ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, April 24, 2024

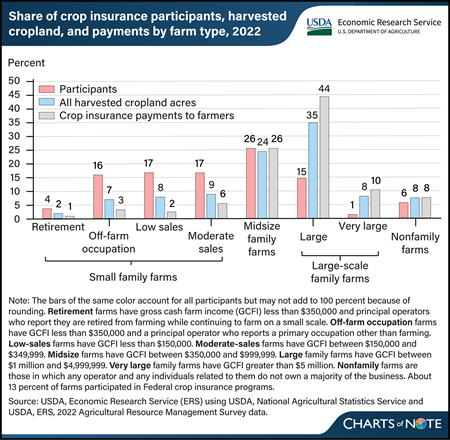

About 13 percent of U.S. farms participated in Federal crop insurance programs in 2022, with the highest share of participants coming from small family farms. The four types of small family farms (retirement, off-farm occupation, low sales, and moderate sales) accounted for 54 percent of the participants in Federal crop insurance programs and received 12 percent of the insurance payments. Small family farms harvested 26 percent of all cropland acres. On the other hand, midsize and large-scale family farm operators accounted for a slightly lower proportion of Federal crop insurance participants (42 percent) but harvested a majority of the U.S. cropland acres (67 percent) and received 80 percent of payments from Federal crop insurance. Larger farms like these account for 46 percent of agricultural acres operated in 2022. Researchers with USDA, Economic Research Service examined survey data and found that participation rates varied widely across commodity production. In 2022, 62 percent of farms producing row crops (cotton, corn, soybeans, wheat, peanuts, rice, and sorghum) purchased Federal crop insurance, while 9 percent of farms growing specialty crops, such as fruits, vegetables, and nursery crops, did the same. This chart appears in America’s Farms and Ranches at a Glance, published December 2023.

Thursday, April 18, 2024

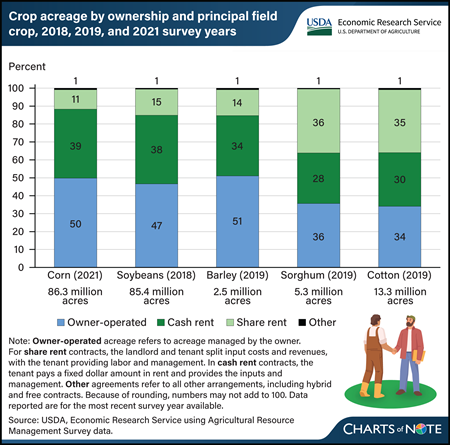

The proportion of farmland managed under a lease agreement and land that is managed by owner-operators varies across crops, according to data collected from Agricultural Resource Management Surveys (ARMS). Owner-operators farmed close to half of U.S. corn, soybean, and barley acres but roughly a third of sorghum and cotton acres. While both cotton and sorghum acreage were roughly evenly split among owner-operated, cash-rent, and share-rent agreements, share-rented farmland had a lower proportion of corn, soybean, and barley acreage. Cash contracts are those in which the tenant pays a fixed rent and provides both inputs and management, and share-based contracts are those in which the landlord and tenant split costs and revenues. Other agreements, such as hybrid arrangements, make up less than 1 percent of crops based on planted acreage in the survey year. Researchers with USDA, Economic Research Service (ERS) examined information supplied by farmers from ARMS across various crops to find that the overall trend in the farmland market favors cash-rented farmland. More information on land leasing can be found in the ERS report Farmland Rental and Conservation Practice Adoption, published in March 2024.

