ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Monday, June 13, 2022

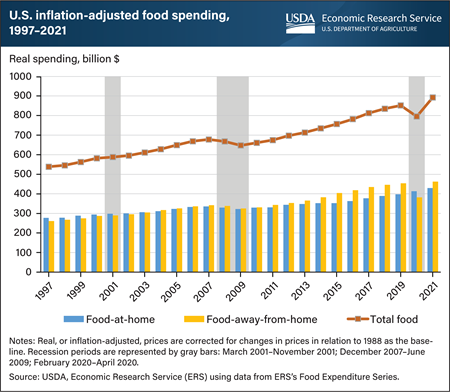

Real, or inflation-adjusted, annual food spending in the United States has increased every year since 1997 except in 2008, 2009, and 2020. Sales increased from 1997 to 2019 for both food at home (FAH), food intended for off-premise consumption from retailers such as grocery stores, and food away from home (FAFH), food consumed at outlets such as restaurants or cafeterias. Over this period, real FAH spending increased at a slower rate (43.5 percent) than for FAFH (73.9 percent). In 2020, during the Coronavirus (COVID-19) pandemic, real total food expenditures fell 6.6 percent from 2019. U.S. consumers’ food-spending patterns changed as efforts were made to limit the spread of COVID-19, which included stay-at-home orders. FAFH spending decreased by 15.8 percent in 2020, while FAH spending increased by 3.9 percent. In 2021, real total food expenditures increased 12.2 percent from 2020. With increased household income during the economic recovery and relaxed safety measures around indoor dining and social distancing, FAFH spending increased by 21.1 percent in 2021 from the previous year and was the primary driver of the overall food spending increase. FAH spending increased by 4 percent. The data for this chart come from the ERS’s Food Expenditure Series data product.

Monday, May 23, 2022

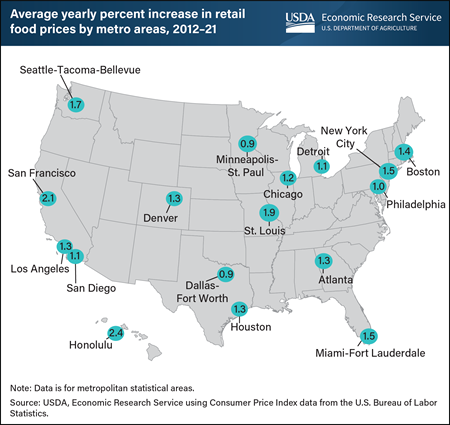

Retail food price inflation varies by locality. In the 10 years from 2012 to 2021, increases in retail food prices ranged from an average of 2.4 percent a year in Honolulu, HI, to 0.9 percent in the Dallas-Fort Worth, TX, area. Retail food at home includes food bought in grocery stores as opposed to restaurants. Differences in transportation costs and retail overhead expenses, such as labor and rent, can explain some of the variation among cities because retailers often pass local cost increases on to consumers in the form of higher prices. Furthermore, differences in consumer preferences among cities for specific foods may help explain variation in inflation rates. For example, a city whose residents strongly prefer foods with less price inflation (such as fresh fruits and vegetables, at 1.3 and 0.8 percent average yearly growth for 2012-21) might experience lower food-at-home price inflation than a city whose residents buy more beef and veal, which increased by an average of 4.2 percent a year in the 10-year period. Across the United States, food-at-home prices increased by an average of 1.4 percent a year over the 10-year period. This chart appears in an Economic Research Service data visualization, Food Price Environment: Interactive Visualization, released May 12, 2022.

