ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, April 17, 2024

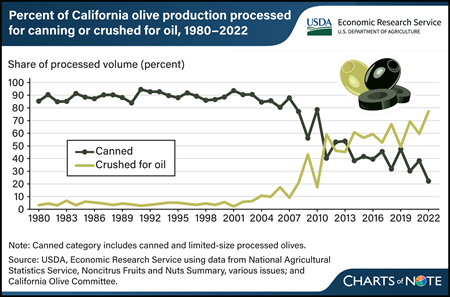

The turn of the century marked a shift in California’s olive industry. Historically, the State’s olive industry—which accounts for about 84 percent of olive acreage in the United States—was synonymous with canned olive production. Between 1980 and 2000, about 90 percent of California’s production was used for canned olives, most of which were of the black-ripe variety. California black-ripe olives are harvested green, before full maturity, and turn black from oxidation during processing. These shiny black-ripe olives are commonly sold as whole pitted or sliced canned products at retail or food service, where they often are used as pizza or salad toppings. Since the mid-2000s, the share of California’s olive production used to make olive oil has grown rapidly, from 10 percent in 2005 to more than 75 percent in 2022. This shift has been driven by increases in labor costs and import competition, as well as technological advancements that have made harvesting new olive oil-type cultivars comparatively quicker and less expensive. California olive oil production rose from 2 million pounds in 2006 to an average of 21 million pounds in 2021–23. Despite this increase in U.S. olive oil production, imports still supply more than 98 percent of the domestic consumption. This chart is based on the USDA, Economic Research Service Fruit and Tree Nuts Outlook Report, released March 2024.

Wednesday, April 3, 2024

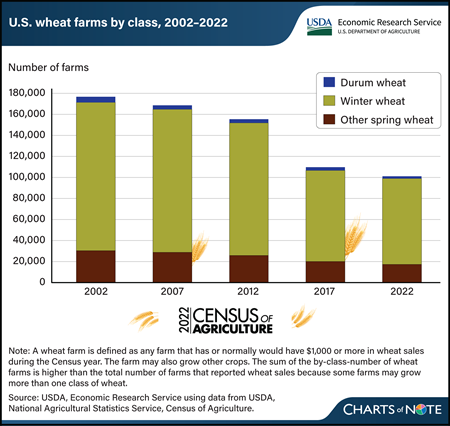

The number of farms producing wheat for grain declined substantially from 2002 to 2022, according to new data from USDA, National Agricultural Statistics Service (NASS) 2022 Census of Agriculture. In 2022, the number of U.S. farms reporting wheat production was 97,014, a 43-percent decrease compared with the 2002 census, when 169,528 farms reported wheat production. The reduction in the number of farms producing wheat was spread across all classes of wheat. The number of farms producing winter wheat—84 percent of U.S. wheat farms in 2022—dropped by nearly 60,000, or 42 percent, between the 2002 and 2022 censuses. Farms producing durum wheat decreased by the largest percentage, down 59 percent from 2002. The number of farms growing spring wheat (other than durum) declined 43 percent from 2002 to 2022. During the same time period, total volume of U.S. wheat produced trended down slightly, largely because of less acreage being harvested. As the profitability of other crops rises, wheat is increasingly planted in rotation with more profitable corn or soybean crops. Among major wheat-producing States, Kansas, which accounts for 15 percent of all U.S. wheat farms, saw a reduction of 9,716 farms—a 40-percent decrease from 2002 to 2022. Texas and Oklahoma reported decreases of 54 and 47 percent, respectively, between 2002 and 2022. Together, these 3 States harvested nearly 32 of percent of the volume of winter wheat produced in 2022, according to data reported by NASS in the Small Grains Annual report. For more details on the 2022 Census of Agriculture, see the NASS Census of Agriculture website. Information on trends in the wheat production sector can be found in the special article, “U.S. Census of Agriculture: Highlighting Changing Trends in Wheat Farming” in USDA, Economic Research Service’s March 2024 Wheat Outlook.

