Editor's Pick 2014: Best of Charts of Note

This chart gallery is a collection of the best Charts of Note from 2014. These charts were selected by ERS editors as those worthy of a second read because they provide context for the year’s headlines or share key insights from ERS research.

_450px.png?v=8802.2)

China’s demand for imported grains, much of it from the United States, has surged recently, with imports of cereal grains rising to 16 million tons in 2012 and 18 million in 2013. Imports in 2013 included 3 million tons of corn and 4 million tons of DDGS (distillers dried grains with solubles; a co-product of U.S. corn ethanol production used for feed) from the United States. In 2013, the United States supplied 70 percent of China’s wheat imports and, for the first time, China became a major market for U.S. sorghum. China’s demand for feed grains appears to have reached a turning point, as a tightening labor supply and rising feed costs force structural change in China’s livestock sector. Labor scarcity, animal disease pressures, and rising living standards are prompting rural households to abandon “backyard” livestock production and shift more production to specialized farm enterprises that rely more heavily on commercial feed. Because of this, China has switched from being a corn exporter to importing 3-5 million tons annually since 2009. Rising feed demand has also pushed up costs and motivated feed mills and livestock producers to explore new feed ingredients like DDGS and sorghum. Find this chart and additional analysis in "China in the Next Decade: Rising Meat Demand and Growing Imports of Feed" in the April Amber Waves. Originally published Thursday May 22, 2014.

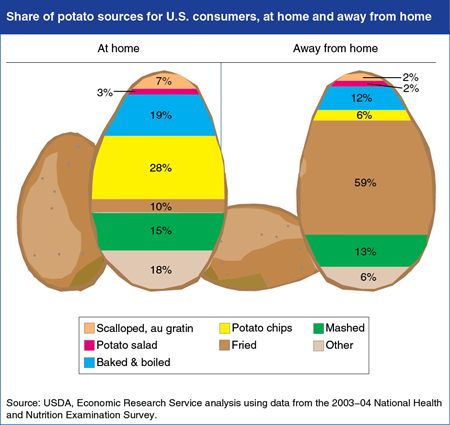

When advised to “eat your vegetables,” Americans may also need to be reminded “and watch how you prepare them.” ERS researchers recently looked at the types of vegetables and vegetable-containing foods eaten by Americans and found that instead of eating vegetables in their simple, unadorned state, Americans often eat vegetables in ways that add calories and sodium and reduce dietary fiber. For potatoes prepared at home, potato chips were the most commonly eaten form, accounting for 28 percent of potato consumption. In restaurants, fast food places, and other away from home eating places, fried potatoes accounted for 59 percent of potato consumption. Food intake surveys show other potato dishes, such as mashed and scalloped potatoes, are often prepared with added fats and sodium. Baked and boiled potatoes accounted for 19 percent of at-home potato consumption and 12 percent away from home, and the skin was usually not eaten, reducing dietary fiber content. This chart appears in “Healthy Vegetables Undermined by the Company They Keep” in the May 2014 issue of ERS’s Amber Waves magazine. Originally published Monday August 11, 2014.

_450px.png?v=8802.2)

The severity and duration of the ongoing drought in California has raised concerns over its role in rising food prices at the grocery store, especially for fresh fruits and vegetables. In 2012, California produced nearly 50 percent (by value) of the nation’s vegetables and non-citrus fruit. Droughts in California are generally associated with higher retail prices for produce, but price increases are lagged due to the time it takes for weather conditions and planting decisions to alter crop production, which then influence retail prices. In 2005, following five years of drought, retail fruit prices rose 3.7 percent and retail vegetable prices increased 4 percent. Prices continued to rise in 2006, one year after drought conditions began to improve. However, other factors such as energy prices and consumer demand also affect retail produce prices. For example, prices for fresh produce fell in 2009 despite drought conditions, as the 2007-09 recession reduced foreign and domestic demand for many retail foods. As of October 2014, ERS analysts are forecasting fresh fruit prices to increase 4.5 to 5.5 percent in 2014 and vegetable prices to be 2 to 3 percent higher. This chart appears in the Food Prices and Consumers section of the 2014 California Drought page on the ERS website. Information on ERS’s food price forecasts can be found in ERS’s Food Price Outlook data product, updated October 24, 2014. Originally published Thursday October 30, 2014.

