ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Wednesday, November 29, 2023

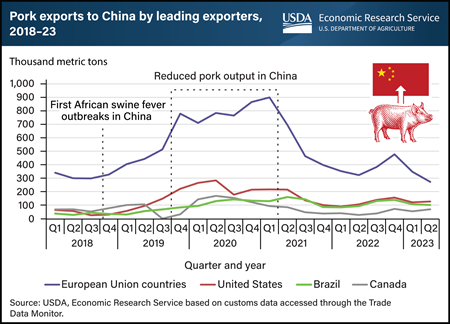

The 2018 spread of African swine fever (ASF) to China had reverberations in the global pork market. ASF—a virus often fatal to swine—caused an estimated loss of 27.9 million metric tons in China’s pork output from late 2018 to early 2021 and led to a doubling of China’s domestic pork prices. These high prices attracted a surge of pork exports from four major suppliers—the European Union (EU), United States, Brazil, and Canada. While the EU was the top supplier, U.S. pork exports were sizable and reached a record high of more than 287,000 metric tons in the second quarter of 2020. After surging, exports by all suppliers began declining during 2021 as China’s domestic production rebounded and associated prices plummeted. According to a recent report from USDA’s Economic Research Service (ERS), pork exports to China might have increased even more during the ASF outbreak if not for several factors. Specifically, China banned pork from some EU countries that also had ASF outbreaks. In addition, U.S. pork faced high retaliatory tariffs because of trade tensions, and China rejected some Canadian pork shipments. Also, during the COVID-19 pandemic, China launched stringent inspections of foreign meat suppliers and required decontamination of meat at Chinese ports. In aggregate, pork imports replaced about an estimated one-fifth of the domestic pork supplies lost in China during the ASF epidemic. Official data indicate that China’s pork production returned to its pre-ASF level in 2021. While exports to China are down from their peak, China is still one of the top 3 overseas markets for U.S. pork, with sales in the first 6 months of 2023 exceeding annual totals posted in years before ASF hit China. This chart first appeared in the ERS report How China’s African Swine Fever Outbreaks Affected Global Pork Markets, published November 2023.

Monday, July 31, 2023

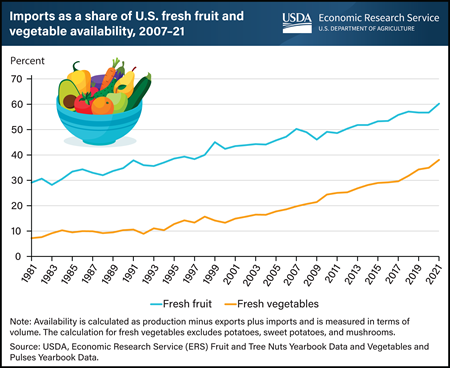

Imports play a vital and increasingly important role in ensuring that fresh fruit and vegetables are available year-round in the United States. Since the 2008 completion of the transition to tariff- and quota-free trade among Mexico, Canada, and the United States under the North American Free Trade Agreement (NAFTA), U.S. fresh fruit and vegetable imports have increased with few interruptions. Between 2007 and 2021, the percent of U.S. fresh fruit and vegetable availability supplied by imports grew from 50 to 60 percent for fresh fruit and from 20 to 38 percent for fresh vegetables (excluding potatoes, sweet potatoes, and mushrooms). The import share increased by more than 20 percentage points during this period for 10 crops: asparagus, avocados, bell peppers, blueberries, broccoli, cauliflower, cucumbers, raspberries, snap beans, and tomatoes. The United States-Mexico-Canada Agreement (USMCA), implemented on July 1, 2020, continues NAFTA’s market access provisions for fruit and vegetables. In 2022, Mexico and Canada supplied 51 percent and 2 percent, respectively, of U.S. fresh fruit imports, and 69 percent and 20 percent, respectively, of U.S. fresh vegetable imports in terms of value. This chart is drawn using data from the USDA, Economic Research Service (ERS) data products Fruit and Tree Nuts Yearbook Data and Vegetables and Pulses Yearbook Data. Also refer to the ERS report, Changes in U.S. Agricultural Imports from Latin America and the Caribbean, published in July 2023, and ERS’s Amber Waves feature, U.S. Fresh Vegetable Imports From Mexico and Canada Continue To Surge, published in November 2021.

