ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, October 11, 2016

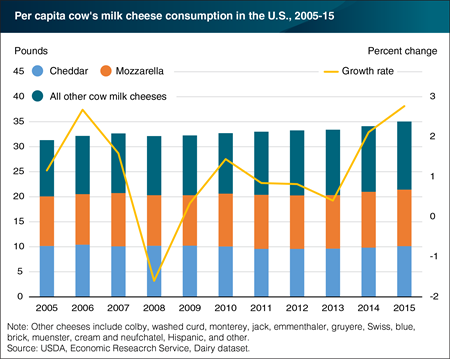

Per capita consumption of cow’s milk cheese rose in 2015, adding to strong growth from 2014. On average, Americans consumed roughly 35 pounds of cheese in 2015. The two most common cheeses, cheddar and mozzarella, accounted for 61 percent of consumption. Consumption of cheddar, which totaled about 10 pounds per person in 2015, increased just over 3 percent. By comparison, mozzarella consumption grew at about 1 percent. Other cheeses—such as cream cheeses, Swiss, and Hispanic cheeses—collectively grew the fastest at nearly 4 percent. Taken together, the growth in U.S. per capita consumption was the highest since 1999, at almost 3 percent. Relatively strong economic growth in the United States helped increase its domestic cheese consumption. Amidst the recession, by comparison, per capita consumption shrank in 2008 and grew minimally in 2009. Relatively low prices likely also encouraged cheese consumption. According to data from the U.S. Bureau of Labor Statistics, retail cheese prices fell by 0.2 percent in 2015. The data for this chart comes from the ERS Dairy Data product, updated in September 2016.

Wednesday, October 5, 2016

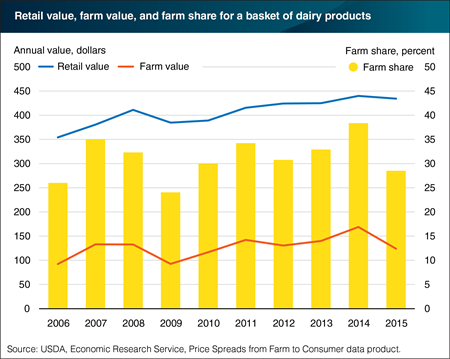

Over the past decade, the farm share for a basket of 14 dairy products—the ratio of grocery store prices (retail value) to prices received by dairy farmers (farm value)—has fluctuated between 24 and 38 percent. In 2015, the annual retail value of the basket fell by 1.2 percent to $435 while the farm value of the same products fell by 26.6 percent to $124. A decrease in the all-milk price received by farmers was responsible for the basket’s lower farm value. In 2014, the all-milk price peaked at $23.98 per 100 pounds on a monthly-average basis. The following year, however, the all-milk price fell to $17.08 per 100 pounds as a result of rising domestic milk production, falling U.S. cheese and dry whey exports, and growing imports of butter and cheese. The basket’s lower 2015 farm value, in turn, caused the farm share to fall from 38 to 29 percent that year. This chart is based on the Price Spreads from Farm to Consumer data product on the ERS website, updated July 2016.

Friday, September 16, 2016

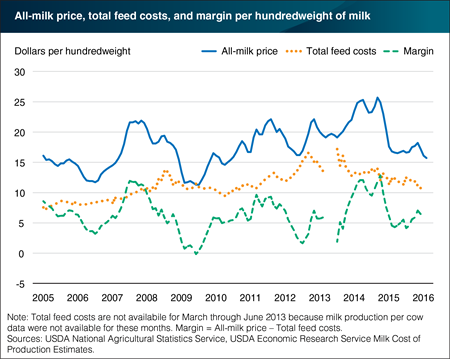

Over the past decade, farm-level prices for milk have been variable. In September 2014, the all-milk price (the average price received by dairy farmers) peaked at $25.70 per 100 pounds, or cwt (1 cwt is just under 12 gallons). A year later, dairy farmers were receiving $17.50 per cwt. By April 2016, the all-milk price was down to $15.00 per cwt. As of June 2016, USDA forecasts indicate that the all-milk price will average between $14.95 and $15.35 per cwt for 2016. Relatively low feed prices in 2015-16 have mitigated the impact of low milk prices on dairy farmers’ incomes. In October 2014, the dairy producer’s margin, or the difference between the all-milk price and ERS’s estimate of average feed costs per cwt of milk was $12.85. As the all-milk price started to fall, the estimated margin hit a low point of $4.14 in July 2015. It thereafter increased slightly to a value of $6.46 in December 2015. By contrast, during the previous downturn in milk prices in 2009-10, the margin reached a low of negative $0.15 in June 2009. This chart is from the ERS Amber Waves article, Processing and Marketing Blunt the Impact of Volatile Farm Prices on Retail Dairy Prices released on August 1, 2016.

