The World Bids Farewell to the Multifiber Arrangement

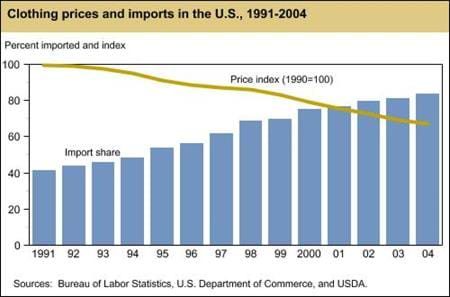

Clothing is one of life’s necessities, so a new trade policy that lowers clothing prices affects us all. Such a change took place at the beginning of 2005, as the U.S., Canada, and the European Union (EU) discontinued most of their limits on imports of yarn, fabric, and clothing from developing countries. Under the Multifiber Arrangement (MFA), trade in textiles—that is, yarn and fabric—and clothing was managed through quotas. January 1, 2005, marked the end of a 10-year phaseout of the MFA quotas under the aegis of the World Trade Organization. This article examines the origins and spread of quotas under the MFA and the impacts of their subsequent elimination.

What Was the MFA?

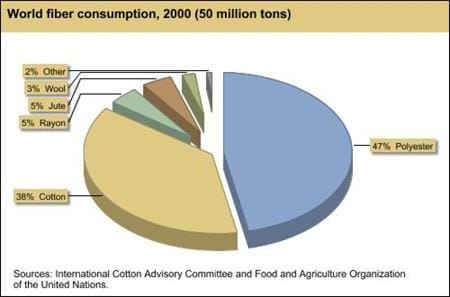

The MFA was a multilateral agreement signed in 1974, but its roots stretch back to the 1930s. At that time, during a period of global economic distress, Japan emerged as the largest exporter of cotton textiles, and the U.S. and Europe moved to limit imports from Japan to preserve their domestic markets for their own textile industries. These restraints never really went away. By the 1960s, they had been extended to Hong Kong, Pakistan, and India. As the restraints on textile trade became globalized, multilateral negotiations ensued, leading to a series of agreements. Initially, the agreements covered only cotton, but they eventually expanded into “multifiber” arrangements covering textiles and clothing made from all fibers: cotton accounts for about 38 percent of world fiber consumption.

At the heart of the MFA were a set of bilateral agreements between developed-country importers, such as the U.S., and developing-country exporters, such as China and Bangladesh. The MFA did not apply to trade among the developed countries. The number of U.S. bilateral export restraint agreements grew from a single agreement with Japan in 1962 to agreements with 30 countries by 1972 and with 40 by 1994. Each agreement governed trade in as many as 105 categories of textiles and clothing, with new categories added to the agreements as the need to avoid “market disruption” arose.

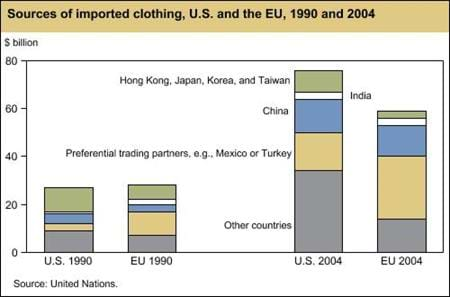

In one sense, the impact of the MFA was quite simple. By limiting imports, the U.S. and the EU raised their domestic prices of clothing. Domestic production rose, and domestic consumption fell. Outside of these two markets, however, the effects were more complex, as the restraints on one set of countries created opportunities for others, driving changes in world clothing markets. Limits on exports by Japan and Hong Kong increased export opportunities for Taiwan and South Korea. Restraints then imposed on Taiwan and South Korea increased opportunities for Thailand and Indonesia. In this way, the MFA grew, but investment in clothing production also spread. Entrepreneurs from countries limited by the MFA shifted capital and expertise to countries that otherwise lacked the ability to export significant amounts of clothing. So, for some countries, the attempt to limit global exports actually spurred an increase in exports.