Thursday, July 27, 2023

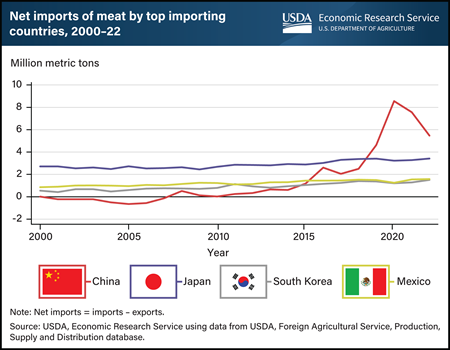

China has been the world’s largest meat importer since 2019. Despite recent reductions in imported meat volumes, the country remains in the top spot. In 2022, China imported 43 percent more than the second largest meat-importing country, Japan. Issues such as disease, tougher laws addressing environmental issues, and an exodus of small-scale farmers have constrained China’s meat supply, boosting domestic prices and incentives to import. As China’s most consumed meat, pork tends to dominate its meat supply and demand. China surpassed Japan to become the top meat importer after an African swine fever epidemic sharply reduced China’s pork supply in 2019. Pork output rebounded and meat imports dropped, but China remained the top meat importer in 2022. Meanwhile, beef imports have been on the rise. Longer beef production cycles, lack of grazing land, and chronic disease have constrained China’s cattle production, preventing it from meeting domestic demand. Poultry consumption also is rising, as chicken tends to be the least expensive meat for consumers to purchase, but rising feed costs and disease have increased domestic prices and boosted poultry imports. China’s meat consumption showed signs of peaking after 2014, but statistical model projections show that consumption will continue to grow through 2031 based on trends such as dietary change and moderate growth in Chinese income and prices. In the short term, the Coronavirus (COVID-19) pandemic and resulting economic slowdown in China weakened consumption and associated import prospects during 2022. In addition, factors such as ongoing disease risks and high feed costs—which reduce profitability for China’s livestock producers—continue to play a role in the market. This chart first appeared in the USDA, Economic Research Report, China’s Meat Consumption: Growth Potential, released in July 2023.

Tuesday, July 18, 2023

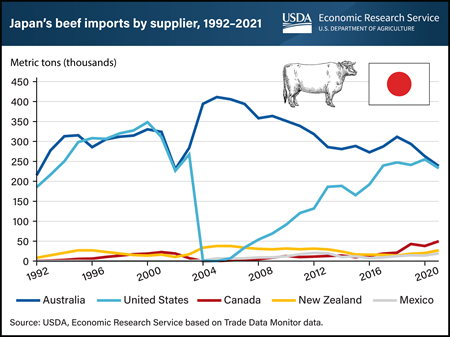

The United States has long been a top supplier of beef to Japan. U.S. market share collapsed in 2004 after a single case of bovine spongiform encephalopathy (BSE), commonly referred to as “mad cow disease,” was detected in a cow shipped from Canada to the United States. In response, Japan placed an embargo on all U.S. and Canadian beef products. Japan reduced its imports of U.S. beef to almost zero in 2004 after importing 267,000 metric tons the previous year. During those two years, the U.S. share of Japan’s beef imports fell from 46.4 percent in 2003 to nearly zero in 2004, and Japan increased its imports of beef from Australia, which had never reported a case of BSE. In 2006, Japan began phasing out the ban on U.S. beef and fully lifted it in May 2019. Over this period, U.S. beef imports rebounded nearly to pre-ban levels, shipping 233,000 metric tons to Japan in 2021. Even so, Australia still supplied most of Japan’s beef imports (40.7 percent), followed by the United States (39.8 percent), Canada (8.5 percent), New Zealand (4.7 percent), and Mexico (3.3 percent). Recently ratified trade agreements between Japan and these partner countries are expected to contribute to changes in Japan’s market for imported beef. Researchers at USDA’s Economic Research Service (ERS) estimate that by 2033, annual scheduled reductions in Japan’s import tariffs will increase imports of U.S. beef by 27 percent, or $413.8 million, from 2018 levels. This chart first appeared in the ERS report, The Impact of Japan’s Trade Agreements and Safeguard Renegotiation on U.S. Access to Japan’s Beef Market, June 2023.