Wednesday, March 27, 2024

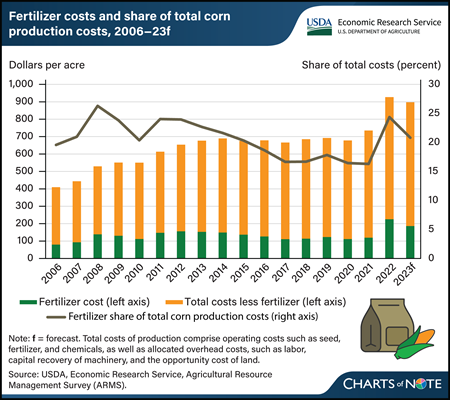

Fertilizer is one of several inputs corn growers buy in the months before April and May, when most U.S. corn acres are planted. Historically, fertilizer is typically the largest variable expense associated with corn production. Every May, USDA’s Economic Research Service (ERS) reports production costs, including fertilizer, for corn and other major commodities in the Commodity Costs and Returns data product. Although fertilizer costs have varied over time, the average cost of fertilizer per acre from 2006 to 2021 was around $125, not adjusting for inflation. Costs jumped to an average of $225.78 per acre in 2022, and then fell to an estimated $186.73 in 2023. This represents an 89-percent increase from 2021 to 2022 followed by a decrease of 17 percent from 2022 to 2023. In addition to fertilizer expenses, other costs of production reported in the data include operating costs, such as seed, fuel, and chemicals, as well as allocated overhead costs, such as labor, capital recovery of machinery, and the opportunity cost of land—a category that reflects rent or income that might have been earned from renting out the land when the land is owned. Fertilizer costs accounted for about 22 percent of total corn production costs per acre from 2006 to 2016, then fell to historical lows averaging around 17 percent from 2017 to 2021. In 2022, price spikes resulted in fertilizer costs jumping to about 24 percent of total costs. While elevated, fertilizer expenses as a share of total costs remained lower in 2022 compared with 2008, when they were 26 percent of total costs. From 2022 to 2023, total corn production costs remained elevated compared with 2021 and before, even as fertilizer costs declined. Iowa prices published by USDA’s Agricultural Marketing Service for the most commonly used fertilizers anhydrous ammonia, urea, and liquid nitrogen (32 percent) show decreases from 2023 to 2024, with slight upticks in the second reporting period of February. Cost of production data for 2023 is set to be released on May 1, 2024. This chart is drawn from the ERS Commodity Costs and Returns data product.

Thursday, February 29, 2024

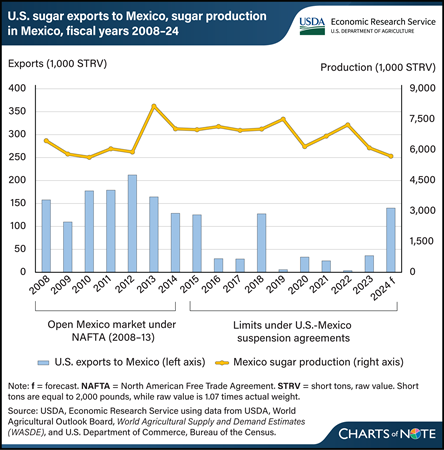

U.S. sugar exports for fiscal year 2024 are forecast to be the largest in 6 years, rising to an estimated 160,000 short tons, raw value (STRV) in the February 2024 World Agricultural Supply and Demand Estimates (WASDE) report. About 88 percent of that volume is expected to go to Mexico, where sugar production has fallen to a 15-year low. This would put U.S. sugar exports to Mexico on par with those during 2008–13, when the North American Free Trade Agreement (NAFTA) was active. Under NAFTA, Mexico could import U.S. sugar without tariffs or quotas, and U.S. exports averaged 167,000 STRV while the trade agreement was in effect. At the time, most of the sugar was imported by Mexico-based manufacturers participating in a promotion program commonly known as IMMEX. The program provided tax incentives if the companies used imported U.S. sugar in food products that would be re-exported within a certain amount of time. In 2014, in response to U.S. investigations into subsidies affecting sugar imports from Mexico, the two countries reached agreements that suspended the investigations and restricted the price and quantity of Mexico’s sugar exports to the United States. Mexico then declared that sugar imported from the United States would no longer qualify for duty-free treatment under IMMEX if that sugar was the beneficiary of the U.S. version of a re-export program. After that, U.S. sugar exports to Mexico fell to below 50,000 STRV, on average, each fiscal year. In the last 2 years, however, the United States increased its sugar exports to Mexico as U.S. domestic beet and cane sugar production rose and Mexico experienced back-to-back years of low production related to drought and reduced fertilizer use. This chart is based on information in the USDA, Economic Research Service’s Sugar and Sweeteners Outlook: February 2024.

