ERS Charts of Note

Subscribe to get highlights from our current and past research, Monday through Friday, or see our privacy policy.

Get the latest charts via email, or on our mobile app for  and

and

Tuesday, February 21, 2023

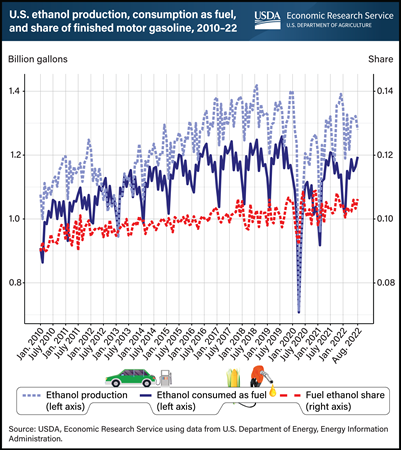

Production and consumption of ethanol as a transportation fuel (largely sourced from corn) grew significantly over the last three decades in the United States before plateauing in recent years. The ethanol share of finished motor gasoline (FMG) has moved concurrently with consumption, leveling off near 10 percent in 2022. The Renewable Fuel Standard—which sets volumes of biofuels that must be blended with fossil fuels—influences ethanol’s share of FMG, along with other factors including relative prices. Steps taken in the spring of 2020 to combat the spread of COVID-19, such as increased remote work and school, and other social distancing efforts, resulted in sharp declines in a variety of ethanol market metrics. For example, from 2017–19, U.S. ethanol production averaged 1.33 billion gallons per month, while consumption averaged 1.18 billion gallons per month. During the pandemic lows, these values fell by 46 percent and nearly 40 percent, respectively, causing the ethanol share of FMG to decline to 9 percent. More recently, estimates for all three figures have largely recovered and leveled off. However, increasing adoption of hybrid and electric vehicles combined with continued fuel efficiency gains in gasoline vehicles are expected to put downward pressure on gasoline consumption and dampen prospects for renewed growth in fuel ethanol demand. This chart appeared in the USDA, Economic Research Service report, Global Demand for Fuel Ethanol Through 2030, February 2023.

Wednesday, December 15, 2021

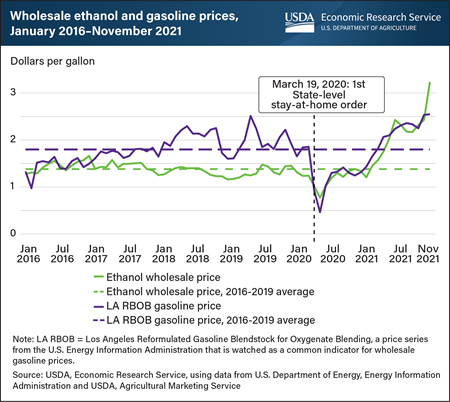

U.S. fuel markets faced shocks in 2020 as shutdowns during the Coronavirus (COVID-19) pandemic meant fewer driving miles and, as a result, less demand for transportation fuel. Wholesale fuel prices slowly increased as demand rose again, but in recent months have surged to multiyear highs. Wholesale prices for Los Angeles Reformulated Gasoline Blendstock for Oxygenate Blending (RBOB), a common indicator for wholesale gasoline prices from the U.S. Department of Energy, Energy Information Administration fell below a dollar per gallon in the early months of the pandemic. Previous RBOB prices in January and February of 2020 were in line with the 2016-19 average of $1.80 a gallon. Wholesale ethanol prices, based on USDA, Agricultural Marketing Service data from locations in Illinois, Iowa, Minnesota, Nebraska, South Dakota, and Wisconsin, were 10 percent below the 2016-19 average of $1.38 a gallon in early 2020. Prices for both fuels began to fall in March 2020 when stay-at-home orders were first issued and eventually reached lows of $0.47 a gallon for RBOB and $0.78 a gallon for ethanol in April 2020. Since then, both price series have trended upward. In November 2021, RBOB prices averaged $2.55 a gallon, while ethanol prices averaged $3.24 a gallon. Ethanol, which in the United States is primarily produced from corn, is blended with gasoline to increase octane levels and to meet Renewable Fuel Standard obligations. On average, about 10 percent of retail gasoline is comprised of ethanol. This article is drawn from USDA, Economic Research Service’s March 2021 Feed Outlook report and features updated data.

