline after reaching a forecast record high of $195.3 billion in 2022. U.S. net farm income (NFI) is forecast to decrease by $30.5 billion (18.2 percent) to $136.9 billion in 2023 after reaching a forecast of $167.3 billion in 2022, its highest level since 1973 after adjusting for inflation. (Calculations include rounding.) Net farm income is a broad measure of farm sector profitability that incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income. If these forecasts are realized, both NCFI and NFI would remain above their respective 20-year averages (2002–2021) in 2023. Underlying these forecasts, cash receipts for farm commodities are projected to fall by $38.9 billion (7.0 percent) from 2022 to $519.8 billion in 2023. During the same period, production expenses are expected to increase by $5.7 billion (1.3 percent) to $459.5 billion. Additionally, direct Government payments to farmers are projected to fall by $5.8 billion (36.2 percent) from 2022 levels to $10.2 billion in 2023, largely because of anticipated lower payments from supplemental and ad hoc disaster assistance programs. Find additional information and analysis on the USDA, Economic Research Service’s topic page Highlights from the Farm Income Forecast, reflecting data released on February 7, 2023.

Tuesday, January 24, 2023

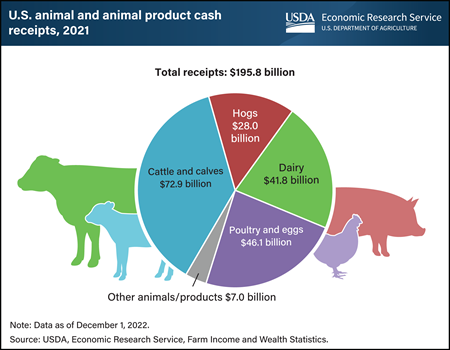

U.S. farm cash receipts from animals and animal products totaled $195.8 billion in 2021, led by receipts for cattle and calves at $72.9 billion (37 percent). Poultry and egg products made up the next largest share of 2021 cash receipts at $46.1 billion (24 percent), followed by dairy at $41.8 billion (21 percent), hogs at $28.0 billion (14 percent), and other animals and animal products at $7.0 billion (4 percent). As part of its Farm Income and Wealth Statistics data product, each year in late August or early September, USDA, Economic Research Service (ERS) releases estimates of the prior year’s farm sector cash receipts from agricultural commodity sales. These data include cash receipt estimates by type of commodity, which can help in understanding the U.S. farm sector. The estimates may be revised as new information becomes available. Additional information and analysis are on the ERS Farm Sector Income and Finances topic page, updated December 1, 2022.

Thursday, January 12, 2023

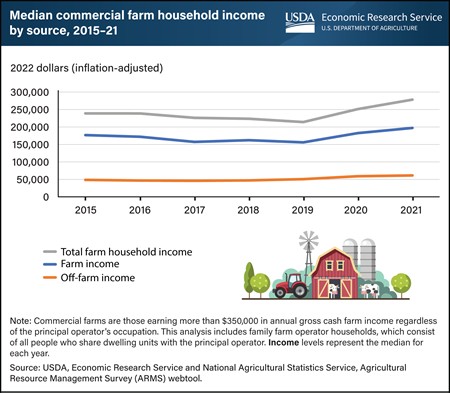

From 2015 to 2021, the median total household income for commercial U.S. farms rose an estimated 16 percent, to $278,339 from $238,994. Commercial farms earn more than $350,000 gross cash farm income regardless of the principal operator’s occupation. In 2021, the median total household income for commercial farms remained above the median income of $75,201 for all U.S. households. Farm households rely on a combination of on-farm and off-farm sources of income. On-farm income is determined by farm costs and returns that vary from year to year, and in any given year a majority of farm households report negative farm income. Off-farm sources—including wages, nonfarm business earnings, dividends, and transfers—are the main contributor to household income for most farm households. Because households operating commercial farms rely mostly on on-farm sources of income, they experience the largest shocks in household income when farm sector income rises or falls. This chart uses data from the new USDA, Economic Research Service and USDA, National Agricultural Statistics Service’s Agricultural Resource Management Survey (ARMS) webtool, released in December 2022, as shown through the ARMS Farm Financial and Crop Production Practices data product.