Monday, February 5, 2024

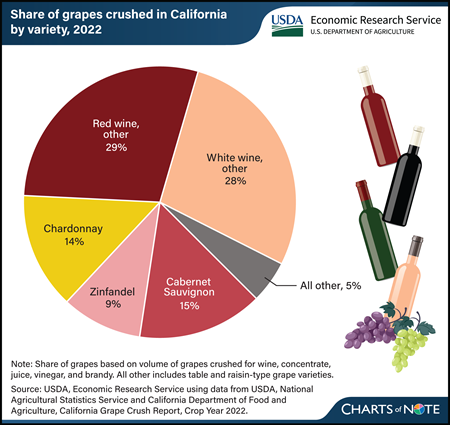

Red or white wine? Red wine varieties accounted for the largest share of grapes crushed in 2022 in California, the top wine grape-producing State. California growers raise more than 100 different varieties of wine grapes, according to the annual California Grape Crush Report. In 2022, Cabernet Sauvignon, a red varietal, accounted for California’s largest share of grapes crushed at 15 percent. White varietal, Chardonnay, came in second among wine grape varieties at 14 percent and was the top white wine variety by volume crushed. Other table grape and raisin-type grape varieties collectively represented 5 percent of the 3.7 million tons of grapes crushed for wine, concentrate, juice, vinegar, and brandy. California producers grow about 94 percent of the total U.S. grape crop, with nearly 70 percent of the State’s grape acreage dedicated to wine-type grapes. In the past few seasons, the value of the wine grape crop, both red and white, in California exceeded $3.6 billion. This chart is based on the USDA, Economic Research Service Fruit and Tree Nuts Outlook Report, released September 2023.

Tuesday, January 30, 2024

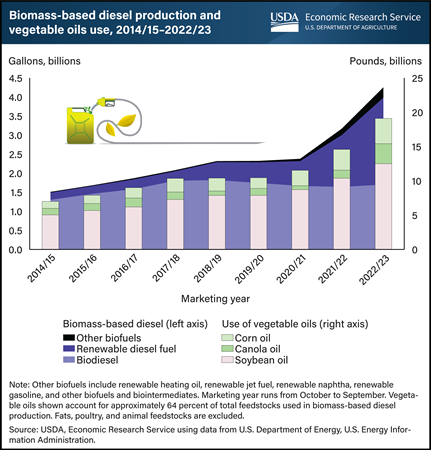

U.S. policies aimed at reducing greenhouse gas emissions have encouraged the production of biofuels—fuels derived from crops and animal fats. The policy framework has supported expansion in the production of biomass-based diesel. Biomass-based diesel includes biodiesel and renewable diesel, which now captures the second-largest share of biofuel production, after ethanol. With vegetable oils as the main feedstock in biomass-based diesel production, demand for major vegetable oils (soybean, corn, and canola) for the 2022/23 marketing year (October-September) reached a high of 19.1 billion pounds, up nearly 4.5 billion pounds from 2021/22. Use of soybean oil accounts for more than 40 percent of total feedstocks used for biomass-based diesel production. It increased from 5 billion pounds in 2014/15 to 12.5 billion pounds in 2022/23. Corn and canola oils also are increasingly used in biofuel production, though in lesser amounts. To date, U.S. production of soybean, corn, and canola oils has not been sufficient to cover the rise in domestic use. Rising domestic demand is supported by increasing imports, which now supply more than 29 percent of domestic vegetable oil consumption. This chart is drawn from USDA, Economic Research Service’s Oil Crops Outlook, December 2023.

Thursday, January 18, 2024

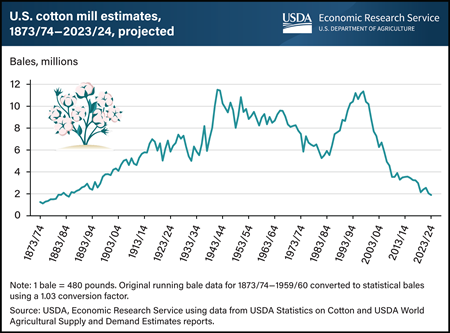

U.S. cotton mill use—the volume of raw cotton processed into textiles—is estimated at 1.9 million bales for the 2023/24 marketing year (August–July). If realized, cotton used by U.S. textile mills would fall to its lowest level in more than 100 years—since the 1884/85 marketing year, when approximately 1.7 million bales were used. U.S. cotton mill use has been mostly on a downward trend since the early 1940s when cotton use peaked during World War II. Soon after the end of the war, synthetic fibers were developed and began substituting for cotton. Use of synthetics in the production of textiles continued to expand and further reduced cotton mill use through the early 1980s when the downward trend was dramatically reversed. Promotion efforts and programs such as the Caribbean Basin Initiative and later the North American Free Trade Agreement (NAFTA) fostered U.S. cotton yarn and fabric production. U.S. cotton mill use rose, peaking again in the mid-1990s, before the World Trade Organization (WTO) Agreement on Textiles and Clothing began phasing out quotas on developed countries’ textile and apparel product imports. By the early 2000s, cotton mill use in several countries—particularly China—expanded to take advantage of the phased-out quotas on cotton product exports to the United States. Although U.S. raw cotton exports benefited from increased foreign mill demand, U.S. cotton mill use weakened, and the downward trend led to the near historically low 2023/24 U.S. cotton mill use projection. This information is drawn from the USDA, Economic Research Service’s December 2023 Cotton and Wool Outlook.