Thursday, May 7, 2020

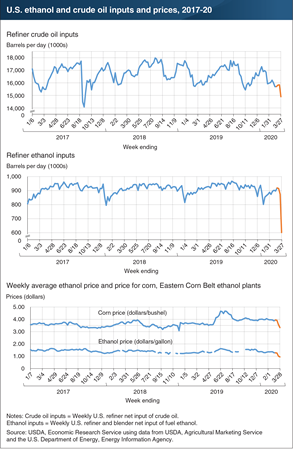

The Renewable Fuel Standard (RFS), first established by the Energy Policy Act of 2005, requires specified volumes of renewable fuels be used to reduce greenhouse gas emissions and expand the nation’s renewable fuels sector. Corn-based ethanol is the primary fuel used to meet the standard. During the last full corn marketing year (2018/19), ethanol accounted for approximately 10 percent of the gasoline consumed in the United States. Over the same period, approximately 5.4 billion bushels of corn, or about 38 percent of total use, were consumed for ethanol. Recently, consumption of gasoline has plummeted due to COVID-19-related travel restrictions, leading to significant declines in both ethanol demand and prices. Although the RFS has ensured that the smaller volumes of gasoline being consumed contain approximately 10 percent ethanol, usage of crude oil at U.S. refineries (U.S. refiner net input of crude oil) fell about 5 percent during March, and consequently, ethanol blending (U.S. refiner and blender net input of fuel ethanol) dropped by approximately 318,000 barrels per day—down 35 percent—over the same period. Ethanol and corn prices have fallen concurrently: at Eastern Corn Belt (ECB) ethanol plants in Illinois, the weekly average price received for gasoline fell about $0.33/gallon (down 26 percent), while the price paid for corn fell about $0.61/bushel (down 15 percent) during March. This chart is drawn from the Economic Research Service’s U.S. Bioenergy Statistics topic page and Feed Outlook for April 2020.

Tuesday, May 28, 2019

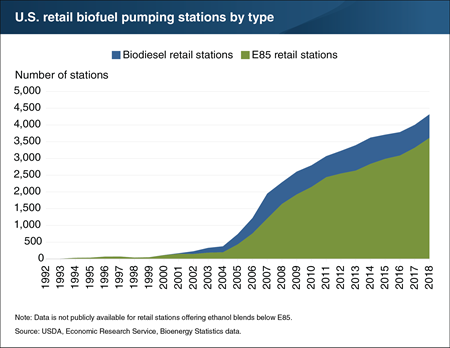

Ethanol is the main agriculturally derived bioenergy product in the United States, accounting for 9.2 percent of the gasoline consumed in 2017. It is often referred to in terms such as E10 or E85. Fuel that is 10 percent ethanol and 90 percent gasoline is referred to as E10, while E85 is 85 percent ethanol and 15 percent gasoline. Ethanol availability beyond the nearly ubiquitous E10 blend is limited. Data for stations offering less than E85 ethanol blends is not publicly available, but E10 blends are mandated in several U.S. states. There were 3,617 retail pumping stations offering E85 in 2018, partially because ethanol sales of blends higher than E10 at the pump are limited to stations that operate dedicated E85 pumps and tanks. Stations use pumps to blend fuel types from multiple tanks to achieve the desired blend. Similarly, biodiesel was available at 702 retail pumping stations in 2018, down from a peak availability of 783 in 2014. While agriculturally-derived bioenergy fuels (E85 or biodiesel) are available at a total of 4,319 pumping stations, they are significantly exceeded by non-agriculturally derived alternative fuel types. Primarily in the form of electricity, alternative fuels not derived from agricultural sources are available at over 66,000 of the roughly 160,000 retail pumping stations in the United States. This chart is based on data from the ERS U.S. Bioenergy Statistics data product, updated in December 2018.