Wednesday, July 6, 2016

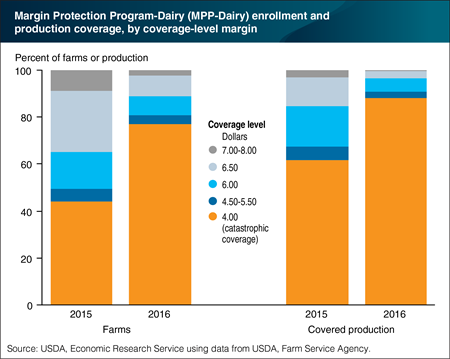

The Margin Protection Program-Dairy (MPP-Dairy) is a risk management program introduced in the 2014 Farm Act. MPP-Dairy is designed to protect agricultural producers against adverse movements in the difference between milk and feed prices (the margin). Enrollees receive catastrophic coverage, for an annual $100 enrollment fee, that provides payments when a national-average margin falls below $4 (the average monthly margin was $8.30 in 2004-13). Farmers can purchase additional “buy-up” coverage, for margin thresholds ranging from $4 to $8 in 50-cent increments. Almost 25,000 farms—55 percent of licensed U.S. dairy operations, accounting for 80 percent of 2014 U.S. milk production—enrolled in the program for 2015 coverage. Forty-four percent of enrollees—with more than three-quarters of production covered by MPP—chose catastrophic coverage. Farms may change coverage annually, and many did so in 2016, as the shares of farms and production under catastrophic coverage rose, moving away from all levels of buy-up coverage. This chart is based on data found in the ERS report, Changing Structure, Financial Risks, and Government Policy for the U.S. Dairy Industry, March 2016.

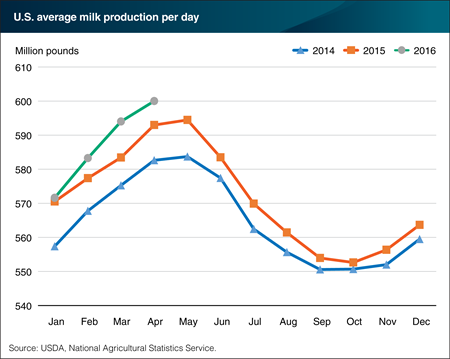

Thursday, June 16, 2016

Milk production in the United States continues to grow, with year-over-year output increasing each month over the past few years. U.S. average daily milk production in April was 1.2 percent higher than the same period last year, following year-over-year gains of 1.8 percent in March, 1.0 percent in February and 0.2 percent in January. The increases reflect a combination of herd expansion and increasing production per cow. Despite relatively low farm milk prices in recent months, low feed prices and favorable weather conditions have contributed to growth in milk production. At the same time, as dairy farms have grown larger, many have developed economies of scale that enable them to maintain profitability and in some cases even expand production in the face of lower margins. This chart is from the Livestock, Dairy, and Poultry Outlook: May 2016.

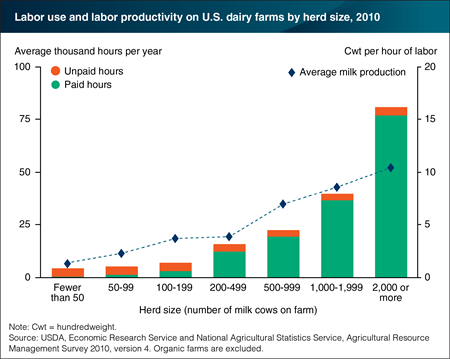

Friday, June 10, 2016

Most labor on small U.S. dairy farms is provided by the operator and the operator’s family, whereas large dairy farms, while usually still family-owned and operated, rely extensively on hired labor. Labor productivity—output of milk per hour of labor—is much higher on larger dairy farms, with the largest (farms with milking herds of at least 2,000 cows) realizing 10 hundredweight (cwt) per hour of labor, compared to 2-4 cwt per hour on farms with herds of 50-500 head. Large farms operate differently than small dairy farms, as their size allows them to apply practices and technologies that result in higher milk yields and labor productivity. For example, farms with at least 500 cows are much more likely to milk three times a day, while smaller farms typically milk twice a day. Thrice-daily milking raises per-cow milk yields, allows farms to offer more work and higher pay to their hired labor, and creates more intensive use of milking equipment. Greater labor productivity is one source of the cost advantages accruing to larger dairy operations. This chart is based on data found in the ERS report, Changing Structure, Financial Risks, and Government Policy for the U.S. Dairy Industry, March 2016.

