ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Monday, April 15, 2024

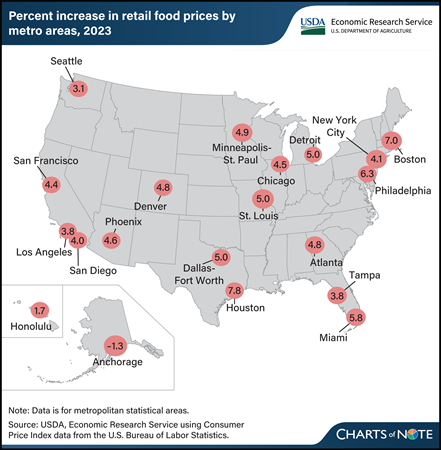

Retail food price inflation varies by locality. In 2023, food-at-home (grocery) prices rose the fastest in Houston, TX, by 7.8 percent, followed by Boston, MA, at 7.0 percent. In contrast, food-at-home prices declined by 1.3 percent in 2023 in Anchorage, AK, and rose by the lowest amount (1.7 percent) in Honolulu, HI. Across the United States, food-at-home prices increased by 5.0 percent on average in 2023. Differences in retail overhead expenses, such as labor and rent, can explain some of the variation among cities, because retailers often pass local cost increases to consumers in the form of higher prices. Furthermore, differences in consumer purchasing patterns for specific foods may help explain variation in inflation rates among cities. Products that consumers purchase vary regionally, and each metro area’s inflation rate is calculated based on a representative set of foods unique to the area. For example, an area whose residents purchase more foods with slower price inflation (such as fresh fruits and vegetables at 0.7 and 0.9 percent average growth in 2023, respectively) might experience lower food-at-home price inflation than an area whose residents buy more cereals and bakery products or nonalcoholic beverages, which increased by 8.4 percent and 7.0 percent, respectively, in 2023. This chart is drawn from the USDA, Economic Research Service Food Price Environment: Interactive Visualization, last updated in February 2024, which presents the 10-year average change in prices by metro area and provides context for the Food Price Outlook data product.

Wednesday, March 20, 2024

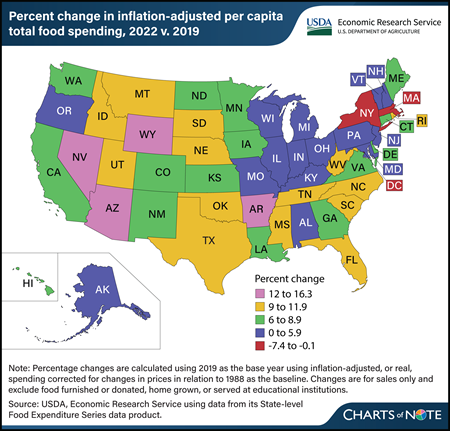

The U.S. food system experienced many changes since 2019, particularly during the Coronavirus (COVID-19) pandemic. Per capita total U.S. food spending increased 6.3 percent in 2022 compared with 2019 when adjusted for inflation. Inflation-adjusted food-at-home spending approached 2019 levels in 2022, while food-away-from-home spending remained high compared with prepandemic levels. However, this trend was not consistent across States. Washington, DC, had the largest decrease in total food spending between 2019 and 2022 (7.4 percent), mainly driven by a 12.9-percent decline in food-away-from-home spending. States with decreases or relatively small increases in total food spending were largely concentrated in the Northeast. Massachusetts and New York each saw decreases of 0.7 percent in inflation-adjusted, per capita total food spending between 2019 and 2022, while food spending in Vermont grew 1.6 percent. Many States with the largest increases in inflation-adjusted, per-capita food spending were concentrated in the West, with Nevada (16.3 percent), Wyoming (15.5 percent), and Arizona (13.9 percent) seeing the largest increases over the period. This chart is drawn from USDA, Economic Research Service’s State-level Food Expenditure Series, updated February 2024. For more on food spending, see the Amber Waves article U.S. Consumers Spent More on Food in 2022 Than Ever Before Even After Adjusting for Inflation, published September 2023.