Monday, May 20, 2019

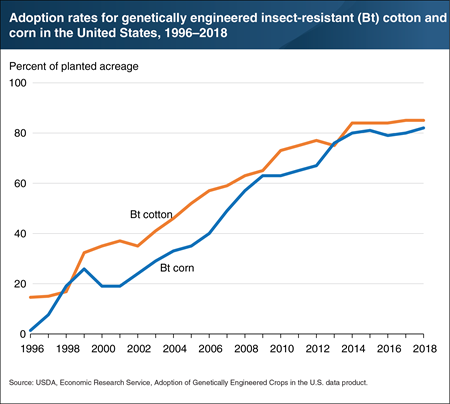

A genetically engineered (GE) plant has had DNA inserted into its genome using laboratory techniques. Some of the first GE crops were created by inserting genes from the soil bacterium Bacillus thuringiensis (Bt) into corn and cotton plants. Bt creates organic, crystalline insecticides that become concentrated in plant tissues, so these GE crops gained insect resistance. Demand increased quickly for Bt corn and cotton after their commercialization in 1996. Five years later, about 37 percent of cotton acres and 19 percent of corn acres had been planted with Bt seeds. By 2018, Bt adoption had increased to 85 percent of cotton acres and 82 percent of corn acres. Early differences in the adoption rates of these two GE crops may be related to the fact that insect infestations tend to be more severe in warmer climates. Cotton-growing areas are concentrated in the Southeastern United States and the Southern Plains, which tend to be warmer than growing areas in the Midwest, where most U.S. corn production takes place. This chart appears in the December 2018 Amber Waves data feature, “Trends in the Adoption of Genetically Engineered Corn, Cotton, and Soybeans.”

Tuesday, August 28, 2018

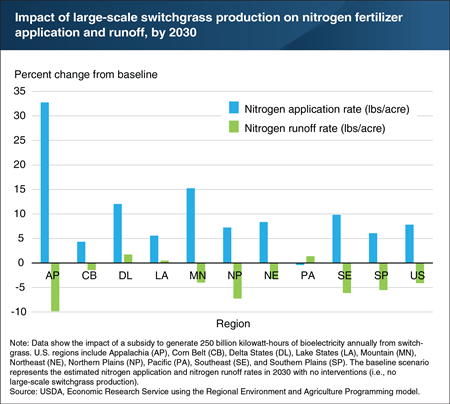

Native grasses, including switchgrass, have extensive root networks that reach deep into the soil—increasing water filtration, nutrient holding capacity, and erosion control. Switchgrass also offers a potential renewable source for liquid fuels or bioelectricity, but is not currently widely grown. An ERS study simulated the effects on agricultural land use and on the environment of growing enough switchgrass to generate 250 billion kilowatt-hours of electricity annually—approximately the amount generated by U.S. hydropower today. Switchgrass is expected to be grown in regions that have high switchgrass yields, but relatively low yields of food crops or hay. The Northern Plains (NP) and Appalachia (AP) would provide two-thirds of total land planted in switchgrass. As switchgrass acreage increases and displaces non-energy crops, nitrogen fertilizer applied per acre of non-energy crop increases. All regions would experience increased nitrogen application per cropland acre, except the Pacific region (PA), which shows a small decrease. However, the overall effect of planting more switchgrass would be to retain more nitrogen nutrient and reduce nitrogen runoff into water bodies. The amount of nitrogen lost to water is expected to decline compared with the baseline scenario by about 4 percent nationally, with declines experienced in 7 of 10 regions. This chart is derived from the January 2017 ERS report, Dedicated Energy Crops and Competition for Agricultural Land.

Wednesday, March 14, 2018

Last year, the Brazilian Government announced a tariff rate quota for ethanol imports, where imports in excess of 600 million liters are subject to a 20-percent tariff. However, U.S. ethanol has been priced so low that it is still an economical alternative in Brazil. Currently, ethanol is $1.50 per gallon at the Gulf Coast Ports in the United States, while ethanol in Brazil is $2.32 per gallon. Demand for ethanol in Brazil is robust because of widespread use of flex-fuel vehicles and a mandate requiring a minimum of a 27-percent ethanol blend in gasoline. Due to price competitiveness and strong demand, Brazil, the second largest global ethanol producer, is also the largest overseas buyer of U.S. ethanol. One contributing factor is the internal distribution of ethanol in Brazil. Ethanol mills are mostly located in the sugar producing areas of southern Brazil. Because of infrastructure constraints, it is cheaper to ship ethanol by boat from the U.S. to the northern regions of Brazil than by overland transport through Brazil. Some new ethanol mills are located in Brazil’s northern corn-producing regions. An expansion of corn ethanol production in Brazil would likely make U.S. ethanol less competitive. This chart is drawn from the ERS Feed Outlook newsletter, released in March 2018.

