ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, February 10, 2016

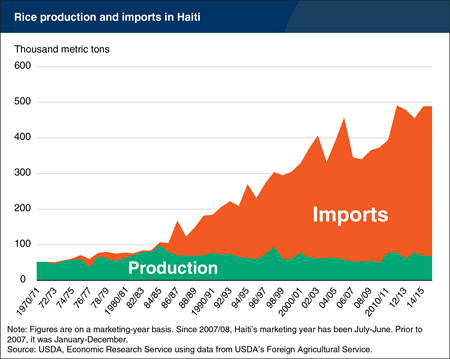

Rice is a critical component of the Haitian diet and access to adequate supplies of rice is a vital food-security objective of the Government of Haiti. Haiti began to open its market to imported rice in 1986, and the greater availability of rice allowed consumption to grow. Today rice consumption in Haiti accounts for about 23 percent of the total calories consumed each day. Rice production in Haiti has stagnated for decades, reflecting low productivity and poor access to financing, technology and skilled labor, so all of the growth in rice consumption since 1996 has been supplied by imports, which now account for 80 to 90 percent of rice consumption. The United States is the primary supplier of rice to Haiti, and Haitians have demonstrated a clear preference for U.S. long-grain varieties, greatly preferring them over cheaper Asian varieties. Efforts are underway to improve agricultural performance, but even with significant productivity gains, Haiti is likely to continue to rely on imports of rice for a significant part of its food needs. This chart is from the report Haiti’s U.S. Rice Imports.

Friday, December 4, 2015

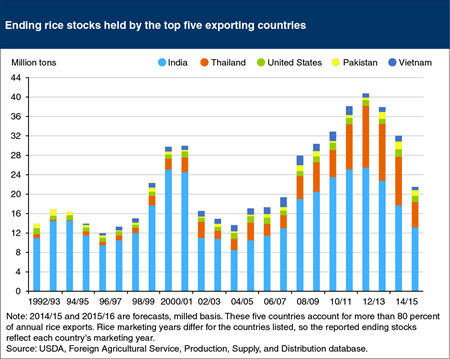

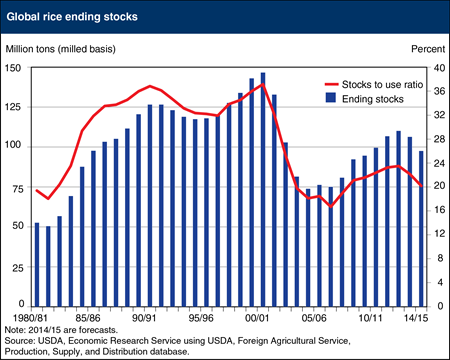

Rice consumption worldwide is expected to exceed production for the third consecutive year in 2015/16, resulting in the smallest global ending stocks since the 2007/08 marketing year. Ending stocks among the world’s five leading rice exporters—India, Thailand, Vietnam, Pakistan and the United States—are projected down a combined 33 percent from last year and 47 percent below the peak levels of 2012/13. These countries account for the bulk of the decline in global stocks. The last time stocks were near these levels in 2007/08, prices rose to their highest nominal level on record, prompted by export bans by Egypt, India, and Vietnam and fears of rice shortages in countries where rice is a staple food. Today the market situation is far different, with global rice prices relatively flat since late August 2015 after trending lower for the previous several years. However, the low stocks held by major exporters suggest that in the event of a major weather problem in any large rice consuming country, prices could rise rapidly since little surplus rice would be available to meet consumer needs. This chart is from the November 2015 Rice Outlook report.