Tuesday, March 12, 2024

In 2022, farm establishments received 24.1 cents for each dollar spent on food at home and 3.6 cents for each dollar spent on food away from home. These amounts, called farm shares, highlight the different paths that food takes from farms to consumers' points of purchase. Food-at-home dollars include food purchases from outlets such as grocery stores, supermarkets, and wholesale clubs that are meant to be prepared at home. Food-away-from-home dollars include food purchases at restaurants, including delivery and carry-out, and other venues where the food is eaten on the premises. The remainder of each food dollar makes up the marketing share, which is the total value of processing, transportation, retailing, and other activities that get food from farm operations to points of purchase for consumers. In 2022, the marketing share was 75.9 cents per food-at-home dollar and 96.4 cents per food-away-from-home dollar. The marketing share can change based on many factors, such as consumer preferences and the costs of production inputs. The marketing share is higher for food away from home because of the higher costs of preparing and serving meals. Find additional information in the USDA, Economic Research Service’s (ERS) Amber Waves article ERS Food Dollar's Three Series Show Distributions of U.S. Food Production Costs, published in December 2023, and the ERS Food Dollar Series data product, updated November 15, 2023.

Wednesday, February 14, 2024

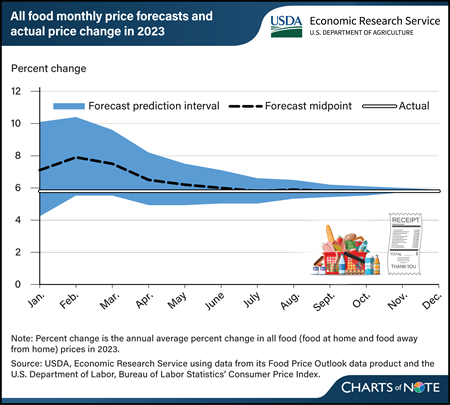

In 2023, all food prices (representing both food at home and food away from home) increased by 5.8 percent on average compared with 2022. The USDA, Economic Research Service (ERS) publishes food price forecasts in the Food Price Outlook (FPO) data product. Each month, the FPO forecasts the annual average change in prices for the current year, and the forecasts are presented as a midpoint and a prediction interval. The prediction interval, which represents uncertainty of the forecast, starts out wider at the beginning of the year and narrows as forecasts incorporate more months of observed data and the forecast period shortens. In January of each year, final data are available to assess the performance of the forecasts from the previous year. During the first few months of 2023, the all-food forecast midpoints were higher than the actual annual average change in all food prices, but the prediction interval from each forecast developed in 2023 contained the actual annual average change in prices. By July, the forecast midpoint converged on the actual average change in prices and remained within 0.1 percent through the remainder of the year. ERS researchers project all food prices to increase 1.3 percent in 2024, with a prediction interval of -1.4 to 4.2 percent. This chart is based on data from the ERS Food Price Outlook, updated January 25, 2024.