Friday, January 5, 2018

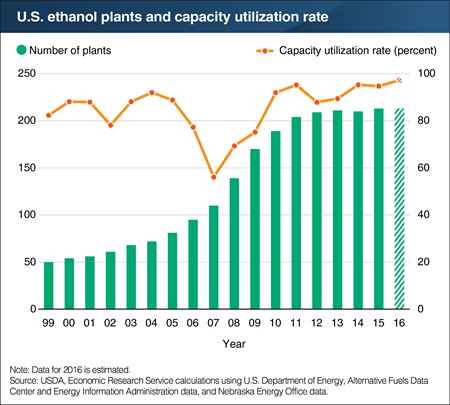

The number of U.S. ethanol plants more than quadrupled since 1999, as demand for ethanol has increased. This growth in the number of plants is driven mainly by the Renewable Fuel Standard program, which was first enacted in 2005. The initial increase in plant numbers after 2005 led to reduced capacity utilization with some plants not producing at their full potential. Since 2011, the number of new plants has generally remained level, allowing for production growth to be achieved through maximizing present capacity utilization. As of 2016, existing plants were operating at roughly 97 percent of total capacity, translating to over 15 billion gallons of ethanol produced. While such a high number might normally signal demand for new plants, limitations on the amount of ethanol that can be blended with gasoline in existing vehicles is effectively limited to 10 percent. Combined with lower gasoline consumption due to greater vehicle efficiency and lower miles driven, further domestic ethanol demand has been constrained. Because of these constraints, additional ethanol production is primarily intended for export markets and is sensitive to competition with the price of gasoline, which has fallen significantly since 2014. This chart appears in the ERS report Global Ethanol Mandates: Opportunities for U.S. Exports of Ethanol and DDGS, released in October 2017.

Thursday, November 2, 2017

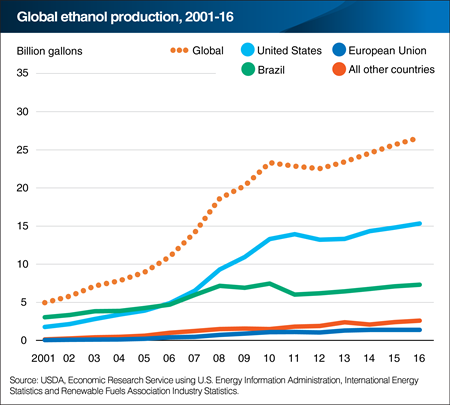

Ethanol production has increased rapidly over the last two decades, making ethanol an important component of today’s transportation fuels. From 2001 to 2016, global ethanol production grew 400 percent, from 5 billion gallons to almost 27 billion gallons. Historically, the United States, Brazil, and the European Union (EU) were the world’s major ethanol markets. In the United States alone, ethanol makes up 10 percent of total gasoline use. Government blending mandates (requirements to add a specified percentage of ethanol to gasoline) have helped fuel increases in ethanol production and consumption worldwide. Despite the global increase in ethanol production, however, many countries do not meet their mandates. Of the ethanol-producing countries outside of the United States, Brazil, and the EU, five countries—Argentina, Canada, China, India, and Thailand—account for 80 percent of the remaining production. This chart appears in the ERS report, "Global Ethanol Mandates: Opportunities for U.S. Exports of Ethanol and DDGS," released in October 2017.