Another twist to the MFA’s impact came from the North American Free Trade Agreement (NAFTA) and from similar regional trade arrangements between the EU and its neighboring countries. Typically, these agreements relax or remove the quota restrictions on neighboring exporters. Examples include Mexico in the case of the United States, and Turkey and other Mediterranean countries for the EU. In this way, Mexico and Turkey benefited indirectly from the MFA’s restraints on their competitors.

Case Study: U.S. Imports of Cotton Trousers

To understand the global impact of the MFA, it is useful to take a closer look at U.S. imports of one particular product—cotton trousers. The distribution of U.S. quotas and trade for cotton trousers illustrates the evolution of the MFA and global clothing trade during the 30 years that the MFA governed world trade and helps us understand the changes in store for global trade now that the MFA is behind us.

About 80 percent of the 180 million dozen cotton trousers purchased annually in the U.S. are imported, approximately the same as for most U.S. clothing and for clothing in most developed countries. In 1974, in contrast, imports accounted for 10 percent of U.S. consumption. The geography of that trade has also changed dramatically over the last three decades. Once, Japan was a major clothing exporter to the U.S, but Japan now imports most of its clothing. Other lower income countries have taken its place as suppliers of U.S. trousers. The fundamental reason for this shift is that labor comprises a much larger share of the cost of clothing than it does for most manufactured products. Wages in China are one-tenth those in the U.S, and wages for textiles and clothing workers in India and Bangladesh are half those in China. Wages are only one factor in determining competitiveness, and the superior infrastructure and education of the developed countries were traditionally able to offset lower wages. But this advantage has tended to erode over time as communication and transportation costs have fallen, and developing economies have become more integrated into the world economy.

The global economy has proven to be more dynamic than the political economy of protectionism, and the rigidity of the system of managed trade has had some unexpected consequences. In 2004, for example, Taiwan and India, two very different countries, had nearly identical quotas for cotton trouser exports to the United States—around 1 million dozen pairs each. While not as advanced as Japan’s, Taiwan’s economy long ago graduated from a focus on textiles to more sophisticated, higher value products. Competing for resources with higher paying industries in Taiwan, Taiwan’s trouser producers were no longer able to export as many trousers as permitted under its quota. Taiwan’s exports of cotton trousers filled 70 percent of its allocated quota in 2004, while India filled 96 percent of its quota.

| Source | MFA quota 2004 (million dozen pair) |

Quota fill rate (percent) |

Imports 2004 (million dozen pair) |

Import growth 20052 (percent) |

|---|---|---|---|---|

| World | NA | NA | 149.3 | 15 |

| Mexico | NA | NA | 31.4 | -10 |

| Hong Kong | 7.0 | 88 | 6.1 | -3 |

| Guatemala | 3.3 | 80 | 2.7 | -17 |

| Bangladesh | 4.5 | 85 | 3.8 | 99 |

| China | 2.4 | 84 | 2.0 | 1,094 |

| India | 1.5 | 96 | 1.4 | 100 |

| Taiwan | 1.5 | 70 | 1.1 | -2 |

| Kenya | NA | NA | 3.1 | 0 |

| NA = Not available. 1MFA category 347/348. 22005 figures based on 9 months of data. Sources: Office of Textiles and Apparel, U.S. Department of Commerce and U.S. Customs and Border Protection. |

||||

As a result, in 2004, the MFA was indirectly protecting the industry of a former U.S. competitor—Taiwan—while India’s quota, which reflected India’s competitive stature of at least a decade before, was frozen in time. As the MFA coalesced during the 1970s and 1980s, India’s economic policies encouraged a textile industry geared to providing employment to village handweavers and providing low-cost cotton cloth to its own population. India’s exports were generally anemic during that period, and its MFA quotas often went unfilled. Since the beginning of the 1990s, however, India’s economy has been dramatically reoriented toward exports, and India’s export capacity has surged. As a result, India’s exports of other textile products have grown, and it is well positioned to take advantage of the MFA’s phaseout. However, before the end of MFA, its access to the U.S. market for numerous products was encumbered by the outcome of negotiations concluded many years before.