Tuesday, February 6, 2024

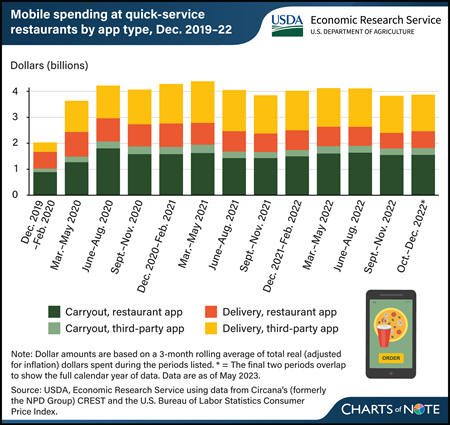

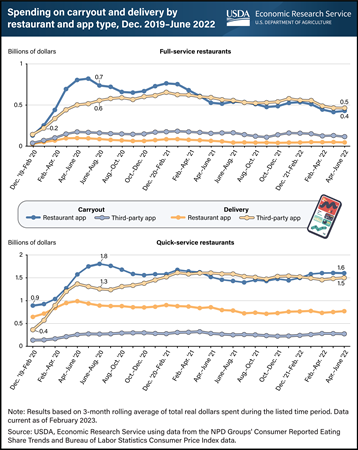

Through the end of 2022, consumer spending at quick-service restaurants on carryout and delivery remained persistently higher than the first observable Coronavirus (COVID-19) pandemic period (March–May 2020). USDA, Economic Research Service (ERS) researchers recently examined consumer spending trends on carryout and delivery from quick-service restaurants by mobile application types (including mobile website equivalents) from December 2019–February 2020 through October–December 2022. Consumers quickly adopted alternative methods to spend money on and acquire food at the beginning of the pandemic. In June–August 2020, carryout spending at quick-service restaurants via restaurant-specific apps doubled from prepandemic levels, and spending on delivery via third-party apps more than tripled. Third-party apps typically offer food from a variety of restaurants, while restaurant-specific apps are operated by the restaurant or establishment. App spending on carryout and delivery peaked in March–May 2021, reaching a total of $4.4 billion, with third-party app delivery and restaurant-specific app carryout spending each reaching about $1.6 billion. Most recently, total app spending on both carryout and delivery reached roughly $3.9 billion, where restaurant-specific carryout spending and third-party app delivery spending accounted for $1.6 and $1.4 billion, respectively. This chart appears in the ERS Amber Waves article, Pandemic-Related Increase in Consumer Restaurant Spending Using Mobile Apps Continued Through 2022, published January 2024.

Monday, January 29, 2024

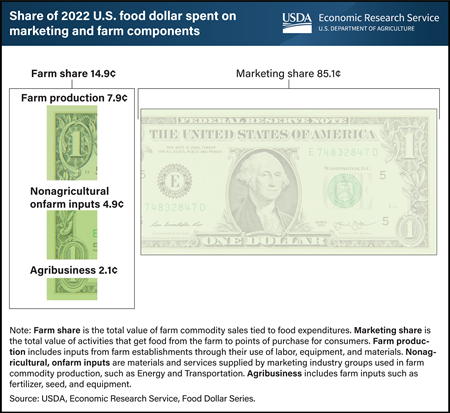

In 2022, farm establishments received 14.9 cents per dollar spent by consumers on domestically produced food for the sale of farm commodities. However, this amount, called the farm share, does not all remain on the farm. Farm commodity production requires many inputs from nonfarm establishments. Some inputs, such as fertilizer, seed, and equipment, are supplied by establishments in the Agribusiness industry group. These inputs to farm commodity production cost 2.1 cents per dollar spent on food in 2022. Inputs from industry groups such as Energy and Transportation are also used on the farm and throughout the food supply chain. In 2022, the cost of these inputs at the farm level was 4.9 cents per dollar spent on food. The remaining 7.9 cents from the farm share (just more than half) are for farm production, which is equal to the value added by farm establishments through their use of labor, equipment, and materials. The remaining 85.1 cents per dollar spent on food in 2022 went to industries to get food to various points of purchase after it left the farm. This portion is called the marketing share. This chart was drawn from the Amber Waves data feature “ERS Food Dollar’s Three Series Show Distributions of U.S. Food Production Costs,” published in December 2023.

Thursday, January 25, 2024

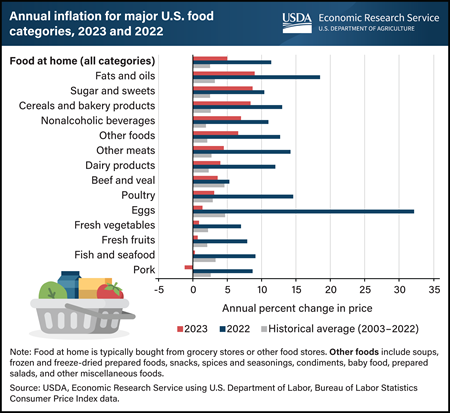

Food-at-home prices increased by 5.0 percent in 2023, much lower than the growth rate in 2022 (11.4 percent) but still double the historical annual average growth from 2003 to 2022 (2.5 percent). All product categories shown grew more slowly in 2023 compared with 2022. Food price growth slowed in 2023 as economy-wide inflationary pressures, supply chain issues, and wholesale food prices eased from 2022. In 2023, prices for fats and oils grew the fastest (9.0 percent), followed by sugar and sweets (8.7 percent), and cereals and bakery products (8.4 percent). Pork prices declined 1.2 percent in 2023, and prices for several categories grew more slowly than their historical averages, including beef and veal (3.6 percent), eggs (1.4 percent), fresh vegetables (0.9 percent), fresh fruits (0.7 percent), and fish and seafood (0.3 percent). Egg price growth receded in 2023 after a highly pathogenic avian influenza (HPAI) outbreak affected the industry in 2022. USDA, Economic Research Service (ERS) researchers project overall food-at-home prices will decrease 0.4 percent in 2024, with a prediction interval of -4.5 to 4.0 percent. ERS tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, updated January 25, 2024.