Wednesday, May 18, 2022

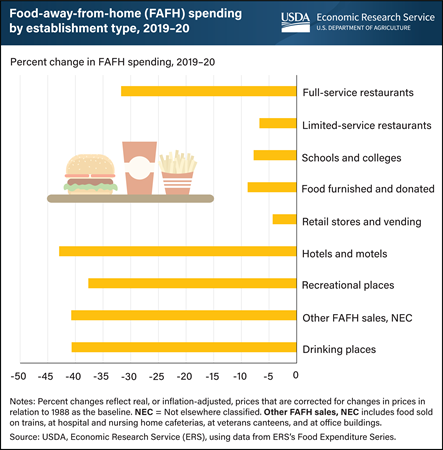

Spending decreased at each of the nine types of food-away-from-home (FAFH) outlets measured in the USDA, Economic Research Service’s Food Expenditure Series (FES) from 2019 to 2020. Although existing infrastructure, such as drive-through services, enabled limited-service restaurants to comply with Coronavirus (COVID-19) pandemic safety measures, these establishments still saw a 6.7-percent decline in annual spending. Full-service restaurants, which accounted for more FAFH spending than all other outlets from 1997 to 2019, experienced a decrease in spending of 31.7 percent in 2020. This was partly due to pandemic-related closures during some of the year. Hotels and motels, recreational places, and drinking places also experienced closures and capacity restrictions throughout much of 2020. Food spending fell 42.9 percent at hotels and motels, 37.7 percent at recreational places, and 40.7 percent at drinking places. Food expenditures at schools and colleges dropped 7.8 percent in 2020. The 2021 annual FES data will be released in June 2022 and will provide an update on these trends as well as other food spending data. This chart uses the FES data and appears in the ERS’s Amber Waves article, “Food Spending by U.S. Consumers Fell Almost 8 Percent in 2020”, October 2021.

Monday, May 16, 2022

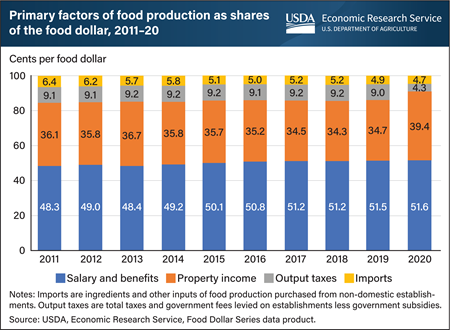

In 2020, the average dollar spent by U.S. consumers on domestically produced food – called the food dollar – returned 39.4 cents as property income, which is income received by owners of capital assets (e.g. land, equipment, and patents) after paying for other intermediate inputs, labor, and output taxes. This 13.5-percent increase from 2019 brought property income’s share of the food dollar to the highest level since 1997. Conversely, the proportion of output taxes, or total taxes and government fees less subsidies, dropped by more than half from 2019 to 4.3 cents of the 2020 food dollar. This reflects increased agricultural subsidies as well as other government policies that affected taxes in 2020. Of the remaining food dollar, 51.6 cents compensated labor for wages and benefits while 4.7 cents went to imported ingredients and inputs. USDA, Economic Research Service’s (ERS) annual Food Dollar Series provides insight into the industries that make up the U.S. food system and their contributions to total U.S. spending on domestically produced food. Annual shifts in the food dollar shares between primary factors occur for a variety of reasons, including changes in the mix of foods consumers buy, the balance of food consumed at home and away from home, and changes in primary factor markets for non-food production. The data for this chart are available for the years 1997 to 2020 and can be found in ERS’s Food Dollar Series data product, updated on March 17, 2022.

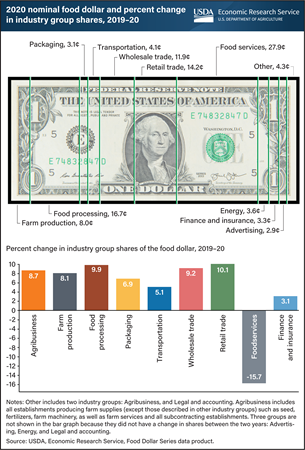

Wednesday, April 20, 2022

In 2020, restaurants and other eating-out establishments received 27.9 cents of an average dollar spent on domestically produced food, called the food dollar. This marks a 15.7-percent drop from 33.1 cents in 2019 as consumers reduced food-away-from-home purchases and increased purchases from food-at-home markets at the onset of the Coronavirus (COVID-19) pandemic. All other industry group shares expanded except for three that had no annual change in 2020: Advertising, Energy, and Legal and accounting. Notably, the Retail trade (10.1 percent), Wholesale trade (9.2 percent), and Packaging (6.9 percent) shares increased by the largest percentages for their respective industry group since the data series began. The USDA Economic Research Service’s (ERS) annual Food Dollar Series provides insight into the industries that make up the U.S. food system and their contributions to total U.S. spending on domestically produced food. ERS uses input-output analysis to calculate the cost contributions from 12 industry groups in the food supply chain. Annual shifts in the food dollar shares between industry groups occur for a variety of reasons, including changes in the mix of foods consumers buy, costs of materials, ingredients, and other inputs, as well as changes in the balance of food at home and away from home. The industry group shares dollar chart is available for 1993 to 2020 and can be found in ERS’s Food Dollar Series data product, updated on March 17, 2022.