Thursday, April 27, 2017

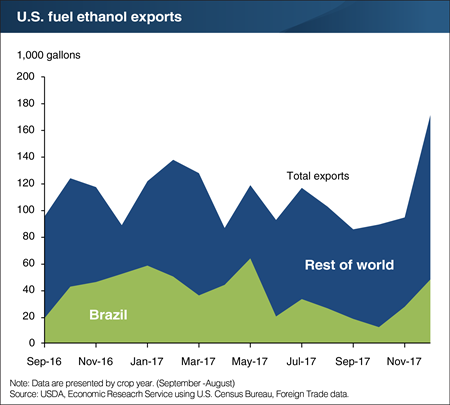

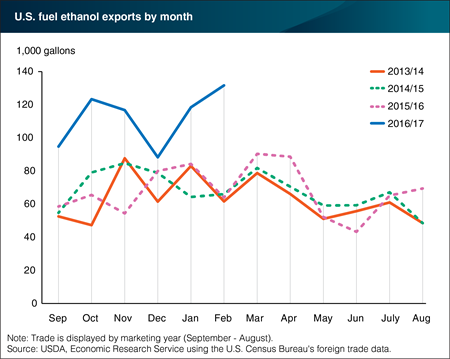

U.S. fuel ethanol exports are up significantly for the 2016/17 marketing year, primarily driven by increased exports to Brazil. The change is related to an increase in Brazil’s sugar prices, which is due to strong international demand for the country’s sugar exports. As a result, the country’s sugarcane refiners have shifted processing capacity from ethanol to sugar. Since Brazil has a 27-percent ethanol inclusion mandate for gasoline, the decline in output has left fuel refiners short of supplies. This has caused an increase in ethanol shipments from the United States, where corn supply is abundant, making up for Brazil’s shortfall. U.S. ethanol shipments to Brazil began rising in October 2016, jumping 138 percent that month. The pace has continued at an elevated level through February 2017, the latest month for which trade data are available. From October 2016 through February 2017, fuel ethanol shipments to Brazil surged 547 percent, compared with the same period a year earlier. In addition, U.S. shipments to the world rose 65 percent and exports to Canada, also a major buyer, rose by 57 percent. This chart appears in the ERS Feed Outlook report released in April 2017.

Tuesday, December 20, 2016

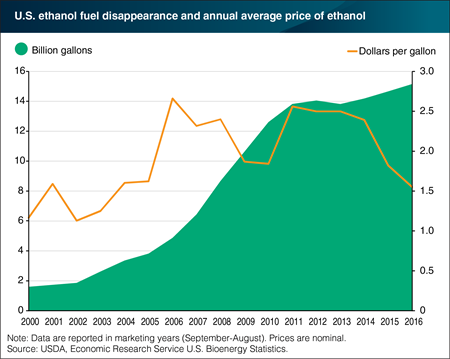

In the United States, production of ethanol is largely tied to federally mandated renewable fuel standards contained in the Energy Independence and Security Act of 2007 and the prior Energy Policy Act of 2005. The former calls for 36 billion gallons of renewable fuels in production by 2022, but requires that an increasing share – 21 billion gallons – of the mandate be met with advanced biofuels, which are biofuels produced from feedstocks other than corn starch (and with 50 percent lower-lifecycle greenhouse gas emissions than petroleum fuels). Corn based ethanol production has begun leveling off since 2010 as production nears the cap for non-advanced biofuels. As production has leveled off, the average annual price of ethanol has declined. The average ethanol price in 2016 was $1.55 per gallon, the lowest price since 2003. While the price of ethanol is also impacted by unrelated movements in the corn market, slowing growth of ethanol production has impacted the prices of both commodities. The data in this chart is drawn from the ERS U.S. Bioenergy Statistics data product updated in December 2016.

Thursday, July 28, 2016

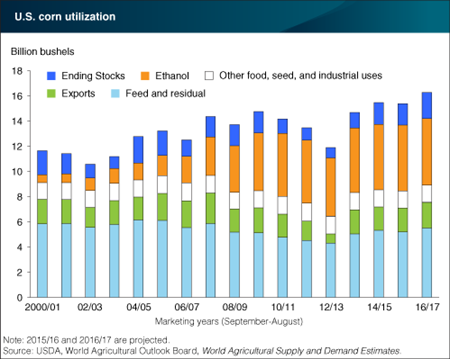

U.S. corn area in 2016/17 is estimated at 94.1 million acres, of which 86.6 million is expected to be harvested for grain, up 5.9 million from last year. With a national average yield forecast of 168 bushels, corn production this year would reach 14.5 billion bushels, 939 million bushels above last year’s harvest and 324 million more than was harvested from the record-large 2014/15 crop. The larger supply is expected to have a dampening effect on prices, making U.S. corn more competitive in the global market and boosting exports to 2.1 billion bushels in 2016/17, up from 1.9 million from the 2015/16 crop and the highest since 2007/08 when they reached 2.4 billion. Use for ethanol as well as other food, seed and industrial uses is expected to increase only modestly (less than 1 percent) to 6.7 million bushels, reflecting the maturity of those markets. Feed and residual use (a category that mainly includes livestock feed as well as other uses unaccounted for) is expected to consume 5.5 billion bushels, up 300 million from the 2015/16 crop. With projected supply expected to exceed total use of the 2016/17 crop, ending stocks are forecast to grow to 2.1 billion bushels, up from the 1.7 billion bushels expected to be on hand at the end of the 2015/16 crop year. This chart is from the ERS report Feed Outlook, July 2016.

