ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, April 14, 2021

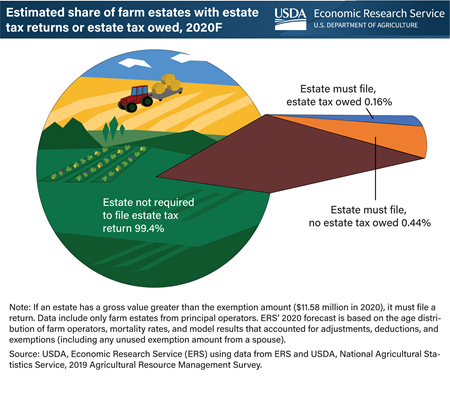

Created in 1916, the Federal estate tax is a tax on the transfer of property from a deceased person to their heirs at death. Legislation enacted over the last several years has greatly reduced the Federal estate tax by increasing the exemption amount from $675,000 in 2000 to $11.58 million in 2020. Under the present law, the estate of a person who owns assets above the exemption amount at death must file a Federal estate tax return. However, only returns that have an estate above the exemption after deductions for expenses, debts, and bequests to a surviving spouse or charity are subject to tax at a rate of 40 percent. Researchers from USDA, Economic Research Service (ERS) estimated that about 31,000 principal farm operators died in 2020. Of those estates, an estimated 189 (0.6 percent) will be required to file an estate tax return—and only 50 (0.16 percent) will owe Federal estate tax. Total Federal estate tax liabilities from farm estates owing taxes were forecasted to be $130.2 million in 2020 from a total estimated estate value of $56.3 billion. This chart appears in the April 2021 Amber Waves finding, “Less Than 1 Percent of Farm Estates Owed Federal Estate Taxes in 2020.”

Friday, March 5, 2021

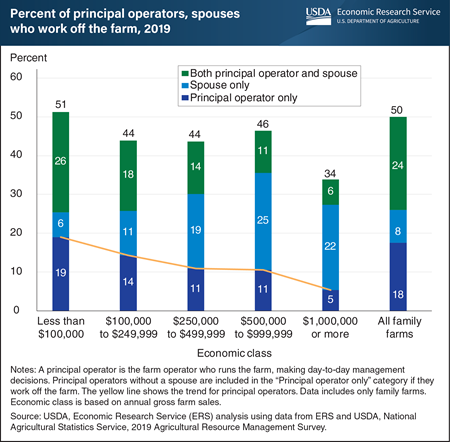

Farm households often rely on off-farm employment to provide other benefits, including health insurance, and to supplement their income. Loss of off-farm employment because of the COVID-19 pandemic can strain a farm household’s financial well-being. In 2019, 50 percent of all U.S. family farm households had the principal operator, the principal operator’s spouse, or both the principal operator and spouse working in an off-farm, wage-earning job. The shares of households working off-farm varied by the farm’s economic class. For small farms with less than $100,000 in annual gross farm sales, 51 percent had the principal operator, the spouse, or both work off the farm. By comparison, 34 percent of large farms with annual gross farm sales of $1 million or more had the principal operator, the spouse, or both work off the farm. As the farm’s sales size increases, the share of principal operators working off the farm decreased. Smaller family farms generally don’t earn enough from farm sources alone to cover household living expenses, whereas larger farms usually require increasingly more on-farm labor and management resources. While this information predates the COVID-19 pandemic, it can provide insights into the potential impact of decreased employment rates, which can result in the loss of off-farm employment for many farm households. This chart updates data found in the USDA, Economic Research Service report, America’s Diverse Family Farms, 2019 Edition, released December 2019.