Monday, January 22, 2024

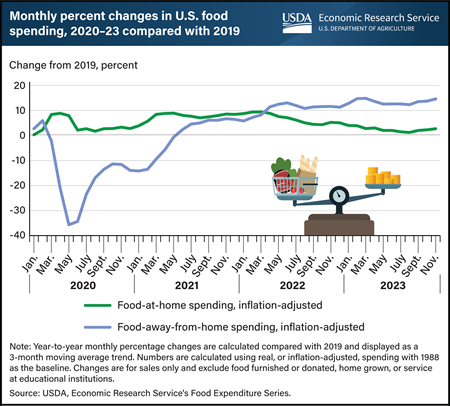

Following shifts in U.S. food spending during the Coronavirus (COVID-19) pandemic, food-at-home (FAH) spending was only 2.7 percent higher in November 2023 compared with November 2019, while food-away-from-home (FAFH) spending remained elevated at 14.6 percent higher. After an initial jump in inflation-adjusted FAH spending in March through May 2020, FAH spending leveled off, averaging just 2.8 percent higher in December 2020 compared with 2019. Even as FAH prices increased throughout 2021 and 2022, inflation-adjusted FAH spending increased as well, with monthly FAH spending in these years averaging 7.2 percent higher than the corresponding months in 2019. FAH spending has trended back toward prepandemic levels since the peak difference of 9.5 percent in March 2022. By contrast, FAFH spending initially fell significantly during the pandemic but reversed quickly and outpaced 2019 spending starting in June 2021. From June 2021 through December 2022, monthly inflation-adjusted FAFH spending averaged 8.7 percent higher than the corresponding months in 2019. FAFH spending peaked at 14.8 percent higher in March 2023 compared with March 2019. This chart combines and updates two charts from USDA, Economic Research Service’s (ERS) Amber Waves article U.S. Consumers Spent More on Food in 2022 Than Ever Before, Even After Adjusting for Inflation using data from the ERS Food Expenditure Series data product, updated January 19, 2024.

Wednesday, December 6, 2023

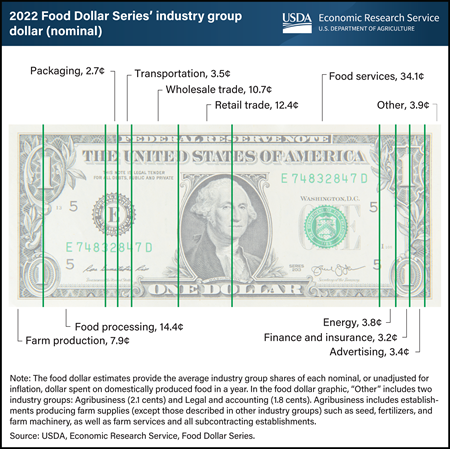

In 2022, more than a third of U.S. dollars spent on domestically produced food went to foodservice establishments, which includes restaurants and other food-away-from-home outlets. At 34.1 cents per food dollar in 2022, the foodservice share increased 1.6 cents from 2021 to reach its highest value in the USDA, Economic Research Service’s (ERS) Food Dollar Series. Industry groups add value by transforming the inputs they purchase from other industry groups and selling their output at higher prices. For instance, foodservice establishments prepare meals using food bought from distributors, such as those in the wholesale trade industry group, and utilities, such as gas and electricity bought from establishments in the energy industry group. Prices paid by customers include the value added by the restaurant itself plus the cumulative value added by all establishments before the restaurant. Annual shifts in the food dollar shares among industry groups occur for a variety of reasons, including changes in the mix of foods consumers buy, costs of materials, ingredients, and other inputs, as well as changes in the balance of food at home and away from home. The industry group shares food dollar data are available for 1993 to 2022 in the USDA, ERS Food Dollar Series data product, updated November 15, 2023.