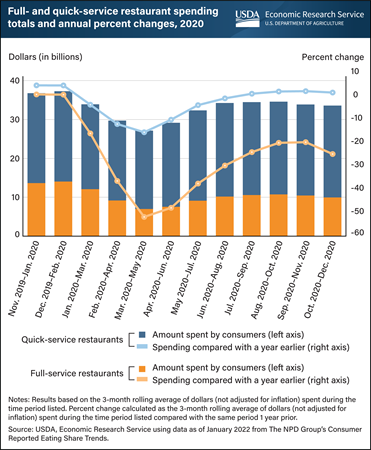

Wednesday, April 13, 2022

Consumer spending at both full-service and quick-service restaurants initially fell following the onset of the Coronavirus (COVID-19) pandemic, with noteworthy differences between the two. Before the pandemic (as of December 2019–February 2020), consumer spending at both quick-service and full-service restaurants was near or slightly above previous year levels. As of March–May 2020, spending at quick-service restaurants had dropped to about $20.1 billion, 15.4 percent lower than average spending a year earlier. Full-service restaurants experienced a more severe drop during this period, likely related to the mandates limiting in-person dining across much of the country. Spending fell to $7 billion, 51.7 percent lower than the year before. Quick-service restaurants recovered faster than full-service restaurants, with spending surpassing previous year levels for the last four months of 2020. In contrast, by the end of 2020, full-service restaurants retained a 24.8 percent drop in year-to-year spending. This chart appears in the USDA, Economic Research Service’s Amber Waves article, “Spending Gap Between Full and Quick-Service Restaurants Widened During Coronavirus (COVID-19) Pandemic”, April 2022 utilizing data from The NPD Group’s Consumer Reported Eating Share Trends (NPD CREST).

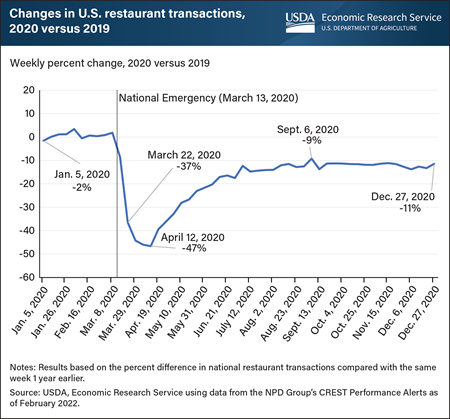

Monday, March 28, 2022

On March 13, 2020, the Federal government declared a national emergency in response to the Coronavirus (COVID-19) pandemic. In response, many State and local governments implemented social distancing measures, stay-at-home orders, and the mandatory closure of businesses in high-risk industries. Restaurants were often included in these mandates, which forced many to close their dining rooms, if not the entire business, sharply reducing restaurant visits across the country. USDA, Economic Research Service (ERS) researchers recently examined the weekly percent change in restaurant transactions relative to a year prior to show how visits changed during the first few months of the pandemic. During the first full week after the national emergency declaration, there were 37 percent fewer restaurant transactions than the same week in 2019. The largest year-to-year changes occurred three weeks later, when transactions were down 47 percent relative to the year before. By the end of the year, weekly transactions remained 11 percent lower than they had been in 2019. This chart is based on a chart in the ERS’s COVID-19 Working Paper: The Impact of COVID-19 Pandemic on Food-Away-From-Home Spending, released March 9, 2022.

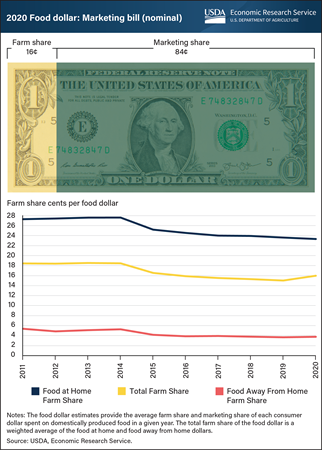

Monday, March 21, 2022

On average, U.S. farmers received 16.0 cents for farm commodity sales from each consumer dollar spent on domestically produced food in 2020, up from a revised 15.0 cents in 2019. Known as the farm share, the one-cent rise is the largest increase in nearly a decade. The marketing share, on the other hand, goes to food-supply-chain industries that move domestically produced food from farms to points of purchase, including costs related to packaging, transporting, processing, and selling to consumers at grocery stores and eating-out places. In the first year of the Coronavirus (COVID-19) pandemic, households redirected a substantial amount of their eating-out dollars, or food-away-from-home (FAFH) spending, toward food-at-home (FAH) markets such as grocery stores. Generally, farmers receive a smaller share from eating-out dollars because a larger portion is spent on preparing and serving meals at restaurants, cafeterias, and other food-service establishments. Historically, the farm share for FAH has averaged 24.3 cents, whereas the farm share for FAFH has averaged below six cents. Although farmers received a smaller share of retail dollars from food-at-home markets in 2020, they received a greater share of the overall food dollar because consumers made more purchases in FAH markets, where farmers receive a higher retail share than from FAFH markets. This gives the unusual result of total farm share rising more than both FAH and FAFH farm shares. The USDA, Economic Research Service (ERS) uses input-output analysis to calculate the farm and marketing shares from a typical food dollar, including food purchased at grocery stores and at eating-out establishments. The data for this chart can be found in ERS’s Food Dollar Series data product, updated March 17, 2022.