See also: Farms and Farm Households During the COVID-19 Pandemic

Tuesday, January 19, 2021

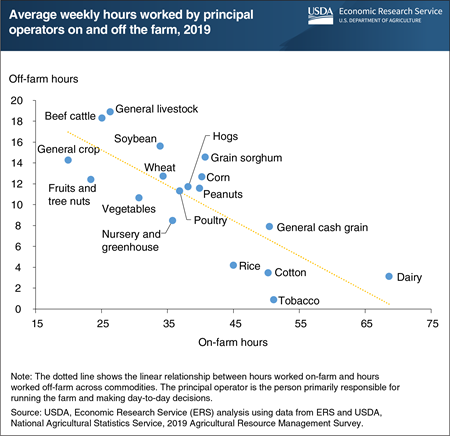

Off-farm income supplements farm income for most farm households, in addition to offering benefits such as health insurance. In 2019, about 71 percent of farm households had one or more household members earning an off-farm salary or wage. More than 40 percent of principal operators worked off-farm, contributing about 54 percent of the total off-farm labor hours reported for their households. Principal operators who reported off-farm employment worked on average 15 hours off the farm per week in 2019. Compared with the seasonality of on-farm work, off-farm work offered principal operators more consistency—with operators working about 25 percent of total off-farm hours in each quarter of the year. However, principal operators who worked more on-farm tended to work less off-farm across a variety of commodities. On average, principal operators with livestock, beef cattle, and fruit and tree nut farm operations worked fewer on-farm hours and more off-farm hours in 2019. Principal operators on those farms may be more vulnerable to disruptions in the off-farm economy, such as increased unemployment because of the COVID-19 pandemic. This chart updates data found in the December 2018 Amber Waves finding, “Farm Households Divide Their Time Between On-Farm and Off-Farm Labor.”

See also: Farms and Farm Households During the COVID-19 Pandemic.

Friday, January 8, 2021

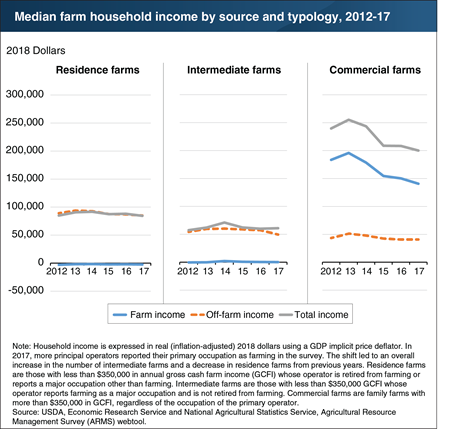

Errata: On January 13, 2021, the charts on residence and intermediate farms were revised to correct the labels for “Median total income” and “Median off-farm income.”

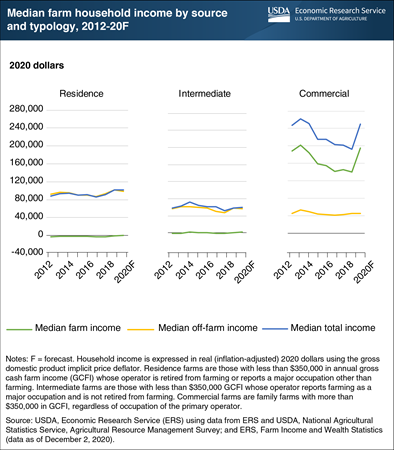

In 2020, USDA’s Economic Research Service (ERS) expects the inflation-adjusted median household income for the principal operators of commercial and intermediate U.S. farms to increase by an estimated 29.6 percent and 4.9 percent, respectively. By comparison, household income for principal operators of residence farms is estimated to remain relatively unchanged. Many farm households rely on a combination of on-farm and off-farm income sources. Generally, residence farms rely most on off-farm income sources. ERS forecasts the median off-farm income for residence, intermediate, and commercial farm households to decline in 2020, with residence farms expected to have the largest percentage decline at 3.4 percent. This decline is due to estimated lost employment and wage income as a result of the coronavirus pandemic, which is partially offset by estimated Economic Impact Payments distributed to most U.S. households as part of the pandemic financial relief efforts. Median farm income for intermediate farm households is forecast to increase by 165 percent, from $662 in 2019 to $1,756 in 2020. By comparison, median farm income for commercial farm households is expected to increase by 39 percent, from $140,729 in 2019 to $194,982 in 2020. Median farm income for residence farms households is estimated to increase too, from –$810 in 2019 to –$160 in 2020. The increase in median farm income is due to pandemic financial relief payments from Federal programs, such as the Paycheck Protection Program (PPP) and the Coronavirus Food Assistance Programs (CFAP) 1 and 2. The increases in median farm incomes were partially offset by the decline in median off-farm income. Because households operating residence farms rely most on off-farm income sources and are estimated to receive smaller amounts of government programs, their median total household income is forecast to decline slightly overall. This chart uses data from ERS’s Agricultural Resource Management Survey webtool and the Farm Income and Wealth Statistics data product, released December 2020.