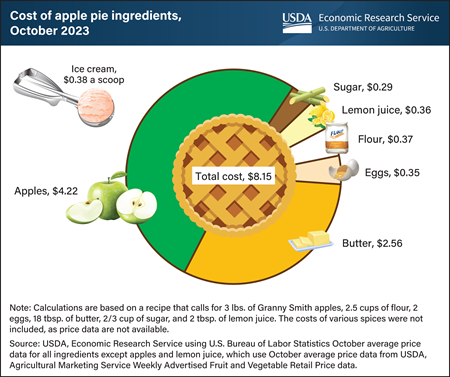

Monday, November 20, 2023

U.S. consumers baking a homemade apple pie for Thanksgiving this year can expect to pay about $8.15 for the ingredients, a decrease of 7.0 percent from last year. Price increases for flour, sugar, and lemon juice were offset by lower prices for apples, butter, and eggs, leading to a $0.61 decrease in the cost of a pie between 2022 and 2023. The price of the main ingredient, Granny Smith apples, fell 7.5 percent from $1.52 per pound in October 2022 to $1.41 per pound in October 2023. Prices decreased the most for eggs (38.6 percent), followed by butter (6.2 percent), between October 2022 and October 2023. Prices increased the most for lemons (20.0 percent) and sugar (16.0 percent), though those ingredients contribute only a small share to the total cost of a pie. If serving the apple pie à la mode, ice cream adds an additional $0.38 per scoop, an increase of $0.02 from last year. The most recent average price data are from October, meaning prices for Thanksgiving week may vary. For example, savings may occur if grocers offer holiday discounts. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the monthly Food Price Outlook data product, which will next be updated on November 22, 2023.

Wednesday, November 15, 2023

U.S. farm establishments received 14.9 cents per dollar spent on domestically produced food in 2022 as compensation for farm commodity production. This portion, called the farm share, is a decrease of 0.3 cents from a revised 15.2 cents in 2021. The farm share covers operating expenses as well as input costs from nonfarm establishments. The remaining portion of the food dollar, known as the marketing share, covers the costs of getting domestically produced food from farms to points of purchase, including costs related to transporting, processing, and selling to consumers. One of the factors behind the long-term downward trend in the farm share is an increasing proportion of food-away-from-home spending. Farm establishments receive a lower portion of dollars spent on food away from home because of the added costs of preparing and serving meals. The USDA, Economic Research Service (ERS) uses input-output analysis to calculate the farm and marketing shares of a food dollar, which is an average of all domestic expenditures on U.S. food. The data for this chart can be found in the ERS Food Dollar Series data product, updated November 15, 2023.

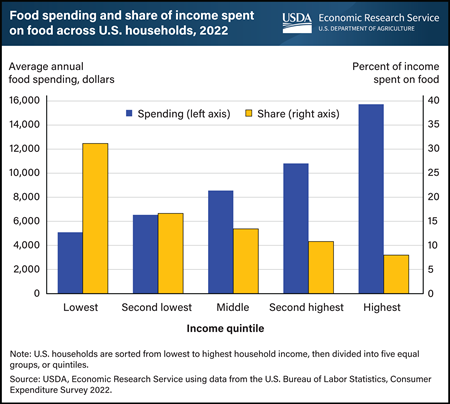

Wednesday, October 4, 2023

Households spend more money on food as their incomes rise, but the amount spent represents a smaller share of their overall budgets. When U.S. households were divided into five equal groups, or quintiles, by household income, households in the lowest income quintile had an average after-tax income of $16,337 and spent an average of $5,090 on food (about $98 a week) in 2022. Households in the highest income quintile, with an average after-tax income of $196,794, spent an average of $15,713 on food (about $302 a week) in 2022. As households gain more disposable income, they often shift to more expensive food options, including dining out. Food spending as a share of income rose across all income quintiles in 2022 as food prices increased faster than the overall inflation rate. Food prices increased 9.9 percent in 2022, the largest annual increase since 1979, and food-at-home (grocery) prices increased 11.4 percent. However, despite these large price increases, households’ share of income spent on food in 2022 was lower than in 2019 for the lowest three income quintiles and nearly the same for the highest two income quintiles. In 2022, food spending represented 31.2 percent of the lowest quintile’s income, 13.4 percent of income for the middle quintile, and 8.0 percent of income for the highest quintile. This chart appears in the Food Prices and Spending section of the USDA, Economic Research Service’s Ag and Food Statistics: Charting the Essentials data product.