_450px.png?v=8802.2)

The severity and duration of the ongoing drought in California has raised concerns over its role in rising food prices at the grocery store, especially for fresh fruits and vegetables. In 2012, California produced nearly 50 percent (by value) of the nation’s vegetables and non-citrus fruit. Droughts in California are generally associated with higher retail prices for produce, but price increases are lagged due to the time it takes for weather conditions and planting decisions to alter crop production, which then influence retail prices. In 2005, following five years of drought, retail fruit prices rose 3.7 percent and retail vegetable prices increased 4 percent. Prices continued to rise in 2006, one year after drought conditions began to improve. However, other factors such as energy prices and consumer demand also affect retail produce prices. For example, prices for fresh produce fell in 2009 despite drought conditions, as the 2007-09 recession reduced foreign and domestic demand for many retail foods. As of October 2014, ERS analysts are forecasting fresh fruit prices to increase 4.5 to 5.5 percent in 2014 and vegetable prices to be 2 to 3 percent higher. This chart appears in the Food Prices and Consumers section of the 2014 California Drought page on the ERS website. Information on ERS’s food price forecasts can be found in ERS’s Food Price Outlook data product, updated October 24, 2014. Originally published Thursday October 30, 2014.

_450px.png?v=8802.2)

If you have a sweet tooth, you are not alone. A recent analysis of intake data from the 2007-10 National Health and Nutrition Examination Survey (NHANES) found that U.S. children ate an average of 9.7 teaspoons of added sugars for each 1,000 calories consumed, and adults consumed 8.4 teaspoons of added sugars per 1,000 calories. Added sugars are the sugars, syrups, and other caloric sweeteners added to foods, including table sugar added to coffee and high fructose corn syrup used in soft drinks, ketchup, and other processed foods. The 2010 Dietary Guidelines for Americans advise that added sugars and added fats should account for no more than 258 calories of a 2,000-calorie diet. Half of this maximum coming from added sugars would equal 3.9 teaspoons per 1,000 calories—less than half of what Americans are consuming. The analysis also found that on average, lower-income individuals consumed more added sugars than higher-income individuals. This chart appears in “Food Consumption and Nutrient Intake Data—Tools for Assessing Americans’ Diets” in the October 2014 issue of ERS’s Amber Waves magazine. Originally published Friday October 10, 2014.

_450px.png?v=8802.2)

During the Great Recession of 2007-09, many Americans experienced large changes in employment and income—changes that affected their food spending and intake. Using intake data from National Health and Nutrition Examination Surveys, ERS researchers found that working-age Americans cut back on the number of meals and snacks eaten away from home between 2005-06 and 2009-10. Working age adults’ total daily calories from food away from home declined as well. After accounting for age and other demographic characteristics, the number of away-from-home meals and snacks consumed by working age adults declined by about 12 percent and their away-from-home calories fell from 833 to 706 calories per day. Accounting for income did not affect the estimated declines, suggesting that the recession effect was not due to lower incomes, but instead to increased time available for shopping and preparing food at home. The statistics in this chart are from the ERS report, Changes in Eating Patterns and Diet Quality Among Working-Age Adults, 2005-2010, released January 16, 2014.

_450px.png?v=8802.2)

The successful cultivation of many U.S. specialty and orchards crops (including almonds, sunflowers, canola, grapes, and apples) is dependent upon commercial insect pollination. The European honey bee is largely preferred over other pollinators due to their relative ease of transport and management. Migration routes often include a stop in California to pollinate almonds in early spring. An estimated 60-75 percent of U.S. commercial hives are employed for the State’s almond bloom, which draws hives from as far away as Florida and Texas. Migratory paths diverge after the almond bloom; some beekeepers remain in California while others move north to service mainly orchard and berry crops, and others depart for southern and eastern States to pollinate a variety of specialty field crops. During the pollination season, an estimated 65-80 percent of commercial hives spend part of the summer foraging in the northern Great Plains. At the end of the summer, many operations return their hives to overwintering sites in southern States. Find this map and further discussion on U.S. pollination markets in Fruit and Tree Nut Outlook.

_450px.png?v=8802.2)

The United Nations has designated 2014 as the "International Year of Family Farming" to highlight the potential family farmers have to help feed the world. But what is a family farm? USDA’s Economic Research Service (ERS) defines family farms as those whose principal operator, and people related to the principal operator by blood or marriage, own most of the farm business. Under the ERS definition, family farms represent 97.6 percent of all U.S. farms and are responsible for 85 percent of U.S. farm production. Other definitions rely on who supplies the labor. Large farms often rely heavily on hired labor, but farm families who own the farm and provide most of the farm’s labor still account for 87.1 percent of U.S. farms, with 57.6 percent of farm production. Some farms also hire firms to perform some farm tasks. If we account for the labor provided by those firms, family farms that provide most of the labor used on the farm still account for 86.1 percent of farms and nearly half of production. This chart can be found in "Family Farming in the United States" in the March 2014 Amber Waves.