Monday, January 9, 2023

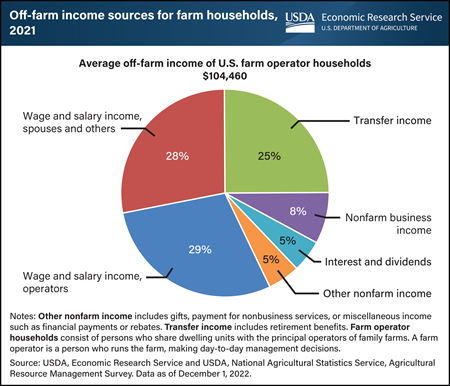

For most U.S. farm households, off-farm sources are the main sources of income. In 2021, earnings from farming accounted for an estimated 23 percent of the average income of farm operator households. Of the off-farm income, 57 percent came from wages earned by farm operators and their spouses. The rest is income from other nonfarm businesses, interest and dividends, transfers, and other miscellaneous nonfarm sources (43 percent). Transfer income, such as retirement benefits, makes up 25 percent of off-farm income, with most coming from public sources. For farm households, off-farm income can help manage risks associated with farm income variability. This chart appears in the USDA, Economic Research Service’s topic page Farm Household Well-being, reflecting data released December 1, 2022.

Thursday, December 1, 2022

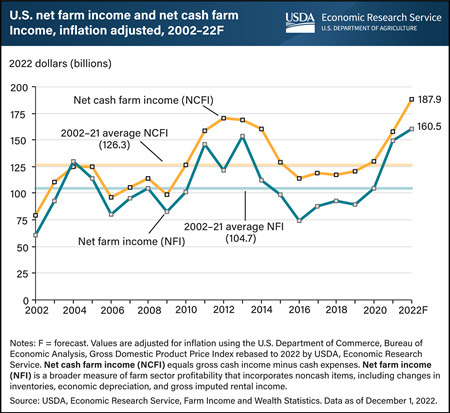

USDA’s Economic Research Service forecasts inflation-adjusted U.S. net cash farm income (NCFI)—gross cash income minus cash expenses—to increase by $30.1 billion (19.1 percent) to $187.9 billion in 2022. This total would be the highest on record for the inflation-adjusted data series. U.S. net farm income (NFI) is forecast to increase by $10.7 billion (7.2 percent) to $160.5 billion in 2022, its highest level since 1973 after adjusting for inflation. Net farm income is a broader measure of farm sector profitability that incorporates noncash items such as changes in inventories, economic depreciation, and gross imputed rental income. Cash receipts from farm commodities drive these income increases, with a projected increase of $78.5 billion (17.0 percent) to $541.5 billion, their highest level on record. In addition, total commodity insurance indemnities paid to farmers are expected to rise by $8.3 billion (70.1 percent) to $20.2 billion, also a record. Production expenses are forecast to increase by $46.6 billion (11.8 percent) to $442.0 billion in 2022, offsetting some income growth. Additionally, direct Government payments to farmers are projected to decrease by $11.0 billion (40.0 percent) from 2021 to $16.5 billion in 2022, mainly because of lower anticipated USDA and non-USDA payments for Coronavirus (COVID-19) pandemic assistance. Find additional information and analysis on the ERS topic page for Farm Sector Income and Finances, reflecting data released on December 1, 2022.

Thursday, October 13, 2022

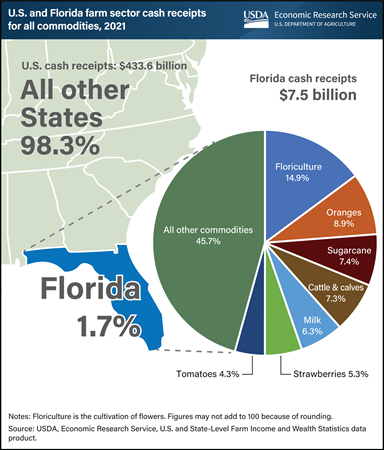

USDA, Economic Research Service (ERS) annually estimates the previous year’s farm sector cash receipts—the cash income received from agricultural commodity sales. This data includes State-level estimates, which offer background information about States subject to unexpected events that affect the agricultural sector, such as Hurricane Ian, which swept across Florida and surrounding States in late September 2022. In 2021, commodities produced in Florida contributed about $7.5 billion (1.7 percent) of the $434 billion in total U.S. cash receipts. Floriculture, the cultivation of flowers, accounted for the largest share of Florida’s cash receipts. Valued at $1.1 billion (14.9 percent of the State’s total), floriculture receipts for Florida were higher than for any other State in 2021. The next largest commodities in Florida in terms of cash receipts were oranges ($670 million), sugarcane ($553 million), cattle and calves ($546 million), milk ($470 million), strawberries ($399 million) and tomatoes ($324 million). Certain Florida crops accounted for large percentages of U.S. cash receipts in 2021, such as sugarcane with 51 percent and oranges with 42 percent, while bell peppers and grapefruit accounted for roughly a third of U.S. production. In addition to floriculture, Florida led the nation in cash receipts for sugarcane, cabbage, cucumbers, watermelon, sweet corn, and snap beans. This chart uses data from the ERS U.S. and State-Level Farm Income and Wealth Statistics data product, updated in September 2022.