Wednesday, February 23, 2022

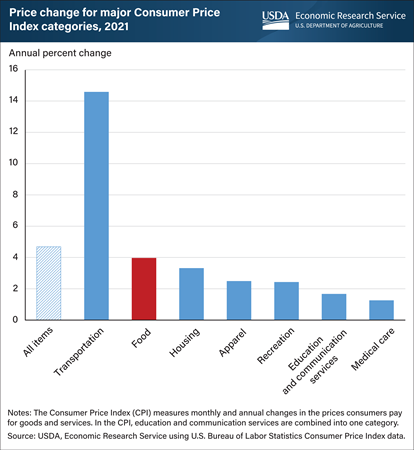

Food prices overall increased by an average of 3.9 percent in 2021 compared to 2020, the highest annual increase since 2008. Food prices grew more slowly than the “all items” and transportation CPIs, but more quickly than all other of the “major groups” tracked by the U.S. Bureau of Labor Statistics (BLS). The CPI for all items rose 4.7 percent in 2021. Among the food categories that comprise the food CPI, the food-away-from-home (restaurant purchases) CPI increased 4.5 percent, compared with an increase of 3.5 percent for food-at-home (grocery stores or other purchases from food retailers). The highest price increases in food-at-home categories in 2021 were for beef and veal (9.3 percent), pork (8.6 percent), and fresh fruit (5.5 percent). Using the CPI data, USDA, Economic Research Service (ERS) researchers project overall food prices will increase between 2 and 3 percent in 2022. A five-year comparison of changes in major CPI categories is available in the Food Prices and Spending section of ERS’s Ag and Food Statistics: Charting the Essentials data product, and a time-series visualization of the data appears in the Food Price Environment data tool. More information on ERS’s monthly food price forecasts can be found in ERS’s Food Price Outlook (FPO) data product. The next FPO release is February 25, 2022.

Monday, January 31, 2022

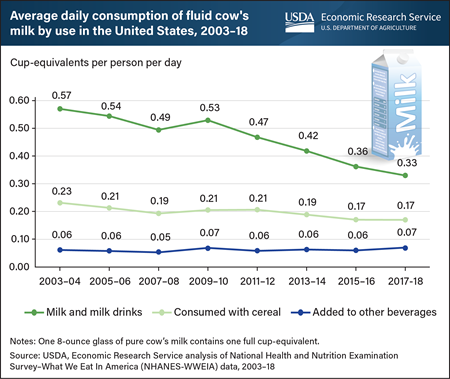

U.S. per capita consumption of fluid cow’s milk has been trending downward since about the mid-1940s, and it fell at a faster rate during the 2010s than in each of the previous six decades. Using dietary intake surveys collected between 2003 and 2018, USDA, Economic Research Service (ERS) researchers examined recent trends in milk consumption by looking at how individuals consumed the milk and consumers’ ages. Results confirmed that drinking milk as a beverage is the primary way that individuals of all ages consume fluid cow’s milk. These beverages include plain and flavored fluid milk as well as malted milk, eggnog, kefir, hot chocolate, and other milk-based beverages. On a given day in 2003–04, U.S. consumers drank about 0.57 cup-equivalents of fluid cow’s milk on average. Per person consumption of milk as a beverage fluctuated over the 2000s between 0.53 and 0.57 cup-equivalents per day. However, it declined over the 2010s, falling to 0.33 cup-equivalents in 2017–18. Over the study period, U.S. per person consumption of milk with cereal also fell by 0.06 cup-equivalents, with the steepest drop in consumption occurring among children. No significant changes were detected in the amount of milk that U.S. consumers pour into other, non-dairy beverages such as tea and coffee. This chart appears in the ERS report Examining the Decline in U.S. Per Capita Consumption of Fluid Cow’s Milk, 2003–18, released October 2021.