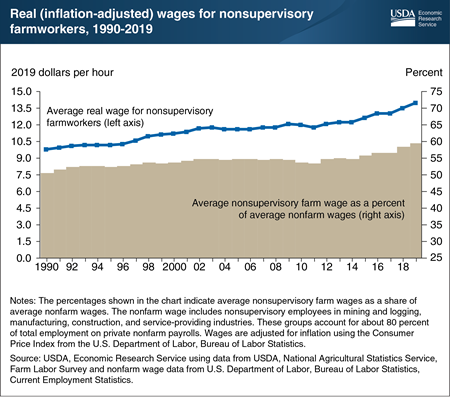

Friday, November 27, 2020

Hired farmworkers make up less than 1 percent of all U.S. wage and salary workers, but they play an essential role in labor-intensive industries within U.S. agriculture, such as the production of fruits, vegetables, melons, dairy, and nursery and greenhouse crops. Farm wages have risen over time for nonsupervisory crop and livestock workers (excluding contract labor). According to data from the USDA’s Farm Labor Survey, real (inflation-adjusted) wages rose at an average annual rate of 1.1 percent between 1990 and 2019. In the past 5 years, real farm wages grew even faster at an average annual rate of 2.8 percent. This is consistent with growers’ reports that the longstanding supply of workers from Mexico has decreased, as growers may respond over time by raising wages to attract workers from other sources. The gap between farm and nonfarm wages has slowly shrunk but is still substantial. In 1990, the average wage for nonsupervisory farmworkers—$9.80 an hour in 2019 dollars—was about half the $19.40 wage of private-sector nonsupervisory workers in the nonfarm economy. By 2019, the $13.99 farm wage was 60 percent of the $23.51 nonfarm wage. This chart appears in the October 2020 Amber Waves data feature, “U.S. Farm Employers Respond to Labor Market Changes With Higher Wages, Use of Visa Program, and More Women Workers.”

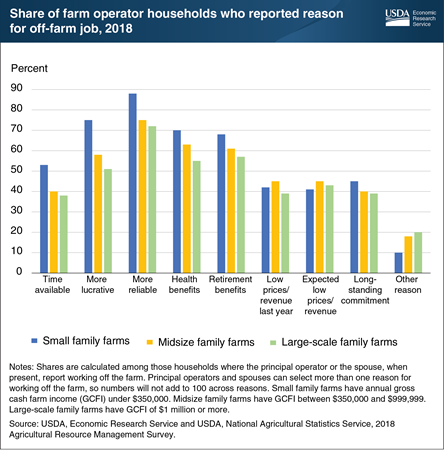

Monday, June 22, 2020

Nearly half of all family farm operators and their spouses reported having a job off the farm in 2018. The majority of households, regardless of farm size, report that they work off the farm because it is more lucrative than farm work, provides more reliable income, and may offer health and retirement benefits. Households had the option to report more than one reason for working off the farm. Among small family farms—those with annual gross cash farm income (GCFI) under $350,000—about 88 percent of these households reported working off the farm because it was more reliable and 75 percent because it was more lucrative. By comparison, among large-scale farm households—those with GCFI of $1 million or more—about 72 percent reported working off the farm because it was more reliable and 51 percent because it was more lucrative. In addition, about 40 percent of all principal operators or their spouses who work off the farm listed farm-related financial stress, such as low commodity prices or low farm revenue, as a reason for having a job off the farm. This chart appears in the March 2020 Amber Waves article, “Family Farm Households Reap Benefits in Working Off the Farm.”