Monday, August 31, 2015

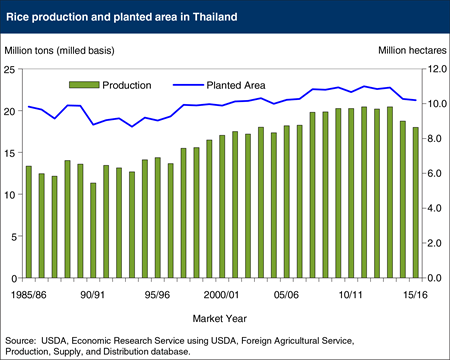

Thailand’s 2015/16 rice production (January/December marketing year) is forecast down 4 percent from last year and will be the lowest since 2004/05. The production decline is due to a second consecutive year of drought and resulting low reservoir levels. Planted area is forecast to fall to 10.2 million hectares for 2015/16, down from 10.92 million in 2013/14, before the current drought began; yields have dropped as well. The USDA area forecast was lowered in August based on Government statements informing growers that they will receive only 50 percent of normal dry-season irrigation water due to the low reservoir levels. In addition to less-than-adequate rainfall in 2014, less-than-normal rainfall at the beginning of the 2015 monsoon season in the central growing region in May and June also contributed to the low reservoir levels. This is the second consecutive year of a drought-reduced rice crop in Thailand. Thailand is typically the largest or near-largest rice exporting country, but exports for the 2015 calendar year are forecast about 18 percent below last year. Exports are forecast to rebound in 2016, but continued low reservoir levels and limited availability of irrigation water could impact the upcoming crop and export prospects. This chart is from the August 2015 Rice Outlook report

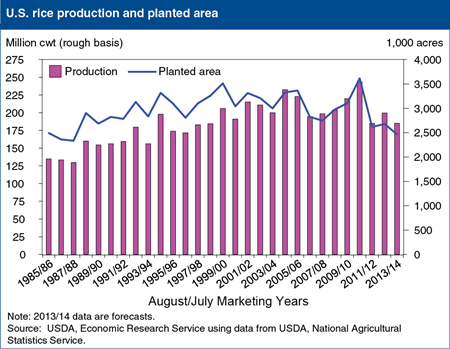

Thursday, August 6, 2015

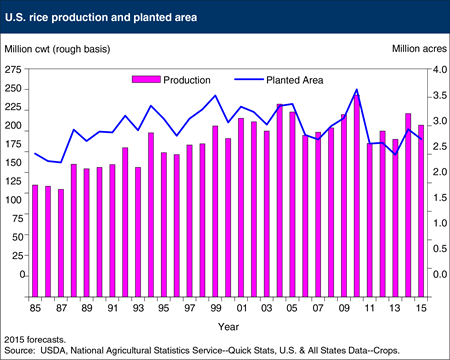

Rice acreage for 2015 is estimated at 2.77 million acres, down 6 percent from last year and 5 percent from March planting intentions. Rice acreage is down in all major producing States, reflecting low prices—especially for long-grain varieties—as well as drought in California, a cool and wet spring across much of the South, and continued water restrictions in Texas. California is reporting the largest percentage decline (11 percent) in rice area, which is the lowest since 1991/92. The 2015 decline follows a 23-percent reduction in rice acreage last year. The large, multi-year declines in California rice area reflect 4 consecutive years of severe drought. Growers in Texas have also faced tightening water restrictions for the past 4 years, and 2015 acreage is down around 20 percent from pre-drought levels, leaving it with the smallest acreage of any rice-producing State. Arkansas—the largest rice-producing State—accounts for more than half of the decline in U.S. rice area this year, with a drop in acreage of more than 6 percent. Arkansas produces both long-grain and medium-grain rice; low prices and unfavorable weather are behind a 9-percent decline in long-grain plantings, while medium-grain plantings in Arkansas increased 25,000 acres (12 percent) this year due to the expectation of favorable prices caused by California’s medium-grain shortfall. Louisiana and Mississippi are also reporting declines in rice acreage this year. This chart is from the July 2015 Rice Outlook report.