China’s 2004 quota for cotton trouser exports to the U.S was about double India’s—2 million dozen pairs—reflecting the rapid growth of China’s industry at the time the MFA restrictions on this product crystallized. But China accounted for only 1 percent of U.S. cotton trouser imports. China accounted for about 25 percent of world textile and clothing exports in 2004, and with the end of the MFA, this is expected to grow. But, when China began reorienting its economy in 1979, its textile industry, like India’s, was domestically oriented. Exports began rising sharply. By September 1980, China and the U.S had negotiated their first bilateral textile agreement. China’s cotton trouser quota has remained essentially fixed since the beginning of the 1980s, while China’s textile industry has grown to be the world’s largest by moving into other products and other markets.

Another explanation for China’s low share in U.S. cotton trouser imports is the role that preferential trade agreements have played in U.S. textile trade. Although much of U.S. trade in cotton trousers was shaped by the MFA, over half of the 149 million dozen cotton trousers imported by the U.S. in 2004 were imported outside the MFA. Most of those imports came from neighboring countries, the result of preferential access granted through NAFTA, the Caribbean Basin Initiative (CBI), and the Andean Trade Preference Act. Mexico’s 31 million dozen pairs of exports were exempt from a specific quota. While Guatemala exported 2.7 million dozen pairs under quota in 2004, its exports outside the quota system were even larger thanks to its preferential access.

Like NAFTA and the CBI, the African Growth and Opportunity Act (AGOA) of 2000 granted preferential access as a form of economic aid to low-income African countries. This agreement allowed Kenya, Lesotho, and more than 30 other African countries to export cotton trousers and other products to the U.S. outside the MFA quota system. The passage of AGOA attracted investment and expertise—mostly from Asian firms—to these countries’ textile and clothing sectors. Kenya’s cotton trouser exports to the U.S rose from 287,000 dozen pairs in 1998 to 3.1 million in 2004, and Kenya garnered a 2-percent share of U.S. imports, twice that of China. In this way, the MFA indirectly encouraged clothing production in new corners of the world. In the 1970s, Hong Kong firms moved resources to Mauritius as quota restraints became binding. In the 1980s, South Korean entrepreneurs began investing in Bangladesh. The end of the quota system has removed some of the incentives to invest in a number of these countries, and their economies are having to adjust to a lower level of clothing exports and employment.

Short-Term Outlook for the Post-MFA World

Most economists analyzing the MFA agree that free trade in textiles and clothing will mean significantly larger exports by China, India, and Pakistan (Pakistan filled 100 percent of its cotton trousers quota in 2004). Higher income exporters like Taiwan, Korea, and Hong Kong can expect to export less. The same is true of countries with preferential access to the U.S. and EU markets. U.S. imports of cotton trousers in 2005 bear out these expectations. During the first 9 months of 2005, U.S. imports rose 15 percent, but imports from Mexico, Guatemala, Sub-Saharan Africa, Hong Kong, and Taiwan fell. On the other hand, imports from India rose 100 percent, and imports from China rose 1,094 percent.

Not all of China’s clothing exports are expected to increase by 1,000 percent. Analysts expect gains of 20-100 percent in China’s total clothing exports. Based on the cost of purchasing an export license from China to the United States, economists estimate that the impact of the MFA on China’s trade was equivalent to a 20- to 30-percent import tariff. Similar estimates for other exporters tend to be lower, and the changes in 2005 U.S. cotton trouser imports confirm this pattern. While China’s wages may exceed those in some other countries, its superior infrastructure helps ensure more timely delivery and higher productivity.

China’s export gains will be constrained in the short term by the “safeguard” mechanism permitted under its 2001 WTO accession agreement. WTO members have the right under certain circumstances to limit growth in their textile imports from China through 2008. To limit the disruption of ad hoc safeguard applications, the U.S. and the EU reached bilateral agreements with China in 2005. These agreements govern textile trade very much the way the MFA did, albeit for a smaller number of products and with a higher level of imports. Furthermore, none of the other WTO exporters formerly constrained by MFA quotas faces any such restraint (see “China Leads World Textile Trade, But For How Long?”).