Friday, January 28, 2022

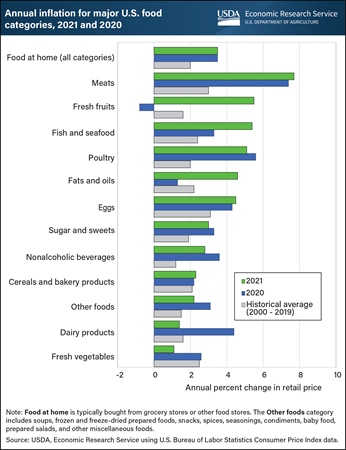

Retail food prices increased by 3.5 percent in 2021, equal to the rate in 2020 and greater than the historical annual average of 2.0 percent from 2000 to 2019. Of the 12 food categories depicted in the chart, six showed slower price increases in 2021 compared with 2020. Dairy products and fresh vegetables, in particular, had significantly slower price increases in 2021 than 2020 and their historical averages. Dairy product prices increased at 1.4 percent in 2021 versus 4.4 percent in 2020 and fresh vegetable prices increased by 1.1 percent compared to 2.6 percent is 2020. Conversely, prices in six food categories increased in 2021 at a faster rate than in 2020 as well as in years prior. Prices for fresh fruits, for instance, increased 5.5 percent in 2021 compared to a 0.8-percent decrease in 2020 and a 1.6-percent average increase over the prior 20 years. Inflationary pressures differ by food category. For example, meat prices, which rose the most of any included product groups, have been driven up by strong domestic and international demand, high feed costs, and supply chain disruptions. Winter storms and drought impacted meat prices in the spring, and processing facility closures due to cybersecurity attacks affected beef and other meat production in May. USDA, Economic Research Service (ERS) researchers project that prices for food-at-home, or food purchased typically from grocery stores or other food stores, will increase between 1.5 and 2.5 percent in 2022, lower than the 3.5-percent increase that occurred in both 2020 and 2021. Forecasts for all food categories for 2022 are available in ERS’s monthly Food Price Outlook data product, updated January 25, 2022.

Friday, January 21, 2022

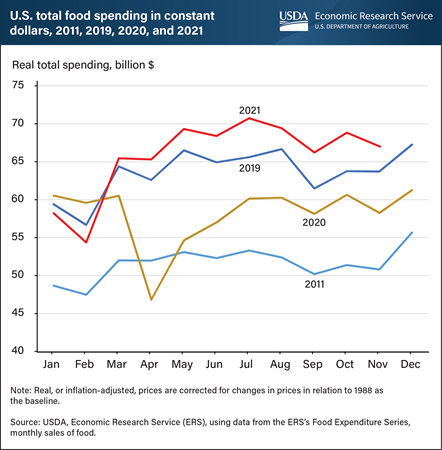

Total food spending in the United States generally follows seasonal trends. The lowest food spending levels usually occur in January and February, before rising in March and remaining at this higher level through August. Spending then drops from September through November before peaking during the December holidays. However, food economy disruptions following the onset of the Coronavirus (COVID-19) pandemic in early 2020 altered historical monthly food spending trends in the United States. The USDA, Economic Research Service’s (ERS) Food Expenditure Series tracks food spending beginning in 1997. The largest monthly decline in food spending (23 percent) occurred in April 2020, and monthly food spending averaged 8.3 percent lower in 2020 than in 2019. Overall, total U.S. food spending has consistently increased over the years, even when accounting for inflation. Average inflation-adjusted monthly expenditures were 23.2 percent higher in 2019 than in 2011. Though total food spending in 2021 has followed the typical pattern, spending began the year below pre-pandemic levels but surpassed previous years beginning in March. The data for this chart come from the ERS’s Food Expenditure Series data product.

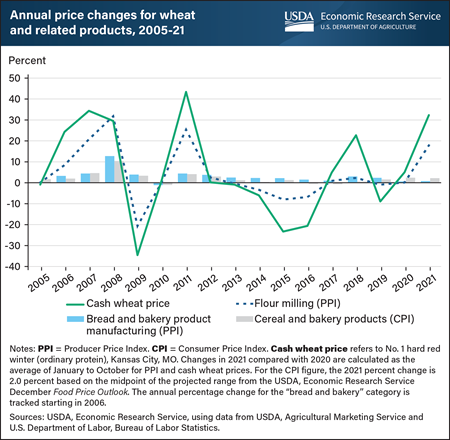

Monday, January 3, 2022

Wheat prices at the farm level rose substantially in 2021, but these changes did not result in correspondingly higher prices for consumer products made from wheat. This disparity reflects the historical pattern most observable from 2005–12, wherein the degree of movement in prices of wheat products was markedly less than the more dramatic changes in wheat prices. Cash wheat prices in Kansas City, MO—the market price that most closely reflects the prices mills pay for wheat—were up by more than 30 percent in 2021 from the same time in 2020. Similarly, the Producer Price Index (PPI) for flour milling—a measure of how wholesale flour prices change over time—also rose, registering an 18-percent year-on-year increase in 2021. In contrast, prices U.S. consumers paid for wheat-containing products, as measured by the Consumer Price Index (CPI), for cereal and bakery products, is projected up 2 percent. This year-to-year increase is below the overall inflation rate for 2021 and similar to the previous year’s gains. The muted and lagged impact of the wheat grain price surge on consumer product prices is in line with historical precedent in which commodity prices usually represent a small share of the consumer food dollar that is spent on processed foods such as bread and pasta. This chart was drawn from “The Effect of Rising Wheat Prices on U.S. Retail Food Prices,” which appeared in the USDA, Economic Research Service’s November 2021 Wheat Outlook.