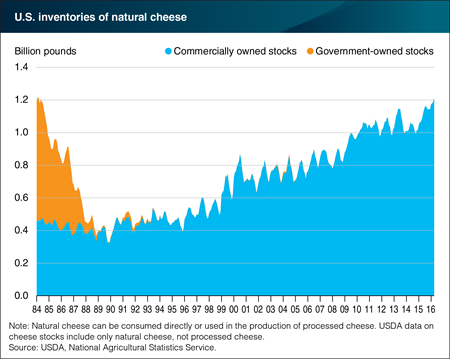

Friday, June 3, 2016

The volume of natural cheese held in cold storage in the United States has grown to 1.214 billion pounds as of the end of April 2016, the highest level since March 1984. However, unlike 1984, inventories today are almost exclusively privately held and reflect the needs of a growing market instead of the consequence of government policy. In the 1980s, the Milk Price Support Program was very active in purchasing large quantities of cheese to support dairy prices. The U.S. Government owned about 60 percent of cheese stocks, which it often distributed through food donation programs in the United States and abroad. In recent years, government purchases of dairy products fell to zero as market prices exceeded support prices, and the Milk Price Support Program was repealed by the 2014 Farm Act. At the same time, commercial cheese stocks have grown to help meet the growing demand for cheese. Total commercial use of cheese (which does not include government donations) grew from 4.6 billion pounds in 1984 to 11.9 billion pounds in 2015, due to population growth as well as increasing consumption per capita and higher exports. Commercial cheese stocks have been growing particularly fast in recent months, reflecting an increasing milk supply, relatively low export demand, and anticipation of further growth in the domestic market. This chart is based on the May 2016 Livestock, Dairy and Poultry Outlook, report and the ERS Dairy Data product.

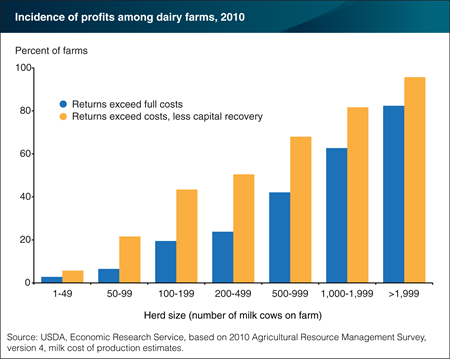

Tuesday, April 19, 2016

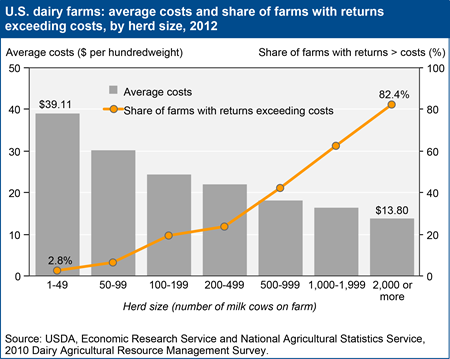

While some small U.S. dairy farms earn profits and some large farms incur losses, financial performance in the dairy sector, on average, is linked to herd size. Data from 2010 (the latest available for dairy farms by herd size) show that a majority of dairy farms with milking herds of at least 1,000 cows generate gross returns that exceed total costs, while most small and mid-size dairy farms do not earn enough to cover total costs. Total costs include annualized capital recovery as well as the cost of unpaid family labor (measured as what the farm family could earn off the farm), in addition to cash operating expenses. Many more small and mid-sized farms are able to cover total costs, except for costs associated with capital recovery. Farms can operate in this way for years, covering operating expenses and providing a reasonable income for a farm family, until the expense of maintaining aging equipment and structures begins to erode the incomes that a family can earn from the farm. At that point, many families may decide to close the farm. Some—particularly those where a younger generation intends to continue the business—may seek financing to expand the dairy herd and realize lower costs through scale economies. This chart is found in the ERS report,