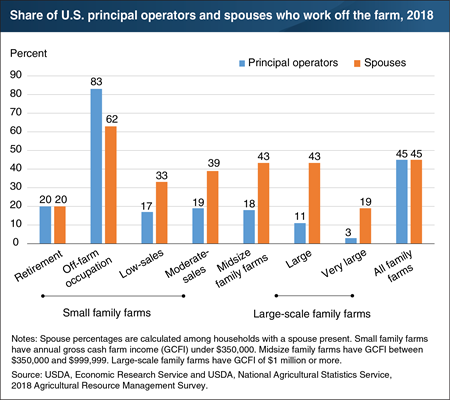

Monday, March 16, 2020

USDA’s Economic Research Service classifies farm households based on the annual gross cash farm income (GCFI) of the farm that they operate, and further separates small farms by the primary occupation of the principal operator. Data from USDA’s Agricultural Resource Management Survey consistently show that income earned off the farm is an important source of income for most farm households. Nearly half of all family farm operators and their spouses reported having a job off the farm in 2018. In general, spouses of principal operators are more likely to work off the farm, except among those classified as off-farm occupation farms. However, off-farm employment varies across farm types. For example, only 11 percent of operators of large farms and 3 percent of very large farms have a job off the farm, while between 17 and 19 percent of those operating low-sales, moderate-sales, and mid-size farms have an off-farm job. About 20 percent of operators on retirement farms hold off-farm jobs. This chart appears in the December 2019 report, America’s Diverse Family Farms: 2019 Edition.

Thursday, December 19, 2019

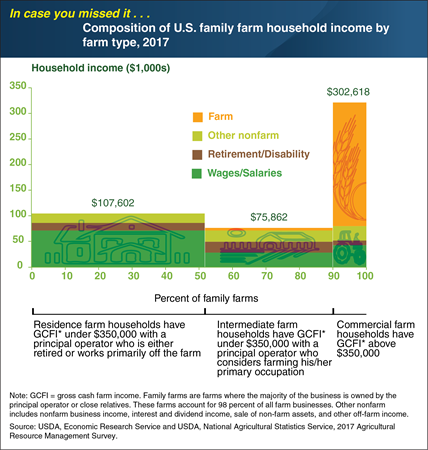

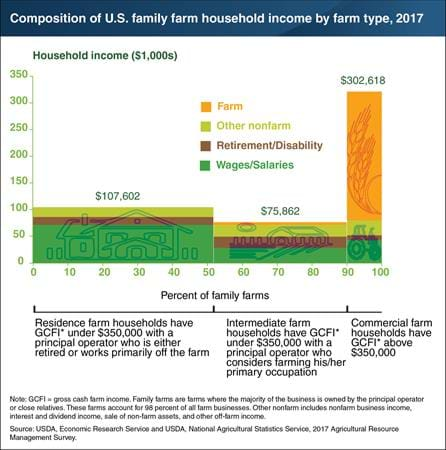

The composition of family farm household income varies by the type of farm. For example, households operating commercial family farms earned most of their income on the farm ($225,264 on average in 2017). Residence family farm households relied mostly on off-farm wages and salaries ($69,493 on average). Intermediate family farm households, meanwhile, had relatively high retirement and disability income ($19,222 on average), in part because these households had the oldest principal operators on average. Less than half of all farm households had positive incomes from their farm operations in 2017. Among commercial farm households, 86 percent had positive income from farming, compared to 51 percent of intermediate farm households and 35 percent of residence farm households. At the median, U.S. farm households earned $67,500 from non-farm sources, compared to a median loss of $800 from farming operations. This chart appears in the Amber Waves infographic “Farm Households Rely on Many Sources of Income,” published June 2019. This Chart of Note was originally published June 14, 2019.

Friday, December 13, 2019

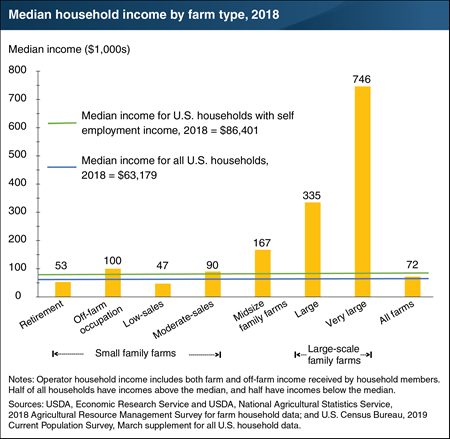

Farm households often earn higher incomes than other types of households. In 2018, 57 percent of U.S. farm households received incomes at or above the median for all U.S. households, which was $63,179 that year. ERS classifies farm households into 7 types based on their annual gross cash farm income (GCFI), and groups small farms by the primary occupation of the principal producer. Median household incomes for 5 out of 7 farm types exceeded both the median U.S. household and the median income for households with self-employment income. However, the median income for all family farm households is lower than the median among all U.S. households with self-employment income. Overall, only 3 percent of farm households had lower wealth than the median U.S. household. This chart appears in the December 2019 report, America’s Diverse Family Farms: 2019 Edition.