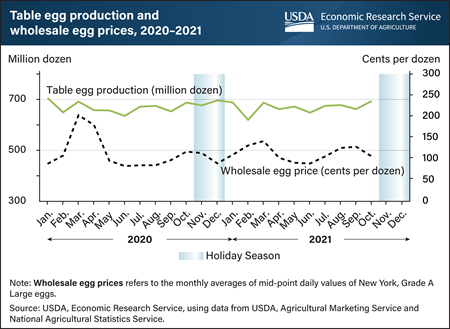

Tuesday, November 30, 2021

Demand for table eggs tends to increase when holiday gatherings and cold weather encourage home baking and cooking. In accordance, wholesale table egg prices—the prices retailers pay to producers for eggs—tend to increase ahead of holidays such as Thanksgiving, Christmas, and Easter. Leading up to the 2021 holiday season, however, wholesale prices of table eggs in the United States have fallen as effects of Coronavirus (COVID-19)-linked flock adjustments linger. In normal years, producers anticipate seasonal demand by adjusting the size of the table-egg laying flocks and the rate at which they produce eggs. In 2020, COVID-19-related disruptions in the demand for eggs led producers to reduce flock sizes. Flock sizes have slowly rebuilt since the summer of 2020 but remain smaller than the same time in 2019. However, the younger flocks produce more eggs per hen. The higher productivity can offset the effects of the small flock size and support increased production. At the beginning of October 2021 the size of the U.S. laying flock was just above the October 2020 levels and the rate of lay was 1.1 percent higher. This productivity bump is predicted to support about a 1 percent increase in October 2021 table egg production compared with a year ago, leading to a 9.6 percent price reduction compared to October 2020. This chart is drawn from the USDA, Economic Research Service Livestock, Dairy, and Poultry Monthly Outlook, published November 2021.

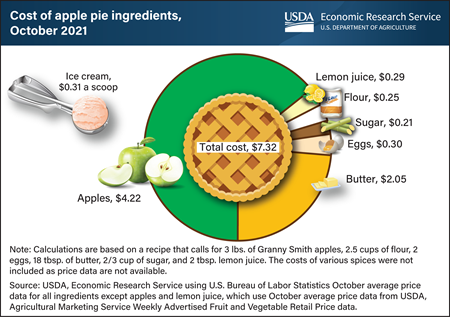

Monday, November 22, 2021

As U.S. consumers finalize their Thanksgiving menus, they might be curious to know how much ingredients will likely cost. If a homemade apple pie is on the menu, consumers can expect to pay about $7.32 for the ingredients, more than half of which ($4.22) is for apples. The same pie ingredients cost about $6.75 last year, meaning the total cost is 8.4 percent higher this year. The cost increase is driven by the price of Granny Smith apples, which increased from an average $1.26 per pound in October 2020 to $1.41 per pound in October 2021. Sugar, eggs, butter, and lemons also increased in price over the same period, while flour prices decreased. If the apple pie is served a la mode, plan to factor in an additional $0.31 per scoop, the same price as in 2020. USDA, Economic Research Service used average price data from the U.S. Bureau of Labor Statistics and USDA, Agricultural Marketing Service Weekly Advertised Fruit and Vegetable Retail Price data to derive the cost for the ingredients of an apple pie. The most recent data points are from October, meaning prices for Thanksgiving week may vary; savings may occur if grocers offer holiday discounts. Forecasts for aggregate food category prices can be found in the Food Price Outlook data product, which will next be updated on November 23.

