Changes in Farmers’ Financial Status May Affect Crop Insurance Demand

Agricultural production is subject to many risks. Market shifts, unfavorable weather conditions, and plant disease can impact crop yields and prices, leading to variability in farmers’ income. Many farmers in the United States and other countries use crop insurance to manage the risk of crop failure or low prices. In the United States, the Federal crop insurance program has grown steadily over the past two decades and is the largest program providing support to producers under the 2014 Farm Act.

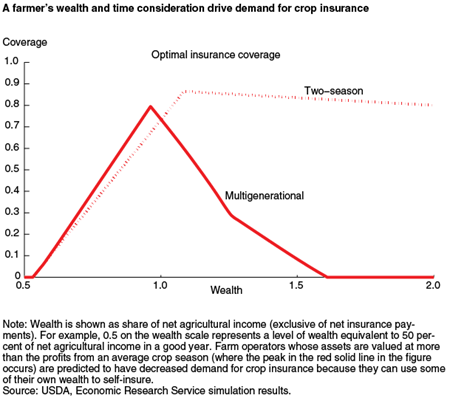

Recent ERS research shows that, when examined over multiple years, farmers’ demand for crop insurance is driven more by a farmer’s wealth and the available financial options than by the farmer’s attitude toward risk. Wealthier farmers use financial assets as a partial or full substitute for crop insurance, as they can self-insure using their savings. Therefore, the more assets a farmer has, the less likely he or she is to purchase crop insurance. In addition, wealthy farmers tend to use savings instead of insurance to manage risk when they plan for several crop seasons or even across generations of operators in a family farm rather than just the current season; this is not the case if a farmer has a short planning horizon of, for example, only two seasons. Thus, two otherwise identical farmers with the same wealth would make different crop insurance coverage decisions if one were planning for two seasons and the other were taking a longer “multigenerational” approach to farm risk management.

By comparison, farmers with limited wealth use additional savings to buy crop insurance. These farmers often use savings to complement insurance. Intuitively, a farmer has to accumulate a lot of wealth through saving to be able to self-insure against the possibility of a large crop failure. If the farmer has not saved enough to build up wealth to this level of self-insurance, he or she can use a smaller amount of savings to purchase an insurance contract; the premium is a much smaller out-of-pocket cost than the insurance payment he or she will receive if a loss occurs. Therefore, an increase in savings among limited-resource farmers leads to an increase in crop insurance purchases, which is the opposite of what one sees when saving increases among non-limited-resource farmers. Additionally, farm operators with more farm debt are more likely to buy crop insurance, possibly to avoid falling further into debt should production or prices fall below certain levels.

Findings also show a link between the rate of crop insurance uptake and a farmer’s education level, race, and gender. Farm operators who are male, White, and have completed at least some college are more likely to purchase Federal crop insurance than other farmers; the same is true for farm operators whose land is more heavily devoted to grain crops.

How Do Time and Money Affect Agricultural Insurance Uptake? A New Approach to Farm Risk Management Analysis, by Katie Farrin, Mario Javier Miranda, and Erik O'Donoghue, USDA, Economic Research Service, August 2016