Wednesday, January 17, 2024

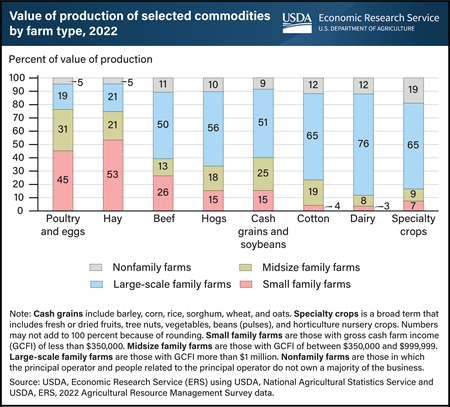

Large-scale family farms accounted for a majority of the value of commodity production in 2022, including cash grains and soybeans (51 percent), hogs (56 percent), cotton (65 percent), specialty crops (65 percent), and dairy (76 percent). On the other hand, small family farms accounted for 3 percent of the value of production for dairy, 4 percent for cotton, 7 percent for specialty crops, and 26 percent for beef, but they produced the majority of hay (53 percent) and 45 percent of poultry and eggs. The value of production by nonfamily farms ranged from 5 percent for both hay production and poultry and eggs production to 19 percent for specialty crop production. This chart uses data appearing in America’s Farms and Ranches at a Glance, published December 2023.

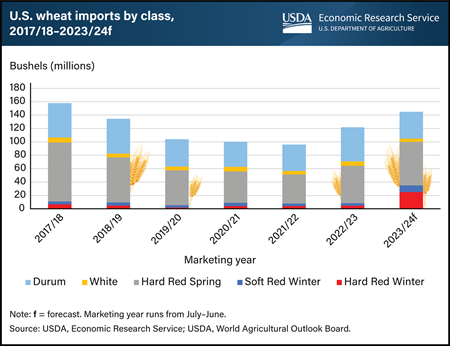

Wednesday, January 10, 2024

U.S. wheat imports are forecast at their highest in 6 years for the 2023/24 marketing year (July–June). Consecutive years of drought in key U.S. growing regions of hard red winter wheat, an ingredient used for making bread, Asian noodles, and flour, have tapered U.S. output, elevating domestic prices. Millers have sought less expensive sources, including competitively priced wheat from the European Union (EU). U.S. imports of hard red winter wheat, mostly from the EU, for 2023/24 are at 25 million bushels, a record high, and up from 5 million bushels from 2022/23. This trade flow is atypical. U.S. wheat imports are normally driven by hard red spring and durum wheat from neighboring Canada. In 2017/18, imports from Canada of both classes of wheat were elevated because of drought-related supply issues in the United States. While U.S. imports of hard red winter wheat are elevated in 2023/24, imports of soft red winter and white wheat are relatively close to normal levels. Related to tight supplies of this hard red winter wheat in 2023/24, U.S. exports of this class of wheat are forecast at their lowest level on record. This chart is drawn from the November 2023 Wheat Outlook, published by USDA, Economic Research Service.

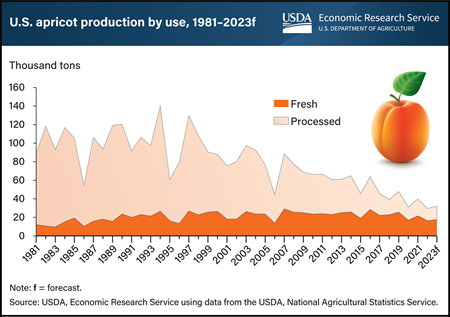

Tuesday, January 9, 2024

How do you like your apricots? Apricots, a stone fruit like peaches, plums, and nectarines, are typically either processed by canning, freezing, or drying, or sold as fresh, whole apricots. Regardless of how you like apricots, their production has been decreasing since the 1990s in response to falling U.S. consumption, especially for processed apricots. Commercial production is concentrated on the West Coast, with California representing 90 percent of apricot production in 2023. The U.S. apricot industry has experienced a long-term downward trend in bearing acreage, falling 62 percent over the past 20 years. Growing competition from imports of processed apricot products and a general increase in consumption for all fresh fruit have encouraged growers to divert more of their acreage to higher valued commodities, resulting in fewer bearing acres of apricots and shifts in use. The downward trend in production has coincided with a decrease in the share of apricots used in the processing market. During the first three seasons of this decade (2020–22), processed utilization has averaged 45 percent—down from 63 percent during the early 2010s and 89 percent in the early 1980s. This reflected both small gains in fresh market use and a marked downward trend in processing uses (particularly canned and frozen). Until the 2020s, the volume used as fresh apricots had been trending higher each decade—roughly pacing population growth. This chart first appeared in the September 2023 Fruit and Tree Nuts Outlook, published by USDA, Economic Research Service.