Wednesday, April 3, 2024

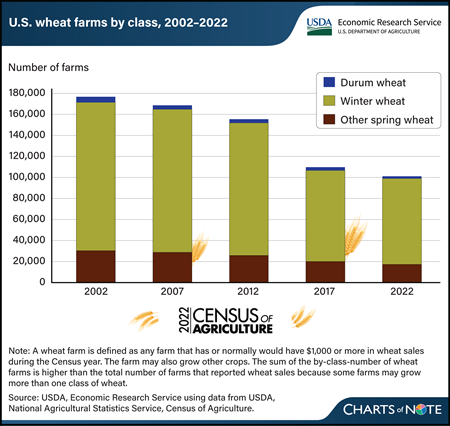

The number of farms producing wheat for grain declined substantially from 2002 to 2022, according to new data from USDA, National Agricultural Statistics Service (NASS) 2022 Census of Agriculture. In 2022, the number of U.S. farms reporting wheat production was 97,014, a 43-percent decrease compared with the 2002 census, when 169,528 farms reported wheat production. The reduction in the number of farms producing wheat was spread across all classes of wheat. The number of farms producing winter wheat—84 percent of U.S. wheat farms in 2022—dropped by nearly 60,000, or 42 percent, between the 2002 and 2022 censuses. Farms producing durum wheat decreased by the largest percentage, down 59 percent from 2002. The number of farms growing spring wheat (other than durum) declined 43 percent from 2002 to 2022. During the same time period, total volume of U.S. wheat produced trended down slightly, largely because of less acreage being harvested. As the profitability of other crops rises, wheat is increasingly planted in rotation with more profitable corn or soybean crops. Among major wheat-producing States, Kansas, which accounts for 15 percent of all U.S. wheat farms, saw a reduction of 9,716 farms—a 40-percent decrease from 2002 to 2022. Texas and Oklahoma reported decreases of 54 and 47 percent, respectively, between 2002 and 2022. Together, these 3 States harvested nearly 32 of percent of the volume of winter wheat produced in 2022, according to data reported by NASS in the Small Grains Annual report. For more details on the 2022 Census of Agriculture, see the NASS Census of Agriculture website. Information on trends in the wheat production sector can be found in the special article, “U.S. Census of Agriculture: Highlighting Changing Trends in Wheat Farming” in USDA, Economic Research Service’s March 2024 Wheat Outlook.

Tuesday, March 26, 2024

Most farms operated only by women are retirement, off-farm occupation, or low-sales farms, according to findings by researchers with USDA, Economic Research Service (ERS). After examining 2017–20 data from the Agricultural Resource Management Survey (ARMS), researchers found that a greater share of farms operated only by women were retirement farms compared with the shares operated only by men or by men and women jointly, 24 versus 11 and 9 percent, respectively. Retirement farms generate annual gross cash farm income (GCFI) of less than $350,000 with principal operators who report they are retired from farming. Three percent of men-only operations were large family farms (with GCFI of $1 million to $4,999,999), compared to 2 and 0.2 percent of farms operated jointly by men and women, or only women respectively. The ARMS data also show that 7 percent of all farms were operated entirely by women from 2017 to 2020, and 44 percent of all farms were operated jointly by men and women, so 51 percent of all farms had at least one woman operator. For more information, see the ERS report An Overview of Farms Operated by Socially Disadvantaged, Women, and Limited Resource Farmers and Ranchers in the United States, published February 2024.

Thursday, March 21, 2024

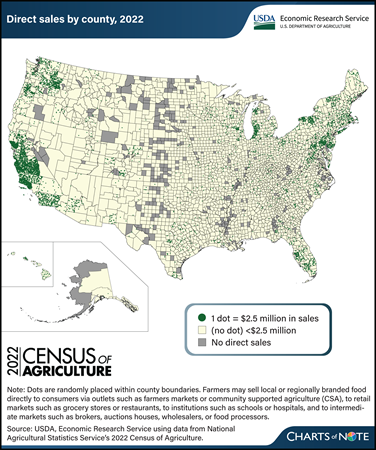

Errata: On March 25, 2024, the map legend was revised to show that areas in yellow without dots represent direct sales of less than $2.5 million.

The Census of Agriculture reports data on local or regionally branded food sold directly to retail outlets, institutions (like schools), intermediate markets (like food hubs), and consumers (via outlets such as farmers markets). These local-food sales channels provide opportunities for farmers to explore revenue streams beyond traditional wholesale markets. Data from the 2022 Census of Agriculture, released in February 2024, show producers sold $17.5 billion in food, including both unprocessed and processed (value-added) food, through direct marketing channels. That was a 25-percent increase (after adjusting for inflation) since the 2017 Census of Agriculture and an annual real growth rate of 4.6 percent. The increase from 2017 was driven by a surge in food sold directly to retail outlets, institutions, and intermediate markets. From 2017 to 2022, sales through these three direct-sales channels increased 33.2 percent (adjusted for inflation) to $14.2 billion, and the number of operations selling through them more than doubled to 60,332. Direct-to-consumer sales through farmers markets, on-farm stores or stands, u-pick operations, community supported agriculture (CSA), and online marketplaces remained consistent with those in 2017 after adjusting for inflation. However, the number of farm operations (116,617) selling directly to consumers in 2022 was 10.3 percent less than in 2017. As was the case in 2017, direct food sales continue to be concentrated along the West Coast, particularly in California (37.7 percent of direct sales), and in the Northeast. Most counties with high volumes of direct sales are in or around metropolitan areas, whose populations provide a large customer base for producers. This chart is based on data obtained from USDA, National Agricultural Statistics Service’s 2022 Census of Agriculture. For more on direct food sales, see the USDA, Economic Research Service report Marketing Practices and Financial Performance of Local Food Producers: A Comparison of Beginning and Experienced Farmers, published in 2021.