Wednesday, June 3, 2015

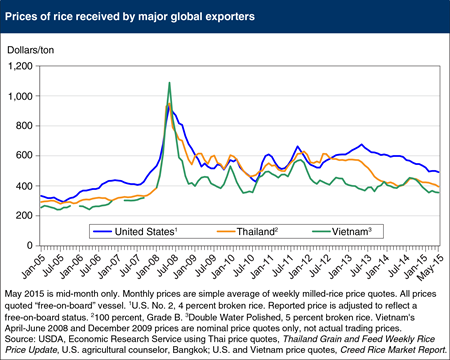

Global rice prices have fallen more than 14 percent over the past 8 months, recently hitting their lowest level since January 2008. Thailand’s global benchmark price was $389 per ton for the week ending May 18, down from $455 in late September; U.S. rice prices have declined at about the same rate. Several factors have contributed to this steep decline: the Government of Thailand selling its record high stock of rice; continued abundance of exportable rice, despite a smaller global rice crop and lower global ending stocks in 2014/15; and the appreciation of the U.S. dollar, which has put downward pressure on global rice prices, since rice is typically traded in dollars. Meanwhile, low oil prices have reduced the buying capacity of several major importers, especially Venezuela and several Middle Eastern buyers, and none of the major Asian rice importers—Indonesia, the Philippines, or Bangladesh—have experienced a crop shortfall that would boost imports. This chart is based on the report, Rice Outlook: May 2015.

Friday, April 17, 2015

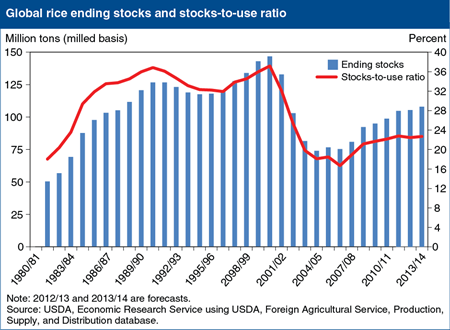

Global ending stocks of most agricultural commodities, including feedgrains, oilseeds, wheat, and cotton are expected to reach multi-year highs in 2015. Ample supplies are reflected in prices that are well below the record levels of just a few years ago. Rice is an exception, with global ending stocks projected to decline for the second year in a row to reach their lowest level since the 2009/10 marketing year (August/July). At the same time, global use continues to grow, led by consumption growth in China, India, Bangladesh, the Philippines, and several other nations. As a result, the global stocks-to-use ratio is projected at just over 20 percent, the lowest it has been since 2007/08, a time when international concern over high commodity and food prices led several of the world’s leading rice producing and consuming countries to restrict exports and increase government-owned rice reserves. These actions resulted in a rapid rise in global rice prices and reduced trade. Today, even though global stocks are approaching levels that prompted substantial trade restrictions in early 2008, prices are lower and global rice trade remains at near-record levels. This chart is from the April 2015 Rice Outlook.

Wednesday, March 25, 2015

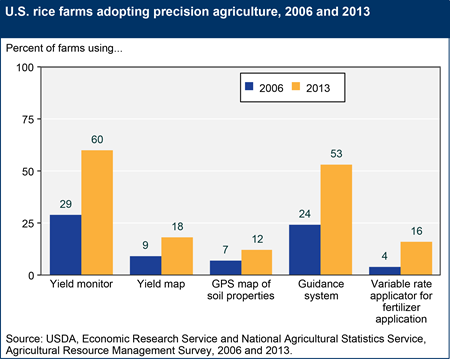

Precision agriculture refers to a set of practices used to manage fields by measuring variations in nutrient needs, soil qualities, and pest pressures. In 2013, USDA conducted the latest Agricultural Resource Management Survey (ARMS) of the U.S. rice industry, interviewing farmers about production practices, resource use, and finances in the 10 largest rice-producing States. Some technologies have been rapidly adopted; in particular, yield monitoring increased in use to 60 percent of farms between 2006 and 2013. Monitors can identify variations in yields within a field, allowing farmers to adjust inputs and practices accordingly. Auto-steer or guidance systems are now used on over half of all rice farms; these reduce stress on operators, and reduce errors in input application overlaps and seeding cut-off at the end rows. The cost savings from using these two technologies can also be accompanied by increases in yields. This chart is found in the joint ERS/National Agricultural Statistics Service (NASS) report, 2013 ARMS—Rice Industry Highlights, based on ARMS Farm Financial and Crop Production Practices data.