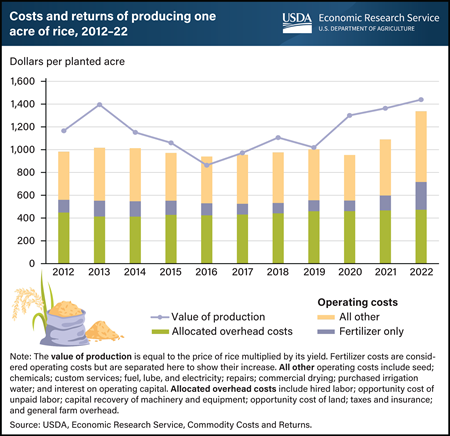

Thursday, January 4, 2024

According to data from USDA’s Economic Research Service (ERS), recent returns from rice farming are positive, on average. From 2012 to 2022, U.S. rice farmers received a positive net return (equal to the value of production minus costs) in all years except 2016, when rice fell to its lowest price of that decade. The total gross value of producing one acre of rice increased 23 percent over that time, ranging from a low of $863.46 in 2016 to a high of $1,439.19. This was, in part, because of strengthening rice prices. Notably, rice prices surged in recent years before reaching an all-time high in 2022. Over the 2012 to 2022 period, the total cost of producing one acre of rice increased by 36 percent. Most of the increase in cost stemmed from an increase in operating costs of 62 percent, while allocated overhead costs increased 6 percent. Surging fertilizer costs, which increased by $150.75 per acre from 2020 to 2022, largely drove the increase. By contrast, allocated overhead costs—a category that includes labor costs and the opportunity cost of land—increased by $12.09 since 2020. This chart is based on data collected from the ERS Commodity Costs and Returns data product.

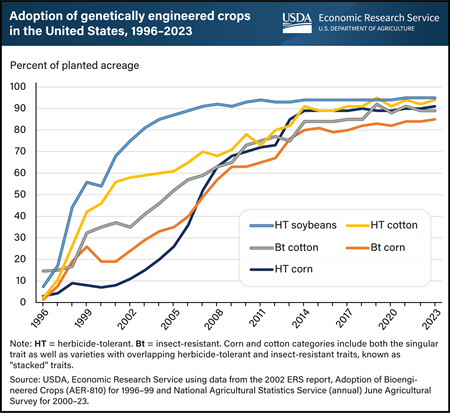

Tuesday, January 2, 2024

Genetically engineered (GE) seeds were commercially introduced in the United States for major field crops in 1996, with adoption rates increasing rapidly in the years that followed. The two main GE trait types are herbicide-tolerant (HT) and insect-resistant (Bt). These traits can be added individually to seeds as well as combined into a single seed, called stacked seed traits. USDA, Economic Research Service (ERS) reports information on GE crops in the data product Adoption of Genetically Engineered Crops in the U.S. These data show that by 2008, more than 50 percent of corn, cotton, and soybean acres were planted with at least one GE seed trait. Today, more than 90 percent of corn, cotton, and soybean acres are planted using at least one GE trait. Traits other than HT and Bt have been developed, such as resistance to viruses, fungi, and drought or enhanced protein, oil, or vitamin content. However, HT and Bt traits are the most used in U.S. crop production. While HT seeds also are widely used in alfalfa, canola, and sugar beet production, most GE acres are occupied by three major field crops: corn, cotton, and soybeans. This chart appears in the ERS topic page Biotechnology, published in October 2023.