Tuesday, July 19, 2016

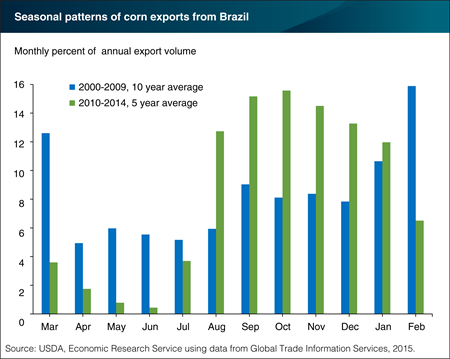

Corn is Brazil’s second largest crop (after soybeans), accounting for 20 percent of planted area, and Brazil is the world’s second largest corn exporter, behind the United States. Due to a favorable climate and long growing season, double-cropping is possible in much of the country, and the majority of corn in Brazil is harvested as a second crop planted after soybeans. Brazil tends to use most of its first-crop corn (harvested primarily during February-April) domestically because it is grown near the poultry and pork enterprises in the South, and the transportation system is focused on moving soybeans into global markets. But second-crop corn is harvested during June-August just as Brazil’s peak soybean export period ends, freeing up port capacity and transportation resources to move corn into export markets. Second-crop corn production in Brazil has expanded rapidly over the past 5 years, and over the same period the seasonal pattern of Brazil’s corn exports has shifted such that a much larger portion now enters export markets from August to January, months when harvesting begins and supplies peak in the United States. This chart is from the ERS report, Brazil’s Corn Industry and the Effect on the Seasonal Pattern of U.S. Corn Exports, released June 15, 2016.

Thursday, July 7, 2016

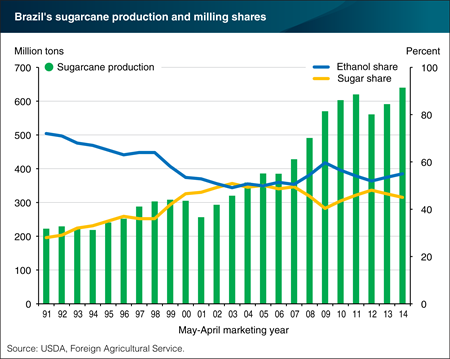

The Government of Brazil has supported the production of ethanol as an automotive fuel for many years, beginning in 1975 with the Proálcool program, to encourage production of ethanol from sugarcane and including many programs that remain in effect today—including mandatory ethanol-blending requirements in gasoline and tax exemptions for ethanol-powered cars. Sugarcane is nearly the exclusive ethanol feedstock in Brazil, and Brazil is the world’s largest sugarcane producer, accounting for 39 percent of world production. Until the mid-1990s, the share of sugar production turned into ethanol was set by government policy, but since then market forces have determined the share that is converted to ethanol. In particular, the relationship among the prices of sugar, gasoline, and ethanol, as well as storage capacity at sugar mills, all play a role. Production of both sugar and ethanol in Brazil has expanded rapidly since the mid-1990s. Sugarcane production reached 640 million tons in 2014, up 188 percent since 1991, while over the same time, the share used for ethanol production declined from 72 percent in 1991 to a low of just over 49 percent in 2003 and a 2014 level of 55 percent. This chart is from the ERS report, Brazil’s Agricultural Land Use and Trade: Effects of Changes in Oil Prices and Ethanol Demand, released June 29, 2016.