Thursday, March 14, 2024

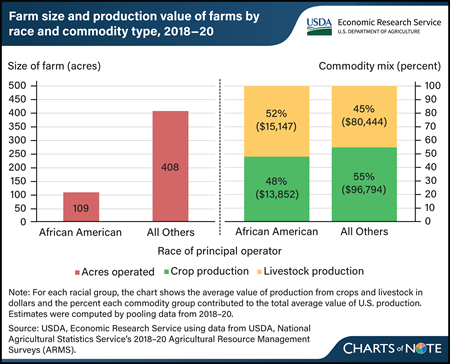

Researchers at USDA’s Economic Research Service (ERS) evaluated characteristics of farms operated by African Americans using data from the 2018–20 Agricultural Resource Management Surveys (ARMS). The researchers observed that farm size and commodities produced differed across race. During 2018–20, the average African-American-operated farm was less than one-third the size of other farms. African-American farms operated an average of 109 acres compared with an average of 408 acres for all other farms. The choice of commodities produced also varied by race. About 83 percent of African-American farms were livestock farms, with livestock production making up more than half of their production value. In contrast, about 66 percent of other farms were livestock farms. The differences in farm size and commodities produced were found to contribute to differences in farm production values. On average, total value of production was about $29,000 for African-American farms, while that of farms with principal operators of other races was about $177,000. Together, these factors contributed to the average African-American farm earning lower net farm income than other farms. This article is drawn from the ERS Amber Waves article Farm Size, Specialization Are Among Factors Influencing Financial Performance of African-American Farms in United States, published in February 2024.

Friday, March 8, 2024

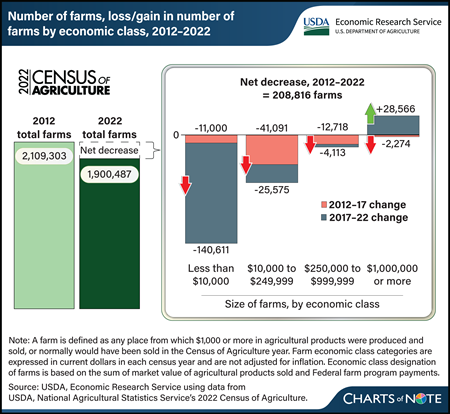

In 2022, farms in the United States numbered 1,900,487, down from 2,109,303 in 2012, according to data from the 2022 USDA Census of Agriculture released in February 2024. That represented a 10-percent (208,816 farms) decline from 2012 to 2022. The Census of Agriculture is a complete count of U.S. farms conducted every 5 years by USDA, National Agricultural Statistics Service. As such, it provides a picture of how different-sized farms, categorized by economic class, changed. In looking at the last two 5-year survey periods, the number of farms decreased in all four farm size categories from 2012 to 2017, represented by the red part of bars in the chart. From 2017 to 2022 (represented by gray part of bars), there was an overall decrease in the number of farms, with a drop in the smallest three economic class categories and an increase in the number of farms with annual revenue of $1 million or more. Farms with annual revenue of less than $10,000 dropped the largest in number within the decade, declining by 151,611 farms, or 13 percent. On the other hand, large farms of $1 million or more in revenue increased by 32 percent, that is, from 81,660 farms in 2012 to 107,952 farms in 2022. The number of farms with $10,000 to $249,999 in revenue declined by 66,666 (a 9-percent decrease) from 2012 to 2022, and farms with revenue of $250,000 to $999,999 declined by 16,831 (a 10-percent decrease). To explore the 2022 Census of Agriculture, see the NASS Census of Agriculture website. For more information on farm structure and its relationship with agriculture, as well as other statistics on the financial performance of farms and ranches, see USDA, Economic Research Service’s report America’s Farms and Ranches at a Glance: 2023 Edition, published in December 2023, which draws on data from the NASS Agricultural Resources Management Survey (ARMS) of farm operations in 2022.