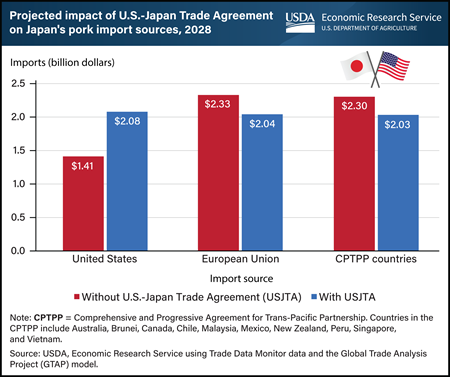

Thursday, May 25, 2023

Japan’s pork imports are estimated to increase to more than $6 billion over the next 5 years. Growth is supported by trade agreements Japan ratified between 2018 and 2021 with its major pork suppliers: the United States, the European Union (EU), and the 10 countries party to the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP). These agreements mandate reductions in Japan’s trade barriers on pork imports. For example, import tariffs on pork carcasses and other unprocessed meat products will drop from 4.3 percent in 2018 to zero by 2027. Similarly, tariffs on processed meat products will be lowered from 8.5 percent in 2018 to zero by 2028. A recent report from USDA’s Economic Research Service (ERS) estimates these trade agreements will boost 2028 exports to Japan from the United States, EU, and CPTPP countries to totals of $2.08 billion, $2.04 billion, and $2.03 billion, respectively. For the United States, this is a large gain compared with a scenario in which the U.S.-Japan Trade Agreement did not exist. Under that scenario, U.S. pork exports to Japan would have totaled $1.41 billion, and EU and CPTPP countries would have gained market share at the expense of the United States. This chart was drawn from the ERS report The Impact of Recent Trade Agreements on Japan’s Pork Market, published in May 2023.

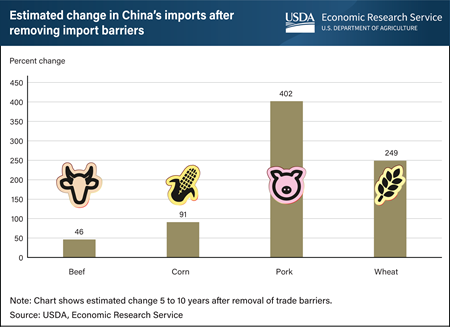

Tuesday, November 29, 2022

China imported more than $205 billion worth of agricultural products in 2021, including more than $37 billion from the United States, yet trade barriers deterred China’s imports from reaching even higher levels. China’s import barriers create what are called “price wedges,” in which domestic prices for agricultural commodities including beef, corn, pork, and wheat are higher than the world price. Researchers at USDA’s Economic Research Service (ERS) recently found that removing these price wedges would lead to increases in agricultural imports for the four commodities over the subsequent 5 to 10 years. For corn and wheat, removing price wedges was estimated to increase China’s imports by 91 and 249 percent, respectively. Both of these commodities are subject to a tariff-rate quota which could constrain additional imports. Removal of the beef price wedge was estimated to increase China’s beef imports by 46 percent, while for pork, it was estimated to increase China’s pork imports by 402 percent—the largest increase among the commodities considered. Overall, the benefits of removing these trade barriers would be widespread, increasing sales for producers in the United States and other exporting countries and yielding lower food prices for China’s consumers. This chart is drawn from the ERS report China’s Import Potential for Beef, Corn, Pork, and Wheat, published in August 2022.