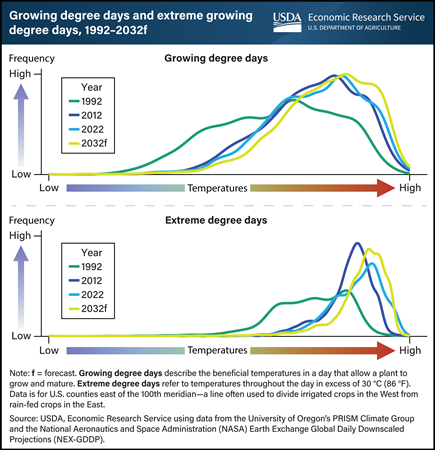

Tuesday, December 5, 2023

According to weather data from National Aeronautics and Space Administration (NASA), temperatures in the Corn Belt, a region spanning across Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Ohio, and Wisconsin, have trended higher in recent years and are projected to continue to rise through the end of this century. Two measures can be used to capture how rising temperatures affect crops’ growth—growing degree days and extreme degree days. Growing degree days describe the beneficial temperatures in a day that allow a plant to grow and mature. With rising temperatures, the growing degree days for corn and soybeans increase. A crop’s exposure to added growing degree days is not necessarily harmful; after all, crops need heat and precipitation to grow. However, extreme degree days, which refer to temperatures throughout the day in excess of 30 °C (86 °F), cause heat stress that is harmful for a plant. Each decade since 1992, both growing degree days and extreme degree days have steadily increased with rising temperatures in the Corn Belt, where about 80 percent of all U.S. corn and soybeans are grown. In the decade leading to 2032, both measures are projected to continue to increase. This chart first appeared in the USDA, Economic Research Service report, Estimating Market Implications From Corn and Soybean Yields Under Climate Change in the United States, published in October 2023.

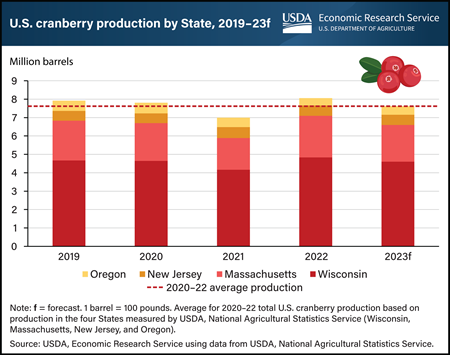

Wednesday, November 22, 2023

U.S. cranberries are harvested in autumn, just in time for the holiday season. The 2023 U.S. cranberry crop is forecast to be 7.62 million barrels, down 5.4 percent from the previous year, but equal to the 2020–22 average. The top-producing State, Wisconsin, typically harvests around 60 percent of the annual U.S. cranberry crop. In 2023, Wisconsin cranberry production is forecast to be 4.6 million barrels, down 5 percent from 2022. In the most recent growing season, Wisconsin experienced challenging weather, from record snowfall in April to statewide drought in July. Similarly, Massachusetts—the second-largest producing State—experienced weather-related challenges including a cold, frosty spring and excessive precipitation during the summer bloom. Consequently, production for Massachusetts, which typically accounts for around one quarter of the U.S. cranberry crop, is forecast to decline 11.5 percent from last year to 2 million barrels. Similarly, New Jersey’s 2023 cranberry forecast is expected to be about 550,000 barrels, a slight 2-percent decrease from the 2020–22 average on the basis of atypically hot summer temperatures in the State. Unlike the top three States, which are set to experience production declines in 2023, the fourth-largest cranberry producing State, Oregon, is forecast to see production rise by 17.5 percent from 2022 to 470,000 barrels. This chart is based on the USDA, Economic Research Service Fruit and Tree Nuts Outlook Report, released September 2023.

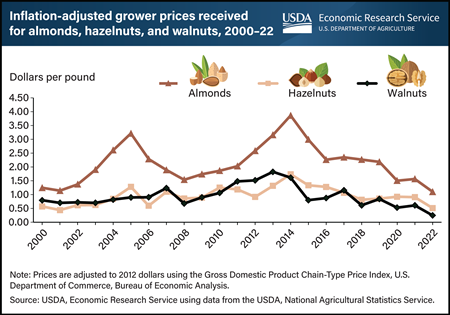

Tuesday, November 14, 2023

In 2022, tree nut prices fell to their lowest levels in at least two decades. Prices after adjusting for inflation, called real prices, were $1.10 per pound for almonds, $0.51 for hazelnuts, and $0.25 for walnuts. The last time real almond and hazelnut prices were this low was at the turn of the 21st century. Walnut (real) prices are at an all-time low, according to data from the USDA, Economic Research Service. Prior to 2020, the lowest real walnut price recorded was $0.58 per pound in 1999. In 2022, walnut prices were less than half of the previous record low and 14 percent of the high observed in 2013 ($1.82 per pound). Low prices have affected walnut producers’ production decisions. In September 2023, USDA’s National Agricultural Statistics Service forecast that 2023 would be the first year since 1999 that walnut-bearing acreage decreased. Acreage in California, the country’s leading walnut producer, was estimated to have dropped from 400,000 acres in 2022 to 385,000 acres in 2023 and was revised further downward to 375,000 acres in October 2023. Producers have not reduced bearing acreage for almonds or hazelnuts, but prices have decreased since 2014. The decision to reduce acreage stems not only from grower prices but also from a series of conditions growers face that include weather, prices of inputs, and competition from other exporting countries. This chart was drawn from the USDA, Economic Research Service Fruit and Tree Nuts Outlook Report, released September 2023.