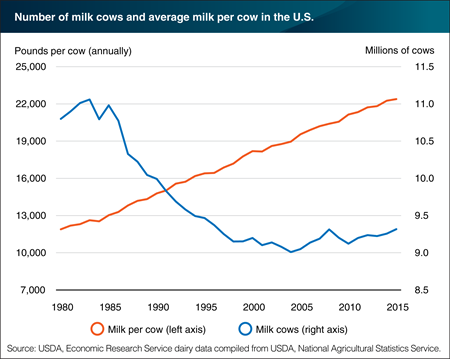

Friday, April 15, 2016

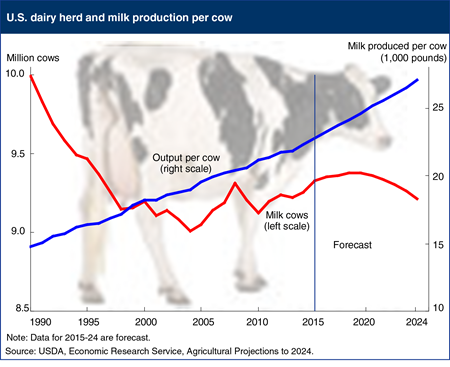

The number of milk cows in the United States was up slightly in 2015, reaching 9.3 million, about equal to the number in 2008. The size of the U.S. dairy herd reached an historic low of just over 9 million cows in 2004, following a long-term decline of more than 2 million head since 1983. Over the past decade, the herd size has grown slightly, by an average of 0.3 percent per year. Improving technology and genetics have allowed milk output per cow to rise steadily, increasing by 88 percent since 1980 and reaching a record-high annual average of 22,393 pounds of milk per cow in 2015. The result has been strong growth in U.S. milk production over the period, which corresponds to growing domestic and international markets for dairy products—particularly for cheese and various dairy-based food ingredients. This chart is based on the ERS Dairy Data product.

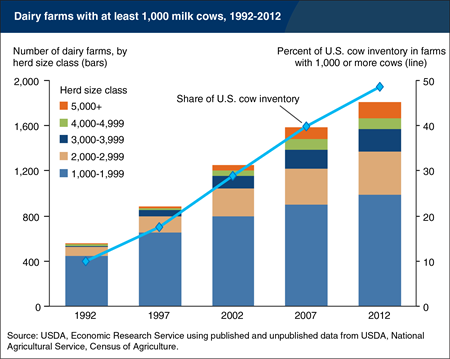

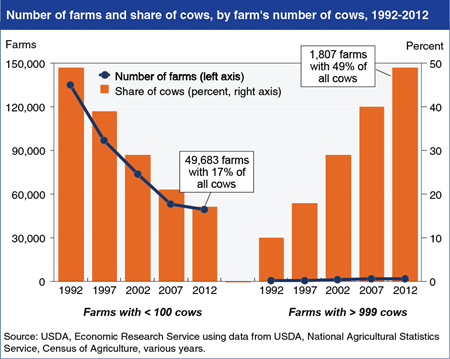

Friday, March 11, 2016

Two decades ago, most milk came from farms with fewer than 150 cows, on which a farm family handled milking, herd management, and crop production for feed. Today, while the United States still has many herds of 50 to 100 cows, most cows and milk production have moved to much larger farms, which are usually still owned and operated by families, but rely on hired labor for most farm tasks. Farms with milking herds of at least 1,000 cows accounted for nearly half of all cows in 2012, up from 10 percent of all cows in 1992. Producers continued to increase herd size in that period; there were 17 farms with herds of 4,000 or more cows in 1992, compared to 95 farms in 2002 and 234 in 2012. Costs are an important reason behind the shift, as production costs appear to be substantially lower, on average, on larger farms. The data underlying this chart are available in the ERS report, Changing Structure, Financial Risks, and Government Policy for the U.S. Dairy Industry, March 2016.