Monday, February 23, 2015

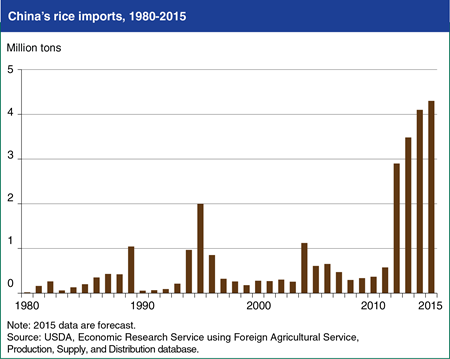

Rice imports by China are expected to set a new record in 2015, surpassing 2014 levels by 200,000 metric tons and marking the fourth consecutive year of record imports. Rice imports surged in 2012 to more than 7 times the average of the previous 5 years, and continued to grow each year thereafter. China remains the world’s largest rice producer and consumer, and has been largely self-sufficient in rice for more than 30 years and until recently, was typically a net rice exporter. In 2012, China surpassed Nigeria to become the world’s largest rice importer. Vietnam and Burma are the largest suppliers of rice to China, along with Pakistan and Thailand. The United States is currently unable to ship rice to China due to ongoing disagreements over phytosanitary issues. China’s record imports are not due to a short crop or tight supplies, but are the result of much lower prices for imported rice than for domestic rice, and continued growth in use partly due to an increasing population. As the world’s largest rice consumer, even small dietary shifts can have a large effect on the supplies needed to meet consumer demand, and China is increasingly turning to the world market to feed its appetite not only for staple commodities such as rice, but also fruits, vegetables, meat and other consumer-oriented products. This chart is based on the February 2015 Rice Outlook report.

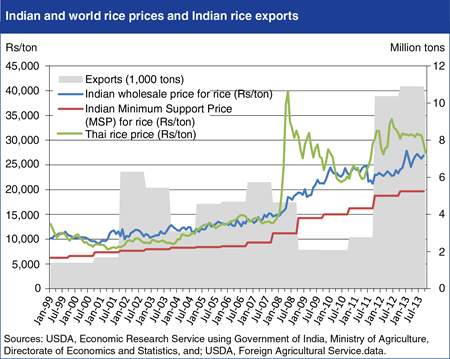

Thursday, December 4, 2014

Because rice is an important commodity for Indian producers and consumers, Indian Government policies intervene heavily in its domestic rice market. Particularly since the global price spike in 2008, India’s system of providing Minimum Support Prices (MSPs) for growers, distributing rice purchased at the MSP to consumers at subsidized prices, and placing periodic bans or quotas on rice exports, has kept domestic rice prices lower and more stable than world prices (represented by the export price of Thai rice). In 2008, India increased subsidized rice distribution and banned most exports of non-basmati (aromatic, long grain) rice to prevent higher world prices from affecting the domestic market; however, domestic rice prices still increased more than 30 percent between mid-2007 and early 2010. According to ERS research, Indian rice consumers were able to maintain rice consumption, but did so primarily by reducing expenditures on non-staple foods, health care, and durable goods. India’s higher level of exports since 2011, along with increases in MSPs, has contributed to current concerns with inflation in domestic rice prices. Find this chart and more in-depth research in Coping Strategies in Response to Rising Food Prices: Evidence from India.

