ERS Tracks Meat Prices at the Retail, Wholesale, and Farm Levels

Since 1961, the ERS has synthesized data from a variety of Federal agencies to develop the Meat Price Spreads Data series, which reports farm-to-wholesale and wholesale-to-retail price spreads for beef, pork, and broilers. These prices, along with poultry prices, are reported each month in ERS’s Meat Price Spreads Data.

The Meat Price Spreads Data series shows the difference between what consumers pay for a certain type of meat at the retail store and what producers actually receive for that meat. To make these calculations, ERS starts with a standard animal at the farm that is cut in a standard way both in the packing plant and in the retail store. ERS then uses retail and wholesale prices to compare the value of the animal at the farm with its wholesale and retail value. Put differently, ERS estimates how much it would cost the retailer, on average, to buy a whole animal from a wholesaler and how much it would cost the consumer, also on average, to buy that same animal from the retailer. ERS calculates the retail price by averaging the prices of all the cuts from an animal. The wholesale price is calculated using the prices that meatpackers get for beef and pork. Both the farm and wholesale prices are adjusted to a retail-weight basis. For example, ERS estimates that it takes about 2.40 pounds of the standard steer (at the farm) to produce a pound of retail beef, and 1.14 pounds of wholesale beef to produce a pound of retail beef. For hogs, the conversion factors are 1.869 pounds of hog to produce a pound of retail cuts and 1.04 pounds of wholesale cuts to produce a pound of retail cuts.

In addition to their meat, cattle and hogs produce a number of byproducts when they are slaughtered, such as organs, bones, and hides/skins. ERS does not calculate retail values for these parts, but the price-spread tables do include estimated byproduct values at the wholesale levels.

Price spreads or simply gross margins?

The price spreads reported by ERS are different from gross margins. The farm-to-retail price spread is the difference between the value of an animal at the farm and its value at the grocery store. In comparison, a gross margin is the difference between the purchase and selling price of a product. Price spreads and gross margins are generally correlated, and economists use price spreads as a measure of gross margins, or as an indicator of trends in gross margins.

Meat price spreads provide important market information

Meat price spreads convey critical information to producers, wholesalers and consumers about the distribution of costs along the marketing chain and the efficiency of producers and processors in transforming livestock to retail meat. A decline in farm prices, for example, can suggest a decrease in production costs due to technological advances or a drop in feed prices. Similarly, improvements in meat processing technology could translate to lower wholesale to retail price spreads, meaning higher prices received by producers and/or lower prices for consumers.

The meat price spreads data are also widely used by producers, consumers, and economists as “benchmarks” for national average meat prices. The data enable producers to know how the prices they receive compare with retail prices and enable consumers to know the margin they pay for the meat they purchase in retail stores. Finally, producers and industry analysts use the price spreads data to monitor market performance and consumer demand for various meat types and, ultimately, for livestock.

What do meat price spreads say about prices over the last decade?

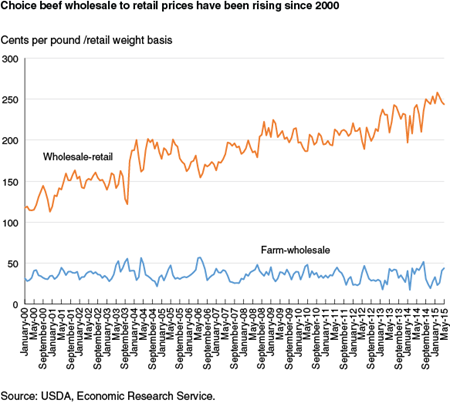

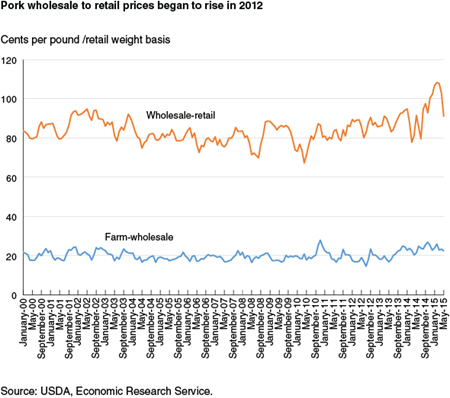

Wholesale to retail prices for Choice beef have been trending upward since 2000, while wholesale to retail prices for pork began to rise only in 2012. However, farm-to-wholesale prices for both beef and pork have been stable. In early 2015, beef retail prices increased, hitting a record high of $6.41 per pound in May. Although prices have moderated since then, they remain high. Meanwhile, retail pork prices declined throughout the first half of the year, reaching $3.70 per pound—about 12 percent lower than the record price seen in September 2014. Elevated beef prices are primarily the result of tight domestic supplies. Drought conditions and the resulting high feed prices in 2008-12 led to decreasing inventories and higher prices for both cattle and hogs. But as feed prices began to fall, hog production started to rebound and pork prices declined. Cattle production, however, has been slow to recover due to the longer life cycle of cattle.

Meat Price Spreads, by William Hahn, USDA, Economic Research Service, April 2024