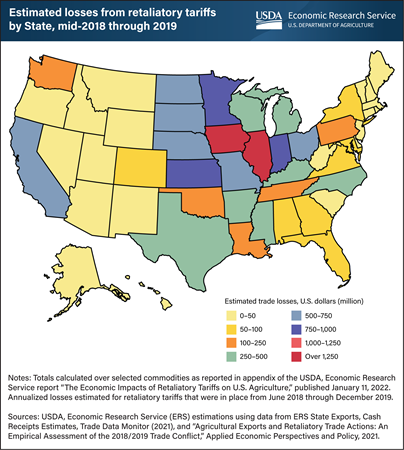

Monday, January 24, 2022

In 2018, six U.S. trading partners—Canada, China, the European Union, India, Mexico, and Turkey—announced retaliatory tariffs affecting agricultural and food products. The agricultural products targeted for retaliation were valued at $30.4 billion in 2017, with individual product lines experiencing tariff increases ranging from 2 to 140 percent. USDA’s Economic Research Service (ERS) estimated trade losses from retaliatory tariffs by State and commodity using data in the ERS State Exports, Cash Receipts Estimates. Estimated annualized losses from mid-2018 through the end of 2019 totaled $13.2 billion across 17 commodity groups, led by soybeans, sorghum, and pork. While retaliatory tariffs affected all States, those in the Midwest experienced the largest losses. ERS researchers estimated Iowa lost $1.46 billion; Illinois, $1.41 billion; and Kansas, $955 million, all on an annualized basis. Iowa and Illinois, which together produce 25 to 30 percent of U.S. soybeans, both experienced trade losses in excess of $1 billion for soybeans alone. The retaliatory tariffs followed the issuance of U.S. tariffs on imports of steel and aluminum from major trading partners and on a broad range of imports from China. This chart can be found in the ERS report, The Economic Impacts of Retaliatory Tariffs on U.S. Agriculture, published in January 2022.

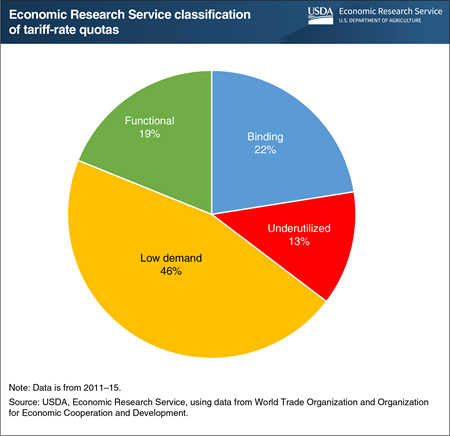

Friday, January 29, 2021

Tariff-rate quotas (TRQs) are a two-tiered tariff available to member countries of the World Trade Organization, including the United States. They function by allowing a specified quantity of goods into a market at a low, in-quota rate. After the in-quota amount is filled, the product can still be imported, but at a higher tariff. While tariff-rate quotas often provide access for markets that might have been closed to trade, some might not function as intended. Researchers at USDA’s Economic Research Service (ERS) analyzed tariff-rate quotas under the World Trade Organization (WTO) and found that 19 percent can be characterized as functional, meaning they provide sufficient market access by functioning as designed. For 22 percent, the quota gets filled, but economic conditions suggest more trade could be occurring. These are called binding TRQs. Other tariff-rate quotas that often lack demand because of market conditions or high tariff rates—low demand TRQs—represent 46 percent of the tariff-rate quotas in the WTO. The remainder of tariff-rate quotas are classified as underutilized. For that 13 percent, the demand for additional imports may be constrained by administrative procedures or other nontariff measures that impede trade. This chart is drawn from the ERS report, Agricultural Market Access Under Tariff-Rate Quotas, January 2021.

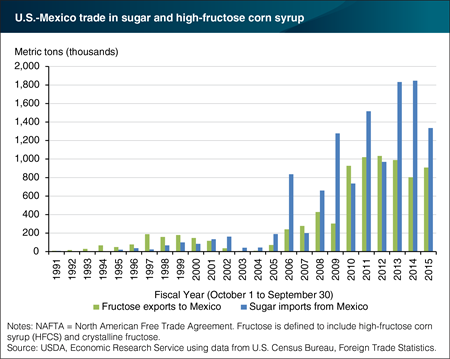

Monday, August 22, 2016

Agreement by the United States and Mexico to implement the provisions of the North American Free Trade Agreement (NAFTA) with respect to bilateral trade in sugar and sweeteners starting in fiscal year 2008 led to a substantial increase in this trade. During fiscal years 2011-15, U.S. sugar imports from Mexico averaged about 1.5 million metric tons per year—contributing about 12 percent of the U.S. sugar supply—and U.S. exports of high fructose corn syrup (HFCS) to Mexico averaged about 950,000 metric tons—equal to about 12 percent of U.S. production. Agreements reached in December 2014 to suspend U.S. antidumping and countervailing duty investigations on sugar imports from Mexico imposed new restrictions on the quantity, price, and composition of U.S. imports of Mexican sugar. However, these measures still allow for larger volumes of trade than prevailed before 2008, and before the start of NAFTA’s implementation back in 1994. This chart is from the ERS report, A New Outlook for the U.S.-Mexico Sugar and Sweetener Market released on August 11, 2016.