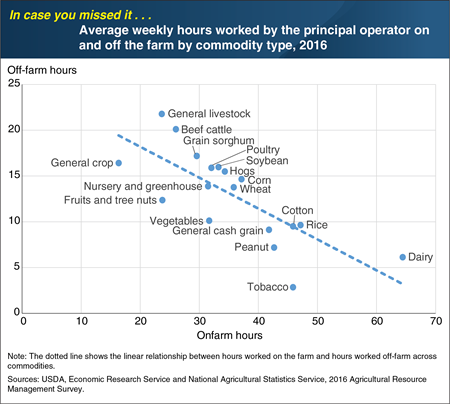

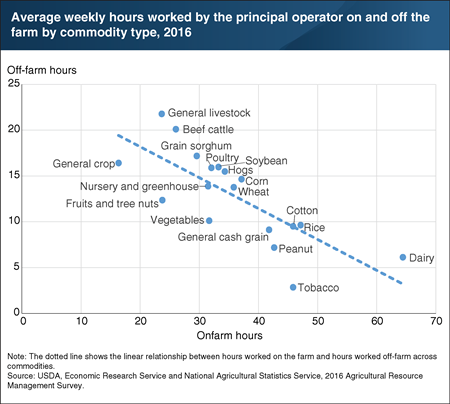

ICYMI… More time spent working on the farm leads to less off-farm labor across different commodities

Thursday, August 1, 2019

Survey data show that the more time a household allots to its farm operation, the less time is available for off-farm employment. Many farm operations require primarily part-time or seasonal work, which can allow household members to work off-farm with little interruption to the farming operation. Across all farms by commodity type, average onfarm hours worked by the principal operator in 2016 ranged from 16 hours per week for general crop farms (where no one crop accounted for a majority of the value of production) to 64 hours per week for dairy farms. Time spent working on the farm limits the time available not only for off-farm employment but also for housework, family, sleep, and leisure activities. Accordingly, the amounts of time spent working on and off the farm are negatively correlated across all commodity types. For example, dairy farmers, who tend to have the most rigid farm schedules, work only 6 hours per week off-farm on average. By comparison, beef cattle farmers tend to have highly flexible schedules and, consequently, spend an average of 20 hours per week working off-farm. This chart updates data found in the August 2018 ERS report, Economic Returns to Farming for U.S. Farm Households. Survey data is drawn from the 2016 Agricultural Resource Management Survey (ARMS), jointly administered by the National Agricultural Statistics Service and the Economic Research Service. This Chart of Note was originally published February 14, 2019.

Friday, June 14, 2019

The composition of family farm household income varies by the type of farm. For example, households operating commercial family farms earned most of their income on the farm ($225,264 on average in 2017). Residence family farm households relied mostly on off-farm wages and salaries ($69,493 on average). Intermediate family farm households, meanwhile, had relatively high retirement and disability income ($19,222 on average), in part because these households had the oldest principal operators on average. Less than half of all farm households had positive incomes from their farm operations in 2017. Among commercial farm households, 86 percent had positive income from farming, compared to 51 percent of intermediate farm households and 35 percent of residence farm households. At the median, U.S. farm households earned $67,500 from non-farm sources, compared to a median loss of $800 from farming operations. This chart appears in the Amber Waves infographic “Farm Households Rely on Many Sources of Income,” published June 2019.