Tuesday, March 5, 2024

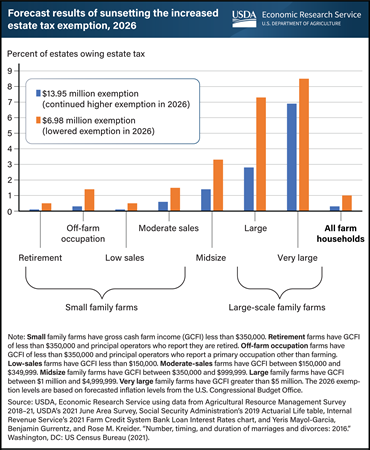

The 2017 Tax Cuts and Jobs Act (TCJA) made significant changes to Federal individual income and estate tax policies, though some policies were temporary. In 2018, the TCJA increased the estate tax exemption amount from $5.49 million to $11.18 million. This increase is set to expire at the end of 2025. The exclusion amount will revert in 2026 to the pre-TCJA level, adjusted for inflation, of $6.98 million per deceased person. For married couples, a portability provision in estate tax law allows the surviving spouse to use any unused portion of the deceased spouse’s exemption. Researchers with the USDA, Economic Research Service (ERS) estimated the expiring increased exemption would be $13.95 million per person at the time of the expiration. Lowering the level of the estate tax exemption in 2026 is estimated to increase the percent of farm operator estates taxed from 0.3 to 1.0. This means that of the estimated 40,883 estates that are expected to be created in 2026, the expiration of the increased exemption would raise the number of estates that owe tax from 120 to 424. Large farms (gross cash farm income between $1 million and $5 million) would experience the largest increase in the share of estates owing estate tax, increasing from 2.8 to 7.3 percent. Total Federal estate taxes for farm estates would be expected to more than double to $1.2 billion if the provision were allowed to expire. The information in this chart appears in the ERS publication An Analysis of the Effect of Sunsetting Tax Provisions for Family Farm Households published in February 2024.

Wednesday, February 28, 2024

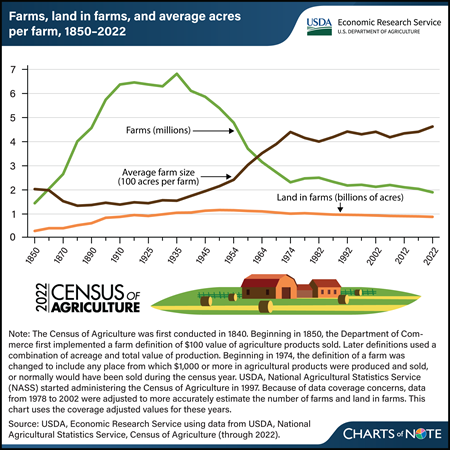

The number of farms in the United States has fallen below 2 million for the first time since before the Civil War, according to the recently released 2022 Census of Agriculture. In 2022, there were 1,900,487 farms in the country, a 7-percent decline from the level reported in the 2017 Census. A farm is defined as an establishment that produced and sold, or would have sold in normal conditions, at least $1,000 in agricultural production in a year. The Census of Agriculture, conducted every 5 years by USDA, National Agricultural Statistics Service (NASS), includes producer responses to questions about their farming operations. The latest Census also reported that the total U.S. land in farms declined 2.2 percent to 880 million acres in 2022. This decline, when combined with the higher proportional decline in the number of farms, meant that the average farm size increased by 5 percent to 463 acres per farm. For more details from the 2022 Census of Agriculture, see the NASS Census of Agriculture website. For more information on farm structure and its relationship with agriculture, as well as other statistics on the financial performance of farms and ranches, see USDA, Economic Research Service’s recent report America’s Farms and Ranches at a Glance: 2023 Edition, published in December 2023, which draws on data from the NASS Agricultural Resources Management Survey of farm operations in 2022.

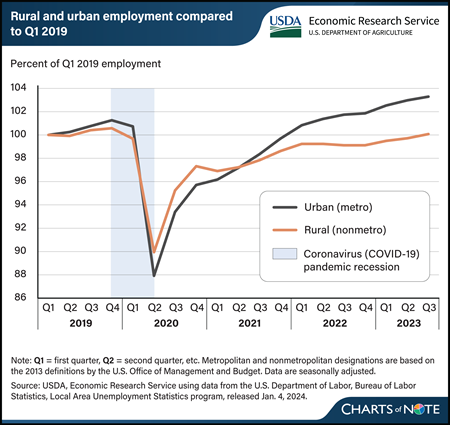

Wednesday, February 21, 2024

The Coronavirus (COVID-19) pandemic affected employment in rural and urban areas differently. Before the pandemic, employment growth was higher and unemployment rates were slightly lower in urban areas. However, these trends reversed during the pandemic. In the second quarter of 2020, urban employment fell to 88 percent of prepandemic (Q1 2019) employment levels, while rural employment fell to 90 percent of prepandemic levels. Unemployment during the pandemic reached a high of 13.3 percent in urban areas and 11.4 percent in rural areas, compared with prepandemic rates of 3.8 and 4.2 percent, respectively. Rural and urban employment grew quickly in the third and fourth quarters of 2020 as many sectors of the economy reopened. Employment growth slowed in 2021, but more in rural areas than in urban. Urban employment recovered to prepandemic levels by the first quarter of 2022, and the urban unemployment rate dropped below the rural rate once again in the second quarter of 2022. Meanwhile, the slow employment growth rate in rural areas in 2022 (0.5 percent) was similar to rates in the years between the Great Recession of 2008 and the COVID-19 pandemic. From 2010 to 2019, the annual average employment growth rate in rural areas was 0.4 percent compared with 1.6 percent in urban areas. Rural employment recovered to prepandemic levels in the third quarter of 2023, more than one year after urban employment did. Rural unemployment rates in 2023 were at their lowest point (3.6 percent) since before 1990. This figure updates data in the USDA, Economic Research Service report Rural America at a Glance, published in November 2023.