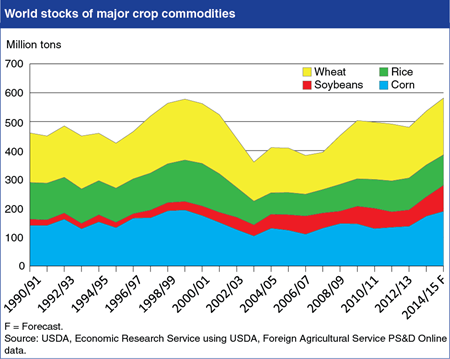

Friday, October 17, 2014

Global stocks of major crop commodities are forecast to expand in the 2014/15 marketing year, with total stocks of wheat, rice, corn, and soybeans completing recovery from the relatively low levels that preceded the 2008 spike in world crop prices. Record U.S. crops of corn and soybeans, along with good harvest by some other major producing countries, are forecast to push both U.S. and global stocks of these commodities to record levels. World wheat stocks are forecast to rise based on the outlook for record or near-record harvests by major foreign producers, including China, the EU, India, and the Former Soviet Union. While world rice stocks are forecast below peak levels of the early 2000s, good harvests and ample stocks are expected across the major producing regions in Asia. The supply outlook is expected to lead to lower commodity prices, with the average U.S. farm prices of corn (-24 percent), soybeans (-23 percent), wheat (-14 percent), and rice (-10 percent) all forecast down in their respective 2014/15 marketing years compared with 2013/14. Find additional analysis in the current editions of Feed Grain Outlook, Oil Crops Outlook, Wheat Outlook, and Rice Outlook.

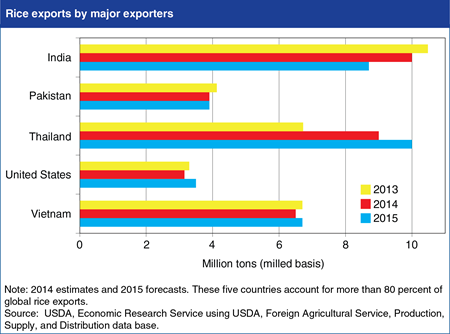

Friday, September 12, 2014

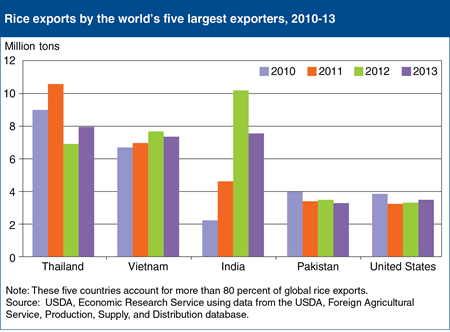

Thailand is forecast to reclaim its position as the largest global exporter of rice in 2015, aided by abundant domestic supplies, competitive prices, and the outlook for record global import demand. Thailand lost its position as the largest rice exporter to India in 2012, after implementation of new price policy—the Paddy Pledging Scheme (PPS)—reduced the price competitiveness of Thai rice and led to the accumulation of government stocks. With the PPS terminated in the spring of 2014, Thai rice exports are forecast to recover to 10 million tons in 2015. India’s rice exports are forecast to slip to 8.7 million tons, because of the outlook for a smaller rice harvest and renewed competition from Thailand. Vietnam and the United States are forecast to have good 2014 harvests and to expand rice exports in 2015. For 2015, world rice output is forecast at a record 477.3 million tons, and exports at a record 41.2 million tons. Sub-Saharan Africa and China are forecast to import record volumes of rice in 2015. Find this chart in the Rice Chart Gallery and additional analysis in Rice Outlook: August 2014.