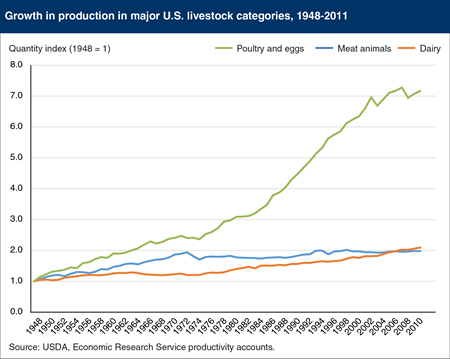

Friday, October 23, 2015

Total U.S. livestock output grew 130 percent from 1948 to 2011, with the poultry and eggs subcategory growing much faster than meat animals (including cattle, hogs, and lamb) and dairy products. In 2011, the real value of total poultry and egg production was more than seven times its level in 1948, with an average annual growth rate exceeding 3 percent. The rapid growth of poultry production is due largely to changes in technology—advances in genetics, feed formulations, housing, and practices—and increased consumer demand. Retail prices of poultry fell in the late 1970’s and 1980’s, relative to beef and pork prices, leading to expanded poultry consumption in that period. Increased domestic consumption and exports were also driven by consumer response to an expanding range of new poultry products, as the industry moved away from a reliance on whole birds and production shifted to cut-up parts and processed products such as boneless chicken, breaded nuggets/tenders, and chicken sausages. This chart is found in the ERS report, Agricultural Productivity Growth in the United States: Measurement, Trends, and Drivers, July 2015.

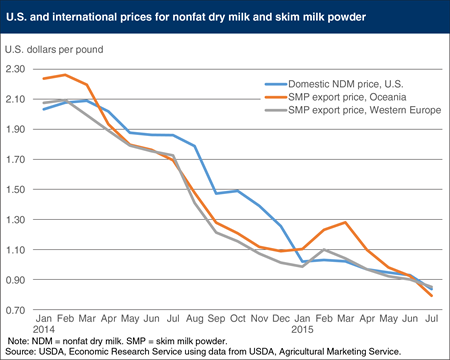

Wednesday, August 26, 2015

The U.S. domestic wholesale prices of nonfat dry milk (NDM) have declined from a record high of $2.090 per pound in March 2014 to $0.837 per pound in July 2015, the lowest price since May 2009. International export prices for skim milk powder (SMP) are also declining, reaching $0.792 per pound in July for Oceania and $0.851 per pound for Western Europe. Since the U.S. market for NDM is highly dependent upon exports (52 percent of production was exported in 2014), domestic prices track closely with international prices. The domestic wholesale price for dry whey, which is also highly dependent upon exports, fell from 42.5 cents in June to 39.4 cents in July, the lowest level since January 2011. Domestic prices for butter and cheese have not fallen as much since those markets are not as dependent upon exports. The declining prices reflect weak global demand, particularly from China, and the Russian import ban on dairy products from major producers. With lower dairy product prices, milk prices are also declining, with the all-milk price currently forecast to average $16.75-$16.95 per hundredweight in 2015, down from an average of $23.97 in 2014. This chart is from the August 2015 Livestock, Dairy and Poultry Outlook report.

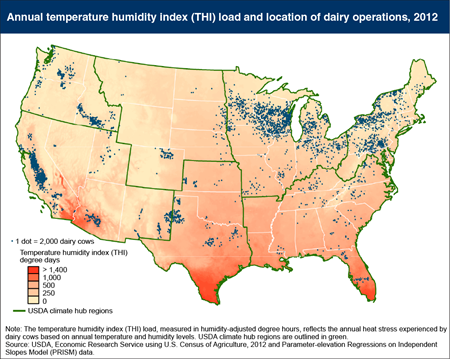

Wednesday, July 8, 2015

Above a temperature threshold, an animal may experience heat stress resulting in changes in its respiration, blood chemistry, hormones, metabolism, and feed intake. Dairy cattle are particularly sensitive to heat stress; high temperatures lower milk output and reduce the percentages of fat, solids, lactose, and protein in milk. In the United States, dairy production is largely concentrated in climates that expose animals to less heat stress. The Temperature Humidity Index (THI) load provides a measure of the amount of heat stress an animal is under. The annual THI load is similar to “cooling degree days,” a concept often used to convey the amount of energy needed to cool a building in the summer. The map shows concentrations of dairy cows in regions with relatively low levels of heat stress: California’s Central Valley, Idaho, Wisconsin, New York, and Pennsylvania. Relatively few dairies are located in the very warm Gulf Coast region (which includes southern Texas, Louisiana, Mississippi, Alabama, and Florida). This map is drawn from Climate Change, Heat Stress, and Dairy Production, ERR-175, September 2014.