Thursday, April 11, 2019

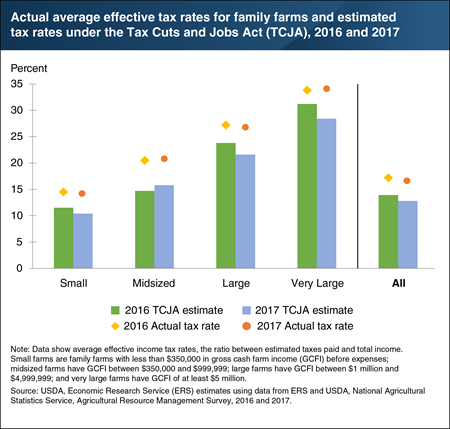

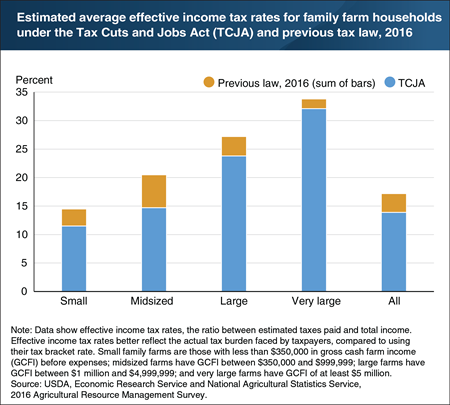

The Tax Cuts and Jobs Act (TCJA), enacted in December 2017, eliminates or modifies many itemized deductions and tax credits, while lowering Federal income tax bracket rates on individual and business income. Had the TCJA been in place in 2016, family farm households would have faced an estimated average effective tax rate of 13.9 percent, compared to the actual 17.2 percent effective tax rate that year. Had the TCJA also been in effect in 2017, the average effective tax rate would have been 12.8 percent, more than a percentage point lower than had it been in effect in 2016. By comparison, the actual effective tax rate in 2017 was 16.8 percent. The estimates vary by farm size. For example, small family farms would experience the lowest average effective tax rates, at 11.5 percent in 2016 and 10.4 percent in 2017. Only midsized family farms would have experienced an increase in their average tax rate, from 14.7 percent in 2016 to 15.8 percent in 2017. Those rates are still below the actual tax rates midsized farms experienced: 20.5 percent in 2016 and 20.8 percent in 2017. This chart updates data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households. For more on this topic, see “The Tax Cuts and Jobs Act Would Have Lowered Average Income Tax Rates for Farm Households between 2016 and 2017” in the April 2019 edition of Amber Waves.

Thursday, February 14, 2019

Survey data show that the more time a household allots to its farm operation, the less time is available for off-farm employment. Many farm operations require primarily part-time or seasonal work, which can allow household members to work off-farm with little interruption to the farming operation. Across all farms by commodity type, average onfarm hours worked by the principal operator in 2016 ranged from 16 hours per week for general crop farms (where no one crop accounted for a majority of the value of production) to 64 hours per week for dairy farms. Time spent working on the farm limits the time available not only for off-farm employment but also for housework, family, sleep, and leisure activities. Accordingly, the amounts of time spent working on and off the farm are negatively correlated across all commodity types. For example, dairy farmers, who tend to have the most rigid farm schedules, work only 6 hours per week off-farm on average. By comparison, beef cattle farmers tend to have highly flexible schedules and, consequently, spend an average of 20 hours per week working off-farm. This chart updates data found in the August 2018 ERS report, Economic Returns to Farming for U.S. Farm Households. Survey data is drawn from the 2016 Agricultural Resource Management Survey (ARMS), jointly administered by the National Agricultural Statistics Service and the Economic Research Service.

Friday, December 14, 2018

The median total household income for commercial U.S. farms is estimated to decline from $239,526 in 2012 to $200,090 in 2017. By comparison, the median farm income for residence and intermediate farms is estimated to remain relatively unchanged. In 2017, the median total household income for residence and commercial farms remained above the median income for all U.S. households ($63,172), despite declines in total income. Farm households rely on a combination of on-farm and off-farm sources of income. On-farm sources include income from the farm business, which is determined by farm costs and returns that often vary from year to year. In any given year, a significant number of farm households report negative farm income. Off-farm sources—including wage income, nonfarm business earnings, dividends, and transfers—are the main contributor to household income for residence and intermediate farms. The heavier reliance on off-farm income of these farms makes them less susceptible to changes in farming costs and returns than commercial farms. Because households operating commercial farms rely most on on-farm sources of income, they experience the largest drop in their total household income when farm sector income falls. This chart uses data from the new ERS and NASS Agricultural Resource Management Survey webtool, released December 2018.