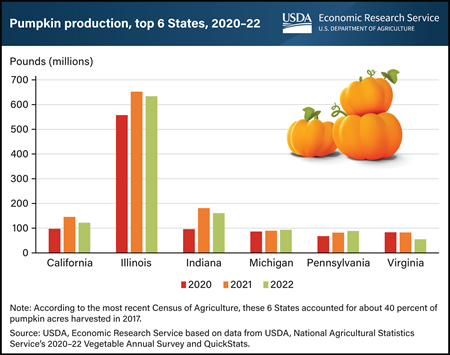

Thursday, October 26, 2023

Pumpkins were one of the earliest cultivated crops in the Americas and have become one of the most distinctive symbols of fall. With a variety of uses, from pies and spiced coffee drinks to festive jack-o’-lanterns, pumpkins are grown commercially in every U.S. State. Production has trended up over the past two decades. In the early 2000s, about 4 pounds of the gourd were available per person, increasing to about 6 pounds per person in the 2020s. In the top 6 pumpkin-growing States, farms produced about 1.2 billion pounds in 2022. Illinois alone harvested 630 million pounds. The next 5 largest pumpkin-producing States by weight were Indiana with 160 million pounds, California with 120 million pounds, Michigan and Pennsylvania with 90 million pounds each, and Virginia with 50 million pounds. Most pumpkins are grown for decorative purposes, with a smaller amount processed into puree to be used in food products such as pies, muffins, or breads. However, in Illinois—the largest producer by both acres and weight—about 80 percent of the State’s harvested pumpkin acres are used for processing. This chart is drawn from the USDA, Economic Research Service’s Trending Topics Pumpkins: Background & Statistics page.

Tuesday, October 24, 2023

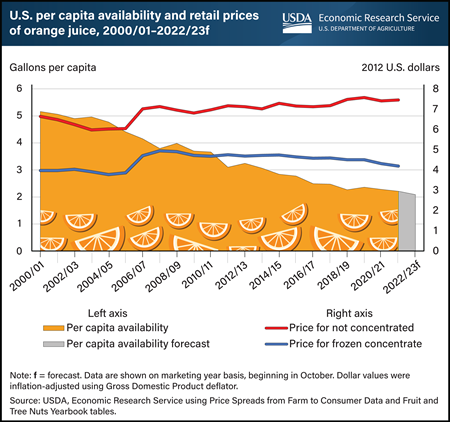

Orange juice, once a staple beverage in many U.S. households, has experienced a steady decline in consumption over the last two decades. While waning consumer demand has played a role, decreased domestic orange production has also negatively impacted per capita availability, a proxy measure for consumption. Orange juice imports from Brazil and Mexico have tempered some of this decline, however, availability of orange juice has fallen from about 5 gallons a person in the 2000/01 marketing year to a forecast of 2 gallons per person in 2022/23. Most oranges grown for the processing/juice market in the United States are harvested in Florida. In recent years, Florida’s citrus crop has suffered from disease and extreme weather events, resulting in smaller orange harvests. Reduced supply has contributed to generally higher orange juice prices. However, adjusted for inflation, prices for frozen concentrated orange juice and not from concentrate (the two main categories) increased at comparatively modest rates between 2000/01 and 2021/22. The price of frozen concentrated orange juice rose by 5 percent over 20 years, while orange juice not from concentrate rose by 12 percent over the same period. The modest increase in the real price highlights the impact of declining demand, somewhat muting the price effect associated with lower supply. This chart is based on the USDA, Economic Research Service (ERS) Fruit and Tree Nuts Outlook Report, released September 2023, and data from the ERS Fruit and Tree Nuts Yearbook and Price Spreads from Farm to Consumer.

