Health Insurance Coverage

Suggested citation for linking to this discussion:

U.S. Department of Agriculture, Economic Research Service. Farm Household Well-being: Health Insurance Coverage, December 1, 2021.

In 2015, USDA surveyed farm operators about their household’s health insurance coverage as part of the annual Agricultural Resource Management Survey (ARMS). The 2015 survey is the most recent source of data on this topic; insurance coverage data were previously included in ARMS in 2011. To see detailed tables with data from all available ARMS surveys, see the section on "Health Insurance Coverage" in the Farm Household Income and Characteristics data product.

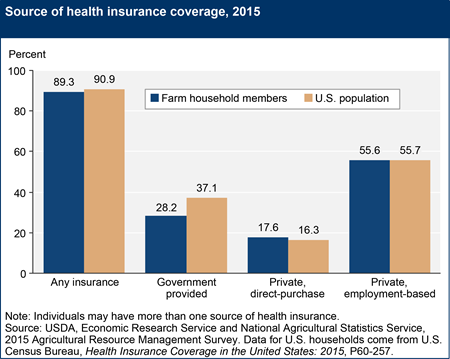

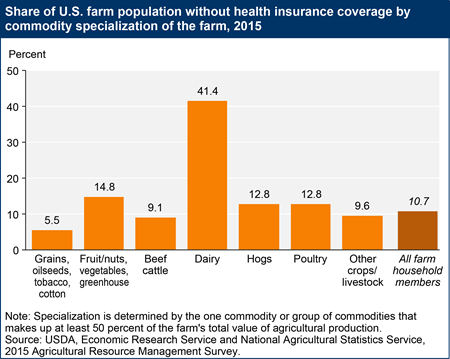

Because medical care is expensive and often essential for maintaining one's health, the incidence of health insurance coverage among populations is an important indicator of their well-being. As with U.S. households in general, a major risk facing farm households is illness or injury to household members, with associated medical expenses incurred in response to an illness capable of draining household resources. Health insurance provides individuals or groups with at least partial reimbursement for covered medical expenses in return for an upfront periodic fee. Health insurance coverage also indicates how much health-related financial risk a household bears. In 2015, 9.1 percent of the U.S. population had no form of health insurance. In comparison, 10.7 percent of farm household members lacked health insurance, indicating that they faced slightly higher health-related financial risks than the general population.

Most Americans with health insurance coverage receive it through their employers, and farm households are no exception. Although farm operators are largely self-employed, the majority of farm households have an operator or spouse employed off the farm (see the Farm Household Income and Characteristics data product table on health expenditure and insurance coverage information of principal farm operator households, by off-farm work, 2015). As with the general population, the most common source of health insurance for members of farm households is employment-based. In fact, farmers are as likely as the general U.S. population to receive their health insurance through an outside employer. Farmers were slightly more likely than the general population in 2015 to purchase their health insurance directly from an insurance company and less likely to receive health insurance from a government-provided program, such as Medicare or Medicaid.

In 2015, more than half of farm household members had health insurance coverage from an employment-based plan. Time demands on the farm prevent many farmers or ranchers from accessing employer-sponsored insurance through an off-farm job (see the Farm Household Income and Characteristics data product table on health expenditure and insurance coverage information of principal farm operator households, by commodity specialization, 2015). This is especially true of dairy farmers; only 36 percent of dairy household members were covered by employee plans in 2015 (versus 56 percent of all farm household members). This may explain why over two-fifths of dairy household members were uninsured in 2015, compared to 10.7 percent of all farm household members.