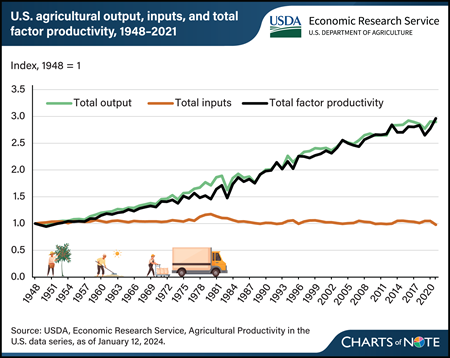

Tuesday, February 13, 2024

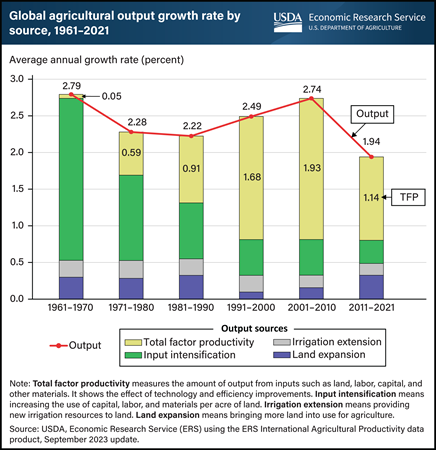

Technological developments in agriculture have enabled continued output growth without requiring much additional inputs. Innovations in animal and crop genetics, chemicals, equipment, and farm organization have made it possible for total agricultural output to nearly triple between 1948 and 2021. During that period, the amount of inputs used in farming declined slightly over time, meaning that the growth in agricultural output over the long term has depended on increases in total factor productivity (TFP). TFP measures the amount of agricultural output produced from the combined inputs (land, labor, capital, and intermediate inputs) employed in farm production. Therefore, growth in TFP indicates positive changes in the efficiency with which inputs are transformed into outputs. It can also be seen as an indicator of technical change. In the short term, total output growth and estimated TFP growth can be affected by random events, such as adverse weather. In the most recent TFP calculation period spanning 2020–21, agricultural output grew, which was due entirely to TFP growth, even as the amount of inputs used in farming fell. This figure appears in the Agricultural Productivity in the U.S.: Summary of Recent Findings updated in January 2024.

Monday, February 12, 2024

The USDA’s Economic Research Service (ERS) routinely forecasts U.S. farm sector financial health. For each calendar year, there are four forecasts of profitability measures before ERS releases an official estimate. The first forecast for each year occurs in February and is partially based on historical data and trends since planting intentions of crops such as corn and soybeans are unknown. It also incorporates early commodity price and production projections from USDA and projections by other entities, such as energy price forecasts by the Energy Information Administration. In 2022, for instance, the initial forecast of 2022 farm income occurred on February 4, 2022, and the forecast projected net farm income of $113.7 billion. The second forecast occurs in late August/early September and is based on observed data from the production cycle, such as input and output price information and planting areas with related output projections. The second forecast also includes revised projections of direct Government payments and insurance indemnities and projections from USDA’s World Agricultural Supply and Demand Estimates (WASDE) report. For calendar year 2022, Forecast 2 occurred on September 1, 2022, and the forecast projected net farm income of $147.7 billion. The third data release, in late November/early December, further refines the forecast based on the most recent data and projections, including additional administrative data on direct Government payments. The last forecast is made in February of the following year. It is still a forecast because the data are still being collected and refined. The first official estimate of 2022 farm income (of $183.0 billion) was published on August 31, 2023, and completed a 19-month cycle. That data release incorporated the first information available from the USDA’s most recent annual Agricultural Resource Management Survey (ARMS), which improves analysis of production expenses. State-level farm income data for the calendar year are released for the first time as a part of the estimates. Adjustments to the U.S. and State-level estimates may be made in future data releases, but they are typically small. On February 7, 2024, ERS released the first forecast of 2024 and the last forecast of 2023 U.S. farm sector financial health. The first estimates of calendar year 2023 will be published on September 5, 2024, together with Forecast 2 for calendar year 2024. A version of this chart appears in the ERS report, The Evolution of U.S. Farm Sector Profitability Forecasts in 2020.