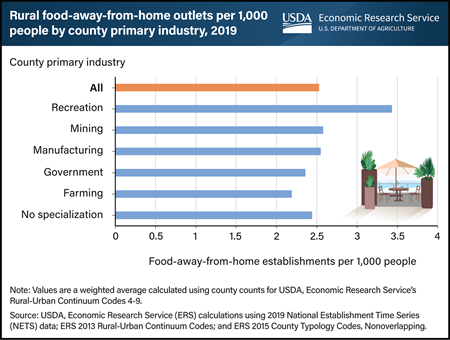

Wednesday, September 6, 2023

Rural U.S. counties that economically depend on natural amenities, tourism, and recreation generally had more options for dining out per 1,000 people in 2019 than those with other leading industries, such as mining, manufacturing, or farming. Roughly 2,000 U.S. counties were considered rural in 2019, where rural is broadly defined as any area that is nonmetropolitan. About 12 percent of those counties had recreation as their primary industry. Those rural, recreation-dependent counties had nearly 3.5 restaurants and other food-away-from-home (FAFH) establishments per 1,000 people, higher than rural counties dependent on other industries. Other types of rural economies had fewer restaurants and other FAFH outlets per 1,000 people, ranging from 2.2 outlets per 1,000 people in farming-dependent counties to 2.6 in mining-dependent counties. Metropolitan counties had average densities between 1.4 and 3.1 FAFH establishments per capita. This chart appears in the ERS Amber Waves article, Among Rural U.S. Counties, Those With Recreation-Dependent Economies Had Most Options Per Capita for Dining Out in 2019, published in August 2023.

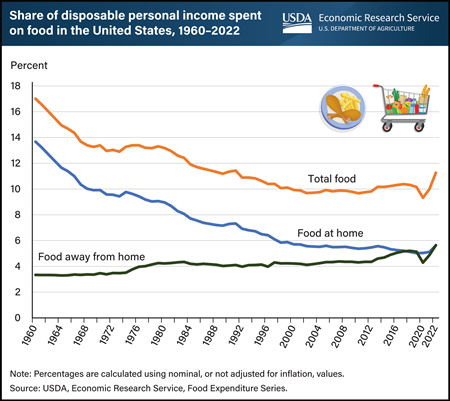

Monday, August 14, 2023

Errata: On August 16, this chart was updated with the correct year for when a similar level of income was previously spent on food. No other data were affected.U.S. consumers spent an average of 11.3 percent of their disposable personal income (DPI) on food in 2022, a level not observed since 1991. DPI is the amount of money U.S. consumers have left to spend or save after paying taxes. Consumers spent 5.62 percent of their incomes on food at supermarkets, convenience stores, warehouse club stores, supercenters, and other retailers (food at home) in 2022 and 5.64 percent on food at restaurants, fast-food establishments, schools, and other places offering food away from home. In 2022, the share of DPI spent on total food had the sharpest annual increase (12.7 percent). This followed an 8.2-percent decline, the sharpest annual drop in total food spending since 1967, during the first year of the Coronavirus (COVID-19) pandemic in 2020. The recent volatility in spending was driven by consumers’ sudden drop in eating out at the beginning of the pandemic followed by a return to food-away-from-home purchases as pandemic-related restrictions and concerns eased. The chart is drawn from USDA, Economic Research Service’s Ag and Food Statistics: Charting the Essentials and Food Expenditure Series data product, updated July 2023.