_450px.png?v=8802.2)

Nearly 4 million veterans resided in rural (nonmetropolitan) America in 2012. They are a rapidly aging and increasingly diverse group of men and women who comprise over 10 percent of the rural adult population despite their persistently declining numbers; the number of veterans living in rural areas declined from 6.6 million in 1992 to 3.8 million in 2012. A drop in the size of the active military population since 1990, from 3 million to roughly 1.4 million, and natural decrease due to aging (over half of rural veterans were age 65 or older in 2012, compared to 18 percent of the nonveteran rural population) means the downward trend in the number of rural veterans will likely continue for many years. Whether due to their military service or because of their age profile, over 20 percent of rural, working-age veterans report disability status compared with 11 percent of nonveterans. Taken together, their older age and higher incidence of disabilities make the well-being of rural veterans, as a group, increasingly dependent on access to medical care in rural areas. This chart comes from Rural Veterans at a Glance, EB-25, November 2013.

_450px.png?v=8802.2)

Between 1990 and 2013, the Hispanic population in the United States (including both foreign and U.S. born) increased from 22.4 million to 54.1 million, growing 142 percent compared with 16 percent for the non-Hispanic population for the same period. Prior to 1990, growth of the Hispanic population was concentrated in larger cities and in relatively few States, mostly in the Southwest. The rural (nonmetro) Hispanic population grew at less than half the rate seen in urban (metro) areas during the 1980s—2.2 percent per year compared with 4.5 percent. Since 1990, however, growth in the Hispanic population has been widespread, occurring in metropolitan and rural communities in every region of the country; average annual population growth rates have been identical for metro and nonmetro Hispanic populations since 2000. However, both rural and urban areas have experienced lower rates of growth among Hispanics since the recession, due in part to a decline in immigration. Rural population growth remains above 2 percent per year for Hispanics, in marked contrast to population decline among non-Hispanic populations, averaging -0.2 percent per year since 2010. This chart updates one found in the ERS newsroom feature, Immigration and the Rural Workforce.

_450px.png?v=8802.2)

China’s demand for imported grains, much of it from the United States, has surged recently, with imports of cereal grains rising to 16 million tons in 2012 and 18 million in 2013. Imports in 2013 included 3 million tons of corn and 4 million tons of DDGS (distillers dried grains with solubles; a co-product of U.S. corn ethanol production used for feed) from the United States. In 2013, the United States supplied 70 percent of China’s wheat imports and, for the first time, China became a major market for U.S. sorghum. China’s demand for feed grains appears to have reached a turning point, as a tightening labor supply and rising feed costs force structural change in China’s livestock sector. Labor scarcity, animal disease pressures, and rising living standards are prompting rural households to abandon “backyard” livestock production and shift more production to specialized farm enterprises that rely more heavily on commercial feed. Because of this, China has switched from being a corn exporter to importing 3-5 million tons annually since 2009. Rising feed demand has also pushed up costs and motivated feed mills and livestock producers to explore new feed ingredients like DDGS and sorghum. Find this chart and additional analysis in "China in the Next Decade: Rising Meat Demand and Growing Imports of Feed" in the April Amber Waves.

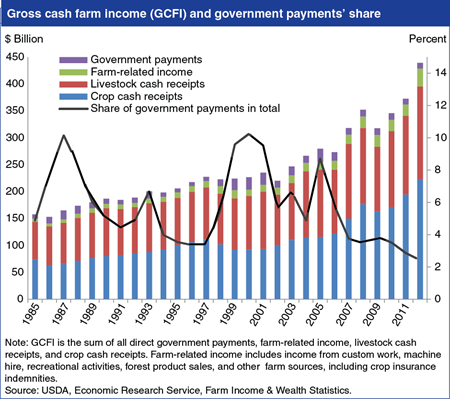

GCFI (cash income to farm operations before accounting for expenses) comes from a number of different sources, including sales of crops and livestock, income generated through farm and equipment services to other operators, use of farmland for recreational activities, sales of forest products, crop insurance indemnities, and other farm-related income. Many producers also receive government payments from a variety of Federal farm programs. The share of government payments in total GCFI has varied widely over time, reflecting the effects of variable weather and prices, as well as changes in farm programs, on the sources of farm income. The share has been historically low in recent years, as relatively high commodity prices have reduced price-triggered payments. Government payments in this chart include only payments made directly to producers, and thus do not reflect government support of Federal crop insurance, which has played an increasing role in farm risk management Producers participate in Federal crop insurance through private crop insurance companies, with the Federal Government covering a portion of the crop insurance premiums and other costs associated with providing this insurance. For more information, see the Farm & Commodity Policy topic page.