Friday, October 19, 2018

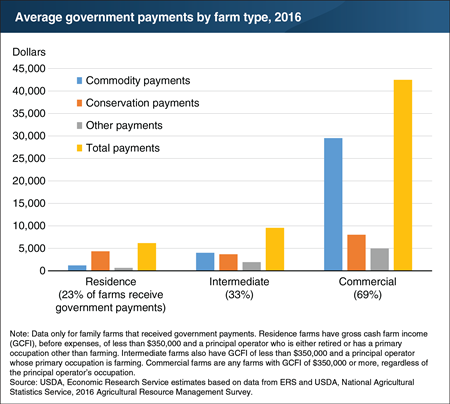

Federal Government programs distribute payments each year to farms, farm operators, and their households. For example, USDA’s Conservation Reserve Program and Environmental Quality Incentive Program provide payments to operators for conservation purposes. And USDA’s commodity programs, such as Price Loss Coverage and Agriculture Risk Coverage, pay producers when prices or revenues fall below a certain level. “Other payments” include disaster assistance programs and other Federal, State and local programs. In 2016, only 23 percent of all residence farms and 33 percent of all intermediate farms received any government payments, compared to 69 percent of all commercial farms. The amount of government payments received varied by farm type. Commercial farms that received payments got an average of $42,459, with commodity payments accounting for the majority (70 percent) of the total. On the other hand, conservation payments were relatively more important for residence and intermediate farms—accounting for about 70 percent and 38 percent of total payments, respectively. This chart updates data found in the August 2018 ERS report, Economic Returns to Farming for U.S. Farm Households.

Monday, October 15, 2018

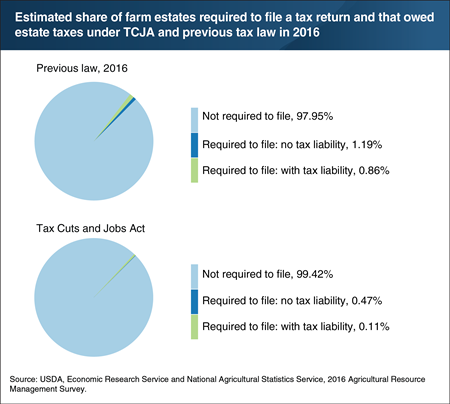

The Tax Cuts and Jobs Act (TCJA), passed in December 2017, doubled the Federal estate tax exemption amount to $11.18 million per individual. The estate tax exemption amount has increased significantly since 2000, when the exemption was $675,000, resulting in fewer farm estates that must file a tax return and that owe estate taxes. ERS researchers estimated that 39,214 farm estates were created in 2016 and, had the TCJA been in effect in 2016, only 0.58 percent of these farm estates would have been required to file an estate tax return. After accounting for adjustments, deductions, and expenses, 0.11 percent would have owed estate taxes, with an aggregate estate tax liability estimated at $104 million. By comparison, ERS estimated that under the previous law, 2.05 percent of farm estates were required to file an estate tax return in 2016 and that 0.86 percent owed estate taxes. The aggregate liability was estimated at $496 million. This chart uses data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

Wednesday, August 22, 2018

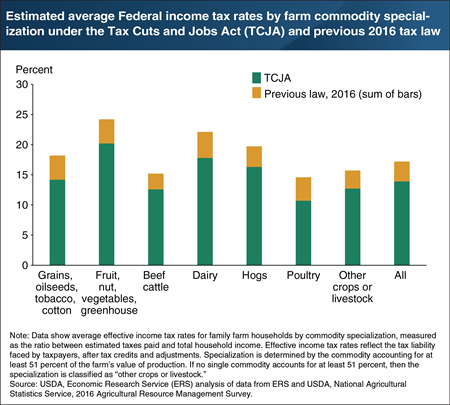

The Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax bracket rates on individual and business income. Had the TCJA been in place in 2016, ERS estimates that family farm households would have experienced a decline of 3.3 percentage points on average in their effective tax rate—the share of income paid in taxes after tax credits and adjustments are taken into account. The effects of the TCJA vary across specializations. Dairy producers would have experienced the largest decline at 4.3 percentage points. This was largely due to the new TCJA deduction for business income, since dairy farmers tend to earn a higher share of total household income from the farm business. Producers of beef cattle, which represented the greatest number of farms of any specialty in 2016, would have experienced the smallest decline at 2.6 percentage points. Beef cattle producers generally operate small farms with farm income making up a lower share of their total household income, which results in smaller tax reductions than for farm households with a higher share of farm income. This chart uses data found in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