Wednesday, July 26, 2023

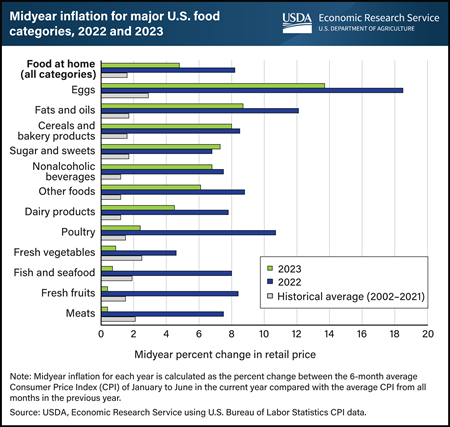

Retail food prices increased 4.8 percent in the first 6 months of 2023, lower than the rate of midyear inflation in 2022 (8.2 percent). The 20-year average for midyear inflation from 2002 to 2021 was 1.6 percent. All food categories except for sugar and sweets experienced smaller price increases through the first half of 2023 compared with the same period in 2022. Prices for eggs increased the most (13.7 percent) so far in 2023, followed by fats and oils (8.7 percent), and cereals and bakery products (8.0 percent). All food categories increased in price in the first 6 months of 2023 compared with 2022, but the increases for meats (0.4 percent), fresh fruits (0.4 percent), fish and seafood (0.7 percent), and fresh vegetables (0.9 percent) were below their historical average price increases. Inflationary pressures and trends differ by food category. For example, egg prices reached historically high levels early in 2023 because of an outbreak of highly pathogenic avian influenza (HPAI), though prices have since fallen from their peak. Prices will continue to change during the remainder of 2023 and may affect the annual inflation rate. The USDA, Economic Research Service (ERS) Food Price Outlook projects food-at-home prices will increase 4.9 percent in 2023, with a prediction interval of 3.7 to 6.1 percent, and was last updated July 25, 2023.

Monday, July 17, 2023

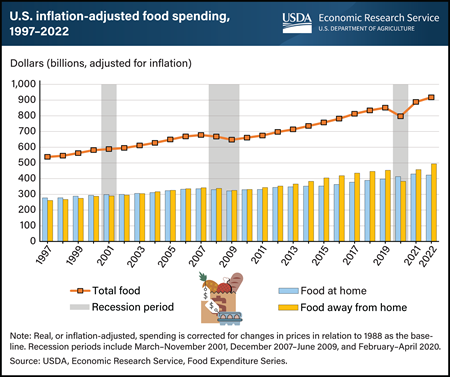

Real, or inflation-adjusted, annual food spending in the United States increased steadily from 1997 to 2022, except in 2008 and 2009 during the Great Recession and in 2020 during the Coronavirus (COVID-19) pandemic. Food spending includes food at home (FAH), described as food intended for off-premises consumption from retailers such as grocery stores, and food away from home (FAFH), described as food purchased at outlets such as restaurants or cafeterias. Total food spending increased 70 percent from 1997 to 2022. During this period, FAH spending increased at a slower rate (53 percent) than for FAFH (89 percent). Total food spending increased on an annual basis by 7.2 percent in 2021 and 4.5 percent in 2022. FAFH spending increases (19 percent in 2021 and 8 percent in 2022) drove overall increases in food spending. FAH spending increased by 4 percent in 2021 but fell by 2 percent in 2022. The data for this chart come from the USDA Economic Research Service’s Food Expenditure Series data product, updated in June 2023.

-FAH-Spending-by-Race_450px.png?v=7383.4)

Monday, July 10, 2023

U.S. households shifted away from buying foods at restaurants and other food service venues to food-at-home (FAH) outlets such as grocery stores and other retail establishments in 2020. The largest FAH shifts came from a category designated by USDA, Economic Research Service (ERS) as “all other FAH,” which includes prepared meals and salads, desserts, and foods not elsewhere classified such as soups, savory snacks, candy, sweeteners, margarine, and butter. “All other FAH” was by far the largest FAH category before 2020, and its share of the household food budget increased by 2.6 percentage points in 2020 compared with the period from 2016 to 2019. However, this increase was unevenly distributed across racial and ethnic populations and among subcategories within “all other FAH.” All U.S. racial and ethnic subpopulations except Hispanic households increased their total food budget share for “all other FAH” during this period. Black households increased their budget shares for “all other FAH” the most, followed by Asian households. The increase by Asian households on “all other FAH” was driven by a 1.6-percentage-point rise in prepared meals and salads and a 1.8-percentage-point increase in other, not elsewhere classified foods, such as snacks. In contrast, Black households had a larger increase in other, not elsewhere classified foods (2.0 percentage points) and desserts (1.4 percentage points). This chart appears in the ERS Amber Waves article, New Analysis Approach Illuminates Differences in Food Spending Across U.S. Populations, published in May 2023.