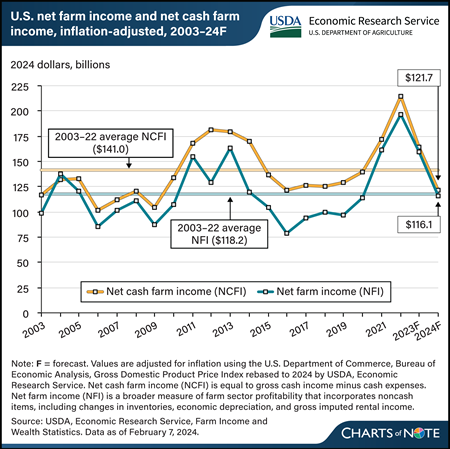

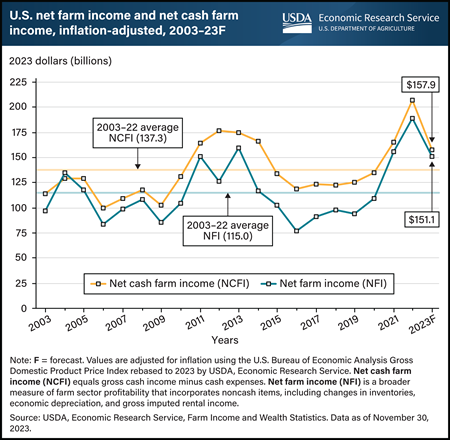

Wednesday, February 7, 2024

USDA’s Economic Research Service (ERS) forecasts that U.S. net cash farm income (NCFI), defined as gross cash income minus cash expenses, will decrease by $42.2 billion (25.8 percent) to $121.7 billion in 2024 in inflation-adjusted dollars. This is after NCFI decreased in 2023 by a forecast $50.2 billion to $163.9 billion. Net farm income (NFI) is forecast to decrease by $43.1 billion (27.1 percent) to $116.1 billion from 2023 to 2024. NFI is a broader measure of farm sector profitability that incorporates noncash items, including changes in inventories, economic depreciation, and gross imputed rental income. The forecasted 2024 NFI decrease follows a decrease of $37.2 billion from 2022 to $159.2 billion in 2023. These decreases are from record levels in 2022, and if forecasts are realized, NCFI and NFI would fall below their respective 2003–22 averages in 2024. Underlying these forecasts, cash receipts for farm commodities are projected to fall by $32.2 billion (6.2 percent) to $485.5 billion in 2024. During the same period, production expenses are expected to increase by $7.2 billion (1.6 percent) to $455.1 billion in 2024. Also, total commodity insurance indemnity payments are forecast to fall by $1.5 billion (6.6 percent) in 2024, and direct Government payments to farmers are projected to fall by $2.2 billion (17.7 percent) from 2023 levels to $10.2 billion in 2024. Find additional information and analysis on the USDA, ERS topic page for Farm Sector Income and Finances, reflecting data released on February 7, 2024.

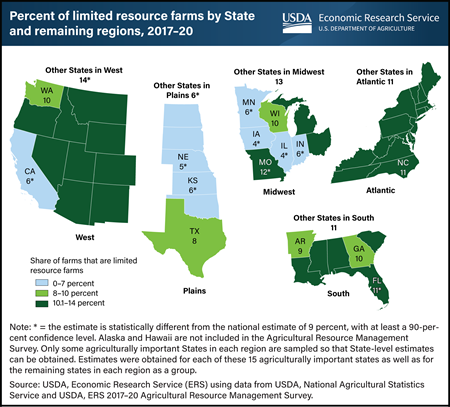

Friday, February 2, 2024

USDA identifies farmers and ranchers as limited resource (LR) producers as those who, for two consecutive years, operate a farm with gross farm sales less than $180,300 (in 2020 dollars) and have total household income either below the Federal poverty level for a family of four or less than half of the median household income in the county where they live. Between 2017 and 2020, 9.3 percent of all U.S. farms had an LR principal operator, according to the Agricultural Resource Management Survey (ARMS). Of the remaining farms, 76.3 percent had farm sales low enough to meet LR status, but did not meet other requirements, while 14.3 percent had gross farm sales above the LR threshold. The ARMS data also reveal that the share of farms that were LR varied geographically, with lower proportions in the Plains region and higher proportions in the Atlantic and West regions. There were also within-region differences in the share of farms that were LR farms, such as the Midwest, where 4 percent of farms in Iowa and Illinois were LR while Missouri had roughly 12 percent. This highlights differences in the scale of production, as well as differences in off-farm income and county median incomes. ARMS is the only nationally representative survey that collects the information needed to determine whether the principal operator on a farm meets the LR criteria. This chart is found in the USDA, Economic Research Service’s report An Overview of Farms Operated by Socially Disadvantaged, Women, and Limited Resource Farmers and Ranchers in the United States, published in February 2024.

