U.S.-Cuba Agricultural Trade: Past, Present, and Possible Future

Highlights:

-

Establishing a more normal economic relationship between the United States and Cuba would allow Cuba to resume exporting agricultural products to the United States and lead to additional growth in U.S. agricultural exports to Cuba.

-

The United States is already one of Cuba’s leading suppliers of agricultural imports, thanks to a loosening of the U.S. economic embargo on Cuba in 2000 that allows for U.S. sales of agricultural products and medicine to Cuba.

-

The executive actions announced in December 2014 relax U.S. restrictions on remittances and travel to Cuba and allow sales of agricultural equipment to small farmers. These steps by themselves could foster some increased agricultural trade with Cuba.

In December 2014, the United States announced that it would re-establish diplomatic relations with Cuba and implement executive actions intended to ease the trade and travel restrictions currently in place. Establishment of a more normal economic relationship with Cuba could foster additional growth in U.S.-Cuba agricultural trade by promoting greater productivity in the Cuban economy; increasing demand for agricultural imports among Cuban consumers, food service providers, and food manufacturers; and providing the policy and legal framework for the resumption of U.S. agricultural imports from Cuba. The executive actions announced in December 2014, however, only constitute a small step in the direction of normal trade relations between the two countries, as Congressional action is required to modify the longstanding U.S. economic embargo of Cuba.

Over the long term, perhaps the most important ingredients for fostering growth in U.S.-Cuba agricultural trade are to build a foundation for a two-way relationship in trade and investment, and creating the trust for sustaining that relationship. For agricultural trade, that foundation does not yet exist. While over the past 15 years the United States has quickly reestablished itself as one of Cuba’s leading suppliers of agricultural imports, the updated U.S. policy approach to Cuba provides few if any opportunities for Cuba to export agricultural products to the United States. Over the next 15 years, the challenge will be to provide more balanced opportunities for U.S.-Cuba agricultural trade and to continue to build confidence in the emerging bilateral commercial relationship.

U.S.-Cuba Past: Cuba was the Largest Foreign Market for U.S. Rice

Levels of U.S.-Cuba agricultural trade prior to the Cuban Revolution of 1959 provide some indication of the possible size and composition of future trade flows between the two countries. At current commodity prices, U.S. agricultural exports to Cuba during fiscal years (FY) 1956-58 would have an approximate annual average value of $600 million, while imports from Cuba would have an approximate average annual value of $2.2 billion.

Rice, lard, pork, and wheat flour were the four leading U.S. agricultural exports to Cuba in terms of value during FY 1956-58. Cuba was the largest commercial market for U.S. long-grain rice exports prior to the Revolution, often taking more than half of U.S. long-grain sales and almost one-third of total U.S. rice exports. Meanwhile, cane sugar, molasses, tobacco, and coffee were the leading U.S. agricultural imports from Cuba. Past volumes of U.S. sugar imports from Cuba, 2.8 million metric tons on average during FY 1956-58, rival contemporary volumes of total U.S. sugar imports from all countries, 3.1 million metric tons on average during calendar years (CY) 2012-14.

After the Cuban Revolution, Cuba switched from a market-based relationship with its agricultural trading partners, primarily the United States, to barter arrangements with the Soviet Union, China, and other countries in the East Bloc. As a result, U.S.-Cuba agricultural trade dropped sharply in 1960 and then disappeared almost completely by the middle of 1961. As relations between the two countries deteriorated, the United States put an extensive economic embargo into place. By February 1962, this embargo covered virtually all aspects of U.S.-Cuba trade, including agricultural imports from Cuba, but still permitted unsubsidized commercial agricultural sales to Cuba. In May 1964, however, the general license for these agricultural exports was revoked as well. Despite some efforts by several administrations to improve U.S.-Cuba relations, the embargo has remained in place for more than five decades.

U.S.-Cuba Present: Relaxation of Embargo Allows U.S. Agricultural Exports to Resume