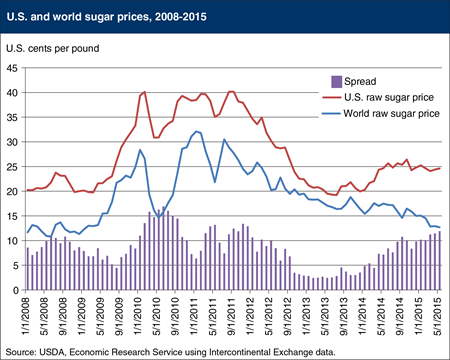

Friday, June 26, 2015

World raw sugar prices have fallen steadily since January 2011, and in May 2015 reached their lowest point since January 2009 due to growing production surpluses and the weakening Brazilian currency. U.S. raw sugar prices have also fallen relative to the record-high levels seen between 2010 and 2012, but have trended higher over the past year. Since the integration of U.S. and Mexican sweetener markets under NAFTA in 2008, U.S. and world prices had tracked more closely. However, those prices began diverging in March 2014 when the U.S. domestic sugar industry filed an anti-dumping and countervailing duty investigation against Mexican sugar imports, resulting in a December 2014 agreement that limits the volume of Mexican sugar entering the United States. With these new limitations on Mexican imports, the spread between U.S. and world prices has increased in recent months, though remains within ranges seen in recent years. This chart is based on the June 2015 Sugar and Sweeteners Outlook.

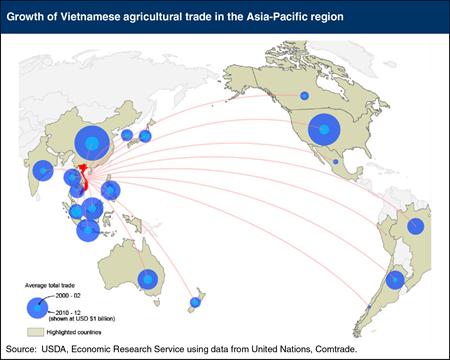

Friday, April 24, 2015

After Vietnam joined the Association of Southeast Asian Nations (ASEAN), its agricultural trade within the 10-member regional trade bloc expanded. The normalization of trade with the United States in 2001 and WTO accession in 2007 also provided catalysts for growth and integration. Subsequent preferential trade agreements (PTAs) have led to tariff reductions that have only recently begun to take effect. Today, Vietnam’s agricultural trade is still led by trade with its ASEAN partners; however, China has become a major export market and Vietnam’s largest trade partner, while the United States is a close second, and also the largest source of imports. Trade growth with both partners has been significant, growing 7- and 10-fold, respectively, while imports from South America have also grown. The Trans-Pacific Partnership (TPP) agreement, now under negotiation, is viewed as important to Vietnam’s long-term economic strategy as it could potentially secure markets abroad and facilitate the flow of foreign investment. Vietnam seeks greater access for its textile and footwear industry, while exporting countries, including the United States, see Vietnam as a market with growth potential. This report is from the Amber Waves article, “Japan, Vietnam, and the Asian Model of Agricultural Development and Trade.”