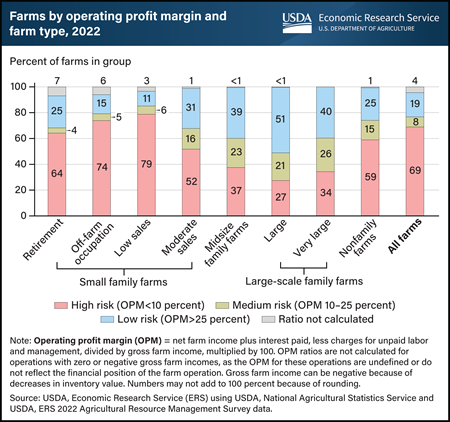

Tuesday, January 23, 2024

Small family farms were more likely to have greater financial vulnerability than other farms, according to data from the 2022 Agricultural Resource Management Survey (ARMS). Researchers with USDA, Economic Research Service (ERS) calculated the operating profit margin (OPM), one of many financial risk measures, by taking the ratio of profit to gross farm income to find that in 2022, between 52 and 79 percent of small family farms—depending on the farm type (retirement, off-farm occupation, low sales, moderate sales)—were at the high-risk level. If OPM is less than 10 percent, the operation is considered at high financial risk. When OPM is between 10 and 25 percent, the operation is considered at medium financial risk, and if OPM is above 25 percent, the operation is at low financial risk. A majority of small-scale family farms, which have a gross cash farm income (GCFI) of up to $350,000, earn most of their income from off-farm sources. For these farms, farm profitability is not necessarily essential to the survival of the household. Small family farms make up 88 percent of all farms but account for only 19 percent of the total value of production. Large family farms (GCFI of $1 million to $5 million) in 2022 were most likely to have low financial risk at 51 percent and least likely to be at high financial risk at 27 percent. Midsize farms (GCFI of $350,000 to $999,999) were also most likely to be in the low-risk zone at 39 percent and least likely to be in the medium-risk zone at 23 percent. This chart appears in the ERS report America’s Farms and Ranches at a Glance, published December 2023.

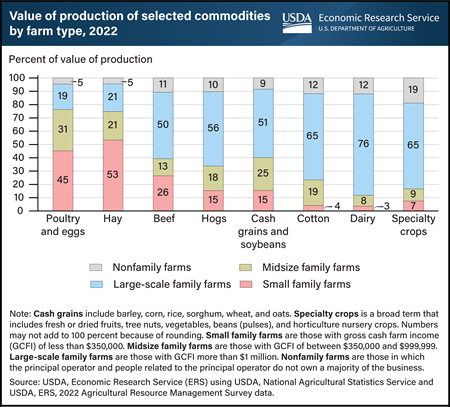

Wednesday, January 17, 2024

Large-scale family farms accounted for a majority of the value of commodity production in 2022, including cash grains and soybeans (51 percent), hogs (56 percent), cotton (65 percent), specialty crops (65 percent), and dairy (76 percent). On the other hand, small family farms accounted for 3 percent of the value of production for dairy, 4 percent for cotton, 7 percent for specialty crops, and 26 percent for beef, but they produced the majority of hay (53 percent) and 45 percent of poultry and eggs. The value of production by nonfamily farms ranged from 5 percent for both hay production and poultry and eggs production to 19 percent for specialty crop production. This chart uses data appearing in America’s Farms and Ranches at a Glance, published December 2023.

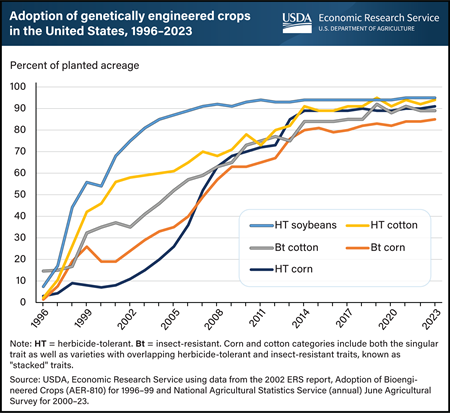

Tuesday, January 2, 2024

Genetically engineered (GE) seeds were commercially introduced in the United States for major field crops in 1996, with adoption rates increasing rapidly in the years that followed. The two main GE trait types are herbicide-tolerant (HT) and insect-resistant (Bt). These traits can be added individually to seeds as well as combined into a single seed, called stacked seed traits. USDA, Economic Research Service (ERS) reports information on GE crops in the data product Adoption of Genetically Engineered Crops in the U.S. These data show that by 2008, more than 50 percent of corn, cotton, and soybean acres were planted with at least one GE seed trait. Today, more than 90 percent of corn, cotton, and soybean acres are planted using at least one GE trait. Traits other than HT and Bt have been developed, such as resistance to viruses, fungi, and drought or enhanced protein, oil, or vitamin content. However, HT and Bt traits are the most used in U.S. crop production. While HT seeds also are widely used in alfalfa, canola, and sugar beet production, most GE acres are occupied by three major field crops: corn, cotton, and soybeans. This chart appears in the ERS topic page Biotechnology, published in October 2023.