Thursday, August 2, 2018

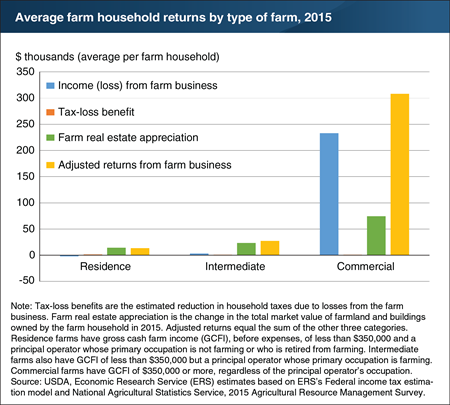

Of the roughly 2 million U.S. farm households, more than half report negative income from their farming operations each year. Most farms are small, and the proportion incurring farm losses is higher for households operating smaller farms—where most or all of their income is typically derived from off-farm activities. However, many households offset their off-farm income with these farm losses, thus reducing their taxable income. Also, in many years, farm real estate values have increased, which bolsters the economic returns for farmland owners. When these tax-loss benefits and changes in farm real estate values are taken into consideration, the returns to farming increased in 2015. For example, for residence farm households, estimated average returns increased from a negative $2,241 to positive $13,619. The increases in average returns for intermediate and commercial farm households were even greater. Finally, the share of total farm households with positive returns from their farm operation rose from 43 percent to 70 percent, primarily due to the broad increases in farmland real estate prices in 2015. This chart appears in the August 2018 ERS report, Economic Returns to Farming for U.S. Farm Households.

Friday, June 29, 2018

In 2016, family farm households faced an estimated income tax rate of 17.2 percent on average. However, the recently passed Tax Cuts and Jobs Act (TCJA) of 2017 eliminates or modifies many itemized deductions and tax credits, while lowering tax rates on individual and business income. The TCJA also expands some business provisions. Had the TCJA been in place in 2016, ERS estimates that family farm households would have faced a lower average income tax rate of 13.9 percent. The effects of the TCJA varies by farm size, with the greatest reduction for households operating midsized farms. The average income tax rate for households of midsized farms would have decreased by 5.8 percentage points. By comparison, the average income tax rate for households operating large farms would have decreased by 3.4 percentage points, for small farms by 3.0 percentage points. The expansion of the standard deduction is a primary reason households operating smaller farms are estimated to face lower income tax rates, while those operating large farms benefit more from reductions in individual tax rates and a new provision allowing a portion of farm income to be excluded from household taxable income (income from farming is taxed at the individual level for family farms). Midsized farms are expected to benefit from all these provisions. This chart appears in the June 2018 ERS report, Estimated Effects of the Tax Cuts and Jobs Act on Farms and Farm Households.

Wednesday, May 23, 2018

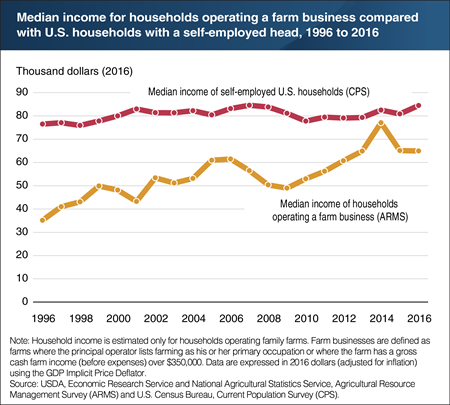

Households that operate farm businesses—which include farmers with commercial farms earning at least $350,000 in gross cash farm income before expenses and those with smaller farms who report farming as their primary occupation—account for two-fifths of U.S. farm households. Since 1996, the median income of these farm business households has remained below the income of self-employed households. However, the median income gap between farm business and self-employed households has varied and has narrowed considerably during this period. Over the past 20 years, after adjusting for inflation, the median income of farm business households has increased substantially. This has occurred both because farms have become more profitable and average off-farm income has risen. In 1996, the median income of farm business households was $35,166, compared to $76,483 for self-employed households. By 2016, the median income of farm business households had increased to $64,929, compared to $84,459 for self-employed households. This chart appears in the ERS topic page Farm Household Well-being, updated May 2018.