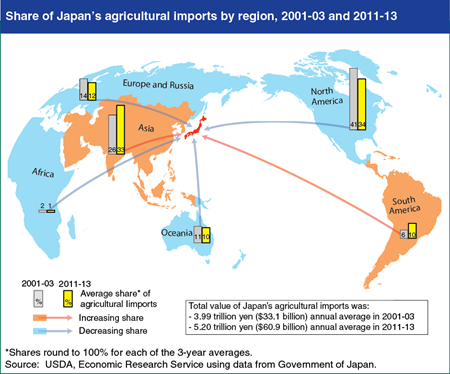

Wednesday, March 4, 2015

Japan is one of the largest markets for U.S. agricultural exports, and the United States has long been its largest supplier. However, in recent years the total value of U.S. agricultural exports to Japan has stagnated (in real terms) and the U.S. share of Japan’s agricultural imports has declined. U.S. exports to Japan of some major products—such as soybeans and fruits/preparations—are down since 2000, and others, such as wheat and corn, have remained flat. Japanese imports of U.S. pork are an exception, with strong growth over the last 15 years. The decline in the U.S. share of Japan’s agricultural imports reflects greater competition from competing suppliers, especially in South America and Asia. Japan has expanded its imports of soybeans, soy meal, poultry meat, and grains from South America; palm oil, rubber, and poultry meat from Southeast Asia; soy meal from South Asia; and alcoholic beverages and processed foods from nearby South Korea. Nevertheless, the United States remains Japan’s largest supplier of agricultural products despite trade policies there that maintain a high level of protection for domestically produced products such as wheat and rice and many consumer-ready foods. This chart is from “Japan, Vietnam, and the Asian Model of Agricultural Development and Trade,” in Amber Waves, February 2015.

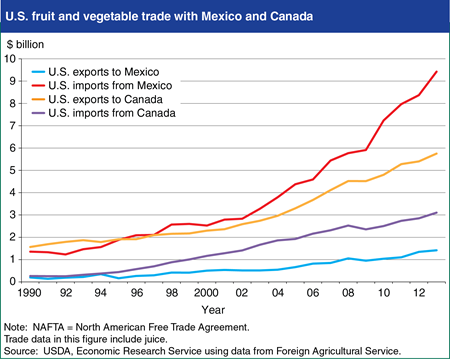

Friday, February 20, 2015

U.S. fruit and vegetable trade with Canada and Mexico has increased more than 380 percent since the implementation of the North American Free Trade Agreement (NAFTA). Canada and Mexico now account for over half of all U.S. trade in fruits and vegetables, up from 37 percent in 1994. Over the same period, the share of U.S. fruit and vegetable trade with South America and Central America has remained relatively steady, while the share accounted for by Asia and the EU declined considerably. Mexico’s annual exports of fruit and vegetables to the United States (including juice) have more than tripled during the NAFTA period, approaching $9.4 billion in 2013. These exports have their roots in the development and growth over the past half century of a Mexican fruit and vegetable sector that is oriented toward the U.S. market. Annual U.S. fruit and vegetable exports to Mexico have more than tripled under NAFTA, reaching about $1.4 billion in 2013 and benefitting from the rapid expansion of Mexico’s supermarket sector, including several U.S. supermarket chains that operate there. At the same time, trade liberalization and broader use of greenhouse technology in Canada has allowed U.S. imports of fruit and vegetables from Canada to grow from $213 million in 1988 to $3.1 billion in 2013. Canada has long been a large market for the U.S. fruit and vegetable industry. During the NAFTA period, U.S. fruit and vegetable exports to Canada have grown from less than $2 billion in 1993 to $5.8 billion in 2013. The chart is from the report, NAFTA at 20: North America’s Free Trade Area and its Impact on Agriculture.

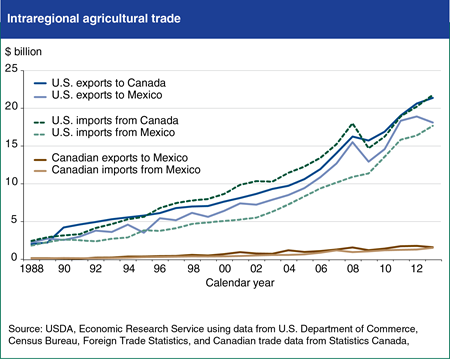

Thursday, February 5, 2015

Agricultural trade among the North American Free Trade Agreement’s (NAFTA) member countries has grown since the agreement was implemented. The total value of intraregional agricultural trade (exports and imports) among all three NAFTA countries reached about $82.0 billion in 2013, compared with $16.7 billion in 1993 (the year before NAFTA’s implementation), and $8.8 billion in 1988 (the year before the Canada-U.S. Free Trade Agreement’s (CUSTA) implementation). When the effects of inflation are taken into account, this expansion in intraregional agricultural trade corresponds to an increase of 233 percent between 1993 and 2013, compared to U.S. agricultural trade worldwide, which grew 126 percent over the same period. The vast majority of trade between these 3 nations involves the United States; U.S. agricultural trade with its 2 NAFTA partners alone reached $78.9 billion in 2013, compared with $16 billion in 1993. The expansion of U.S. trade under NAFTA reflects similar patterns of growth between exports and imports, highlighting the high degree of market integration across these nations. This chart is from the report, NAFTA at 20: North America’s Free Trade Area and its Impact on Agriculture.