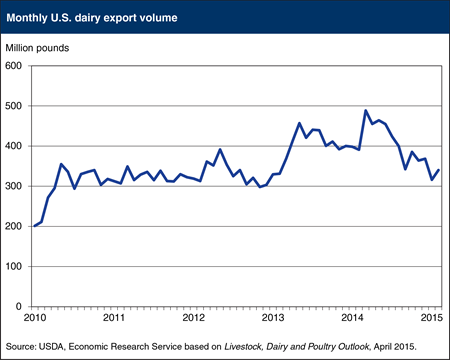

Thursday, April 30, 2015

Exports of U.S. dairy products have been strong over the past decade, growing from 1.95 billion pounds in 2005 to nearly 5 billion pounds in 2014. However, over the past 9 months, exports have softened considerably, falling from 464 million pounds in May 2014 to below 340 million pounds in February 2015. Much of the reduction in export volume can be attributed to lower demand by China. Chinese imports of milk powders surged in late 2013 and early 2014, reflecting tight domestic supplies due to herd reductions, stricter regulations on dairy/infant formula production, and strong consumer demand. China turned to the United States and the European Union to supply growing volumes of skim milk powder, while New Zealand increased output of whole milk powder. By mid-2014, China scaled back purchases of milk powders due to growing inventory, slowing economic growth, and an upsurge in China’s domestic milk production. In addition, U.S. dairy exports have been hampered by the strong exchange rate value of the dollar and flagging international demand for milk powders in general. This chart is based on Livestock, Dairy and Poultry Outlook, LDPM-250, April 2015.

Monday, March 30, 2015

U.S. milk cow numbers are projected to rise through 2018 as high milk prices and lower feed costs provide favorable returns to producers. Lower returns due in part to higher feed costs are expected to lead to year-to-year declines in cow numbers from 2020-24. At the same time, U.S. milk output per cow is projected to increase through the projection period, reflecting continued technological and genetic developments. Domestic commercial use of dairy products is expected to increase faster than the growth in U.S. population over the next decade. The demand for cheese is expected to rise due to greater consumption of prepared foods and increased away‑from-home eating, while the long-term decline in per capita consumption of fluid milk products is likely to continue. The United States is expected to expand exports of dairy products; commercial U.S. dairy exports are projected to increase steadily over the next decade, reaching record levels on both a fat and a skim-solids basis. Production increases in other major dairy exporting countries are expected to lag growth in global import demand, supporting a favorable outlook for U.S. dairy exports. This chart is based on the report, USDA Agricultural Projections to 2024.

Tuesday, January 6, 2015

Over the last two decades, a major transformation of the dairy sector reduced the number of dairy farms by nearly 60 percent, even as total milk production increased by one-third. The accompanying shift to larger dairy farms is driven largely by farm profitability. Average costs of production per hundredweight of milk produced fall as herd size increases even among the largest farms (e.g., average costs are lower for farms with 2000+ cows compared to 1000-1999 cows). Production costs include the estimated cost of the farm family’s labor as well as capital costs and cash expenses. While some small farms earn profits and some large farms incur losses, most of the largest dairy farms generate gross returns that exceed full costs, while most small and mid-size dairy farms do not earn enough to cover full costs. The cost differences reflect differences in input use; on average, larger farms use less labor, capital, and feed per hundredweight of milk produced. These financial returns provide an impetus for the shift to larger dairy farms. This chart is drawn from the December 2014 Amber Waves data feature, "Milk Production Continues Shifting to Large-Scale Farms."

Wednesday, December 10, 2014

In 2012, there were still nearly 50,000 U.S. dairy farms with fewer than 100 cows, but that represented a large decline from 20 years earlier, when there were almost 135,000 small dairy farms. Over the same period, the number of dairy farms with at least 1,000 cows more than tripled to 1,807 farms in 2012. Movements in farm numbers were mirrored by movements in the share of cow inventories. Farms with fewer than 100 cows accounted for 49 percent of the country’s 9.7 million milk cows in 1992, but just 17 percent of the 9.2 million milk cows in 2012. Meanwhile, farms with at least 1,000 cows accounted for 49 percent of all cows in 2012, up from 10 percent in 1992. The shift to larger dairy farms is driven largely by the economics of dairy farming. Average full costs of production (which include the annualized cost of capital, imputed cost of unpaid family labor, and cash operating expenses) are substantially lower on farms with larger herds. This chart is drawn from the December 2014 Amber Waves data feature, "Milk Production Continues Shifting to Large Scale Farms."