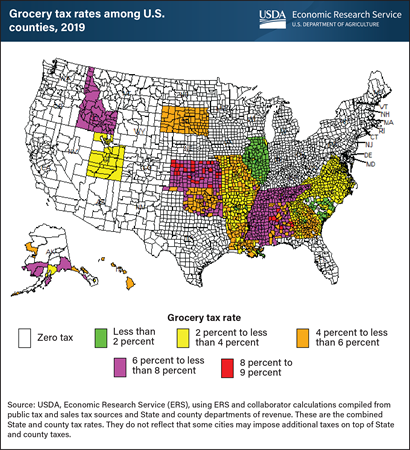

Friday, November 5, 2021

Foods purchased at grocery stores, supercenters, and other retail venues were exempt from sales taxes in 57 percent of U.S. counties in 2019. The remaining counties taxed food purchases at various levels across 18 states, mostly in the Southeast and Midwest. Alabama’s Tuscaloosa and Cullman counties had the highest grocery tax rate at 9 percent (4 percent State plus 5 percent county). Grocery tax rates not only vary across different States, counties, and cities, but they can also change over time. Using county-level tax data in combination with the USDA’s National Household Food Acquisition and Purchase Survey (FoodAPS), researchers at USDA, Economic Research Service (ERS) recently examined whether grocery taxes are associated with how much money U.S. households spend for food at retail outlets and restaurants. ERS found that grocery taxes were associated with differences in food spending among lower-income households that were eligible for the Supplemental Nutrition Assistance Program (SNAP) but did not participate in it. Among those households, researchers were able to associate taxes on groceries with reduced food spending at retail stores and increased food spending at restaurants. However, Federal law and USDA regulations stipulate that foods purchased with SNAP benefits are exempt from State and local sales taxes, and no such relationship was found among households participating in SNAP. This chart is drawn from the ERS report Food Taxes and Their Impacts on Food Spending, released September 2021.

Friday, September 24, 2021

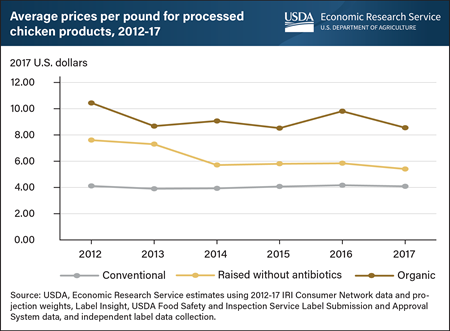

Processed chicken products whose labels show they were raised without antibiotics (RWA) were on average $2.23 per pound more expensive than conventional chicken products between 2012 and 2017, representing a 55-percent markup over conventional products. Processed chicken products include fresh or frozen chicken products that are cooked, marinated, breaded, or fried. A recent USDA, Economic Research Service (ERS) report shows consumer awareness of antibiotic use in meat and poultry production has increased over the past decade, and a growing market has emerged for chicken products that carry an RWA label. Though raising animals without antibiotics can be costly, producers can benefit from doing so when consumers are willing to pay higher prices for RWA products. Analyzing national household scanner data and a constructed dataset of chicken product labels, ERS researchers also found prices for organic processed chicken products were higher than those with RWA labels. From 2012 to 2017, prices for organic processed chicken products were on average $5.13 a pound more than conventional chicken products, representing a 125-percent total markup. These price differences suggest there are significant market opportunities for production practices that fall somewhere between conventional and the standards required for organic production. This information is drawn from the ERS report, The Market for Chicken Raised without Antibiotics, 2012-17, released September 2021.

Friday, August 13, 2021

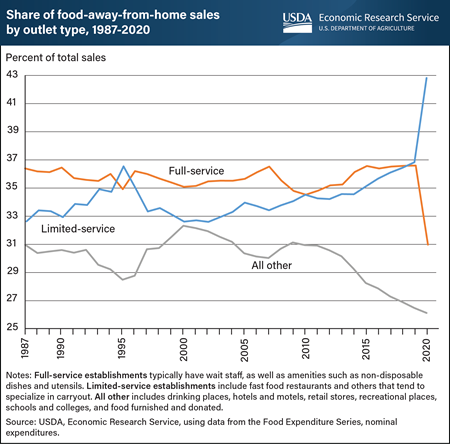

Full-service and limited-service restaurants (fast food restaurants)—the two largest segments of the commercial foodservice market—accounted for 70 percent of all food-away-from-home (FAFH) spending on average from 1987 to 2020. Consumers spent the other 30 percent at places such as hotels and schools. Full-service restaurants had the highest share of FAFH sales in every year of that period except 1995, 2010, 2019, and 2020. In 2020, the share of sales at full-service restaurants dropped from 36.5 percent in 2019 to 31 percent, resulting from a 29.4 percent decline in sales, partly because of safety closures during the Coronavirus (COVID-19) pandemic. Full-service establishments typically have wait staff and other amenities such as ceramic dishware, non-disposable utensils, and alcohol service. In contrast, limited-service restaurants, use convenience as a selling point; they have no wait staff, menus tend to be smaller, and dining amenities are relatively sparse. Given their minimal physical interactions with customers, fast food restaurants adapted to COVID-19 restrictions more quickly during 2020 and assumed a larger share of total FAFH sales at 42.7 percent, compared with 36.8 percent in 2019. Despite the increase in the relative share of FAFH sales, fast food sales decreased by 3.6 percent in 2020 compared with 2019. All other FAFH establishments, such as school and college cafeterias, reported a 17.9 percent decline in sales in 2020 and accounted for 26.3 percent of total FAFH sales. This chart appears on the USDA, Economic Research Service’s Market Segments topic page and its data come from the Food Expenditure Series data product.