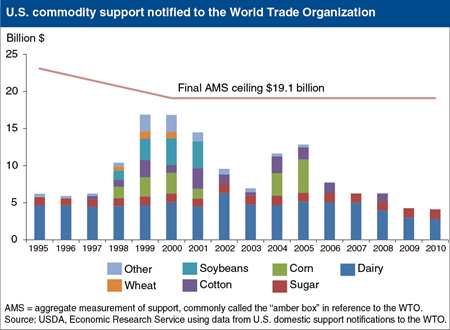

Monday, May 13, 2013

The current Agreement on Agriculture of the World Trade Organization (WTO) limits how much members can spend on trade-distorting support. Members notify this spending as the aggregate measurement of support (AMS), commonly called the “amber box.” The U.S. limit, or ceiling, is currently $19.1 billion, reduced from a starting point of $23 billion in 1995. For developed countries, the AMS includes support for specific commodities (product-specific support) that totals more than 5 percent of the value of production of that commodity, and support generally available to producers (non-product specific support) that totals more than 5 percent of the country’s total value of agricultural production. For the United States, only a small number of commodities have been supported above the 5-percent minimum (or de minimis) level, and general support has never risen above that level. Even so, during several years of low commodity prices, U.S. program support led to AMS totals close to the WTO ceiling. In recent years, however, high commodity prices have reduced program spending, and an AMS has been notified to the WTO for only a few commodities. This chart is based on data found on the U.S. WTO Domestic Support Reduction Commitments and Notifications topic page on the ERS website.

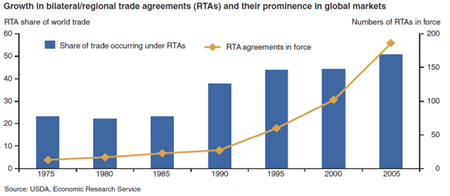

Friday, August 31, 2012

Countries use bilateral and regional trade agreements to increase market access and expand trade in foreign markets. These agreements are called reciprocal trade agreements (RTAs) because members grant special advantages to each other. RTAs include many types of agreements, such as preferential arrangements, free trade agreements, customs unions, and common markets, in which members agree to open their markets to each other's exports by lowering trade barriers. RTAs have become an increasingly prominent feature of the multilateral trading system in recent years. According to the World Trade Organization, there were 186 such agreements in force in 2005, up from 50 just prior to the Uruguay Round in 1994, less than 25 in 1985, and just 13 agreements in 1975. As the number of agreements expanded, the RTA share of world trade rose from 22 percent in 1975 to over 50 percent in 2005. This chart comes from Reciprocal Trade Agreements: Impacts on Bilateral Trade Expansion and Contraction in the World Agricultural Marketplace, ERR-113, April 2011.

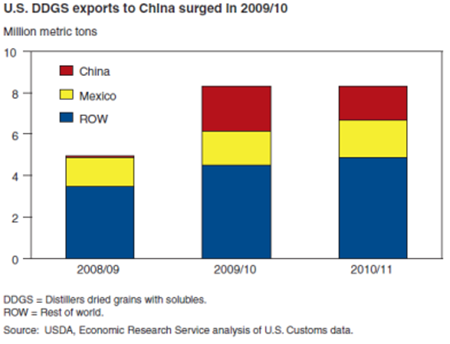

China has become a significant export market for U.S. DDGS, a co-product of the corn ethanol process

Wednesday, August 22, 2012

The expansion of corn-based ethanol production in the United States yields a large volume of residual co-products called distillers dried grain with solubles (DDGS). Approximately 75 percent of DDGS are utilized in the domestic U.S. market, but Chinese importers seeking raw materials for animal feed have emerged as a significant export market. High feed prices and favorable tax treatment within China stimulated a surge of imports of U.S. DDGS during 2009-11. China's potential demand for U.S. DDGS depends on various factors that include the price of corn, Chinese policy, and the availability and price of other substitute feed ingredients, such as the byproducts of grain processing in China (residual products from alcohol production). Demand is robust, but slower growth in the U.S. supply of DDGS and uncertainties about Chinese policy may constrain growth in exports to China. This chart is found in China's Market for Distillers Dried Grains and the Key Influences on Its Longer Run Potential, FDS-12g-01, August 2012.