For the U.S. and EU, the removal of the 20-percent or so implicit tax the MFA imposed on much of their imported clothing has led to increases in clothing imports by both regions. Domestic clothing prices can be expected to fall 5-10 percent, once production and consumption adjust to a new equilibrium. As clothing imports rise, the mix of exporters and products will change. The U.S. and EU can also expect to see increased availability of lower quality clothing. The experience of voluntary export restraints in automobiles, footwear, and steel during the 1980s attests to the “quality-upgrading” exporters undertake in the face of quotas. Quotas create opportunities for unusually high profits, and the resulting welfare-reducing inefficiencies include a shift to more expensive lines of products.

Many Sources of Uncertainty in the Long Term

The elimination of the MFA will lead to longer term structural changes in the global textile industry, and these are harder to predict. The pursuit of profits under the MFA introduced inefficiencies in clothing production, which may require time to eliminate. Firms in many developing countries were structured to acquire quota and then maximize the profits from this quota rather than simply to compete in the marketplace. Similarly, U.S. and EU importers pursued the “excess profits” inherent in a quota system and, by some measures, succeeded in capturing a significant share. These factors are difficult to measure and add uncertainty to the outlook for the post-MFA world.

Another source of uncertainty is that the elimination of the MFA did not occur in isolation. Other forces, such as the depreciation of the U.S. dollar and technological change, may also affect textile and clothing trade. In the United States, a weakening dollar would tend to put upward pressure on clothing prices, perhaps offsetting the downward pressure exerted by the removal of the quotas. Moreover, clothing prices around the world have fallen in recent years as globalization and technical change increased trade and reduced distribution costs. The exchange of point-of-sale information (“electronic data interchange”) between retailers and manufacturers has reduced inventory costs substantially, and the rise of discount retailing has been a global phenomenon. With so many other changes taking place in the global economy, it is hard to predict exactly the most important shifts consumers will face in the immediate aftermath of the MFA.

Furthermore, the MFA was far from being the only trade policy instrument relevant to global textile trade. Tariffs on textiles and clothing are typically several times higher than the 4-percent global average for manufactured products. Anti-dumping cases have been pursued around the world with increasing frequency. Many countries apply nontariff barriers to textile and clothing imports. Finally, the high labor component of clothing production helps make it a sensitive industry in the eyes of many governments.

<a name='box'></a>China Leads World Textile Trade, But For How Long?

Today, many of the questions about the future of international textile trade, policy, and consumption revolve around China. The expansion of China’s textile production and exports has seemed relentless. The textile industry was among the first to benefit from China’s opening to the rest of the world at the end of the 1970s. China’s clothing producers are well positioned to coordinate with the design and management capabilities of Hong Kong. They have ready access to high-quality fabric produced in countries like Japan, as well as to their own burgeoning domestic production.

China’s role in global textile trade may be constrained in the short term by the special safeguard provisions of its 2001 accession to the WTO. These safeguards, which will remain applicable through 2008, can limit China’s export growth in specific products to a 7.5-percent annual rate. The United States applied these safeguards to a few products in 2003. Turkey and Argentina implemented broader sets of safeguards immediately after the end of the MFA, and Brazil has announced its intention to restrict textile imports from China. In May 2005, the United States applied safeguard provisions to cotton trousers, cotton shirts, and underwear. In 2004, the EU took steps to raise the tariffs it applies to clothing imports from China, and in June 2005, announced restrictions for 10 products imported from China. The United States and the EU each subsequently negotiated new bilateral textile trade agreements with China in 2005, which could limit China’s exports to these markets through 2008.

China also has longer term pressures. During the last few years, reports of rising wages in China have emerged, particularly for the Pearl River Delta near Hong Kong. Electrical power shortages are also reportedly more frequent, suggesting rising costs in more than one respect. While China is unquestionably the global leader today, leadership in global textiles has shifted from one country to another over the centuries. Before the Industrial Revolution, India’s cotton textiles dominated world trade. Later, England and then Japan and Hong Kong rose to prominence. In the long run, the only certainty is change, and China will have to face this issue as well.

Cotton and Wool Outlook, Economic Research Service, May 2012

Bilateral Fiber and Textile Trade, by Leslie Meyer and Taylor Dew, USDA, Economic Research Service, May 2023

Cotton and Wool, by Leslie Meyer, USDA, Economic Research Service, November 2022

China, by Fred Gale, USDA, Economic Research Service, June 2023