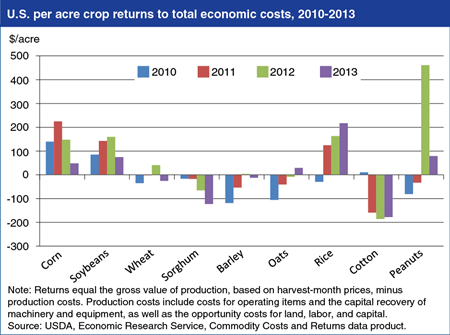

Wednesday, June 25, 2014

Estimates of U.S. crop returns per acre reveal large differences in crop profitability across commodities and over time during 2010-13. Returns to crop production are defined as the gross value of production less total economic costs. Total economic costs include operating costs such as seeds, fertilizer, and pesticides; the capital recovery cost for machinery and equipment; and the costs—known as opportunity costs—of employing land, labor, capital and other owned resources that have alternative uses. While returns to total economic costs for corn, soybeans, rice, and peanuts were positive, on average, for the 2010-13 period, average returns for other major crops were negative. For most crops, changes in farm prices and the gross value of production per acre, rather than changes in production costs, have driven returns to total economic costs. Lower prices contributed to reduced returns for corn, soybeans, wheat, sorghum, and peanuts in 2013, while price and yield increases improved returns for oats and rice. The negative returns over total economic costs for some crops indicate that that those producers realized a lower rate of return to their land, labor, and capital than the benchmark rates of return used in ERS commodity cost and returns accounts; returns over operating costs alone were positive for all crops throughout the period. This chart is based on data found in Commodity Costs and Returns.

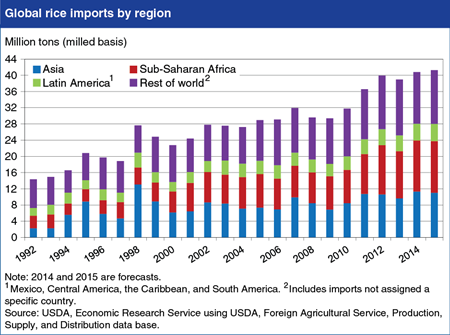

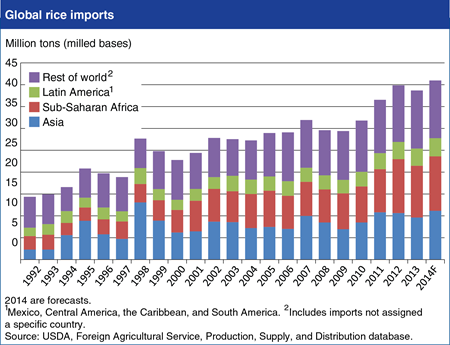

Friday, June 6, 2014

Global rice trade is forecast at a record 41.3 million tons in 2015, continuing the pattern of higher levels of global rice trade established since 2012. Recent growth in rice trade is largely based on record imports by Sub-Saharan Africa and China, moderating world rice prices, and abundant exportable supplies in Asia and the Western Hemisphere. Sub-Saharan Africa is projected to import a record 12.75 million tons of rice in 2015, with Nigeria (3.5 million tons) the largest regional—and second largest global—rice importer. China is forecast to import a record 3.7 million tons of rice in 2015, up 0.5 million tons from 2014, making it the largest global importer. Other major buyers expected to boost rice imports in 2015 include Iran, Iraq, Saudi Arabia, United Arab Emirates, and the European Union. Thailand is projected to be the largest rice exporter in 2015, shipping 10 million tons of rice, followed by India (9 million), Vietnam (6.7 million), Pakistan (3.9 million), and the United States (3.25 million). Although U.S. season average farm prices for long grain rice are forecast to be down about 10 percent in 2014/15, the recent pattern has been for U.S. rice to sell at larger premiums than Thai and Vietnamese rice. Find this chart in the Rice Chart Gallery, with additional analysis in Rice Outlook: May 2014.

Tuesday, March 25, 2014

Total calendar year 2014 global rice trade is forecast at a record 41.0 million tons, up 2.3 million tons, or nearly 6 percent, from 2013 and continuing the trend of expansion that began in 2010. The increase of rice trade has been driven by the combination of increasing demand by markets in Africa, the Middle East, and Asia, and abundant exportable supplies with Asian exporters. In 2014, China is forecast to be the world’s largest rice importer, followed by Nigeria, Iran, Indonesia, Iraq, and the Philippines. India is forecast to again be the largest rice exporter, followed by Thailand, Vietnam, Pakistan, and the United States. World rice prices, while remaining somewhat volatile since the 2008 spike in global food prices, have remained well below those that occurred in 2008 and have generally supported the growth in world rice trade. Find this chart in the Rice Chart Gallery and more analysis in Rice Outlook: March 2014.