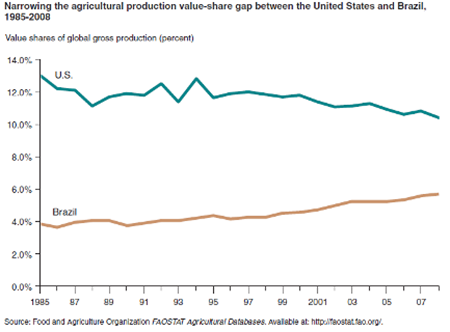

Friday, August 3, 2012

With the world's largest arable land area of 76 million hectares, fifth largest population base, and a strong record of agricultural production and exports, Brazil is viewed by many as the latest model of global agriculture. Over the last quarter-century, Brazil's agricultural production has grown significantly. Using production and trade data from the Food and Agriculture Organization of the United Nations, ERS found that the total value of the country's agricultural production between 1985 and 2008 grew 3.79 percent each year, driving up its share of total global production from 3.9 percent in 1985 to 5.7 percent in 2008. This robust production growth has increased Brazil's agricultural exports, with the total value of its agricultural trade growing 7.7 percent annually between 1985 and 2008. This chart comes from Policy, Technology, and Efficiency of Brazilian Agriculture, ERR-137, July 2012.

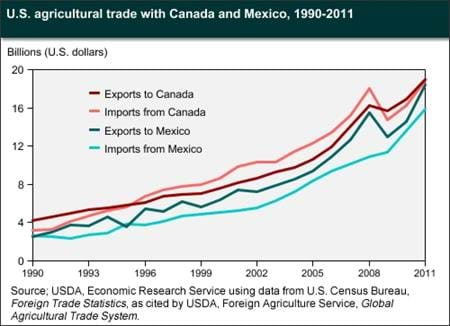

Tuesday, May 1, 2012

Agricultural trade within the NAFTA region has recovered from the recent global economic downturn, reaching record levels in 2011. The total value (exports and imports) of U.S. agricultural trade with Canada and Mexico reached about $72.1 billion in 2011, compared with $60.7 billion in 2008 and $54.7 billion in 2009. Prior to the downturn, regional agricultural trade had enjoyed a long period of sustained growth with few interruptions. Even when accounting for the effects of the recent downturn, U.S. agricultural trade with Canada and Mexico has nearly quadrupled since NAFTA's implementation in 1994. This chart is an update of one found in the ERS report, NAFTA at 17, WRS-11-01, March 2011.

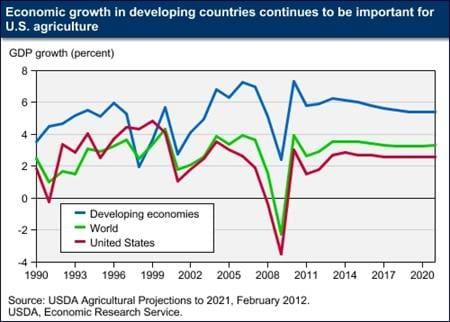

Monday, March 5, 2012

Projections for the agricultural sector through 2021 are based on assumptions about macroeconomic conditions. World GDP growth is projected to increase at an average annual rate of around 3.3 percent over the next decade. This return to long-run steady global economic growth supports gains in world food demand, global agricultural trade, and U.S. agricultural exports. The strongest economic growth is anticipated to occur in developing countries. This growth is important for agriculture because food consumption and feed use are particularly responsive to income growth in those countries, with movement away from traditional staple foods and increased diversification of diets. Developed economies of the world are projected to grow 2 percent annually, on average, from 2011 to 2021, with U.S. growth averaging about 2.5 percent. This chart is based on the macroeconomic assumptions that underpin the report, USDA Agricultural Projections to 2021, OCE-121, February 2012.