Wednesday, August 4, 2021

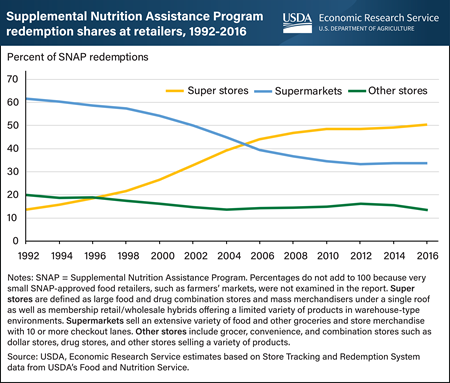

Since 2006, super stores received more USDA, Supplemental Nutrition Assistance Program (SNAP) redemptions than any other type of store, totaling half of all redemptions in 2016. SNAP participants can redeem benefits to buy food items at super stores, supermarkets, grocery stores, and other types of approved food retailers. Super stores are defined as large food and drug combination stores and mass merchandisers under a single roof as well as membership retail/wholesale hybrids offering a limited variety of products in warehouse-type environments. USDA, Economic Research Service (ERS) researchers examined the effects of entrant super stores on the survival of existing SNAP-approved stores and their revenue from redeemed benefits. Researchers found that when one super store entered a market area from 1994 to 2015, about 0.25 supermarkets and 0.05 other smaller food retailers on average left over the first three years after entry. Overall store availability did not decline though, as the entry of one super store more than offset the loss of supermarkets and other smaller food retailers in the markets. The ERS researchers estimated that from 1994 to 2005, local supermarkets and other smaller food retailers annually lost $191,000 on average in SNAP redemptions for each super store entrant into their local market. That loss increased to $213,000 on average from 2005–15. At the same time, super stores gained much more in SNAP redemptions than was lost at local food retailers, leading the researchers to conclude that SNAP beneficiaries shifted purchases to super stores. Based on previous research showing that food is about 3 percent less costly at super stores, the researchers estimated that a shift of SNAP redemptions to super stores expanded the purchasing power of SNAP participants’ benefits by $108.6 million in 2015 (0.15 percent of total SNAP benefits and costs in 2015).This chart appears in the ERS’ Amber Waves article, “New Super Stores Slightly Expanded Purchasing Power for Participants in USDA’s Supplemental Nutrition Assistance Program (SNAP),” June 2021.

Wednesday, July 28, 2021

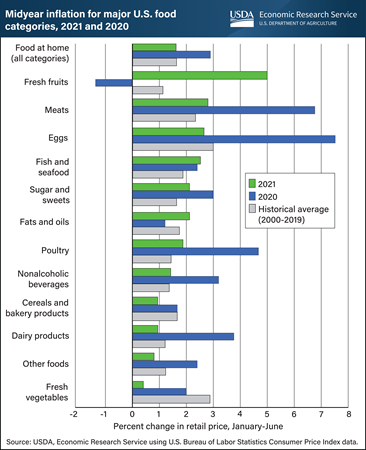

Retail food prices have increased 1.6 percent in the first six months of 2021, less than the rate over the same period last year (2.9 percent) and equal to the historical average over the same six months from 2000 to 2019. Of the 13 food categories depicted in the chart, 10 have experienced slower price increases so far in 2021 compared with halfway through 2020, while 5 categories trailed their historical midyear average price increases. In the first six months of 2021, prices for five food categories increased at a rate slower than in 2020 and years prior: eggs, dairy, fresh vegetables, cereals and bakery products, and “other foods.” Conversely, prices for three food categories increased in the first six months of 2021 at a rate faster than in 2020 and in years prior: fresh fruits (4.8 percent), fish and seafood (2.5 percent), and fats and oils (1.9 percent). Inflationary pressures differ by food category. For example, fresh fruit prices currently are increasing more than four times faster than their historical average rate because of low citrus supplies and increased exports. Prices may change during the remainder of 2021; in the second half of 2020, prices increased for all food categories except eggs and the category of beef and veal. USDA, Economic Research Service (ERS) researchers project food-at-home prices will increase between 2 and 3 percent in 2021. Forecasts for all food categories, including for 2022, are available in ERS’s monthly Food Price Outlook data product, updated July 23, 2021.