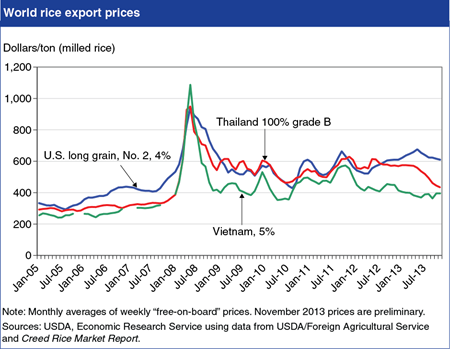

Tuesday, December 10, 2013

Key reference prices for rice traded in world markets have been more volatile since the 2008 spike in rice and other farm commodity prices. In 2013, rice prices have remained moderate despite recent cyclone activity that has damaged Asian crops, particularly in India. U.S. prices are currently more than $160 per ton above Thai prices, the largest differential on record, the result of smaller U.S. supplies, relatively high quality, and limited competition from Asian exporters in the Western Hemisphere—the largest market for U.S. exports. This chart can be found in the Rice Chart Gallery, with accompanying analysis in Rice Outlook: November 2013.

Monday, October 28, 2013

The 2013/14 (August/July) U.S. rice crop is projected at 185.1 million cwt (hundredweight, rough basis), 7 percent below a year earlier and 24 percent below the record 2010/11 crop. U.S. 2013/14 long-grain is projected at 126.5 million cwt, 12 percent below a year earlier, while combined medium- and short-grain production is projected at 58.5 million cwt, up 6 percent from a year earlier. Total area planted to rice is estimated at 2.49 million acres, 8 percent below a year earlier and the smallest U.S. rice planting since 1987/88. The decline is largely due to higher expected returns from alternative crops—such as corn and soybeans in the Mississippi Delta—and to weather problems in many parts of the South and water restrictions in Texas. Rice plantings are estimated to be higher than a year ago in Louisiana and Texas, unchanged in California and Mississippi, and lower in Arkansas and Missouri, with Arkansas accounting for the largest share of the decline. At a record 7,511 pounds per acre, the 2013/14 all rice average yield forecast is 62 pounds above 2012/13. Despite the decline in U.S. production, global rice production for 2013/14 is forecast at a record 476.8 million tons, primarily due to expanded area in Asia. This chart can be found in the. This chart can be found in the Rice Chart Gallery, with analysis in Rice Outlook: September 2013.

Thursday, July 25, 2013

Global rice stocks, which declined sharply in the early 2000s, prior to the 2008 spike in prices for rice and other food commodities, are forecast to continue the process of rebuilding in 2013/14. Global rice stocks are forecast to rise almost 3 percent in 2013/14, to the highest level since 2001/02. Widespread production gains have been a key driver of stock rebuilding. In 2013/14, global rice output is forecast at a record 476.1 million tons (milled basis), up more than 1 percent from a year earlier. Record crops are projected in India and China, the world’s largest producers, in 2013/14, with India forecast to be the largest exporter and China both a major importer and exporter. Larger harvests are also forecast for other major Asian producers, as well as in South America, North Africa, and Sub Saharan Africa. With ample supplies in major exporting countries, reference prices for major traded rice varieties from Thailand and Vietnam have continued to move lower in nominal U.S. dollar terms during 2012 and 2013. This chart can be found in the Rice Chart Gallery.