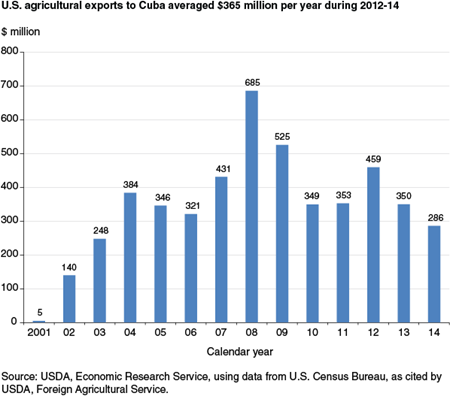

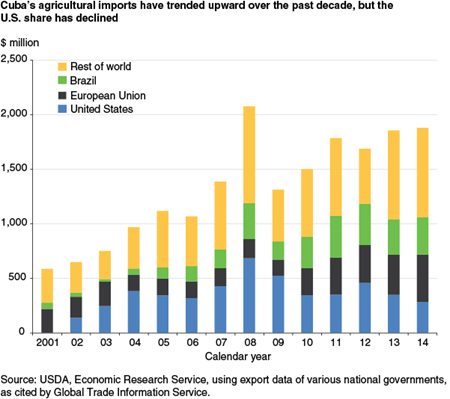

In October 2000, the Trade Sanctions Reform and Export Enhancement Act (TSRA) authorized sales of certain food, medicines, and medical equipment to a number of countries, including Cuba. With the loosening of the embargo, the United States soon became one of Cuba’s leading suppliers of agricultural imports. From 2003 to 2012, the United States was the leading agricultural exporter to Cuba, but the United States slipped to second place in 2013 and to third place in 2014, behind the European Union (EU) and Brazil. During CY 2012-14, U.S. agricultural exports to Cuba averaged $365 million per year, with chicken meat, corn, soybean meal, and soybeans accounting for 84 percent of the value of these exports.

Growth of U.S. agricultural exports to Cuba has been dampened by the financial restrictions imposed by embargo. While U.S. exporters are prohibited from extending credit to Cuban buyers, exporters from other countries are able to do so. As a result, U.S. exporters of wheat, rice, dried milk, soybean oil, and other commodities have seen their sales to Cuba drop to zero, where previously they held considerable market share, while other exporting countries filled in the gap; Vietnam and Brazil export rice to Cuba, the EU exports wheat, and New Zealand exports dried milk.

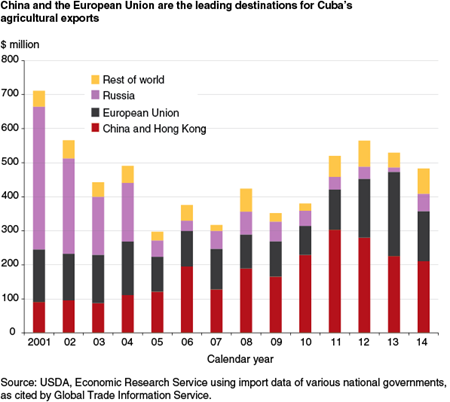

Another impediment to bilateral agricultural trade is the lack of a legal framework for resuming U.S. agricultural imports from Cuba. As a result, U.S. agricultural imports from Cuba are still zero, even though Cuba still produces many of the agricultural commodities that it formerly exported to the United States. During 2012-14, Cuban agricultural exports to the world averaged $526 million per year, with sugar and tobacco being the leading products. During this time, the leading customer countries for Cuba’s agricultural exports were China (including Hong Kong), accounting for 45 percent of the total, and the EU, accounting for 36 percent.

Recent Executive Actions Create Possibilities for Some Increased Trade

The executive actions announced in December 2014 updated the U.S. approach to Cuba, with several key elements that have the potential to affect bilateral agricultural trade. The first element, the effort to re-establish diplomatic relations with Cuba, began in January 2015 and was completed in July 2015. While diplomatic relations are not a guarantee of increased agricultural sales, they do increase expectations of a more favorable economic and policy environment for bilateral agricultural trade over the medium and long term.

The second element relaxes U.S. restrictions on traveling to Cuba by expanding the set of classifications of U.S. citizens and permanent residents who may visit Cuba under general license from the U.S. Government, requiring no special approval. This could lead to increased travel by people pursuing authorized export transactions, possibly resulting in additional U.S. agricultural sales and stronger commercial ties with Cuba via the dissemination of information by the U.S. agribusiness and academic sectors, because some of the classifications directly relate to such linkages—such as the activities of private foundations or research and educational institutes; the exportation, importation, or transmission of information or information materials; and certain export transactions that may be considered for authorization under existing regulations and guidelines.

The third element creates additional exemptions to the embargo on U.S. exports to Cuba, which could also stimulate agricultural trade between the two countries. These exemptions include certain building materials for private residential construction, goods for use by entrepreneurs in the Cuban private sector, and agricultural equipment for small farmers. The new exemptions could also stimulate additional agricultural trade between Cuba and the United States. For instance, small-scale Cuban livestock producers who import equipment for their operations could also increase their feedstuff imports from the United States. In addition to these new exemptions for U.S. exports, licensed U.S. travelers to Cuba will be allowed to import up to $400 worth of goods, with a limit of $100 for tobacco and alcohol combined.