Friday, June 24, 2016

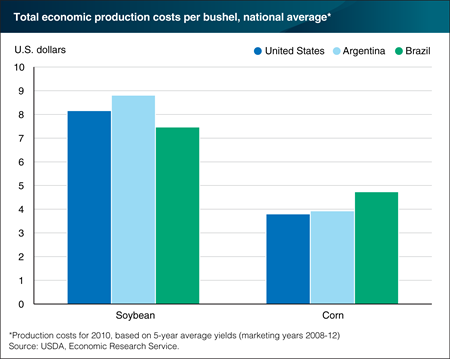

The cost of producing agricultural commodities varies across countries and regions due to many factors, including the quality of resources, climatic conditions, and the cost and availability of necessary inputs. Differences in cost of production help to determine a country’s export competitiveness in global markets, with low-cost producers usually capturing a larger share of global exports. Corn and soybeans are among the most important agricultural commodities traded in global markets, and the United States, Brazil and Argentina are the leading exporters, accounting for a combined 88 percent of world soybean exports and 73 percent of world corn exports between 2008 and 2012. Based on data for 2010 and 5-year average yields, the cost of producing soybeans in Argentina average $8.81 per bushel, compared to $7.47 in Brazil and just over $8.00 in the United States. For corn, Brazil had the highest cost of production at $4.74 per bushel, compared to $3.93 for Argentina and $3.80 in the United States. This chart is from the ERS report, Corn and Soybean Production Costs and Export Competitiveness in Argentina, Brazil and the United States, released on June 22, 2016.

Tuesday, June 21, 2016

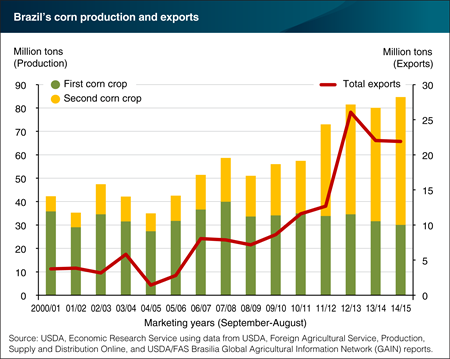

Since 2000/01, corn production in Brazil has doubled, reaching a record 85 million metric tons in 2014/15, equivalent to 8.4 percent of global corn production. Corn is now Brazil’s second largest crop (after soybeans), accounting for 20 percent of planted area, and Brazil is the world’s second largest corn exporter, behind the United States. Due to a favorable climate and long growing season, double-cropping is possible in much of the country, and the majority of corn in Brazil is harvested as a second crop planted after soybeans. Technological advances in soil management and improvements in hybrid corn varieties have supported this expansion. The second-crop corn harvest largely serves the export market, putting it in direct competition with the timing of the U.S. corn harvest. This chart is from the ERS report, Brazil’s Corn Industry and the Effect on the Seasonal Pattern of U.S. Corn Exports, released on June 15, 2016.

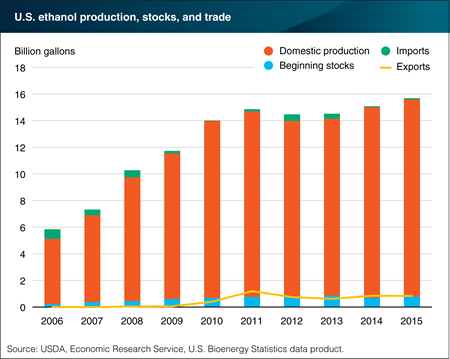

Thursday, May 5, 2016

U.S. production of ethanol hit a record 14.8 billion gallons in 2015, and when combined with the carry-over stocks from the previous year and 2015 imports, the total ethanol supply reached an all-time high of 15.7 billion gallons. Nearly all ethanol blended into the U.S. gasoline supply is produced domestically, and, over the past five years, about 94 percent of domestic production was used in the United States. Ethanol imports peaked in 2006 at 731 million gallons (equal to 12 percent of the U.S. supply), but each year since 2010 exports have exceeded imports, making the United States a net exporter of ethanol. The domestic market for ethanol is at full capacity due to the technical and regulatory constraints that limit most of the U.S. gasoline supply to a 10 percent maximum ethanol blend, so the export market is now the primary opportunity for growth. Ethanol exports peaked in 2011 at nearly 1.2 billion gallons, but have remained below 850 million gallons for the past four years. This chart is based on the ERS U.S. Bioenergy Statistics data product.