Thursday, September 1, 2022

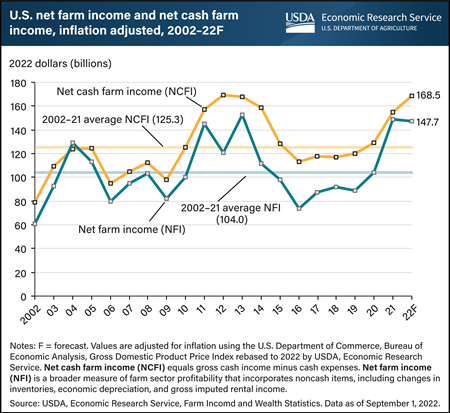

USDA’s Economic Research Service forecasts inflation-adjusted U.S. net cash farm income (NCFI)—gross cash income minus cash expenses—to increase by $13.5 billion (8.7 percent) from 2021 to $168.5 billion in 2022. This is the highest level since 2012. In comparison, U.S. net farm income (NFI) is forecast to fall by $0.9 billion (0.6 percent) from 2021 to $147.7 billion in 2022. This comes after NFI increased by $44.4 billion (42.6 percent) in 2021 to the highest mark since 2013. NFI is a broader measure of farm sector profitability that incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income. Both cash receipts and expenses are forecast to increase. Cash receipts for farm commodities are projected to rise by $66.3 billion (14.4 percent) from the previous year to $525.3 billion in 2022, their highest level on record. At the same time, production expenses are expected to increase by $44.4 billion (11.3 percent) to $437.3 billion in 2022, offsetting some of this income growth. Additionally, direct Government payments to farmers are projected to fall by $14.3 billion (52.5 percent) from 2021 to $13.0 billion in 2022, primarily because of lower anticipated USDA and non-USDA payments for Coronavirus (COVID-19) pandemic assistance. Find additional information and analysis on the USDA, Economic Research Service’s topic page for Farm Sector Income and Finances, reflecting data released on September 1, 2022.

Monday, August 29, 2022

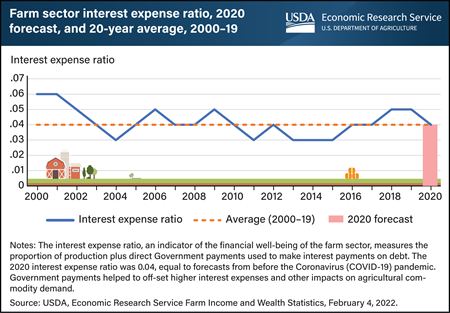

The interest expense ratio is one indicator of the financial well-being of the farm sector. For 2020, the ratio was 0.04, remaining in line with the long-term trend and initial forecasts despite the impact of the Coronavirus (COVID-19) pandemic on reduced demand for agricultural commodities. The interest expense ratio is calculated by dividing interest expenses by the sum of the value of production and Government payments for a given year. Interest expenses are the costs incurred by farm operations when debt is used to finance farm activities. A lower interest expense ratio is preferable as it indicates that farmers are spending a smaller share of total revenue on interest expenses. A USDA forecast in February 2020 predicted interest expenses for 2020 at $18.0 billion, with a predicted interest expense ratio of 0.04. By February 2022, interest expenses for 2020 were estimated to be slightly higher than predicted at $19.4 billion. The February 2022 estimates also showed that while the value of production was lower than initially forecast, Government payments were higher. This resulted in an upward revision to the sum of the value of production and Government payments, offsetting the upward revision to interest expenses. That meant the interest expense ratio for 2020 remained consistent with the predicted value as well as the 20-year average of 0.04. The interest expense ratio was highest at 0.06 in 2000 and trended downward to a low of 0.03 multiple times from 2000 to 2020. This chart is drawn from data in the USDA, Economic Research Service COVID-19 Working Paper: Farm Sector Financial Ratios: Pre-COVID Forecasts and Pandemic Performance for 2020, published August 24, 2022.