The fourth element relaxes U.S. restrictions on remittances to Cuba. Remittances are transfers of money sent by a migrant or immigrant to people in his or her country of origin. U.S. remittances to Cuba are already quite large—approximately $2 billion per year. Since 2009, the United States has placed no limits on remittances to close relatives in Cuba, except for certain officials of the government or the Communist Party. The new policy approach has raised the limit on general donative remittances to most Cuban nationals from $500 to $2,000 per quarter, and donative remittances for humanitarian projects, support for the Cuban people, and support for the development of private businesses in Cuba no longer require a specific license. Increased remittances to Cuba are expected to increase consumer budgets, with the potential for additional agricultural exports to Cuba. In addition, some remittances could be used to invest in agricultural production or agriculture-related businesses, such as restaurants or retail establishments.

The fifth element facilitates authorized transactions between the United States and Cuba. The regulatory definition of the statutory term “cash in advance” was revised to specify that it means “cash before transfer of title.” Under the previous interpretation of the term, in effect since February 2005, cash payments for U.S. agricultural exports to Cuba needed to be made before the goods could leave a U.S. port. In response to this requirement, Cuba shifted to the more laborious technique of paying for its purchases of U.S. agricultural products with a confirmed, irrevocable letter-of-credit completed with a third country bank. In addition, U.S. institutions will be permitted to open correspondent accounts at Cuban financial institutions to facilitate the processing of authorized transactions, and travelers are allowed to use U.S. credit and debit cards while in Cuba.

The sixth element declares the U.S. Government’s intention to assist in the expansion of Internet access to the Cuban population. The commercial export of certain consumer communications devices, related software, applications, hardware, services, and items for the establishment and update of communications-related systems are now permitted, and telecommunications providers are now allowed to establish the necessary mechanisms in Cuba, including infrastructure, to provide commercial telecommunications and Internet services. These changes are intended to improve telecommunications between Cuba and the rest of the world, which may also facilitate U.S.-Cuba trade. In addition, wireless telecommunications in the developing world is central to helping buyers and sellers of agricultural products to find better prices.

The final element updates the application of U.S. sanctions on Cuba in third countries. U.S.-owned or -controlled entities in third countries will be generally licensed to provide services to, and engage in financial transactions with, Cuban individuals in third countries. In addition, general licenses will unblock the accounts at U.S. banks of Cuban nationals who have moved out of the country, permit U.S. persons to participate in third-country professional meetings and conferences related to Cuba, and allow foreign vessels to enter the United States after engaging in certain humanitarian trade with Cuba.

Current Trade Patterns Offer a Clue to Potential U.S.-Cuba Trade

Establishing a more normal trading relationship with Cuba, either through executive action or more profound legislative changes, is likely to have a positive influence on U.S.-Cuba agricultural trade. If U.S. agricultural imports from Cuba are allowed to resume, Cuba will need to diversify its agricultural exports in order to benefit fully from such a policy change. Sugar currently accounts for about 90 percent of Cuba’s total agricultural exports, but U.S. sugar policy might inhibit Cuba’s ability to export sugar to the United States. Most U.S. sugar imports come from Mexico, which has duty-free access as part of the North American Free Trade Agreement (NAFTA) but faces price and quantity restrictions as a result of agreements suspending U.S. antidumping and countervailing duty investigations concerning sugar from Mexico. The United States uses a tariff-rate quota system, instituted through the Agreement on Agriculture of the World Trade Organization (WTO), to manage its sugar imports from most other countries. Cuba is a WTO member, so if Cuba were allocated quota space, some level of imports would likely occur, depending on U.S. market conditions and the quota’s size.

Over time, Cuba is likely to develop comparative advantages in the production and export of fruit, vegetables, tropical plants, and cut flowers, although this will require substantial levels of investment to construct the physical capital for such operations. As a potential agricultural exporter to the U.S. market, Cuba will face competition from other exporting countries in the Western Hemisphere, many of which have free-trade agreements with the United States. Over the past several decades, Cuba is reported to have made strides in organic production and in the production of certain fruit and vegetables, due in part to the decreased availability of pesticides, fertilizers, and petroleum that resulted from the Soviet Union’s dissolution. Certification of organic production destined for foreign markets, however, takes time, and some Cuban growers might shift away from organic techniques if given greater access to non-organic inputs.

For U.S. exports, a more normal agricultural trading relationship with Cuba might eventually resemble the current relationship between the United States and the Dominican Republic, a country that is similar to Cuba in terms of total population and per capita income. Currently, the Dominican Republic is a much larger market for U.S. agricultural exports. During 2012-14, U.S. agricultural exports to the Dominican Republic averaged $1.1 billion per year, compared with $365 million for U.S. agricultural exports to Cuba. The United States also exports a wider range of agricultural commodities to the Dominican Republic than to Cuba, including some products—such as rice, wheat, nonfat dried milk, cheese, dried beans, and soybean oil—that Cuba currently imports from countries other than the United States and other products—such as beef, turkey, breakfast cereals, and fresh apples—that Cuba does not currently import in sizable quantities. Thus, a more normal trading relationship with Cuba could feature much larger levels of U.S. agricultural exports—in part due to the growth in the share of U.S. exports at the expense of other exporting countries, such as the EU and Brazil, and in part due to a broadening of the commodity composition of U.S. exports.