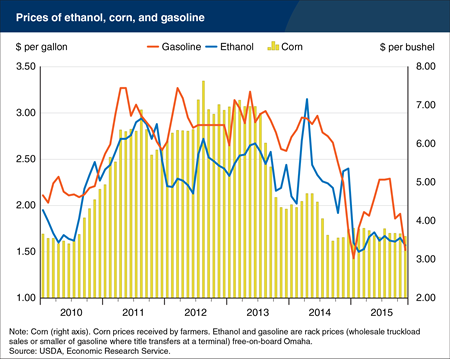

Thursday, January 21, 2016

Errata: On January 26, 2016, this chart was reposted to correct the data labels for ethanol and gasoline, which were switched in the original chart.Each gallon of automobile gasoline typically contains about 10-percent ethanol, reflecting a mandate under the Renewable Fuels Standard that specifies the volume of ethanol that must be blended into the Nation’s gasoline supply. The steep decline in crude oil prices over the past 18 months has pushed the price of many conventional fuels down by more than 50 percent, including gasoline, which has fallen to price levels not seen since 2007. The price of ethanol has also fallen, driven primarily by the more than 50-percent decline in the price of corn—the primary ethanol feedstock—since summer 2013. Although ethanol is not derived from crude oil, its price is still influenced by the price of gasoline (as well as the price of corn) since ethanol and gasoline can substitute as an energy source, and as an oxygenate or octane booster, ethanol competes against petroleum-based alternatives. The price of ethanol is usually below the price of gasoline because of ethanol’s lower energy content, but the most recent data show wholesale gasoline prices falling slightly below the price of ethanol. This pattern, if it continues, suggests further downward pressure on ethanol prices. This chart is from the USDA/ERS U.S. Bioenergy Statistics data set.

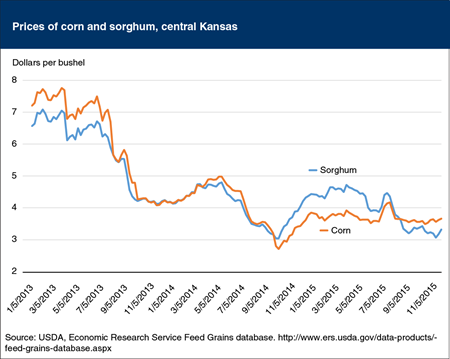

Friday, December 18, 2015

Sorghum is a common feed grain that can substitute for corn in livestock feed rations and in the production of ethanol. Corn tends to be preferred over sorghum as a feed ingredient, so sorghum typically sells at a discount compared to corn in global markets. Throughout much of the 2014 marketing year (September-August) this situation reversed, and due in large part to strong demand from China, sorghum began selling at a premium over corn, at times exceeding 20 percent. As a result, sorghum use for ethanol production declined while acreage for the 2015 harvest increased to result in a record-large U.S. crop. This, combined with recent changes in China’s import policy that could reduce U.S. sorghum’s export prospects for the 2015 crop, has greatly increased the availability of sorghum in domestic markets for feeding and ethanol production. Because of the greater availability of sorghum, the price fell back below the price of corn and is now more in line with historic relationships. Given these lower prices, sorghum use for ethanol production is expected to expand more than fivefold this year, and U.S. shipments to Mexico, which were hampered by the high prices for the 2014 crop, are expected to at least partially resume during the current marketing year, which began in September 2015. This chart is based on the October 2015 Feed Outlook and the ERS Feed Grains database.

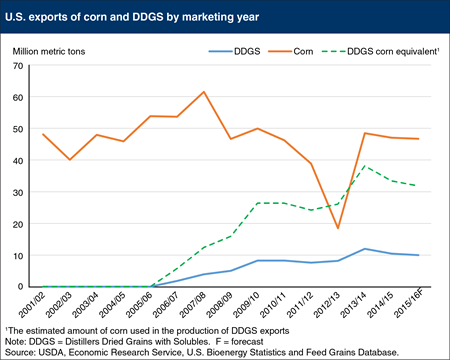

Thursday, November 5, 2015

U.S. exports of distillers dried grains with solubles (DDGS)—a common byproduct of corn ethanol production—have grown from nearly zero in 2005 to as high as 12 million metric tons in the 2013/14 marketing year (September/August), with 10 million metric tons forecast for export in the 2015 marketing year. This increase in exports reflects the expansion in ethanol production that occurred over this same period, rising from just under 4 billion gallons in 2005 to more than 14 billion gallons in 2014. While U.S. corn exports still exceed the volume of DDGS exported, these markets are linked because each ton of corn processed into ethanol produces just under a third of a ton of DDGS. Ethanol production accounted for 38 percent of U.S. corn use in 2014/15, while exports were less than 14 percent, but DDGS exports represent another way that U.S. corn production enters global markets. This chart is from the ERS data products, U.S. Bioenergy Statistics and the Feed Grains Database.