_450px.png?v=7383.4)

Tuesday, June 27, 2023

For Fourth of July cookouts this year, cheeseburgers could cost more than they did in 2022. In May 2023, the ingredients for a home-prepared ¼-pound cheeseburger totaled $2.17 per burger, an increase of 10 cents (4.9 percent) from 2022. Prices for cheeseburger ingredients grew more slowly over the year than prices for all groceries (food at home), which rose 5.8 percent from May 2022 to May 2023. Ground beef made up the largest cost of the burger at $1.24, and Cheddar cheese accounted for $0.37. Both these items increased in price by 3.5 percent between 2022 and 2023 and together accounted for half the increase in costs. Bread prices rose the fastest, by 21.5 percent, and added 4 cents to the cost of a burger between 2022 and 2023. Tomato prices fell slightly over the year, but an increase in lettuce prices added 1 cent to total costs. USDA, Economic Research Service tracks aggregate food category prices and publishes price forecasts in the Food Price Outlook data product, updated June 23, 2023.

Tuesday, June 13, 2023

The Coronavirus (COVID-19) pandemic led to large shifts in how consumers spent money on and acquired food. USDA, Economic Research Service (ERS) researchers recently examined the changes in how individuals acquired food away from home by analyzing spending trends on carryout and delivery. They examined these trends among full- and quick-service restaurants by mobile application types (including mobile website equivalents) from December 2019–February 2020 through April–June 2022. Following the onset of the pandemic (June-August 2020), delivery spending via third-party apps at full-service restaurants tripled while restaurant-specific apps spending for carryout at quick-service restaurants matched their growth. Third-party apps typically offer food from a variety of restaurants, while restaurant-specific apps are operated by the offering establishment. At quick-service restaurants, spending on carryout via restaurant-specific apps doubled by June–August 2020 and more than tripled for delivery orders placed using a third-party app. As of April–June 2022, the increased spending persisted at quick-service restaurants on delivery and carryout via third-party and restaurant-specific apps, respectively. However, the spending levels via all app types at full-service restaurants remained higher than pre-pandemic but declined somewhat from the post-onset jump. This chart appears in the ERS’ : COVID-19 Working Paper: Food-Away-From-Home Acquisition Trends Throughout the COVID-19 Pandemic, released May 2023.

Thursday, June 1, 2023

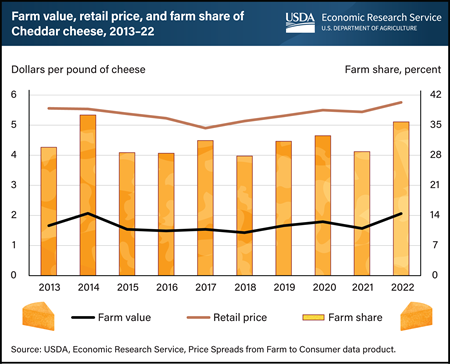

In 2022, dairy farmers received a larger share of the retail price of Cheddar cheese than during the previous year. The ratio of what dairy farmers received for the milk used in making Cheddar cheese (farm value) compared with what consumers paid in grocery stores (retail price), called the farm share, increased to 36 percent from 29 percent in 2021. The farm value of the 10.3 pounds (1.2 gallons) of milk used to make a pound of Cheddar cheese rose 49 cents to $2.06 in 2022 from $1.57 after subtracting the value of the whey coproduct. However, the average retail cheese price increased only 32 cents to $5.76 per pound from $5.44 the previous year. U.S. dairy farmers faced high operational costs and increased their collective output by less than one tenth of one percent in 2022, leaving milk processors and cheese manufacturers to compete for limited milk supply at a higher price. Wholesale prices for Cheddar cheese rose by 21 percent when packaged in 40-pound blocks and by 31 percent for 500-pound barrels. Retailers absorbed much of these wholesale price increases instead of passing them on to consumers. This allowed domestic use of American-type cheeses (including Cheddar, Colby, Monterey, and Jack) to increase above 2021 levels. USDA, Economic Research Service (ERS) hosted a data training webinar in 2022 on farm-to-retail price spreads and farm share statistics. More information on farm share data can be found in the ERS Price Spreads from Farm to Consumer data product, updated in April 2023.