| Product | Dominican Republic - Value (dollars) | Dominican Republic - Volume (metric tons) | Cuba - Value (dollars) | Cuba - Volume (metric tons) |

|---|---|---|---|---|

| Total agricultural exports | 1,149.643 | -- | 365.255 | -- |

| Animals and animal products | 233.699 | -- | 161.192 | -- |

| Beef and veal | 40.351 | 4.584 | 0.041 | 0.042 |

| Pork | 40.700 | 16.363 | 4.331 | 1.663 |

| Chicken meat, fresh or frozen | 21.156 | 18.204 | 148.925 | 143.085 |

| Turkey meat, fresh or frozen | 10.840 | 4.807 | 1.112 | 0.722 |

| Nonfat dry milk | 28.131 | 7.779 | 0 | 0 |

| Cheese | 19.961 | 4.318 | 0 | 0 |

| Other animals and animal products | 72.560 | -- | 6.783 | -- |

| Grains and feeds | 331.272 | 852.667 | 97.257 | 344.061 |

| Wheat, unmilled | 158.847 | 494.020 | 0 | 0 |

| Corn | 67.430 | 303.728 | 72.869 | 269.198 |

| Prepared foods obtained by the swelling or roasting of cereals or cereal products, not containing sugar | 35.828 | 6.155 | 0 | 0 |

| Brewing or distilling dregs or waste | 0.271 | 1.074 | 14.055 | 54.912 |

| Mixed feeds, not elsewhere specified or indicated | 1.469 | 1.283 | 10.279 | 19.914 |

| Other grains and feeds | 67.427 | 46.407 | 0.054 | 0.037 |

| Fruit and preparations | 34.322 | 25.522 | 0.973 | 0.511 |

| Apples, fresh | 15.363 | 14.363 | 0.104 | 0.087 |

| Other fruit and preparations | 18.959 | 8.159 | 0.869 | 0.424 |

| Fruit juices1 | 13.029 | 9.160 | 0.015 | 0.006 |

| Vegetables and preparations | 46.850 | -- | 0.090 | -- |

| Dried beans | 24.302 | 23.853 | 0 | 0 |

| Other vegetables and preparations | 22.548 | -- | 0.090 | -- |

| Oilseeds and products | 292.231 | 458.598 | 103.584 | 192.478 |

| Soybean meal | 186.780 | 359.247 | 59.371 | 112.721 |

| Soybean oil | 64.918 | 68.958 | 0 | 0 |

| Soybeans | 0.345 | 0.624 | 44.083 | 79.710 |

| Other oilseeds and products | 40.188 | -- | 0.130 | -- |

| Tobacco, unmanufactured | 89.898 | 9.027 | 0 | 0 |

| Essential oils | 10.315 | 0.920 | 0 | 0 |

| Sugar and tropical products | 20.337 | 8.402 | 0.063 | 0.009 |

| Other horticultural products | 50.553 | -- | 1.029 | -- |

| Other agricultural exports | 27.137 | -- | 1.052 | -- |

| 1Volume is measured in millions of liters, and unit value is measured in dollars per liter. Source: U.S. Census Bureau, as cited by USDA, Foreign Agricultural Service. |

||||

The prospects for U.S.-Cuba agricultural trade also depend on which policy measures the Cuban Government uses to foster further economic growth and development. A scenario featuring a broader opening of the Cuban economy to foreign trade and investment is likely to lead to more sustained growth of bilateral agricultural trade. Growth could be particularly strong if such an opening spurs income growth in Cuba and the expansion of sectors that rely on agricultural imports, such as tourism, restaurants, food service, food manufacturing, and livestock production. Cuba’s economic growth and expansion of bilateral agricultural trade are constrained by the availability of credit: the current credit rating for Cuba’s sovereign debt indicates sovereign debt of low quality and high credit risk.

Congressional action would be needed to define the policy framework for establishing a more normal economic relationship with Cuba. Actions that might stimulate U.S. agricultural exports to Cuba include a loosening of restrictions on private-sector credit for Cuban purchases of U.S. agricultural products and allowing Cuba to export products (agricultural and nonagricultural) to the United States, which would enable Cuba to accumulate the foreign exchange needed to increase its agricultural imports.

U.S.-Cuba Agricultural Trade: Past, Present and Possible Future, by Steven Zahniser, Bryce Cooke, Jerry Cessna, Nathan Childs, David Harvey, Mildred Haley, Michael McConnell, and Carlos Arnade, USDA, Economic Research Service, June 2015