Tuesday, June 11, 2013

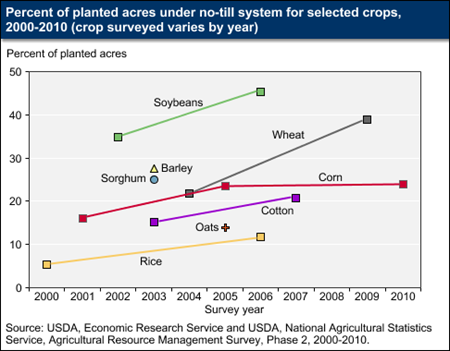

Farmers have choices for how they prepare the soil; reduce weed growth; incorporate fertilizer, manure and organic matter into the soil; and seed their crops, including the number of tillage operations and tillage depth. Tillage practices affect soil carbon, water pollution, and farmers’ energy and pesticide use. No-till is generally the least intensive form of tillage. Approximately 35 percent of U.S. cropland (88 million acres) planted to eight major crops had no-till operations in 2009, according to ERS researchers who estimated tillage trends based on 2000-07 data from USDA’s Agricultural Resource Management Survey (ARMS). Furthermore, the use of no-till increased over time for corn, cotton, soybeans, rice and wheat, the crops for which the ARMS data were sufficient to calculate a trend. While a more recent estimate of nationwide use of no-till by all major crop producers is not available, based on the results of recent surveys of wheat producers in 2009 and corn producers in 2010, it seems likely that no-till’s use continues to spread, albeit at a much reduced pace among corn producers. This chart is found on the ERS topic page, Soil Tillage and Crop Rotation, and in the ERS report, Agriculture’s Supply and Demand for Energy and Energy Products, EIB-112, May 2013.

Thursday, April 18, 2013

India exported a record 10.3 million tons of rice in 2012, making that country the world’s largest exporter for the first time. India’s rice exports increased from 2010 to 2012 because of generally good harvests, the accumulation of record Government stocks, globally competitive prices, and the relaxation of export restrictions. In September 2011, India removed restrictions on exports of non-basmati rice. The restrictions had been put in place during the 2008 global price spike to insulate Indian consumers from higher world prices. Vietnam, typically the world’s second largest exporter, shipped a record 7.7 million tons in 2012, also due to a bumper crop and competitive prices. In 2013, both India and Vietnam are projected to reduce their rice shipments as exports from Thailand, typically the world’s largest exporter, show some recovery. Thailand’s exports dropped to 6.9 million tons in 2012, when that country’s new Paddy Pledging Scheme, initiated in 2011/12, led to government purchases at above-market prices and the accumulation of about 16 million tons of stocks by early 2013. This year, the Thai Government is expected to release some of this rice, allowing Thailand to again become the world’s No. 1 exporter. This chart is adapted from the Rice Chart Gallery published with Rice Outlook: March 2013, RCS-13c.

Monday, January 14, 2013

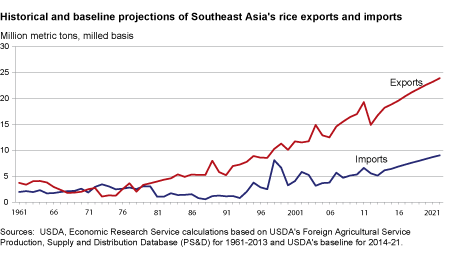

The Southeast Asia region is a major supplier of rice to global markets, accounting for about half of the import needs of the rest of the world in 2011. In USDA's most recent projections, Southeast Asia's rice surplus is expected to continue to expand over the next 10 years. Although rice production in the region is projected to grow at a slower rate over the next decade, growth in production is still expected to outpace growth in the region's rice demand. Land constraints are expected to lead to slower growth in both rice area and production, while the diversification of diets away from rice as incomes rise is projected to slow growth in rice consumption in most of the region. Overall, Southeast Asia's net exports of rice are projected to rise from an average of 11.2 million tons during 2009-11 to an average of 14.5 million tons in 2019-21. For this analysis, the Southeast Asia region refers to Brunei, Burma, Cambodia, Indonesia, Laos, Malaysia, the Philippines, Singapore, Thailand, and Vietnam. This chart appears in the ERS report, Southeast Asia's Rice Surplus, RCS-12l-01, December 2012.