Financial Risks and Incomes in Contract Broiler Production

Highlights:

-

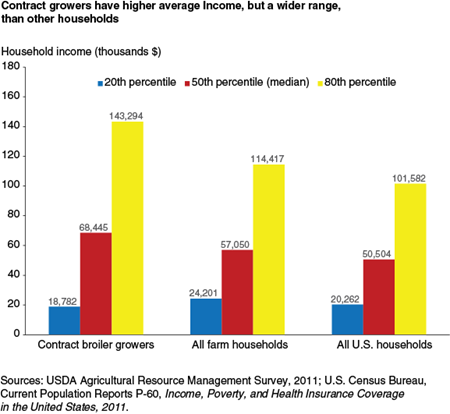

Contract broiler growers earn average household incomes that substantially exceed those of all farm and all U.S. households.

-

Contract growers’ incomes cover a wider range than the incomes of all farm and all U.S. households.

-

The range of income reflects, in part, the risks of contract production; while contracts are designed to remove or reduce certain financial risks, they introduce other risks, and the payments that growers receive for raising broilers can vary widely.

Households that raise broilers realize higher average incomes than other farm households and other U.S. households. However, averages don’t tell the whole story; the range of household incomes earned by broiler growers is also wider than other groups, reflecting the financial risks associated with contract production. The reasons are partly due to the way broiler production in the United States is organized and the way broiler producers are typically paid for their services.

U.S. broiler production is organized in a distinct manner. Almost all broilers are raised by farms that operate under contract with chicken companies known as integrators. The farms provide capital (housing and equipment), utilities, and labor. They receive chicks, feed, transportation, veterinary services, and technical guidance from integrators, who pay contract fees to the growers to raise the chicks to market weights.

Most of the farms are small and focus on broiler production, and contract fees account for the bulk of the farms’ gross income. Contract growers make a substantial and long-lived investment in broiler housing, usually financed by borrowing from commercial banks or the Farm Credit System. While most farms have maintained long-term relationships with their integrator, the actual contracts frequently cover short durations and only limited commitments for the placement of flocks. The contracts limit some market risks that growers might face, but introduce other risks.

Contract Growers’ Household Incomes

Household income measures the cash income flowing to a household and available for expenditures during a year. For farmers, household income combines the income that the household receives from off-farm activities with the income that the household receives from the farm business, net of expenses and payments to other stakeholders in the business.

ERS researchers compared average incomes using the median, at which half of households earn less and half earn more. In 2011, the median income among all U.S. households was $50,504, while the median income among farm households was $57,050. The median for contract broiler growers was higher, at $68,455. Sixty percent of contract broiler growers earned household incomes that exceeded the U.S.-wide median.

The spread of household incomes was also much greater among contract growers. ERS analysts measured the spread of household incomes by comparing incomes at the 80th and 20th percentiles of the income distribution. Twenty percent of households have incomes above the 80th percentile, while 80 percent realize incomes below that level. Correspondingly, 20 percent of households earn less than the 20th percentile income, and 80 percent earn more. The 80-20 range captures the range of incomes earned by the middle 60 percent of households; the estimates are calculated using farm household data available from USDA’s Agricultural Resource Management Survey and data for all households reported by the U.S. Census Bureau.

Among contract broiler growers, the 80th percentile of household income was $143,294— greater than the 80th percentile values for all farm households and for all U.S. households. But the 20th percentile value ($18,782) was less than the corresponding values for the other comparison groups. Therefore, the spread between the 80th and 20th percentile incomes was much greater for contract broiler growers than for all farm households or all U.S. households.

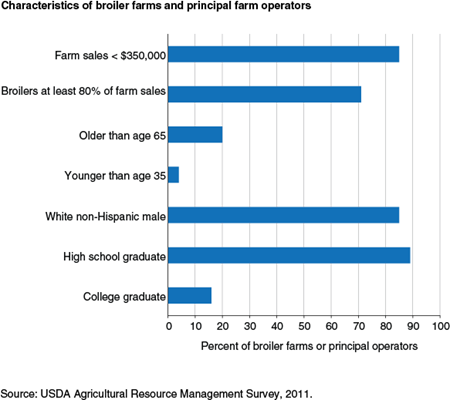

Researchers expected to see a wide range of incomes among all U.S. households because the U.S. population encompasses a wide range of ages, occupations, regions, and levels of education—all things that affect earnings. In contrast, contract broiler growers comprise a much more uniform group. They have a common occupation—growing broilers under contract—and 85 percent of their farms are small, with sales of less than $350,000. The farms tend to be rather specialized, with a focus on growing broilers. They are geographically concentrated, in that most are located in rural areas in the South. Few contract growers are young, especially compared to the population of household heads in the United States: their average age is 55, and only 4 percent are younger than 35. Most (93 percent) are men, although most list their wives as secondary operators. Eight-five percent are white males, and while 89 percent have a high school degree, only 16 percent have completed college. Contract growers are a much more homogeneous group than either the U.S. population or the overall farm population, yet their incomes vary more widely.