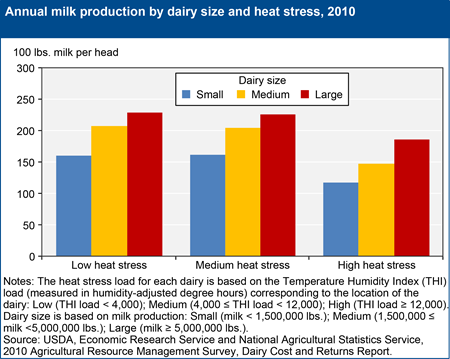

Thursday, November 20, 2014

Above a temperature threshold, an animal may experience heat stress, which results in changes in its respiration, blood chemistry, hormones, metabolism, and feed intake. Depending on the species, high temperatures can reduce meat and milk production and lower animal reproduction rates. Dairy cattle are particularly sensitive to heat stress; experiments have shown that high temperatures lower milk output and reduce the percentages of fat, solids, lactose, and protein in milk. A 2010 USDA survey of dairy farmers shows how climate influences milk production in practice. For small, medium and large dairies, milk output per cow was lower in areas with high heat stress compared to areas with low or medium heat stress. In much of the United States, climate change is likely to result in higher average temperatures, hotter daily maximum temperatures, and more frequent heat waves. Such changes could increase heat stress and lower milk production, unless new technologies are developed and adopted that counteract the effects of a warner climate. This chart is based on data found in the ERS report, Climate Change, Heat Stress, and Dairy Production, ERR-175, September 2014.

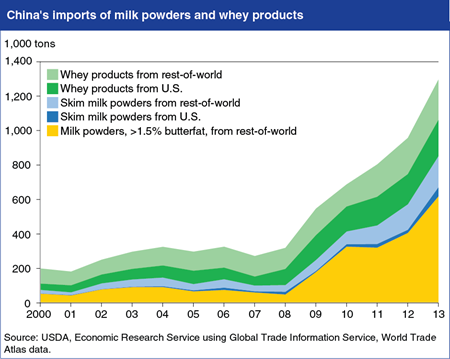

Friday, November 14, 2014

Increasing demand in China for imported dairy products has become a major driver in global markets, especially for milk powders and whey products. The largest increase in Chinese imports has been milk powders with greater than 1.5 percent butterfat, which includes whole milk powder. New Zealand has been the primary supplier of whole milk powder to China, while the United States has been a significant supplier of skim milk and whey products. In 2013, the United States supplied about 23 percent of China’s imports of skim milk powder and about 47 percent of its imports of whey products. Most milk powders are further processed and used for infant formulas, ultra-high temperature (UHT) milk, yogurt, milk-based beverages, and food processing. About half of the imported whey products are used for animal feed, with the rest mainly used for the processed food industry and infant formula. Find additional data and analysis of dairy markets in Livestock, Dairy, and Poultry Outlook: October 2014 and Dairy Data.

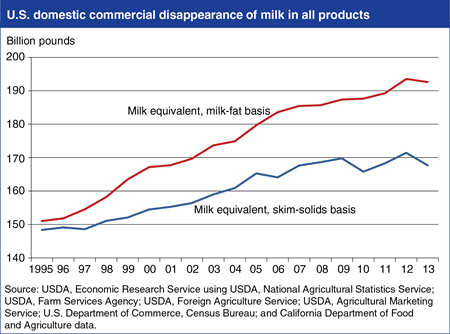

Tuesday, September 16, 2014

U.S. consumption of dairy products is expanding, with the fastest growth occurring in products with relatively high milk-fat content. ERS estimates commercial disappearance (a measure of consumption) of fluid milk and other dairy-containing products in two different ways: one based on the milk fat content of the various products (milk-equivalent milk-fat basis) and the other based on the skim solids (proteins, lactose, and minerals) content of the products (milk equivalent skim-solids basis). Estimates on a milk-fat basis place greater weight on products with relatively high milk-fat content, such as butter and cheese, while estimates on a skim-solids basis place greater weight on products with relatively high skim solids, such as beverage milk and nonfat dry milk. Since 1995, commercial disappearance on a milk-equivalent, milk-fat basis has grown twice as fast as disappearance on a milk-equivalent skim-solids basis. This pattern reflects increasing U.S. per capita consumption of cheese, butter, and other products with relatively high milk-fat content, along with declining per capita consumption of fluid milk. Find these data in the new commercial disappearance dairy product tables provided in Dairy Data.