Wednesday, October 18, 2023

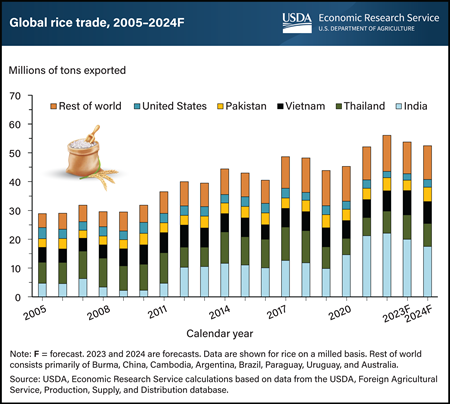

Global rice trade is projected to decline in 2023 and 2024 after India, the world’s largest rice exporter, implemented additional export restrictions on rice in July and August 2023. India accounted for more than 40 percent of global exports in 2022, supplying more rice than each of the next four largest suppliers—Thailand, Vietnam, Pakistan, and the United States. In summer 2023, India placed a ban on export sales of regular-milled white rice while imposing tariffs and additional restrictions on other types of exported rice. Global prices for rice then rose by 12 to 14 percent by the end of July. Prices continued to surge in August, reaching their highest since 2008, dropping slightly by mid-September as panic buying slowed. The impact is felt by many of the world’s food-insecure countries, especially in Sub-Saharan Africa, India’s largest export market. This region is expected to import less rice in 2023 and 2024 even as Thailand, Vietnam, and Pakistan pick up additional sales, despite tight supplies in Thailand and Vietnam. This chart is drawn from the October 2023 Rice Outlook, published by USDA, Economic Research Service. Also see the August 2023 and September 2023 Rice Outlook.

Thursday, October 5, 2023

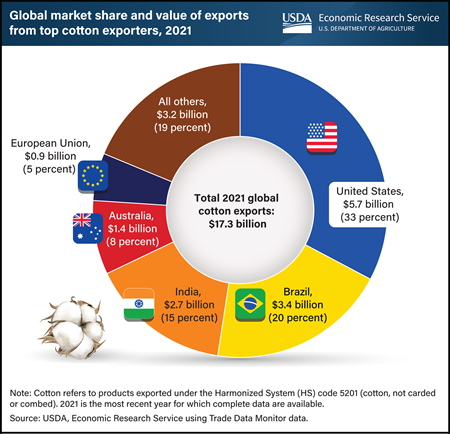

The United States is the global leader in cotton exports by value, holding a 33-percent share ($5.7 billion) of the global export market in 2021. U.S. cotton exports expanded to $8.9 billion in 2022 and, while U.S. cotton exports in 2023 are expected to be lower than 2022 levels, USDA’s 10-year projections for U.S. exports indicate growth in the long term. In 2021, the most recent year for which complete global data are available, U.S. exports of cotton totaled nearly 3 million metric tons, 47 percent more volume than the next highest exporter, Brazil. Other major competitors in the global cotton market include Australia, India, and the European Union, with 2021 market shares (in terms of value) ranging from 5 to 15 percent each, as well as several exporters from Africa, including Benin, Burkina Faso, and Côte d’Ivoire. In addition to maintaining the largest share of the aggregate global market, the United States is a key supplier to several top importer markets. For example, in 2021, U.S. cotton accounted, by value, for 39 percent of cotton imports to China, the top cotton importer in the world. Other top destinations for U.S. cotton exports include Vietnam, Turkey, Pakistan, and Mexico. These countries combined with China, accounted for more than 70 percent of U.S. cotton exports in 2021. This chart is drawn from the USDA, Economic Research Service report, U.S. Export Competitiveness in Select Crop Markets, March 2023.

Tuesday, September 26, 2023

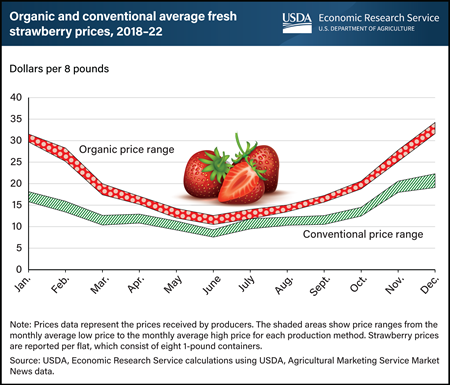

Fresh strawberry prices tend to exhibit strong seasonal trends in part because of their relatively short shelf life. Even being refrigerated immediately after harvest, fresh-picked strawberries last about 1 to 2 weeks, reducing the ability to store the crop and maintain a consistent supply. In the United States, grower prices for fresh organic strawberries move in tandem with conventional strawberry prices throughout the year while also typically running 40 to 50 percent higher than conventional prices—this difference is known as a “price premium.” In late fall and throughout winter, supply wanes even though demand remains robust. During this period, grower (or farm-gate) price premiums for organic strawberries rise above typical levels. From 2018–22, the highest average price premium was in January, when organic strawberry prices were 74 to 88 percent higher than conventional strawberries. Price premiums in July averaged 18 to 24 percent. Organic strawberry production has increased faster than conventional production. Since 2008, domestic organic strawberry acreage has tripled in California, which provides about 75 percent of U.S. organic strawberry production. This chart updates one that appeared in the USDA, Economic Research Service report The Changing Landscape of U.S. Strawberry and Blueberry Markets: Production, Trade, and Challenges from 2000 to 2020, published in September 2023.