Why Do Grower Incomes Vary So Widely?

Some of the variation in household incomes reflects differences in off-farm income earned by contract growers and their families. On average, off-farm income accounts for half of the total household income earned by contract growers, and off-farm income varies widely. Some of this variation may also reflect differences in the size of grower’s broiler business; one quarter of growers have one to two chicken houses, while a third have five or more. These two variations largely offset one another, in that growers with one to two houses derive 80 percent of their income from off-farm jobs, while growers with five or more houses derive over 60 percent of their income from the farm business.

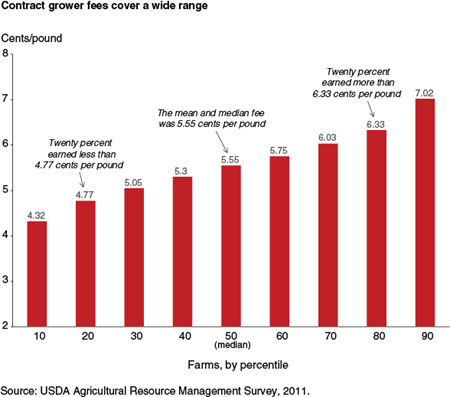

The fees—per pound of chickens produced—that growers can earn from contract production also vary widely, and this is an important source of the variation in household incomes. Contract fees can vary with attributes of production that also affect grower costs—for example, higher per-pound payments are associated with smaller birds, birds raised without antibiotics, and certified organic production. However, fees also vary because of the way that broiler production contracts are designed.

Contract fees are rarely a fixed amount per pound delivered; instead, fees are based on a grower’s relative performance compared to other growers who deliver chickens to the poultry company at the same time. This method is sometimes called a tournament method of determining pay because, like a professional golf or tennis tournament, a participant’s earnings do not depend on absolute performance, but on performance compared to other tournament competitors.

Fees are determined in the following way. The integrator measures the average cost of the inputs that the integrator provided to growers for chickens delivered to the processing plant in a week—the total value of feed, chicks, and veterinary services provided to growers divided by the total weight of chickens delivered that week. The company develops this calculation for each grower. Each grower is then paid a base fee, and those growers whose costs are lower than the average for all growers receive a premium over the base fee; those whose costs exceed the average for all growers receive a deduction from the base. The amount of the premium or deduction reflects the size of the cost difference.

Growers’ relative costs differ, reflecting differences in chick mortality and feed conversion across growers. Growers with higher mortality in their flocks will deliver fewer live-weight pounds to the processing plant, and hence, they will have higher costs per pound. Growers whose flocks put on less weight for a given amount of feed provided will also deliver fewer live-weight pounds and have higher costs per pound delivered.

The adjustments can have substantial impacts on grower revenues. In 2011, the average payment to contract growers was 5.55 cents per live-weight pound delivered, but actual fees varied widely around the average. Twenty percent of growers earned more than 6.33 cents per pound, and 10 percent earned more than 7.02 cents per pound. At the other end of the spectrum, 20 percent of growers earned less than 4.77 cents per pound, and 10 percent earned less than 4.32 cents per pound.

Contracts, Risks, and Incomes

Tournament contracts are designed to reward low-cost production, which depends in part on the care and effort of the grower. Effective growers check and maintain equipment so that feed and water are easily accessible and available to birds, and they manage temperatures, humidity, and production practices in houses to maintain bird comfort and health.

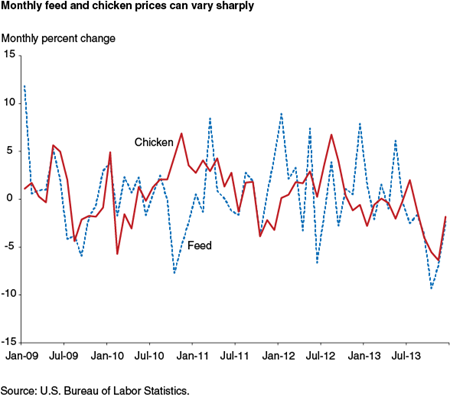

The tournament payment designs also alter the financial risks faced by farmers irrespective of their efforts. Poultry companies provide feed to growers and then handle processing and marketing. Consequently, price risks for feed and for chicken meat are borne by the company, not by the grower. These risks are not small; feed prices rose or fell by at least 5 percent in 11 of the 60 months between January of 2009 and December of 2013. Poultry companies also bear production risks that commonly affect growers. For example, if weather or disease affects mortality among all growers, base payment rates remain the same.

Tournaments introduce a new risk, sometimes called a league-composition risk. The average broiler processing plant handles about 1.12 million birds per week, and the average grower delivers about 90,000 birds at a time; at that rate, about 12 growers would be competing in a tournament in an average week. If the group delivering in one week happened to have three exceptional growers, and the group delivering in the next week had just one, then any given grower would be likely to have a much better relative performance, and better compensation, if he or she were delivering in the later week. This is a pure risk, in that the grower has no control over the identity of the other growers in the group, and the addition or subtraction of one or two exceptional (or lucky) growers can have a meaningful impact on group averages when the group is small.