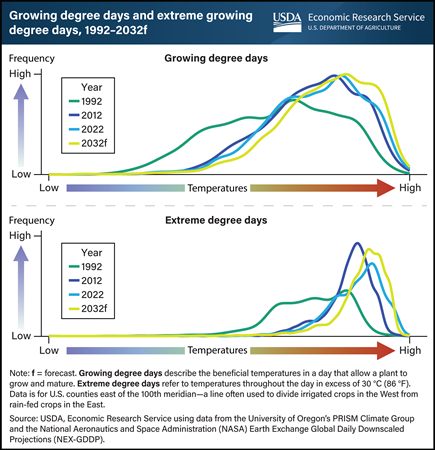

Tuesday, December 5, 2023

According to weather data from National Aeronautics and Space Administration (NASA), temperatures in the Corn Belt, a region spanning across Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Ohio, and Wisconsin, have trended higher in recent years and are projected to continue to rise through the end of this century. Two measures can be used to capture how rising temperatures affect crops’ growth—growing degree days and extreme degree days. Growing degree days describe the beneficial temperatures in a day that allow a plant to grow and mature. With rising temperatures, the growing degree days for corn and soybeans increase. A crop’s exposure to added growing degree days is not necessarily harmful; after all, crops need heat and precipitation to grow. However, extreme degree days, which refer to temperatures throughout the day in excess of 30 °C (86 °F), cause heat stress that is harmful for a plant. Each decade since 1992, both growing degree days and extreme degree days have steadily increased with rising temperatures in the Corn Belt, where about 80 percent of all U.S. corn and soybeans are grown. In the decade leading to 2032, both measures are projected to continue to increase. This chart first appeared in the USDA, Economic Research Service report, Estimating Market Implications From Corn and Soybean Yields Under Climate Change in the United States, published in October 2023.

Thursday, November 30, 2023

The USDA, Economic Research Service (ERS) forecasts inflation-adjusted U.S. net cash farm income (NCFI) to decrease by $49.2 billion (23.8 percent) from 2022 to $157.9 billion in 2023. Similarly, U.S. net farm income (NFI) is forecast to fall by $37.9 billion (20.0 percent) from 2022 to $151.1 billion in 2023. NCFI is calculated as gross cash income minus cash expenses. NFI is a broader measure of farm sector profitability that incorporates noncash items including changes in inventories, economic depreciation, and gross imputed rental income. The projected decreases in 2023 come after both NCFI and NFI reached all-time highs in 2022 of $207.1 billion and $188.9 billion, respectively. For 2023, cash receipts for farm commodities are projected to fall by $43.0 billion (7.8 percent) from 2022 to $509.6 billion in 2023. This includes forecasted declines in milk, corn, and broiler receipts. Total production expenses are expected to remain relatively stable in 2022, increasing by $0.6 billion (0.1 percent) to $443.4 billion in 2023. However, individual expense items are expected to vary, with interest expenses forecast to increase in 2023, while spending on fertilizer/lime/soil conditioner and feed is expected to decrease. Finally, direct Government payments to farmers are forecast to fall $4.0 billion (24.8 percent) lower in 2023 to $12.1 billion because of lower supplemental and ad hoc disaster assistance. Find additional information and analysis on the ERS topic page Highlights from the Farm Income Forecast, reflecting data released on November 30, 2023.

Monday, November 27, 2023

In the last decade, world agricultural output grew at an average annual rate of 1.94 percent per year, far slower than the 2.74-percent output growth rate over the previous decade and below the average annual rate of 2.3 percent over the last six decades (1961–2021). The slowdown in agricultural growth was primarily tied to a slowing rate of growth in agricultural total factor productivity (TFP), which fell to 1.14 percent per year in 2011–2021 (compared with 1.93 percent per year the previous decade). TFP measures the amount of agricultural output produced from the aggregated inputs used in the production process (land, labor, capital, and material resources). The figure shows four major sources of overall growth: bringing more land into production (holding yields fixed); extending irrigation to land; intensifying the use of capital, labor, and material inputs per unit of land; and improving TFP, which reflects the rate of technological and efficiency improvements of inputs. This data can be found in the ERS International Agricultural Productivity data product, updated in September 2023.