Broiler production contracts add another risk aside from the way in which compensation is determined. Traditionally, broiler contracts have not required strong commitments by integrators. In 2006, about half of broiler contracts were “flock to flock”; that is, the integrator made no specific commitment to provide birds beyond the current flock’s placement. Those contracts that specified a longer duration (usually 1 to 5 years) rarely committed the integrator to a specified number of birds or flocks in a year.

The average grower has four broiler houses, with a total value (including the land) of about $1 million; most finance their houses with 15-year bank loans, and hence carry a long-term commitment on housing. With fixed monthly expenses for a bank loan, growers that do not get enough birds placed risk a significant reduction in revenues and household income, and they can face a liquidity risk from not having cash to meet the monthly mortgage payment.

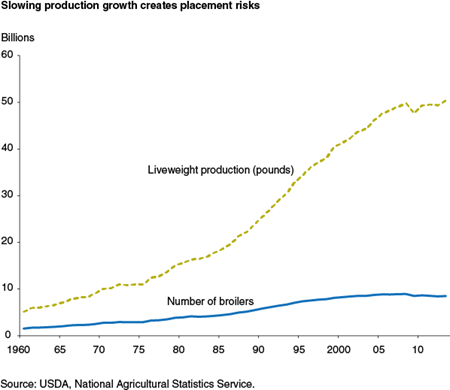

Such placement risks may not have seemed important to growers and their lenders in the past. Broiler production increased in every year from 1980 to 2008, with average growth of 4.3 percent per year (from 15.53 billion pounds in 1980 to 49.78 billion in 2008). With rapid production growth, growers could expect to get flocks placed on a regular basis, and to get larger flocks placed if they expanded their housing capacity. However, production fell in 2009 and again in 2012, and total production in 2013 was just 1.1 percent greater than it was in 2008. With flat or declining production, more growers face a risk of contract non-renewal or getting fewer chicks placed.

Growers incorporate new technology that can improve industry productivity into broiler houses when they reconstruct old houses or build new ones. However, growers are reluctant to commit the investment needed, and lenders grow more reluctant to provide the credit needed, when placement risks start to become more apparent. In this way, increased placement risks can lead to slowing industry productivity growth and rising costs.

Contracts are starting to reflect the recognition of placement risks. Most contract grower debt—about 90 percent—is financed by commercial banks and the Farm Credit System. However, USDA’s Farm Service Agency (FSA) also plays a significant role, largely through the agency’s guaranteed loan program. FSA provides guarantees to lenders in the case of loan defaults, covering up to 95 percent of the principal and interest, on qualifying loans provided to farmers by lenders under the program. Over 2009-2013, FSA provided guarantees on an annual average of $210 million in loans made to broiler producers; the program induces lenders to serve groups who otherwise might be unable to obtain credit, especially beginning and socially disadvantaged farms.

To qualify for an FSA guarantee, borrowers’ production contracts must meet certain criteria. In a guidance issued in April 2009, FSA adjusted those criteria in recognition of increased placement risks. The agency required that production contracts offered in support of new loan applications should feature durations of at least 3 years and minimum annual flock commitments.

The agency’s new requirements apply only to new loans provided under FSA guarantee. However, growers and other lenders may perceive the same increased placement risk and be reluctant to enter the business without stronger integrator commitments. Because of this, contracts are now more likely to contain specific integrator commitment regarding flock placements. In addition, contracts offered to newer growers today have longer specified durations than those held by long-time growers, especially when growers have just a single integrator active in their area. With just a single integrator, a grower would be left with no alternative contracting options if the integrator were to reduce placements or experience financial difficulties, creating an added risk. To offset that risk and attract new growers, some integrators are offering better contract terms in the form of stronger commitments.

| Number of integrators | Years producing broilers (operation) 0-5 |

Years producing broilers (operation) 6-10 |

Years producing broilers (operation) 11-19 |

Years producing broilers (operation) >19 |

|---|---|---|---|---|

| 1 | 84 | 52 | 47 | 40 |

| 2 | 51 | 36 | 39 | 26 |

| 3 | 44 | 30 | 29 | 26 |

| >3 | 29 | 33 | 21 | 11 |

| Source: USDA Agricultural Resource Management Survey, 2011. | ||||

Contract broiler production allows growers to realize incomes that, on average, exceed those earned by other farm households and by U.S. households. However, averages can be misleading; contract production features several financial risks, which lead to a wide range of incomes among contract growers. Many growers make substantially more than the average, but many earn substantially less. Prospective growers and their lenders need to be fully aware of the risks associated with production, and take account of them in planning.

Technology, Organization, and Financial Performance in U.S. Broiler Production, by James M. MacDonald, USDA, Economic Research Service, June 2014